Huawei Qiankun's 'Two Realms' and Hongmeng Zhixing's 'Five Boundaries': A Showdown Looms

![]() 11/28 2025

11/28 2025

![]() 516

516

Written by: Xue Fei

Produced by: Five-Star Car Review

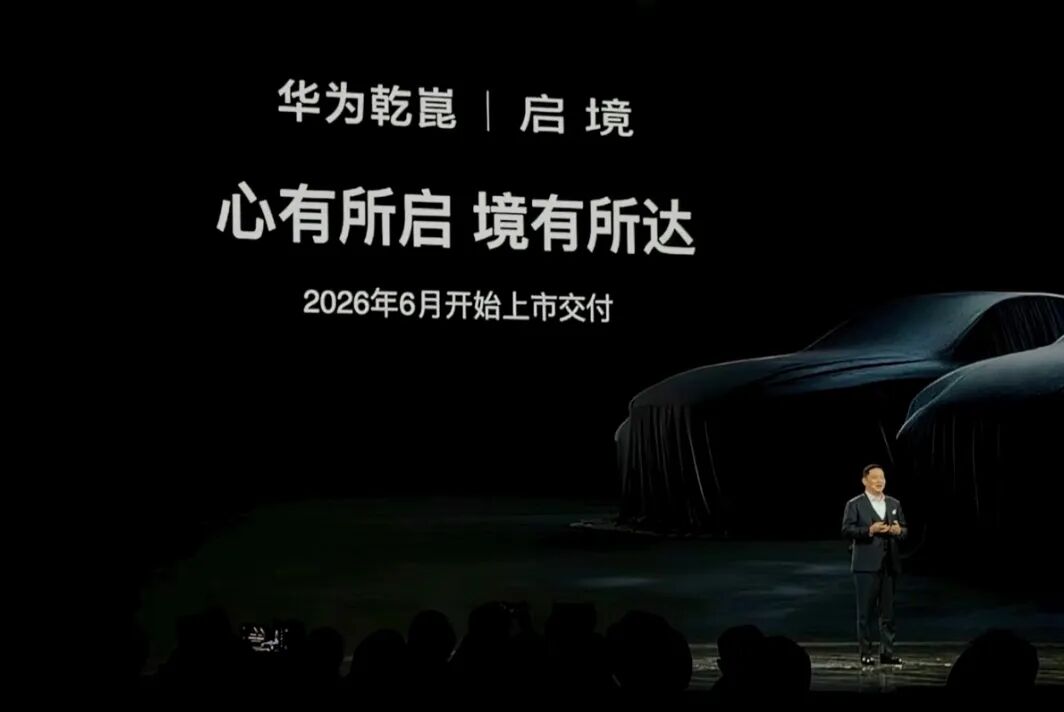

At the 2025 Huawei Qiankun Ecosystem Conference in November, two new automotive brands—Dongfeng's 'Yijing' and GAC's 'Qijing'—were officially unveiled. This move solidified Huawei's dual-track strategy within its smart car ecosystem, comprising the 'Five Boundaries' under Hongmeng Zhixing and the 'Two Realms' under Huawei Qiankun.

The five brands under Hongmeng Zhixing—AITO, Luxeed, Enjoya, Zenseer, and Shangjie—follow a 'Huawei-led, automaker co-creation' model for smart selection vehicles. By October 28, 2025, cumulative deliveries had surpassed 1 million units, achieving this milestone in just 43 months and setting a new benchmark for growth in the smart car sector.

Meanwhile, the 'Two Realms' brands, led by Huawei Qiankun and affiliated with the Vehicle Business Unit (Yinwang Intelligence), adopt an 'in-depth co-creation, automaker-led' upgrade model. These brands serve as the cornerstone for the Vehicle Business Unit to establish its proprietary ecosystem.

While Huawei asserts that both ecosystems share 'common technological roots and collaborative expansion,' significant overlaps in market positioning, resource competition between internal business units, and conflicting interests among seven automakers are poised to escalate this internal rivalry from implicit to explicit, reshaping the competitive landscape of China's smart car market.

01 Latecomer's 'Targeted' Surge

From their inception, the 'Two Realms' have strategically positioned themselves against the 'Five Boundaries.' Huawei Qiankun has set a price range of 150,000-350,000 yuan for 'Yijing' and 'Qijing,' targeting the core segment of China's passenger car market and inevitably overlapping with Hongmeng Zhixing's portfolio.

The Shangjie H5, priced at 159,800-199,800 yuan, focuses on the cost-effective market; Luxeed targets the 250,000-300,000 yuan coupe segment, while AITO dominates the mid-to-high-end market above 300,000 yuan. This price overlap directly fuels terminal competition.

As latecomers, the 'Two Realms' explicitly benchmark against the successful models of the 'Five Boundaries.' Qijing's debut 300,000-yuan premium hunting coupe, available in both pure electric and extended-range powertrains, directly challenges Luxeed S7's tech-focused coupe positioning. Similarly, Yijing targets the mid-to-high-end family market, emphasizing 'practicality and quality balance,' and aims at AITO M7's family user base, forming a targeted competitive dynamic.

The market performance of the 'Five Boundaries' provides clear benchmarks for the 'Two Realms.' As of September 2025, AITO's cumulative sales reached 275,900 units, accounting for 75% of Hongmeng Zhixing's total sales and serving as its primary sales driver. Luxeed followed with 57,800 units, Enjoya with 19,900 units, Zenseer with 3,522 units, and Shangjie with 5,712 units.

