Insights from the Guangzhou Auto Show: Automakers Find Clarity, Auto Market Heads into a Rational "Protracted Battle"

![]() 11/28 2025

11/28 2025

![]() 530

530

In the age of video, consumers have access to simpler and more intuitive channels for obtaining information. Essentially, all details about a product can be found online. Thus, large auto shows such as the Guangzhou Auto Show serve more as a platform for automakers and automotive professionals to showcase their offerings. After all, many automakers have already launched their key products in the first half of the year or ahead of peak sales seasons. The year-end exhibition is primarily about displaying a full range of products and aiming to boost car sales. The costs associated with multi-million-dollar exhibition stands are substantial, making every sale crucial.

Therefore, at the Guangzhou Auto Show, which commenced on November 21st, automakers have abandoned flashy marketing tactics and are now clear about their product strategies. Competition has also returned to a more rational level.

Next year will mark a pivotal period as policy incentives are phased out, with subsidies fully withdrawn, support for new energy vehicle purchase taxes diminishing, and new industrial support policies yet to be defined. With increasing calls for equal treatment of gasoline and electric vehicles, the auto market will transition into a new phase of gradual movement towards pure market competition. Automakers are closely observing and contemplating how to align their products with policy requirements for the upcoming year.

This year's auto show boasts 93 global premieres and 1,085 exhibition vehicles. Strong independent brands like Geely and Chery have largely adhered to a standard marketing approach. Weaker joint venture brands have refrained from making grandiose claims and are simply striving to regain lost ground. Next year will also be a critical year for joint venture brands to launch strategic counterattacks, hence their major products have been reserved for then.

No Longer Adhering to Pure Electric as the Sole Path

An intriguing phenomenon at this year's auto show is that brands previously focused solely on the pure electric market have now introduced extended-range and plug-in hybrid models. Automakers are no longer hesitant about new energy routes. As long as a product meets market demand and consumers are willing to pay for it, it qualifies as a good product.

For instance, the Xiaopeng X9 Super Extended-Range Edition addresses the gap in long-distance driving range, while Geely Galaxy has introduced the Extended-Range MPV V900, both expanding from their original pure electric MPV models. They target the core pain points of MPV long-distance travel and range anxiety, showcasing that automakers are evolving with the times and making changes based on consumer concerns.

Even joint venture brands have bolstered their product offerings across all routes. Volkswagen, which previously derided extended-range technology, has also yielded to market demands. For example, SAIC Volkswagen's ID. ERA series will launch multiple pure electric, hybrid, and extended-range products next year to cater to users' all-scenario travel needs. The Nissan N6 is also a product born out of this evolving context.

Ford's Bronco family's first new energy model, the Ford Intelligent Bronco, has commenced pre-sales ahead of the auto show, with prices starting at 229,800 yuan. The Ford Intelligent Bronco is a new benchmark model that integrates Ford's global R&D resources and localized manufacturing capabilities. Based on Ford's "Fuyu" native intelligent new energy architecture, it offers both extended-range and pure electric powertrain options. Equipped with NVIDIA's dual Orin-X intelligent driving chips and 31 sensors (including one LiDAR), it provides high-speed NOA assisted driving functions, further enhancing its intelligence capabilities.

Buick's Ultimate Series has deepened the plug-in hybrid layout of the GL8 family, and together with Chery's Fengyun T9L equipped with Kunpeng C-DM, it demonstrates that PHEV remains the optimal solution for family travel.

The commonality among these products is their close alignment with market demand. Extended-range and plug-in hybrid technologies are transitional, yet they are volume-driving technologies in the current market. Consumers are only willing to pay for their needs, so automakers do not need to be rigid about their new energy routes. Meeting user needs suffices.

