Why Didi's Electric Transformation in Latin America Deserves Attention from Chinese Automakers?

![]() 11/25 2025

11/25 2025

![]() 559

559

The transformation towards new energy vehicles in the Latin American market begins with ride-hailing.

Author I Wang Bin

On November 22nd, local time in Brazil, the 30th United Nations Climate Change Conference (COP30) finally came to a close. Ten years ago, at the 21st United Nations Climate Change Conference, participating countries signed the Paris Agreement. All parties hope that the outcomes of this conference will set the direction for global climate governance in the next decade.

Xinhua News Agency reported that this was the first time the United Nations Climate Change Conference was held without the participation of the U.S. federal government. The series of achievements reached at the conference once again proved that the Paris Agreement is a consensus among the vast majority of countries worldwide and that the global green transition is irreversible. Xinhua pointed out that global Southern countries, represented by China, have become an important force in driving consensus.

Chinese companies play a significant role in promoting the global green transition. At the China Pavilion of COP30, many Chinese companies continued to share their practical achievements in driving green transitions, attracting numerous conference representatives to participate. Li Bing, Vice President of the China Enterprise Confederation, stated that Chinese companies are a crucial force in implementing China's "dual carbon" strategy and play an irreplaceable role in achieving a just transition.

This is particularly evident in the overseas layout (overseas layout here means 'overseas expansion strategies') of some Chinese companies, which deeply participate in local green transition practices. For example, during COP30, Didi's Brazilian ride-hailing platform, 99, announced that its electric vehicle ride category, "99electric-Pro," has expanded to cover five major Brazilian cities, including São Paulo, Brasília, Porto Alegre, Goiânia, and Curitiba, continuously expanding its green travel options.

Brazil is one of Didi's key markets for international business. As early as 2018, Didi entered the Brazilian ride-hailing market by acquiring 99 Taxi. Currently, 99 is one of the largest ride-hailing platforms in Brazil.

However, the significance of the launch of 99electric-Pro may go far beyond the platform's own business expansion. By promoting the adoption of new energy vehicle models in the ride-hailing category, Didi has effectively opened a pathway for Chinese new energy automakers to enter the Brazilian market, laying a market foundation for the overseas expansion of China's new energy automotive industry chain.

Didi's Globalization Reaches a New Stage

While domestic users are already familiar with new energy vehicle models in ride-hailing, in overseas markets, especially in Latin America, new energy vehicle models in ride-hailing are still extremely rare.

In fact, the 99electric-Pro launched by Didi's 99 platform is Brazil's first new energy ride-hailing category served by a combination of pure electric and hybrid vehicle models.

In July 2024, 99electric-Pro was first launched in São Paulo, Brazil's largest city. After a year of expansion, it now covers five major Brazilian cities, with over 30,000 new energy vehicle models registered on the platform, serving more than 27 million passengers cumulatively, and covering a total driving distance exceeding 245 million kilometers.

In contrast, Uber's new energy vehicle fleet, Uber Green, officially announced its launch in São Paulo a month later. It wasn't until September of this year that Uber Green landed in Rio de Janeiro, with limited fleet size and operational scope in the initial stages.

99electric-Pro is not Didi's only move in overseas new energy ride-hailing layout (overseas new energy ride-hailing layout here means 'overseas new energy ride-hailing expansion'). Last October, Didi also announced a grand new energy plan in Mexico, stating that it would introduce 100,000 electric vehicles in Mexico by 2030 to assist in the electric transformation of local ride-hailing services.

The Latin American market features varying levels of urban development, and locals often rely on two-wheeled vehicles such as motorcycles for transportation. In addition to launching the two-wheeled travel category, 99Moto, in Brazil, Didi's 99 is also gradually promoting the electric transformation of local two-wheeled travel.

Pure electric motorcycles launched by 99 and Riba Brasil in Belém, Brazil

In Belém, the host city of COP30, 300 electric motorcycles jointly launched by 99 and Brazilian local company Riba Brasil have officially gone into operation. During the conference, these electric motorcycles also received widespread attention from attending media and were regarded as one of the representative cases of green transportation.

