DELL: Is the Storage Price Hike a Nuisance? AI Guidance Lends Support Again

![]() 11/28 2025

11/28 2025

![]() 401

401

Dell Technologies (DELL.N) released its third-quarter financial report for fiscal year 2026 (ending October 2025) after the market closed on the early morning of November 26 (Beijing Time):

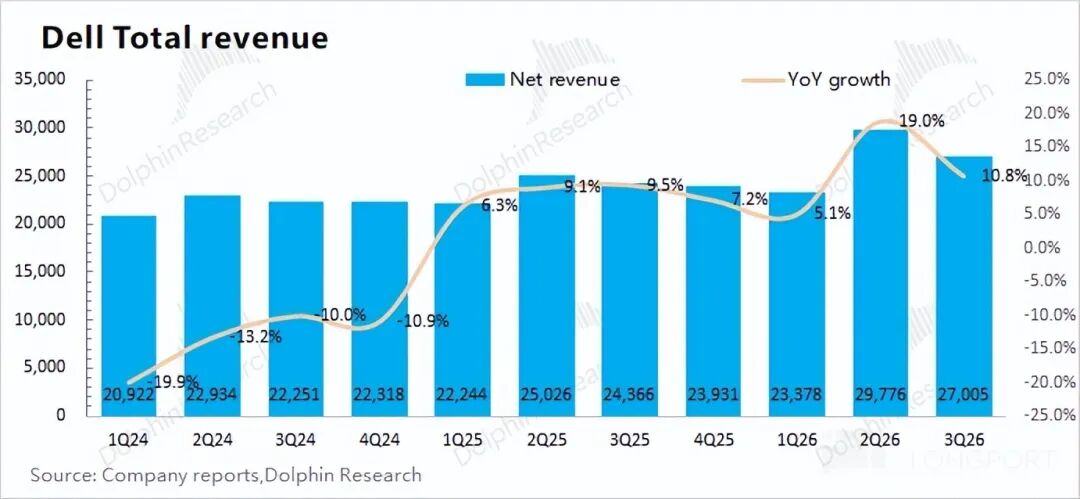

1.Core Performance: Dell Technologies reported revenue of $27 billion for the quarter, a 10.8% year-over-year increase, nearing market expectations ($27.3 billion). Nearly all of the $2.7 billion year-over-year revenue growth came from AI server shipments.

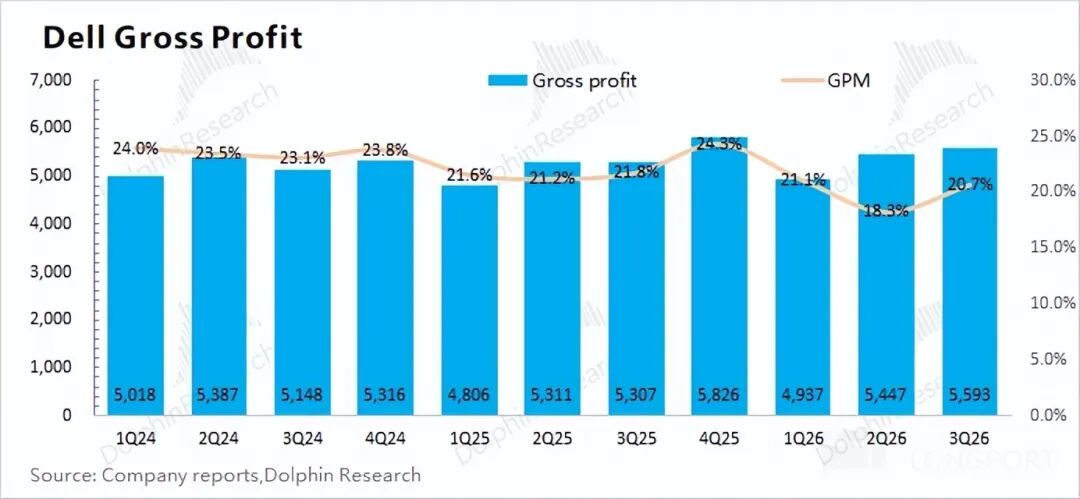

The company's gross margin for the quarter was 20.7%, down 1.1 percentage points year-over-year, slightly better than market expectations (20%). Compared to service revenue, products like AI servers have relatively lower gross margins. As revenue from AI server-related products increases, it structurally lowers the overall gross margin.