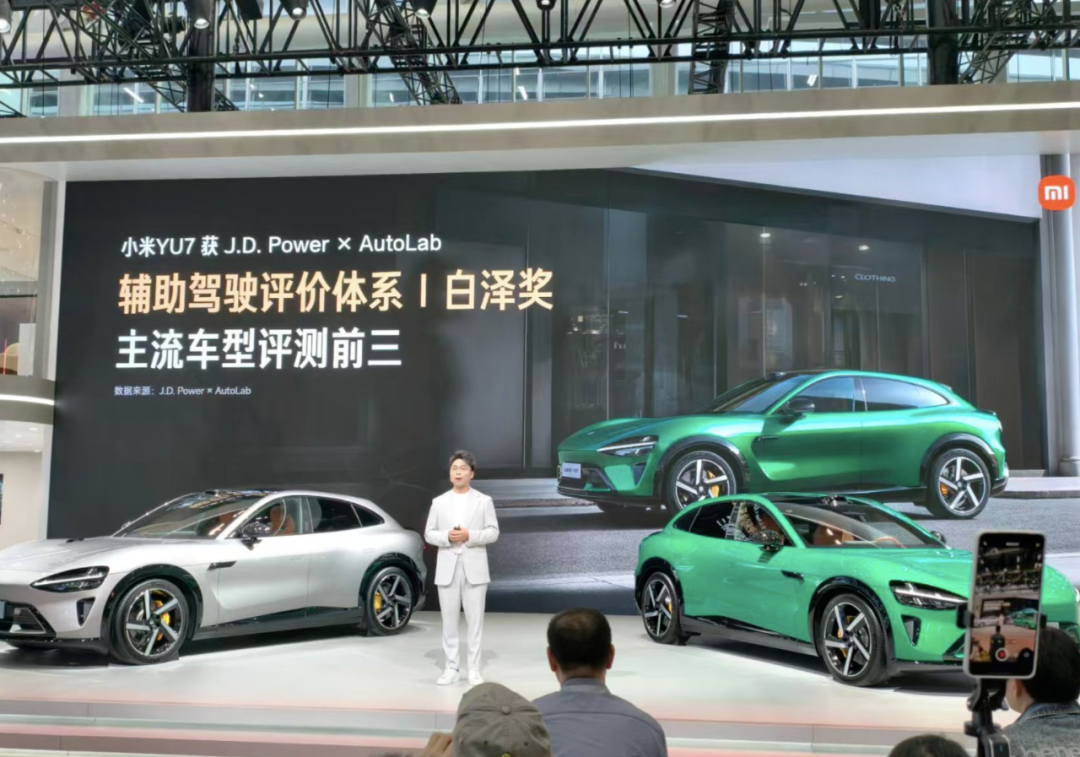

The Rise of Xiaomi and the Expanding Influence of Huawei

The two companies garnering the most attention in the automotive circle are Xiaomi and Huawei. These two major players have vastly different approaches to the auto show.

Xiaomi Automobile's CEO, Lei Jun, did not attend the auto show. After all, Xiaomi Automobile's popularity is not contingent on his presence. Of course, it is also possible that Xiaomi is deliberately distancing itself from Lei Jun's personal brand. After all, if a brand relies too heavily on the founder's image, the risks are indeed significant. Take Tesla, for instance. Whenever Elon Musk tweets, its stock price fluctuates. Additionally, given the recent spate of incidents involving Xiaomi, it is more prudent for Xiaomi to position itself as a normal new energy vehicle startup.

On the other hand, Huawei has been highly active at the Guangzhou Auto Show. Among the major new vehicle announcements and strategic plans unveiled by various automakers at the show, Huawei, which does not manufacture cars, plays an indispensable role.

This year's Guangzhou Auto Show undoubtedly boasts the highest "Huawei content" in history. In addition to the five brands under Huawei's ecosystem, two new brands have been added. Not to mention a series of brands highly associated with Huawei, such as Avita, Mengshi, and LanTu.

At the Huawei Qiankun Ecosystem Conference held on the eve of the Guangzhou Auto Show, Jin Yuzhi, CEO of Huawei's Automotive BU, stated that for every two luxury vehicles sold domestically, one is equipped with Huawei Qiankun Intelligent Driving. According to statistics, Huawei Qiankun Intelligent Driving ADS has 33 collaboration models, with sales of collaboration models exceeding 100,000 units last month. If we count based on the 33 models already on the market, the number of vehicles equipped with it has surpassed 1 million.

As more and more brands join the Huawei camp, it is only a matter of time before the Huawei Qiankun Ecosystem becomes a standard feature in new energy vehicles. Automakers are adopting the attitude of collaborating if they cannot compete, which is also the scenario Huawei, which does not manufacture cars, desires.

Major Reshuffling Among New Forces Expected Next Year

Over the past year, the reshuffling among new forces has been intense. The rise of Leapmotor and Xiaopeng's comeback can be attributed to their precise targeting of the largest mainstream consumer market with highly competitive products. From January to October this year, Leapmotor's cumulative sales reached 421,500 units, a year-on-year increase of 105.3%. It has been leading among new energy vehicle startups for several consecutive months. Xiaopeng, which had been experiencing sluggish sales last year, has also made a strong comeback in the sales rankings this year, with a gap of less than 10,000 units from Li Auto.

Therefore, after undergoing a period of adjustment, the new forces have realized that they should no longer follow trends in product development but should instead align their strengths with market demand. Only by meeting consumer expectations can they discuss sales and survival for the upcoming year. The barriers built solely on "product definition," like those of Li Auto, are being quickly leveled by the wave of technological homogenization. Thus, new forces still need to adopt a protracted war mentality.

Recently, at Geely's financial results conference, Gui Shengyue, the Executive Director and CEO of Geely Automobile Holdings Limited, criticized some new forces, stating that despite being established for a considerable amount of time, few of them are profitable. He warned, "Next year, the auto market will begin to cull the weak. Without strong profitability, it will be very difficult to survive."

These words are not alarmist or mere rhetoric from someone standing on the shoulders of giants. Instead, they come from an industry veteran's perspective based on the underlying logic of the industry. Automaking is not a short-term speculative endeavor but a long-term protracted battle. Only by having sufficient reserves can one remain calm. After the culling process, only those with true strength will endure.