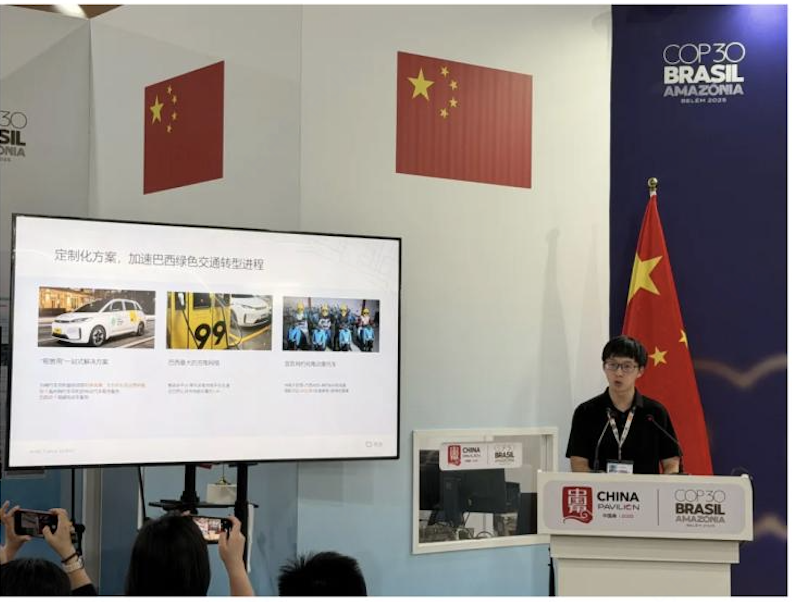

During COP30, Didi's international business and 99-related executives were also invited to participate in multiple themed events held at the China Pavilion, sharing their experiences in implementing green travel. At the "Belt and Road" green-themed event organized by the UN Newsroom, Didi was the only digital travel company selected as a "Belt and Road" green supply chain case for two consecutive years.

Mao Chenyu, Didi's Head of International Food Delivery and Spanish-Speaking Region Travel, sharing at COP30

In addition to accelerating the electric transformation of ride-hailing categories in the Latin American market, Didi is also continuously promoting the construction of local new energy infrastructure. As early as 2022, 99 took the lead in establishing the "Brazil Sustainable Development Alliance," aiming to increase the penetration rate of electric vehicles in new car sales in Brazil to 15% and build 10,000 new public charging stations by the end of 2025.

Ride-hailing drivers strongly support this initiative. Compared to fuel-powered vehicles, new energy vehicles offer advantages in operating costs, maintenance fees, comfort levels, and even intelligence. Drivers are more willing to choose new energy vehicles. According to 99 data, drivers providing "99electric-Pro" services earn an average income about 60% higher than those in traditional fuel-powered vehicle categories.

In Brazil, the 99electric-Pro fleet operating around the clock on the streets serves as the most intuitive display window for Chinese new energy automotive brands locally. Many users who have not had the opportunity to experience Chinese new energy vehicles can intuitively feel the leap in comfort and intelligence of Chinese autonomous brands through this.

To some extent, this means that Didi's current international layout (international layout here means 'international expansion strategy') has reached a new stage. Over the past few years, the overseas expansion methods of Chinese companies have evolved from early-stage capital and technology overseas expansion to deep participation in the transformation and upgrading of overseas industry chains.

According to Didi's Q2 2025 financial report, the platform's total orders for the quarter reached 4.464 billion, a year-on-year increase of 15.2%, marking the tenth consecutive quarter of double-digit year-on-year order growth. Both domestic and international order volumes reached all-time highs, with international business growth being even more rapid. During the quarter, Didi's international business GTV reached RMB 27.1 billion, surging by 27.1% year-on-year at a constant exchange rate.

Currently, Didi's international business covers 14 countries and regions worldwide, with particular success in Latin America, primarily Mexico and Brazil, which are core markets for Didi's international business. After completing the initial market expansion, Didi is now deepening its layout ( layout here means 'strategic presence') in Latin America, moving from market exploration to driving the transformation and upgrading of local ride-hailing services. For Didi, this also means a larger market space.

China's New Energy Overseas Expansion Needs New Support

The fundamental reason for emphasizing the industrial significance of Didi's promotion of ride-hailing electric transformation in Latin America is that the local automotive market is still dominated by fuel-powered vehicles, and market education for new energy vehicles is still in its early stages.

Brazil is the world's sixth-largest automotive market, following China, the United States, India, Japan, and Germany. According to data from the Brazilian National Association of Automotive Manufacturers (ANFAVEA), new car sales in Brazil increased by 14.1% year-on-year to 2.635 million units in 2024.

However, multinational automakers account for more than half of the market share. Fiat, Volkswagen, and General Motors, all under the Stellantis Group, have consistently held more than 50% of the Brazilian market share. Last year, the combined market share of three Chinese automakers in Brazil—BYD, Chery Automobile, and Great Wall Motors—was only 6.8%.

