The "Definitive Solution" for Solid-State Batteries Can Only Emerge in China

![]() 11/27 2025

11/27 2025

![]() 468

468

Author/Proton

Editor/Jiajia

"Vehicles equipped with all-solid-state batteries can potentially achieve a range exceeding 1,000 kilometers, surpassing the 500-kilometer mark," Qi Hongzhong, the head of new energy power R&D at GAC Group's Platform Technology Research Institute, proudly declared in a recent interview with CCTV News. He revealed that GAC has established China's first large-scale all-solid-state battery production line, achieving the conditions for mass production of automotive-grade all-solid-state batteries.

As the "ultimate battery solution," GAC is not the sole contender in solid-state battery technology. Domestic new energy companies across the upstream and downstream sectors, including BYD, CATL, EVE Energy, and Ganfeng Lithium, consider 2026 and 2027 as pivotal milestones for transitioning solid-state batteries from laboratory research to industrial-scale production.

In the realm of solid-state batteries, the breakthrough extends beyond GAC Group, representing a collective endeavor by Chinese enterprises. These companies have not only overcome technical and engineering hurdles but are also driving the industrialization of solid-state batteries.

[1] From a Late Start to a Collective Leap Forward

Perhaps to mitigate the financial impact of lithium price fluctuations, Li Liangbin, the founder of Ganfeng Lithium, embarked on a quest for a second growth curve for the lithium mining giant in 2016 by venturing into new energy storage and power battery sectors.

At that time, the storage and power battery markets were dominated by two giants: CATL and BYD. To differentiate itself, Li chose to invest in the future by bypassing mainstream liquid batteries (ternary lithium and lithium iron phosphate) and instead invested 250 million yuan in a partnership with the Chinese Academy of Sciences to develop next-generation new energy batteries: solid-state batteries.

(Source: China Battery Network)

(Source: China Battery Network)

"In the future, we will have second- and third-generation solid-state battery products. By the third generation, we anticipate true solid-state lithium batteries featuring solid electrolytes, lithium metal anodes, and possibly 811 cathodes," Li stated. For Ganfeng Lithium, capturing future markets justifies continuous trial-and-error iterations.

In fact, many shared Li's optimism about solid-state batteries:

In August 2017, BYD applied for a patent on a composite cathode material for all-solid-state lithium-ion batteries and solid-state lithium-ion batteries. In November of the same year, Guoxuan High-Tech announced it had initiated solid-state battery R&D at its Japanese research institute. The following February, Jineng Technology signed a cooperation agreement with Canada's Hydro-Québec to introduce "lithium iron phosphate all-solid-state batteries" with an energy density of up to 250Wh/kg...

Even CATL, the leader in power batteries, whose chairman Robin Zeng repeatedly emphasized that commercialization of solid-state batteries was still years away, continued exploring both polymer and sulfide-based solid-state battery technologies simultaneously...

For these battery and lithium mining companies, solid-state batteries represent the pinnacle of new energy battery technology, capable of addressing current pain points and shaping the future.

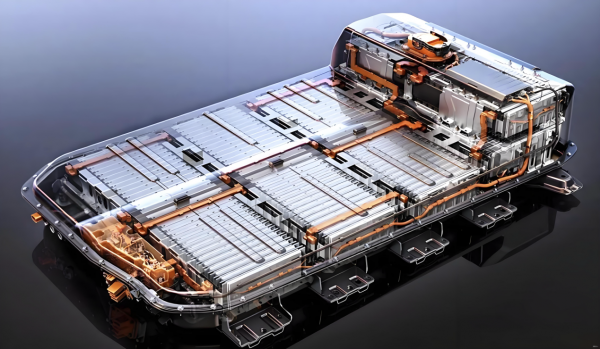

Firstly, their high energy density—theoretically reaching 600Wh/kg, two to three times that of current liquid lithium batteries—means that solid-state batteries of the same volume can extend a new energy vehicle's range from 500 kilometers to 1,000 kilometers, directly eliminating range anxiety.

Secondly, their enhanced safety resolves issues like fires and explosions caused by battery thermal runaway. As AnnMarie Sastry, co-founder and CEO of Sakti3, put it: "You can split the battery in half or expose it to high temperatures, and it will still function."

Compared to the concentrated efforts of Chinese companies in solid-state batteries between 2016 and 2018, European, American, Japanese, and South Korean companies began earlier.

In 2010, Toyota unveiled a solid-state battery with a range exceeding 1,000 kilometers. In 2015, Sakti3 developed a solid-state battery with an energy density of 1,100Wh/L, securing a $15 million investment from James Dyson, founder of Dyson Ltd. Before 2018, Hydro-Québec possessed the world's most advanced solid-state battery technology...

"I'd need a crystal ball to predict all the challenges encountered during development. There's a British saying, 'stick your neck on the line,' which means taking a leap into something new and different. If it succeeds, great," James Dyson told Yicai Global, viewing his investment in solid-state batteries as a bet on the future.

[2] Turning the Tables: Chinese Companies Achieve Comprehensive Breakthroughs

The consensus in the industry is that solid-state batteries will disrupt the new energy sector. The only question is their prohibitive cost.

"Currently, costs comparable to gold are a major obstacle to commercializing solid-state batteries," CLSA directly stated in a research report, expressing skepticism about short-term commercialization.

While companies like Toyota and Sakti3 could manufacture solid-state batteries with ranges exceeding 1,000 kilometers in their labs over a decade ago, the cost was astronomical.