2.ISG Business (Infrastructure Solutions Group): Revenue for the quarter was $14.1 billion, up $2.7 billion sequentially, meeting market expectations ($14 billion). The sequential increase was entirely driven by AI servers.

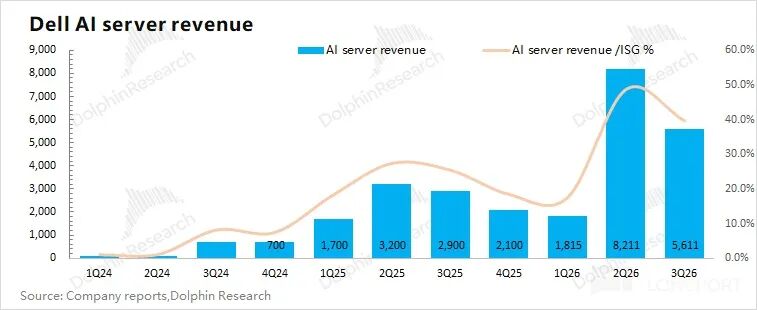

①AI Server Segment: The company's AI server revenue for the quarter was approximately $5.6 billion, roughly in line with market expectations ($5.5 billion). The backlog of AI server orders at the end of the quarter reached $18.4 billion. Dolphin Research estimates that the company's AI server revenue will reach around $9.4 billion next quarter, significantly exceeding market expectations ($5.3 billion), marking the quarter's biggest 'highlight.'

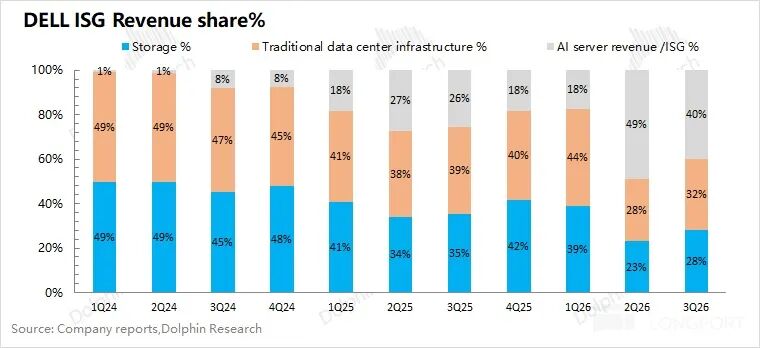

②Other Segments: Excluding AI servers, performance remained relatively stable. Traditional server-related businesses contributed approximately $4.5 billion in revenue, up 1% year-over-year; storage contributed around $4 billion, down 1% year-over-year.

3.CSG Business (Client Solutions Group): Revenue for the quarter was $12.5 billion, up 3% year-over-year, below market expectations ($12.7 billion). Specifically: Dell's client business remains primarily focused on commercial clients. Revenue from commercial clients was $10.6 billion, up 5% year-over-year; revenue from individual consumers was only $1.86 billion, down 7% year-over-year.

4.Dell's Next-Quarter Guidance: The company expects fourth-quarter revenue of $31-32 billion, a significant upward revision (previous guidance was below $29 billion). Considering the nearly $18.4 billion backlog this quarter, the guidance increase is primarily driven by the AI business (estimated sequential increase of around $3.8 billion). The company's next-quarter EPS (GAAP) is projected at $3.1, up sequentially, mainly driven by AI business growth.

Dolphin Research's Overall View: Traditional Business Remains Flat, AI Injects Confidence Again

Dell's quarterly revenue grew by $2.7 billion year-over-year, entirely driven by the AI server business. Excluding the AI segment, the company's traditional business remained flat year-over-year, with the main focus still on the AI business.

Compared to this quarter's data, the next-quarter guidance is even more 'surprising.' The company raised its guidance to $31-32 billion (previous guidance was below $29 billion). With a significant increase in backlog to $18.4 billion this quarter, Dolphin Research estimates that the company's AI server revenue will rise to around $9.4 billion next quarter (sequential increase of $3.8 billion), the primary reason for the guidance increase.