Even though the pace of new energy vehicle transformation in Brazil has accelerated in recent years, fuel-powered vehicles remain the dominant model. Last year, Brazil sold a total of 125,600 new energy vehicles (including pure electric and hybrid), accounting for only 4.8% of the country's annual car sales, comparable to the penetration rate of China's new energy vehicle market in 2018.

In other words, the current acceptance level of Brazilian consumers towards new energy vehicles is still at the stage of China's market seven years ago. Thinking back to the domestic market's perception of new energy vehicles seven years ago, BYD's annual sales were at the 500,000-unit level, NIO was about to face its toughest year, and Tesla could only sell fewer than 7,000 vehicles in China annually.

Didi's active promotion of ride-hailing market electric transformation in Latin America holds even greater significance in pre-cultivating the market, establishing user recognition of new energy vehicles in high-frequency travel scenarios, and laying a foundation for Chinese automotive brands to enter the local market. The ride-hailing vehicles with 99 or Didi stickers actively operating on the streets of Brazil and Mexico serve as mobile billboards for Chinese new energy brands.

Pure electric vehicle model BYD D1 jointly introduced by 99 and BYD to Brazil

Pure electric vehicle model BYD D1 jointly introduced by 99 and BYD to Brazil

Looking back at the development of China's new energy vehicle industry, this point has been fully demonstrated. China's new energy vehicles first completed their generational shift in the taxi and ride-hailing categories. As early as 2014, the "Guidelines on Accelerating the Promotion and Application of New Energy Vehicles" issued by the State Council explicitly proposed expanding the application scale of new energy vehicles in the public service sector, with taxis and ride-hailing vehicles being key focuses.

A report titled "2023 Digital Travel Facilitating Zero-Carbon Transportation" compiled by the China Academy of Transportation Sciences previously pointed out that while private passenger vehicles are a key area for carbon emissions and energy conservation in China's transportation sector, practical experience shows that starting with public service vehicles and taxis to drive the electrification of private car consumption is a feasible path to ultimately achieve societal electrification transformation.

Currently, the cumulative number of new energy vehicles registered on the Didi platform exceeds 6 million, with 5.1 million being pure electric vehicles. Over 68% of ride-hailing mileage is contributed by pure electric vehicles.

This is also one of the reasons why Chinese automakers have enthusiastically responded to Didi's call and actively participated in promoting the electric transformation of ride-hailing categories in both Brazil and Mexico. The electric transformation of ride-hailing vehicles will significantly drive consumer market recognition at the C end.

The "Sustainable Development Alliance" initiated by 99 in Brazil has already attracted 23 Chinese and Brazilian companies, including BYD, spanning multiple sectors such as automotive manufacturing, car rental, charging energy, and even financial services. Didi's ride-hailing electric transformation plan in Mexico has also attracted participation from BYD, GAC Group, Changan Automobile, JAC Motors, and numerous Mexican local companies.

In fact, almost all of Didi's new energy vehicle fleets deployed in Latin America are composed of domestic new energy brands. The main model of the 99electric-Pro fleet is the pure electric vehicle model BYD D1 jointly customized by Didi and BYD. The pure electric premium vehicle fleet deployed by Didi in Mexico also consists of models from domestic autonomous brands such as GAC Group and JAC Motors.

GAC new energy vehicle model introduced by Didi to Mexico

Many overseas platforms have also started to introduce Chinese new energy vehicles along Didi's path. As early as 2022, 99 reached a cooperation agreement with BYD to introduce BYD's electric vehicle models to Brazil. Two years later, Uber announced a cooperation agreement with BYD to deploy BYD's electric vehicle models in the global market. Last year, Uber announced a cooperation agreement with JAC Motors to provide preferential vehicle purchase plans for Brazilian Uber drivers.

In the current overseas expansion process of Chinese new energy automakers, technological strength has achieved global leadership, and funding is no longer an issue. However, market cultivation still requires time. The severe shortage of overseas new energy infrastructure and the fact that market education cannot be completed overnight objectively restrict the global expansion of China's new energy industry chain.

From this perspective, Didi's continuous promotion of ride-hailing electric transformation in overseas markets is also accelerating the market education for overseas new energy vehicles, creating a more stable demand foundation for the localization of China's new energy industry chain.

© All rights reserved by Shanshang. Unauthorized reproduction is prohibited.