Automotive Market Update: These Vehicle Types Make It to Government Procurement List

![]() 11/24 2025

11/24 2025

![]() 411

411

Weekly Report on the New Energy Vehicle Industry

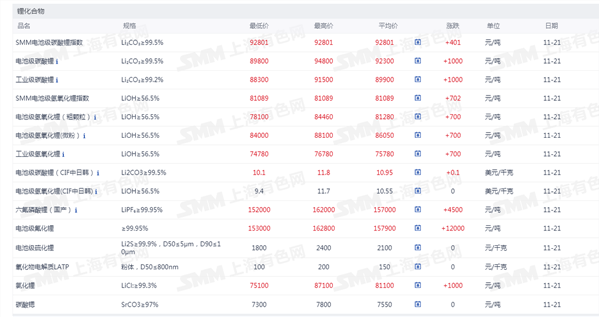

According to Shanghai Metals Market, this week saw a more pronounced price hike for lithium hydroxide compared to last week. Regarding market sentiment, the continuous price surge of lithium carbonate and lithium ore has fostered a sentiment among lithium salt manufacturers to hold prices steady.

Upstream salt manufacturers have been setting prices based on futures discounts. For downstream players, most manufacturers of ternary materials have not witnessed significant changes in current demand, resorting only to a small amount of just-in-time purchasing. Overall market transactions have remained relatively subdued. It is anticipated that, in the short term, lithium hydroxide prices will continue to gradually rise, propelled by the prices of lithium carbonate and lithium ore.

01. Institutional Perspectives

Soochow Securities holds the view that the Q4 lithium battery market is thriving beyond expectations, projecting a 25%-30% growth for 2026. Each segment has the potential for price increases, bolstered by energy storage. Q4 industry production schedules are expected to further ramp up by 10-20% month-on-month and 30% year-on-year, with a 25%-30% growth in industry demand projected for 2026, including a 50% growth in energy storage.

Every segment is poised for price hikes, with energy storage battery prices already seeing a 1-3 cent increase. Q4's 2026 long-term agreement prices may witness another modest rise even without production scheduling adjustments. On the material front, 6F and lithium iron phosphate cathode materials have the strongest expectations for price increases, with 6F spot prices surpassing 100,000 yuan, November long-term agreement prices climbing to 70,000-80,000 yuan, and further increases anticipated. Leaders in lithium iron phosphate cathode materials have commenced comprehensive price negotiations, with increases ranging from several hundred to 1,000-2,000 yuan per ton, some of which have already been implemented. Additionally, separator and anode prices may also undergo minor adjustments, with some already implemented for smaller clients.

02. Macro Developments

Two Departments Release 'New Energy Vehicle Government Procurement Requirement Standards (Draft for Comment),' with Fuel Cell Vehicles Included in Government Procurement Catalog

On November 20, the Ministry of Finance, in collaboration with the Ministry of Industry and Information Technology, publicly sought comments on the 'New Energy Vehicle Government Procurement Requirement Standards (Draft for Comment).' The draft proposes that these standards apply to new energy vehicle government procurement projects, serving as a guide for procurers. New energy vehicles encompass pure electric vehicles, plug-in hybrid (including extended-range) electric vehicles, and fuel cell (hydrogen) vehicles.

Procurers are prohibited from setting supplier qualifications, technical, or commercial conditions that impose unreasonable differential or discriminatory treatment on suppliers. The Treasury Department's National Treasury Administration will dynamically update the configuration, performance, safety, and quality indicators for new energy vehicles in these standards based on the industry's development. Competent budgetary units should determine the annual new energy vehicle government procurement ratio for their department (including affiliated budgetary units) in accordance with the 'Notice on Further Clarifying the New Energy Vehicle Government Procurement Ratio Requirements' (Caobanku [2024] No. 269).

This signifies that fuel cell vehicles are now part of the government procurement catalog.

National Energy Administration: China's Electric Vehicle Charging Infrastructure (Guns) Reached 18.645 Million Units by the End of October

On November 19, the National Energy Administration released October's national electric vehicle charging facility data. According to the National Charging Facility Monitoring Service Platform, by the end of October 2025, China's total electric vehicle charging infrastructure (guns) had reached 18.645 million units, marking a 54.0% year-on-year increase. Among them, there were 4.533 million public charging facilities (guns), a 39.5% year-on-year increase, with a total rated power of 203 million kilowatts and an average power of approximately 44.69 kilowatts. There were 14.112 million private charging facilities (guns), a 59.4% year-on-year increase, with a reported installed electrical capacity of 124 million kilovolt-amperes.

Beijing: Enhancing Financial Support for Automobile Consumption, Especially New Energy Vehicles

On November 18, 12 departments, including the Beijing Branch of the People's Bank of China, issued the 'Implementation Plan for Financial Support to Boost and Expand Consumption in Beijing.' It proposes increasing consumer credit support for goods, actively engaging in automobile loan business, reasonably determining loan disbursement ratios, terms, and interest rates, and appropriately reducing penalties for early loan repayment during automobile trade-ins.

Financial institutions are guided to optimize and innovate financial products for various car purchase scenarios, such as first-time purchases, trade-ins, and used cars, boosting financial support for automobile consumption, especially new energy vehicles. Financial institutions are encouraged to actively meet consumer finance needs in areas like home appliance trade-ins, green smart home furnishings, and electronics, participating in merchant promotion activities through various means, offering consumer loans, credit card installment fee discounts, and appropriately reducing fees and profits for consumers.