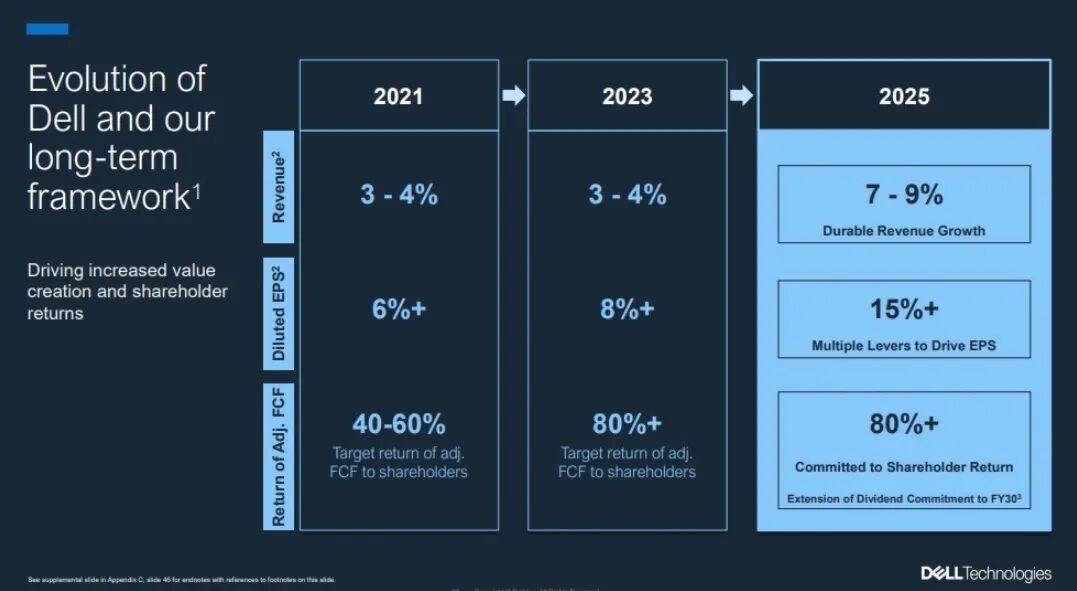

Dell had raised its long-term revenue guidance for fiscal years 2026-2030 from '3-4%' to '7-9%' at its investor conference in early October, pushing the stock price to a high of $165.

Despite the upward revision in long-term guidance, Dell's stock price continued to decline afterward, primarily due to concerns in two areas:

a) Storage Price Hikes and Cost Pressures: Driven by increased demand for traditional storage from servers, storage market prices surged again since September. The rise in storage prices has somewhat impacted downstream market expectations for smartphones and PCs.

Previously, SMIC's management mentioned that, given the current storage price hikes, terminal manufacturers have not provided relatively clear guidance for next year, with expectations remaining cautious.

Given the current lack of signs of a decline in storage prices, Dell's PC business will also be affected. If the company does not raise product prices, it will directly impact the gross margin; if it chooses to raise prices, the cost increase will be passed on to consumers, directly affecting next year's terminal demand.

With storage still in a price hike cycle, market expectations for Dell's CSG business (Client Solutions Group) remain cautious.

b) AI Servers: Beyond the 'lackluster' traditional business, the market's primary focus is on the performance of AI servers, which represent the company's main growth driver in the future.

Previously, major cloud providers increased capital expenditures, and OpenAI's 'frenetic collaborations' fueled the 'frenzy' in AI Capex, pushing the stock price to nearly $170. However, with the emergence of 'circular trading' and other events, market concerns over an 'AI bubble' increased, driving the stock price down.