Data shows: In 2018, producing a solid-state battery to power a smartphone cost $15,000 per unit, while a battery for a new energy vehicle cost a staggering $90 million.

Thus, for both foreign companies like Toyota and Sakti3 and Chinese firms like BYD and CATL, the key to becoming the new leader lies in reducing solid-state battery costs to consumer-friendly levels.

In this race to cut costs, Chinese companies are not only leading but charging ahead as a collective force:

At the 2025 Guangzhou Auto Show, GAC Group Chairman Feng Xingya announced that its self-developed automotive-grade all-solid-state battery (above 60Ah) had achieved an energy density exceeding 400Wh/kg and was ready for mass production.

Guoxuan High-Tech's pilot line for its "Jinshi" solid-state battery is operational, with test vehicles equipped with "Jinshi" samples having completed over 10,000 kilometers of driving.

Chery Automobile's solid-state battery module prototype, "Rhino S," achieved an energy density of 600Wh/kg and passed safety tests including drilling, nail penetration, 50% compression deformation, and even immersion in water. It plans to begin vehicle integration testing in 2027.

Dongfeng Motor stated it has established an independent and controllable solid-state battery supply chain, producing batteries with energy densities of 240Wh/kg and 350Wh/kg, achieving a maximum range exceeding 1,000 kilometers.

More importantly, beyond solving engineering challenges, Chinese new energy automakers have significantly reduced the cost of integrating solid-state batteries into vehicles.

GAC previously announced that its all-solid-state battery would debut in the "Hyper" model. Currently, the Hyper lineup includes three models—Hyper HL, Hyper HT, and Hyper GT—priced between 173,900 and 329,900 yuan. This suggests the solid-state battery version of "Hyper" will cost around 300,000 yuan.

(Source: Yiche)

(Source: Yiche)

In contrast, only a few foreign companies like Toyota are competitive in solid-state batteries.

At the June 2025 Toyota Technical Workshop, Toyota unveiled its solid-state battery timeline—planning practical applications by 2027–2028, targeting mass production for Lexus flagship models.

According to Siku Finance, Lexus's current flagship models include the LS, LX, LC, and LM series, priced starting at 880,000, 1.3 million, 1.3 million, and 1.2 million yuan, respectively.

Why can Chinese automakers like GAC deploy solid-state batteries in vehicles priced around 300,000 yuan, while Toyota reserves them for million-yuan luxury cars?

The answer lies in the fact that widespread adoption of solid-state batteries can only happen in the Chinese market.

[3] Right Time, Right Place: China's Market as the Promised Land

"Although we (China) lag behind Japan, South Korea, and others in solid-state technology to some extent, our vast industry-academia-research ecosystem and national policy support will accelerate our R&D speed," Sun Huajun, CTO of BYD's battery division, confidently stated. Only China's environment can nurture the next "king" of solid-state batteries.

Indeed, Chinese companies hold unique advantages in market demand, R&D capabilities, and talent:

Firstly, talent reserves. China produces approximately 30,000–40,000 electrochemistry graduates annually, while Japan's Ministry of Economy, Trade, and Industry's "Competitiveness Enhancement Plan" aims to train 4,000 battery design technicians by 2030.

This talent gap enables continuous technological breakthroughs for Chinese companies. As of May this year, China accounted for 7,640 of the 20,798 global key patents in solid-state batteries, representing 36.7% of the total.

Secondly, supply chain strength. China boasts the world's most complete and lowest-cost power battery supply chain, covering cathodes, anodes, separators, and electrolytes. The processes and equipment required for solid-state battery production are not only readily available but also benefit from cost-sharing. Moreover, mature liquid battery processes can be directly adapted.

According to The Paper, trial production data from Toyota's Fukuoka plant showed a solid-state battery yield rate of just 65%, significantly increasing costs. In contrast, Guoxuan High-Tech reported a yield rate exceeding 90% for its Jinshi solid-state batteries, approaching the 95% yield of liquid batteries.

Finally, market demand. IDC data shows that China's new energy vehicle market reached 5.47 million units in the first half of 2025, up 26.8% year-on-year. However, most consumers remain concerned about range anxiety and thermal runaway safety issues, meaning that once solid-state battery prices drop, they will become the top choice for many buyers.

(Source: Internet)

(Source: Internet)

Under this market pressure, both battery and automakers are intensifying technological efforts to avoid being left behind by the solid-state battery revolution.

More importantly, China has formed a unique "market size–industrial upgrading" positive cycle. Its massive new energy vehicle market provides the richest application scenarios and fastest iteration feedback for solid-state batteries.

From GAC deploying solid-state batteries in the 300,000-yuan Hyper model to Dongfeng, Chery, and others setting clear 2027 vehicle integration timelines, Chinese automakers are using "large-scale application" as a tool to rapidly amortize R&D costs and break through mass production bottlenecks. This market-driven industrialization capability is precisely what traditional automotive powers like Japan and Germany lack.

"Our (battery) industry is now globally leading. We don't want to be disrupted, but because all-solid-state batteries have disruptive potential, we still face risks (though not yet reality)," Ouyang Minggao, academician of the Chinese Academy of Sciences and Tsinghua University professor, warned at the 2024 China All-Solid-State Battery Innovation Development Summit. He urged domestic companies to unite in tackling solid-state battery challenges to maintain China's global dominance in the battery sector.

Two years later, GAC established China's first large-scale all-solid-state battery production line, initiating the industrialization of solid-state batteries. More importantly, behind GAC stand CATL, BYD, Changan Automobile...

END