Bentleys Entirely Absent from Guangzhou Auto Show! Are Youngsters Turning Their Backs on Classic Luxury Cars?

![]() 11/25 2025

11/25 2025

![]() 505

505

Are luxury cars facing a 'crisis of relevance'?

As the 'ultimate showdown' for the year-end automotive market, the Guangzhou Auto Show is not only a pivotal moment for automakers to boost sales but also a central hub for the entire industry.

However, amidst the glitz and glamour, some brands have quietly bowed out.

According to incomplete data, the roster of absent brands at the 2025 Guangzhou Auto Show has grown once again. Excluding officially delisted brands like Neta and HiPhi, joint ventures and imported brands such as Subaru and Chevrolet are also notably absent. More surprisingly, ultra-luxury and luxury joint venture brands including Rolls-Royce, Porsche, Bentley, Genesis, and Chery Jaguar Land Rover have all withdrawn.

Image source: Dianchetong Production

For lesser-known joint venture brands, their absence might be understandable—due to a lack of competitiveness, limited marketing budgets, and low exposure efficiency at auto shows—all valid considerations. However, the collective 'vanishing act' of ultra-luxury brands has left the high-end exhibition zone unusually subdued, marking one of the most unexpected developments in this year's automotive market.

Reflecting on past years, ultra-luxury brands were the 'crowd-pullers' at A-class auto shows: multi-million-dollar custom models, exquisitely designed exhibition booths—all drew the attention of audiences and media alike.

This seems to signal a deeper shift: the consumption logic in China's automotive market is undergoing a profound transformation.

Ultra-Luxury Brands Collectively 'Missing'? The Truth Is 'Not Cost-Effective'

This collective 'disappearance' of ultra-luxury brands is not a sudden move but a calculated commercial 'withdrawal.' The reason is straightforward: spending on exhibitions fails to drive sales, and the input-output ratio at auto shows has become severely unbalanced.

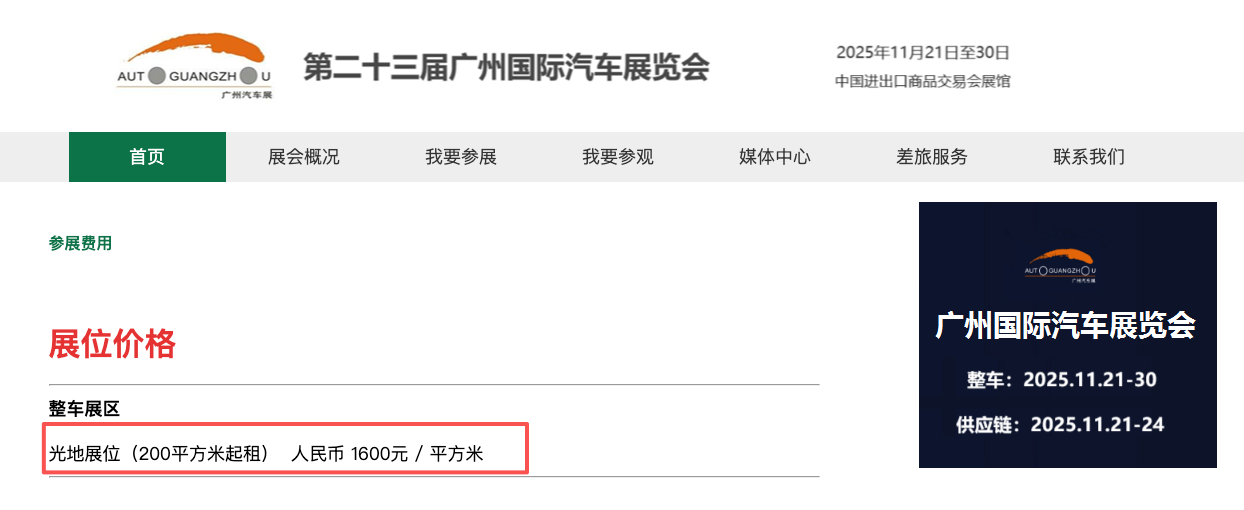

Dianchetong checked the official pricing for the Guangzhou Auto Show, where the cost of a bare exhibition space in the Vehicle exhibition area has soared to 1,600 yuan per square meter—but this is just the tip of the iceberg.

Screenshot: Guangzhou International Automobile Exhibition Official Website

Companies must also shoulder additional costs for custom booth design, construction, cross-regional vehicle transportation, personnel travel, utilities, security, and more—each representing a significant financial burden. The special exhibition booths, which ultra-luxury brands prize the most, are the main arena for burning cash.

According to quotes from professional exhibition design firms, the construction cost for customized special exhibition booths ranges from 800 to 5,000 yuan per square meter. Using a small 100-square-meter booth as a simple estimate: the combined cost of bare space rental and basic special booth construction alone would be at least 280,000 yuan. Factoring in the luxury materials typically used by high-end brands, transportation and high-value insurance for multiple display vehicles, on-site personnel salaries, and other expenses, the comprehensive cost of participating in a single auto show can easily exceed one million yuan.

Ultra-luxury brands are not short on funds; they simply refuse to spend on ventures deemed 'doomed to fail.'

Although automakers have never disclosed specific order data during auto shows, the reality of 'wasted investment' has already been confirmed by the market.

The terminal market has raised red flags first. In the first quarter of this year, sales of new vehicles priced over 1 million yuan in the Chinese market totaled just 21,000 units, a staggering 53% year-on-year decline. Sales for ultra-luxury brands have collectively plummeted, with the highest drop reaching 44%.