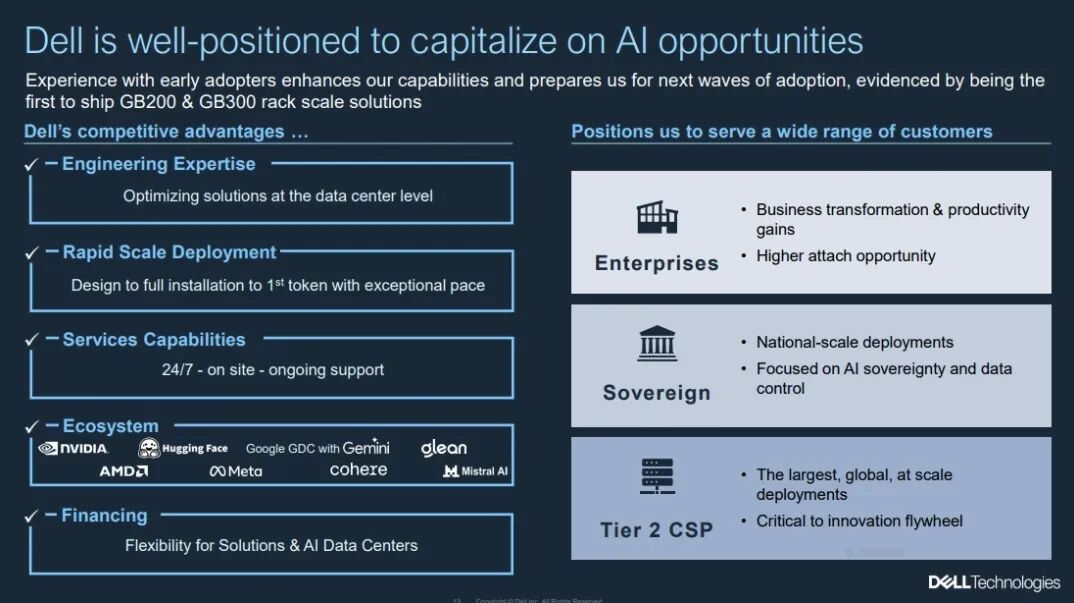

Recently, the market has also started to worry about the 'Google + Broadcom' alliance challenging NVIDIA, especially considering cost-effectiveness as a crucial factor for downstream clients. If Google's TPU secures large orders and begins external supply, it will undoubtedly weaken NVIDIA's market competitiveness.

NVIDIA is Dell's core partner for AI servers. If NVIDIA's competitiveness declines, the market worries about Dell's AI server growth performance (and the feasibility of long-term guidance). On a positive note, Dell's business focus on enterprise and sovereign/government clients to some extent helps the company meet guidance and maintain better profit margins.

Considering Dell's current market capitalization ($85.5 billion), it corresponds to around 11 times PE for core operating profit after tax in fiscal year 2027 (assuming revenue +12.5% year-over-year, gross margin 20%, tax rate 18.1%). Referencing Dell's historical valuation range, the company's valuation mostly falls between 10-20x PE.

Affected by factors such as continuous storage price hikes, market divergence in AI, and the NVIDIA supply chain, the company's valuation has declined again. Currently trading at around 11x PE, it essentially reflects the valuation of the traditional business. Although the company raised its guidance for fiscal years 2026-2030, the stock price's subsequent decline indicates that the market remains more concerned about the feasibility of the guidance (especially pressure on traditional business and sustainability of AI business growth).

Given the relatively certain squeeze on traditional business from storage price hikes, the progress of Dell's AI business is a crucial focus. The company reported $18.4 billion in AI server orders this time, which is quite impressive and will directly drive AI revenue growth next quarter. While it cannot fully eliminate market concerns, the 'eye-catching' performance of AI servers can still inject confidence into the company in the short term. Beyond traditional business, the company still possesses AI attributes.

The following is a detailed analysis:

I. Dell DELL's Overall Performance

1.1 Revenue

Dell DELL achieved revenue of $27 billion in the third quarter of fiscal year 2026 (25Q3), a 10.8% year-over-year increase, nearing market expectations ($27.3 billion). The $2.7 billion year-over-year growth was entirely driven by increased AI server shipments.

1.2 Gross Profit

Dell DELL reported a gross profit of $5.6 billion in the third quarter of fiscal year 2026 (25Q3), a 5.4% year-over-year increase.

The company's gross margin for the quarter was 20.7%, down 1.1 percentage points year-over-year, slightly better than market expectations (20%). The increase in the proportion of the ISG business, which has a relatively lower gross margin, had a structural dilutive effect on the overall gross margin.