03. Industry News

Passenger Car Association: From November 1-16, National Passenger Car New Energy Market Retail Sales Reached 554,000 Units, a 2% Year-on-Year Increase

On November 19, the Passenger Car Association released data indicating that from November 1-16, national passenger car new energy market retail sales reached 554,000 units, a 2% year-on-year increase and a 7% increase compared to the previous month. Cumulative retail sales for the year reached 10.703 million units, a 21% year-on-year increase. From November 1-16, national passenger car manufacturers' new energy wholesale sales reached 618,000 units, a 1% year-on-year increase and a 17% increase compared to the previous month. Cumulative wholesale sales for the year reached 12.675 million units, a 28% year-on-year increase.

Huang Ling from CAERI New Energy: In 2026, Solid-Liquid Hybrid Battery Adoption Will Soar to the Hundred-Thousand Unit Level

On November 16, at the '10th International Summit on Power Battery Applications (CBIS2025),' Huang Ling, Director of Advanced Technology Development at CAERI New Energy Battery Technology Co., Ltd., stated that according to the '2026 China Automotive Top Ten Technology Trends' released by the Chinese Society of Automotive Engineers, next year, solid-liquid hybrid battery adoption will surge to the hundred-thousand unit level. Analysis suggests that liquid batteries have hit an energy density ceiling of 300Wh/kg, but providing all-solid-state batteries with >400Wh/kg still poses challenges, requiring 3-5 years for mass production. In the meantime, it presents a critical window for the commercialization of solid-liquid hybrid batteries.

Cui Dongshu from the Passenger Car Association: In October, the National Automobile Market Showed Strong Momentum, with Structural Growth in the Commercial Vehicle Market

On November 15, Cui Dongshu, Secretary-General of the Passenger Car Association, stated in an article that driven by national consumption promotion policies, the automobile market maintained robust growth. In October, the national automobile market exhibited strong momentum, with noticeable recoveries in the truck and bus markets. Due to the slow transmission of retail sales driving wholesale sales, retail sales in October 2024 were significantly stronger than wholesale sales, resulting in a negative year-on-year growth in passenger car retail sales in October this year. However, manufacturer sales growth remained strong in October, thanks to exports and inventory increases. New energy vehicles performed strongly in October, with continuous strength in the automobile export market, significant changes in manufacturer inventories, and increased industry pressure.

04. Company News

New Xiangjie S9 Launched, Priced from 309,800 Yuan

On November 20, the new Xiangjie S9 was officially launched, with prices ranging from 309,800 to 369,800 yuan. The new car boasts a brand-new Universal Star emblem, iconic Galaxy headlights, a new Nebula taillight, smart electric doors, and is equipped with over ten screens in the intelligent cockpit, including a 16.1-inch new center console screen, a 12.3-inch passenger screen, a smart projection giant screen system 2.0, and a new MagLink Mini control screen. It comes standard with a 5-speed adjustable intelligent air suspension and a new continuously variable damping shock absorber across all models, powered by Huawei's new Turing platform, adopting a new six-in-one full-domain fusion architecture sourced from Zunjie. The new car is equipped with the latest version of Huawei's Qiankun Intelligent Driving ADS 4, featuring 36 high-precision sensors. Additionally, Yu Chengdong announced that Hongmen Zhixing's first flagship MPV will debut soon.

XPENG Motors: 'Producing Thousands of Autonomous Taxis Annually in the Next Two Years' Is Untrue

On November 19, market news claimed that XPENG Motors would produce thousands of autonomous taxis annually from 2026 to 2027. A relevant department head at XPENG Motors stated that after noticing the market news, the company verified it and found it did not originate from officially disclosed data. Subsequently, the company contacted the source, who claimed the content was from a predictive analysis report and not XPENG Motors' actual production plans, leading the company to conclude that the rumors were untrue.

Lu Weibing: Xiaomi Automobile Is Expected to Complete Its Annual Delivery Target Ahead of Schedule This Week

On November 18, Xiaomi Group released its Q3 earnings announcement, with single-quarter revenue reaching 113.1 billion yuan, a 22.3% year-on-year increase, surpassing 100 billion yuan for four consecutive quarters. Adjusted net profit reached 11.3 billion yuan, an 80.9% year-on-year increase. Among them, revenue from innovative businesses such as smart electric vehicles and AI reached 29 billion yuan, a 199% year-on-year increase, with smart electric vehicle revenue at 28.3 billion yuan and other related revenue at 700 million yuan. Lu Weibing, Partner and President of Xiaomi Group, revealed during the earnings call that Xiaomi Automobile is expected to complete its annual delivery target of 350,000 units this week. Earnings data showed that in Q3, Xiaomi Automobile delivered over 100,000 new cars, with cumulative deliveries exceeding 260,000 units in the first three quarters.

05. Secondary Market

Industry Performance

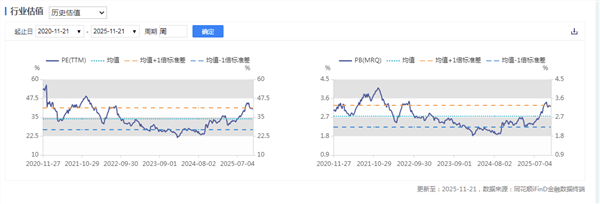

Industry Valuation

New Energy Vehicle Sales

06. Raw Material Prices

Lithium Compound Spot Prices

Cathode Material Prices

Electrolyte Prices

- End -