Fallen New Energy Vehicle Players Rise Once More

![]() 11/25 2025

11/25 2025

![]() 630

630

In recent years, the new energy vehicle market has witnessed intensified competition, prompting a swift elimination race among major automakers. Amidst this backdrop, several well - known new entrants have found themselves in dire straits due to disrupted funding chains and have quietly exited the market. However, recently, some of these stalled new forces have been actively signaling their intention to restart operations. They have been disclosing revival plans one after another, in a bid to re - enter the automotive market and vie for a share.

The latest addition to this trend is Evergrande Auto.

According to the Qichacha APP, Guangzhou Juli Modern Industrial Development Co., Ltd., a subsidiary of Guangzhou's state - owned assets, has officially completed its transformation. It has now become the wholly - owned controlling shareholder of Evergrande Intelligent Automobile Co., Ltd. and Evergrande New Energy Vehicle Co., Ltd. The original shareholder, Evergrande New Energy Vehicle Investment Holding Group, has completely exited the scene.

Regarding the news of Guangzhou's state - owned assets taking over, a representative from the shareholder side of Guangzhou Juli Modern Industrial Development Co., Ltd. confirmed its authenticity. They stated that the first step would be to reclaim the land owned by Evergrande Auto in Nansha District, Guangzhou. As for whether they will venture into the automotive manufacturing business, no definitive response was provided.

There is a prevailing public sentiment that this marks the first substantive rescue by a 'national team' after Evergrande Auto's multiple failed attempts to attract strategic investments. It signifies a shift from a phase of 'survival of the fittest' to a 'government - led restructuring' phase.

Currently, Evergrande Auto is in a desperate situation. Since its inception, it has only launched one model, the Hengchi 5, which has failed to establish effective market competitiveness. Financially, Evergrande Auto is also in a dire state. Reports indicate that in 2023, its total liabilities reached RMB 72.543 billion, with its asset - liability ratio soaring to 208%. In the first half of 2024, its revenue plummeted by 75.17% compared to the same period last year, resulting in a net loss of RMB 20.256 billion. On July 1st, Evergrande Auto announced on the Hong Kong Stock Exchange that due to persistent liquidity depletion, it could not determine the release date of its 2024 financial report. Additionally, its stock suspension, which began on April 1st, would be extended indefinitely. Moreover, its production bases in Tianjin and Shanghai have successively entered bankruptcy proceedings.

After the takeover by Guangdong's state - owned assets, Evergrande Auto may see a glimmer of hope. However, this is merely the first step in its bid to escape desperation. The debt burden, brand influence, production capacity recovery, and the rebuilding of supply chains and sales networks all pose inevitable challenges for Evergrande Auto. Whether Evergrande Auto can truly experience a 'rebirth' remains highly uncertain.

WM Motor not only has plans for revival but also sets an ambitious annual production target of one million units.

Earlier this month, WM Motor released a poster on its official social media with the caption 'Good things are coming, please stay tuned.' According to insiders, WM Motor will host a 'new car launch event' at the end of the month. The 'good things' involve multiple aspects, including products, networks, and suppliers, covering a wide range of areas. However, this teaser was quickly deleted, followed by a notification of the relaunch of the Xiao Wei Sui Xing APP. Prior to this, Shenzhen Xiangfei, a Baoneng Group enterprise that took over WM Motor, released a white paper, declaring its goal to achieve one million units of production capacity and RMB 120 billion in revenue by 2030.

WM Motor's revival plan reveals significant ambition. However, achieving this goal will be no easy feat. Specifically, the WM EX5 and WM E.5 models that are resuming production are several years old and lag behind mainstream products in core indicators such as intelligent driving and range. Additionally, WM Motor is already in a state of severe insolvency, while the Baoneng Group behind Shenzhen Xiangfei also faces considerable debt pressure and operational challenges. Furthermore, consumer market acceptance of WM Motor's products remains questionable.

WM Motor's bold statements are indeed eye - catching, but whether they can truly be realized ultimately depends on solid hard power as the core support. Currently, WM Motor does not possess a competitive advantage in the automotive market.

Neta's revival focuses on 'capital recruitment' as the core breakthrough.

On June 30th of this year, Hozon New Energy released a 'Pre - recruitment Notice for Restructuring Intentional Investors,' seeking financial support and industrial resource integration to resume production and further develop.

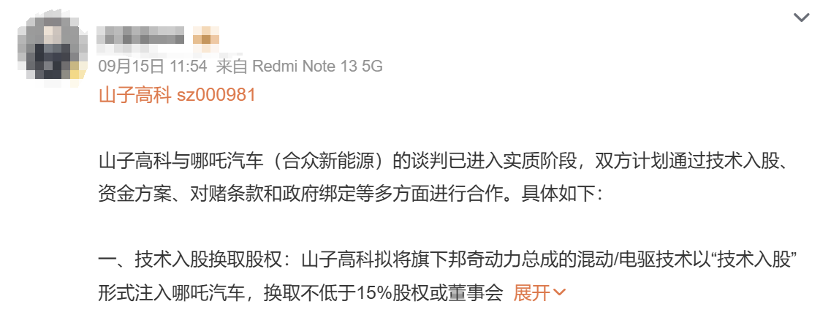

By September, media reports stated that Shanzhi Hi - Tech is advancing restructuring efforts with Hozon New Energy, the parent company of Neta. The reports pointed out that their cooperation would revolve around two major areas: technology equity participation and supply chain integration. Additionally, it was reported that after Shanzhi Hi - Tech takes over, Neta will launch dual - line products featuring hybrid and extended - range technologies. By 2027, Neta aims to achieve annual vehicle sales of 200,000 units.

Industry insiders believe that Shanzhi Hi - Tech's entry may bring new vitality to Neta.

On November 17th, the administrator of the parent company, Hozon New Energy, officially submitted an application for RMB 100 million in co - benefit debt financing, which will be used to maintain daily operations and after - sales service. On the 25th of this month, Neta will hold its second creditors' meeting. This will become a 'life - or - death' juncture for Neta. According to media reports, if the restructuring plan is approved, Neta can officially embark on its revival path.

However, it should also be noted that Neta's recovery still faces difficulties. Among them, the incomplete resumption of production at the Tongxiang factory, the massive debt scale and prominent litigation pressure, and the intense market competition making it difficult to regain market share will all become significant obstacles for Neta. Furthermore, the cooperation between Neta and Shanzhi Hi - Tech has not yet been formalized, and the restructuring path is still full of uncertainties.

Epilogue

Behind the 'resurgence' trend of these new forces essentially lies a secondary breakthrough attempt during the reshuffling period of the new energy vehicle industry. However, there are no shortcuts on the road to revival. Whether it is debt resolution after state - owned asset takeovers, resource integration in cross - border restructurings, or the iteration of old products and the rebuilding of new market trust, the core revolves around two major propositions: 'sustainable operation' and 'core competitiveness reshaping'.

In the current automotive market, there is no precedent for a new energy vehicle new force to rise again after falling. The self - rescue efforts of new forces such as Evergrande Auto, Neta, and WM Motor represent both a final contest for industry opportunities and face unknown challenges with no precedents to follow.

This reminds the author of a case from eight years ago.

In 2017, after LeTV Auto's funding chain broke, Sun Hongbin, the chairman of Sunac China, stepped in. However, in the end, Jia Yueting fled to the United States and never returned, leaving a huge debt hole for LeTV and Sunac. As a result, Sun Hongbin could only admit defeat with tears, saying, 'I've lost my head trying to save others.'

This also highlights the uncertainties and potential risks faced by new forces during the revival process.

(Images sourced from the internet, removed if infringing)