1.3 Operating Expenses

Dell DELL's operating expenses for the third quarter of fiscal year 2026 (25Q3) were $3.47 billion, down 5% year-over-year. Faced with relatively sluggish traditional business, the company implemented layoffs, reducing the operating expense ratio to 12.9% this quarter.

1) R&D Expenses: The company's R&D expenses for the quarter were $750 million, up 1% year-over-year, indicating continued growth in R&D investment; 2) Sales and Marketing Expenses: The company's sales and marketing expenses for the quarter were $2.72 billion, down 6% year-over-year, primarily due to cost reductions in sales and related areas amid sluggish traditional PC business.

1.4 Net Profit

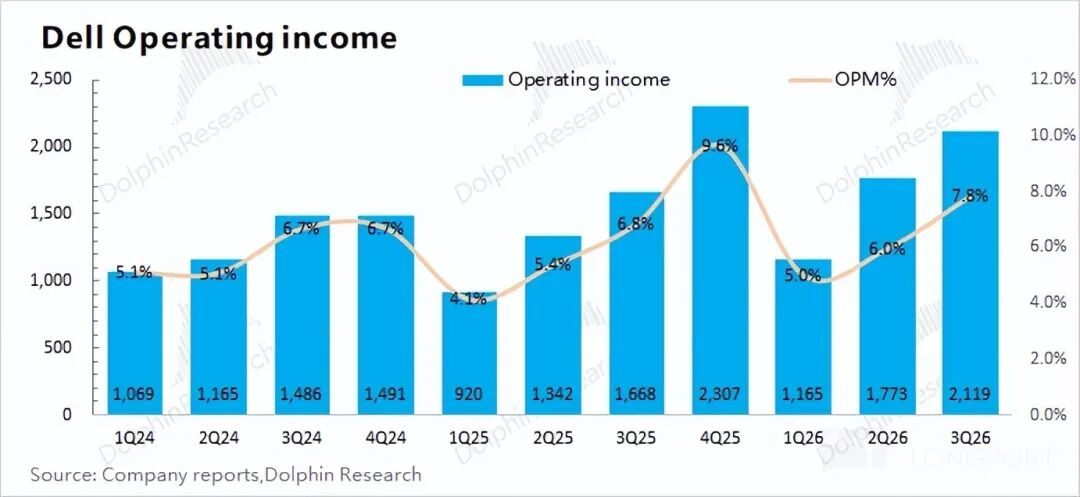

Dell DELL reported core operating profit of $2.12 billion in the third quarter of fiscal year 2026 (25Q3), a 27% year-over-year increase, with the core profit margin rising to 7.8% this quarter. The profit growth was primarily driven by AI business expansion and operating expense reductions.

II. Dell DELL's Core Business Performance

From Dell DELL's business segment perspective, driven by AI server growth, the company's ISG business (Infrastructure Solutions Group) showed an upward trend, accounting for 52% this quarter, surpassing the traditional CSG business (Client Solutions Group).

Based on the company's previous growth guidance, the ISG business is expected to achieve a compound annual growth rate (11-14%) from fiscal years 2026-2030, significantly higher than the CSG business (2-3%), with the ISG business's proportion continuing to rise.

The ISG business is the company's most crucial segment, with specific breakdowns as follows:

2.1 ISG Business (Infrastructure Solutions Group)

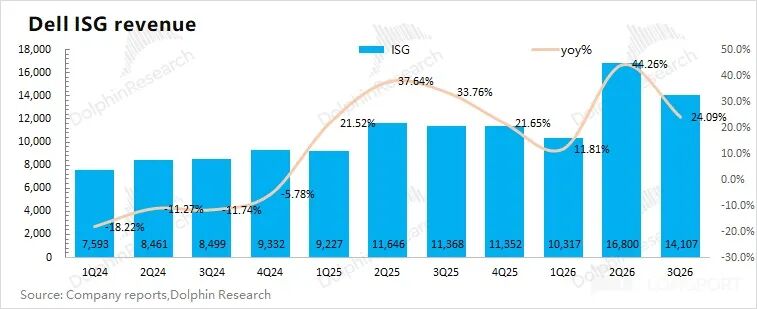

Dell DELL's ISG business achieved revenue of $14.1 billion in the third quarter of fiscal year 2026 (25Q3), a 24% year-over-year increase, meeting market expectations ($14 billion).