Chart: Dianchetong

More critically, an increasing number of ultra-luxury brands are realizing that auto show traffic tactics pale in comparison to targeted, exclusive salons.

Federico Foschini, Chief Marketing and Sales Officer of Lamborghini, bluntly stated, 'The crowded environment of auto shows makes it impossible to achieve meaningful communication with high-end clients,' confirming a permanent exit from auto shows.

In contrast, their small, private events in Shanghai and Paris have secured over a dozen custom orders in a single session, with conversion efficiency far surpassing auto shows. This has prompted Lamborghini to decisively shift its entire budget toward private operations.

Similarly, ultra-luxury brands like Bentley, Rolls-Royce, McLaren, Aston Martin, and Porsche have also redirected resources into 'customer-centric' private operations.

Image source: Rolls-Royce Official Website

Against the backdrop of a sluggish global economic recovery in 2025 and an 8% year-on-year decline in demand for ultra-luxury vehicles, brands are tightening marketing budgets and allocating funds to more efficient channels.

Abandoning auto shows and focusing on private operations have become rational choices for ultra-luxury brands to navigate market changes, fundamentally creating the desolate scene of 'no luxury cars to see' at this year's Guangzhou Auto Show.

Rather Than Saying 'No Luxury Cars to See,' It's Better to Say the 'Luxury Car Irrelevance' Phenomenon Is Intensifying

However, based on Dianchetong's years of auto show experience, it's more accurate to say that the 'luxury car irrelevance' phenomenon is intensifying—audiences are gradually losing interest in ultra-luxury display vehicles.

Before entering the automotive media industry, Dianchetong always believed that to reach the pinnacle of ultra-luxury brands, a car must either possess hardcore performance like Porsche or AMG or offer unparalleled luxury like Bentley, Rolls-Royce, or Maybach.

Thus, at every major auto show, Dianchetong would head straight to the ultra-luxury brand booths to experience the pinnacle of automotive engineering, while family cars were merely glanced at.

But visiting auto shows today feels entirely different.

Image source: Dianchetong Production at the 2017 Guangzhou Auto Show

Domestic new energy brands have been breaking through, continuously redefining what 'luxury' means.

NIO, Li Auto, XPeng, BYD, Xiaomi... they have not only surpassed traditional luxury cars in intelligent driving and cabin interaction but also achieved zero-to-100 km/h acceleration capabilities previously reserved for million-dollar fuel-powered vehicles with their 300,000-yuan electric models. Even the 'materials' and 'texture' once monopolized by luxury brands now feature unique styles and attitudes, from 'fridge, TV, sofa' setups to large tables and configurable cabins—better catering to Chinese users' demands for a 'second living space.'

As domestic brands master the combination of 'performance, intelligence, and luxury,' audiences' criteria for judging 'what is luxury' no longer fixate on the historical legacy behind century-old brand logos but instead focus on whether the driving experience enhances their daily lives.

On the other hand, ultra-luxury brands seem stuck in 'innovation stagnation.'

The display vehicles at auto shows are always minor facelifts or special editions—changing paint colors, adding exclusive badges, or upgrading interior materials—while core handling technologies and powertrains remain unchanged. Electrification transitions have been sluggish, with either 'fuel-to-electric' transitional products or delayed pure electric models, and intelligent configurations lag far behind domestic new energy brands.

This lack of innovation has rendered ultra-luxury brand booths unappealing.

Image source: Porsche Official Website

On one side, domestic brands continuously push technological boundaries and reshape experiences; on the other, ultra-luxury brands cling to past glory. Naturally, the 'luxury car irrelevance' phenomenon becomes more pronounced.

At today's auto shows, audiences would rather queue at domestic brand booths to experience the latest technology than linger at ultra-luxury booths. The collective exit of ultra-luxury brands may simply be their last attempt to preserve dignity.

Ultra-Luxury Brands' Collective Exit: Losing Due to 'Not Understanding Users'

Previously, ultra-luxury booths attracted 'spectator traffic'—people came for legends and dreams, not necessarily to buy. Today, the new energy high-end exhibition area gathers 'value-driven traffic'—audiences come for technology, compare experiences, and inquire about configurations. They are genuine potential buyers with budgets and needs.

The new generation of consumers no longer blindly pays for the 'luxury car logo' halo but evaluates whether the technology is leading, the value is equivalent, and the experience is satisfactory. This shift in the definition of 'luxury' is driving the market from 'brand premium' to 'value-driven.'

This transformation signifies that Chinese consumers are maturing, and the Chinese auto market is returning to product fundamentals. Unfortunately, most ultra-luxury brands remain stuck in the old script of brand premium, attempting to maintain their status with 'boring' display vehicles like 'special editions,' 'limited editions,' and 'classics.'

Ultra-luxury brands must recognize that exiting auto shows cannot hide the reality of declining sales in the domestic market. Only by genuinely humbling themselves, accelerating electrification, and sincerely understanding Chinese users' new demands for intelligence, scenarios, and emotional value can they regain market recognition.

For domestic high-end brands, the collective exit of ultra-luxury brands signals the opening of a strategic window. The center stage, media headlines, and consumer mindshare once occupied by traditional luxury barriers are now experiencing a rare vacuum.

This is not just a replacement of exhibition space but a transfer of market influence.

(Cover image source: Dianchetong Production at the 2017 Guangzhou Auto Show)

Guangzhou Auto Show, luxury brands, ultra-luxury brands, Bentley, Rolls-Royce

Source: Leitech

Images in this article are from the 123RF licensed library.