Among these, the new AITO M7 received over 50,000 reservations within 25 days of its launch and over 15,000 reservations during the 2025 National Day holiday, accounting for more than 31% of the series' total orders. Luxeed R7 received 6,551 orders during the holiday, and Shangjie H5 received 5,388 orders. These figures validate the success of the 'Huawei technology + precise positioning' strategy.

The 'Two Realms' aim not only to replicate this logic but also to achieve technological superiority as latecomers. Standard features include 192-line LiDAR (detection range of 250 meters), 4D millimeter-wave radar (detection range of 280 meters), and the Qiankun ADS 4.0 system, with hardware levels rivaling those of Hongmeng Zhixing's flagship models. Simultaneously, they differentiate themselves through 'youthful design' and 'practical configurations.' This 'targeting successful models' strategy is destined to bring the two sides into direct confrontation in the terminal market.

02 Hidden Concerns of 'Favoritism' Under Shared Technological Roots

While Huawei emphasizes that the 'Boundaries' and 'Realms' share a core technological foundation, their belonging to different business systems poses a risk of imbalanced resource allocation.

The 'Five Boundaries' under Hongmeng Zhixing fall under Huawei's Consumer Business Group, with Huawei deeply involved in product definition, marketing, and sales, while partner automakers primarily handle manufacturing. In contrast, the 'Two Realms' are led by Huawei's Vehicle Business Unit and serve as the core carrier for exploring the 'in-depth co-creation' model. Huawei has dispatched hundreds of personnel to work alongside GAC and Dongfeng in a 'co-located office + system integration' approach, covering the entire product lifecycle from definition to development and marketing.

Given limited internal resources, the Vehicle Business Unit has shown a tendency to prioritize the 'Two Realms' in terms of technological configurations and research and development support to drive rapid market penetration.

This prioritization is evident in the technological implementation timeline: the first models of the 'Two Realms' come standard with the latest ADS 4.0 system and the all-dimensional collision avoidance CAS 4.0 function. This system has accumulated 5.83 billion kilometers of assisted driving real-world testing and prevented 2.91 million potential collisions, leading the industry in safety redundancy under extreme conditions. Meanwhile, some models under Hongmeng Zhixing still require OTA updates to reach this version.

More critically, the 'Two Realms' have received exclusive joint innovation support from the Vehicle Business Unit. Huawei has established on-site joint innovation labs with GAC and Dongfeng, focusing on breakthroughs in AI Pan scene applications—a privilege not enjoyed by some partner automakers of the 'Five Boundaries.'

In the long run, when technological research and development face cost pressures, Huawei may prioritize allocating the latest algorithms and hardware resources to the 'Two Realms.' After all, the 'Two Realms' represent the Vehicle Business Unit's independently expanded ecological footprint, while the 'Five Boundaries' are more collaborative products with automakers. This 'favoritism' in resource allocation logic will gradually widen the technological experience gap between the two.

03 Automakers' Involvement: 'Passive Game' Under Interest Entanglement

The competition between the 'Two Realms' and the 'Five Boundaries' is essentially a game of interests among the seven automakers involved. The five partner automakers of Hongmeng Zhixing are already deeply integrated into Huawei's ecosystem: Seres has become the biggest beneficiary of the smart selection car model through AITO, accounting for 75% of Hongmeng Zhixing's total sales as of September 2025; Chery has achieved brand upscaling through Luxeed, while BAIC, JAC, and SAIC have also leveraged Huawei's technology to enter the high-end market.

However, the emergence of the 'Two Realms' has placed these automakers under dual pressure: on the one hand, Dongfeng and GAC, as new entrants, will leverage the 'Two Realms' brands to divert market share in the core 150,000-350,000 yuan segment, directly impacting the sales of the 'Five Boundaries'; on the other hand, Huawei's in-depth co-creation model with Dongfeng and GAC has raised concerns among existing partner automakers about being 'marginalized.' If Huawei allocates more core resources to the 'Two Realms,' the technological advantages of the 'Five Boundaries' models will gradually diminish.

To establish a foothold for the 'Two Realms,' Dongfeng and GAC have invested significant production resources and opened up their mature channel networks, indirectly competing with Huawei's store channels for the 'Five Boundaries.'

This game, triggered by Huawei's ecological layout, has forced automakers that originally had no direct competition to take opposing stances, each supporting their bound ecological camps. The final market outcome will directly determine each automaker's voice and future development space within Huawei's ecosystem.

The clash between Huawei Qiankun's 'Two Realms' and Hongmeng Zhixing's 'Five Boundaries' is an inevitable outcome of Huawei's smart car ecosystem expansion reaching a certain stage and a microcosm of China's smart car market transitioning from 'blue ocean expansion' to 'stock competition.'

Direct benchmarking at the product level, potential favoritism at the resource level, and interest entanglement at the automaker level make this 'ecosystem civil war' unavoidable.

For Huawei, balancing the interests of the Consumer Business Group and the Vehicle Business Unit to avoid 'self-cannibalization' tests its ecological governance capabilities; for the seven partner automakers, this game presents both opportunities and risks—they can achieve brand upscaling through Huawei's technology but may also become 'sacrifices' in the ecological competition.

For consumers, technological upgrades, increased product choices, and intensified price competition will ultimately make them the biggest beneficiaries. Huawei's ecosystem 'civil war' has begun, and China's smart car market is quietly forming a new order amid this competition.

------- The end -------