Specifically: ①The AI server business generated around $5.6 billion in revenue this quarter, a $2.7 billion year-over-year increase, contributing the entire revenue increment for the quarter; ②Traditional server and related businesses generated $4.5 billion in revenue this quarter, up 1% year-over-year; ②The storage business generated $4 billion in revenue this quarter, down 1% year-over-year.

Currently, the company's growth is driven by AI servers, while traditional business remains relatively flat. With the expansion of the AI business, its proportion in the ISG business has now risen to 40%.

AI business is the company's primary focus. Although the company's AI business revenue for this quarter was only $5.6 billion, it provided quite impressive order data. The company's current backlog of orders has reached $18.4 billion. Dolphin Research expects the company's AI server revenue to reach around $9.4 billion next quarter, representing a quarter-on-quarter increase of $3.8 billion.

In fact, prior to this earnings report, the market had some concerns about the company's AI business: a) Under the influence of events such as 'circular transactions,' the market was worried about the sustainability of subsequent AI capital expenditures (capex); b) NVIDIA and Dell have a core partnership. With the possibility that the 'Google + Broadcom' camp may weaken NVIDIA's competitiveness, Dell also faces indirect potential impacts within the NVIDIA supply chain.

Although the company previously raised its long-term guidance expectations, the market remained concerned about the extent to which these long-term goals could be achieved, leading to a further decline in the company's stock price. This time, the company provided relatively 'impressive' AI order data, which can once again inject 'confidence' in AI for the company.

2.2 CSG Business (Client Solutions Group)

Dell's CSG business achieved revenue of $12.5 billion in the third quarter of fiscal year 2026 (i.e., 25Q3), representing a year-on-year increase of 3%, slightly below market expectations ($12.7 billion).

Specifically, Dell's client business continues to be dominated by commercial clients. Revenue from commercial clients this quarter was $10.6 billion, up 5% year-on-year; while revenue from individual consumers was only $1.86 billion, down 7% year-on-year.

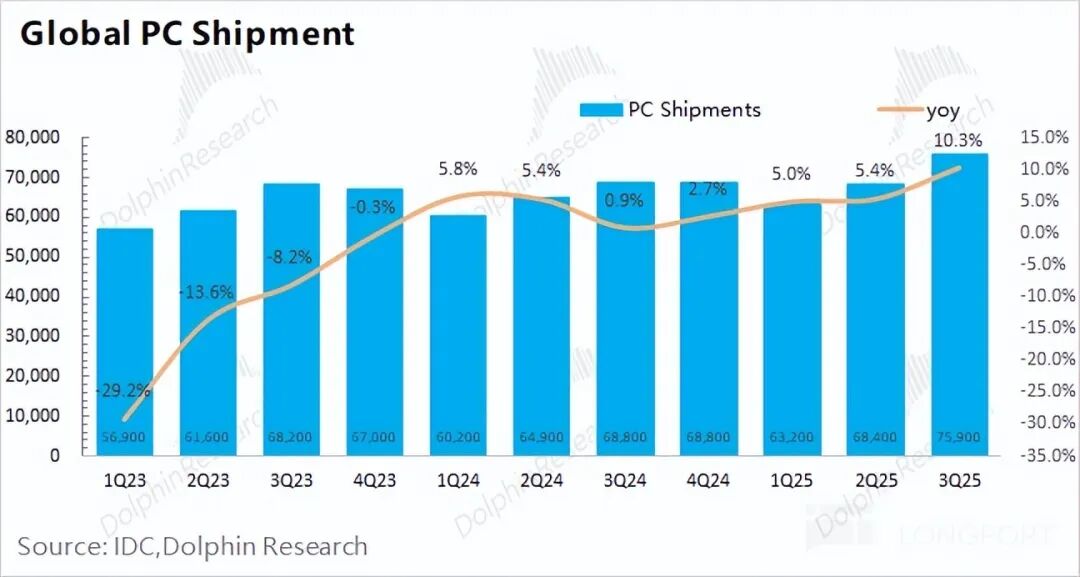

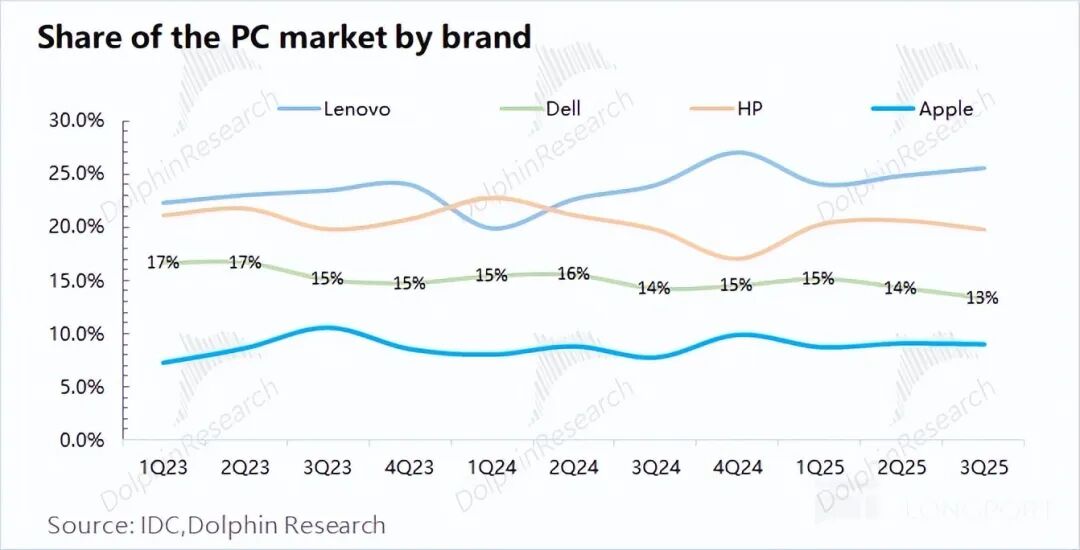

Combining global PC market data, global PC shipments in the third quarter of 2025 reached 75.9 million units, up 10.3% year-on-year, showing a rebound. Among them, Dell's shipments were 10.1 million units, up 3% year-on-year, performing below the industry average, which also led to a decline in the company's market share in the PC market to 13%.

Since Dell's CSG business revenue and PC shipments both grew by around 3% year-on-year this quarter, it can be inferred that the company's average PC price remained roughly unchanged year-on-year. However, it cannot be ignored that storage prices continue to rise. Under the influence of cost pressures, the company may also raise the prices of some PC products, which could to some extent affect growth expectations for the CSG business next year.

- END -

// Reprint Authorization

This article is an original piece from Dolphin Research. Reprinting is only allowed with authorization.

// Disclaimer and General Disclosure Notice

This report is intended solely for general comprehensive data purposes, aimed at users of Dolphin Research and its affiliated entities for general reading and data reference. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information mentioned in this report assumes full risk. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data in this report are based on publicly available sources and are provided for reference purposes only. Dolphin Research strives for, but does not guarantee, the reliability, accuracy, and completeness of the relevant information and data.

The information or views mentioned in this report shall not, under any jurisdiction, be regarded or construed as an offer to sell securities or an invitation to buy or sell securities, nor shall it constitute advice, solicitation, or recommendation regarding relevant securities or related financial instruments. The information, tools, and materials contained in this report are not intended for, nor are they intended to be distributed to, jurisdictions where the distribution, publication, provision, or use of such information, tools, and materials would conflict with applicable laws or regulations, or would subject Dolphin Research and/or its subsidiaries or affiliated companies to any registration or licensing requirements in such jurisdictions, nor are they intended for citizens or residents of such jurisdictions.

This report merely reflects the personal views, insights, and analytical methods of the relevant contributors and does not represent the stance of Dolphin Research and/or its affiliated entities.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual shall (i) produce, copy, duplicate, reproduce, forward, or create any form of copies or reproductions in any manner; and/or (ii) directly or indirectly redistribute or transfer to any other unauthorized persons. Dolphin Research reserves all related rights.