Sales of plug-in hybrids approach pure electric vehicles. China Association of Automobile Manufacturers: The situation of international trade protectionism is still severe

![]() 06/17 2024

06/17 2024

![]() 473

473

Under the influence of multiple replacement subsidies, the overall performance of the automobile market in May continued to be good. On June 14, the China Association of Automobile Manufacturers (hereinafter referred to as CAAM) officially announced the production and sales data of automobiles in May. The analysis believes that in the same month, both car sales and production achieved small growth month-on-month and year-on-year, and new energy vehicle production and sales and automobile exports continued to maintain a rapid growth trend, and Chinese brands also continued to maintain good performance.

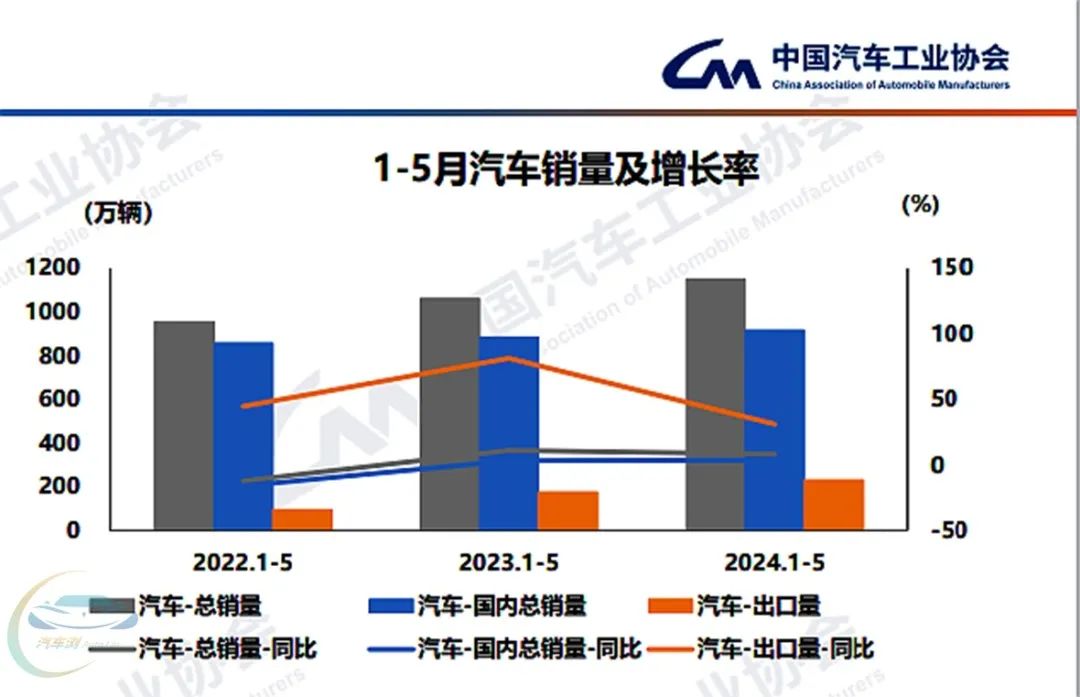

According to data from CAAM, in May, automobile production and sales reached 2.372 million and 2.417 million vehicles respectively, with a month-on-month decrease of 1.4% in production and a month-on-month increase of 2.5% in sales, and year-on-year increases of 1.7% and 1.5% respectively. From the data, it is not difficult to see that the automobile market in May showed a clear "mild growth" state, which even dragged down the overall market performance from January to May.

From January to May, automobile production and sales reached 11.384 million and 11.496 million vehicles respectively, with year-on-year increases of 6.5% and 8.3% respectively. CAAM pointed out that "the growth rates of production and sales have narrowed by 1.3 and 2 percentage points respectively compared with January to April."

From a policy perspective, with the current multiple benefits from national subsidies to local subsidies and automaker subsidies, coupled with the fierce price war, it should be a very good opportunity for consumers to buy or replace a car. In fact, it also has a driving effect on the market.

Overall market conditions are improving, but after segmentation, it will be found that the situation is still quite severe. According to CAAM data, in May, domestic car sales reached 1.936 million vehicles, an increase of 4.3% month-on-month and a decrease of 2.9% year-on-year; automobile exports reached 481,000 vehicles, a decrease of 4.4% month-on-month and an increase of 23.9% year-on-year—that is, domestic sales were better than last month but lower than the same period last year.

As the main force in the automobile market, the passenger car market sold 1.678 million vehicles domestically in May, an increase of 6.7% month-on-month and a decrease of 2.8% year-on-year. While passenger car exports reached 397,000 vehicles, a decrease of 7.4% month-on-month and an increase of 22.1% year-on-year.

From January to May, the cumulative domestic sales of passenger cars reached 7.828 million vehicles, an increase of 3.9% year-on-year. Exports reached 1.937 million vehicles, an increase of 32% year-on-year.

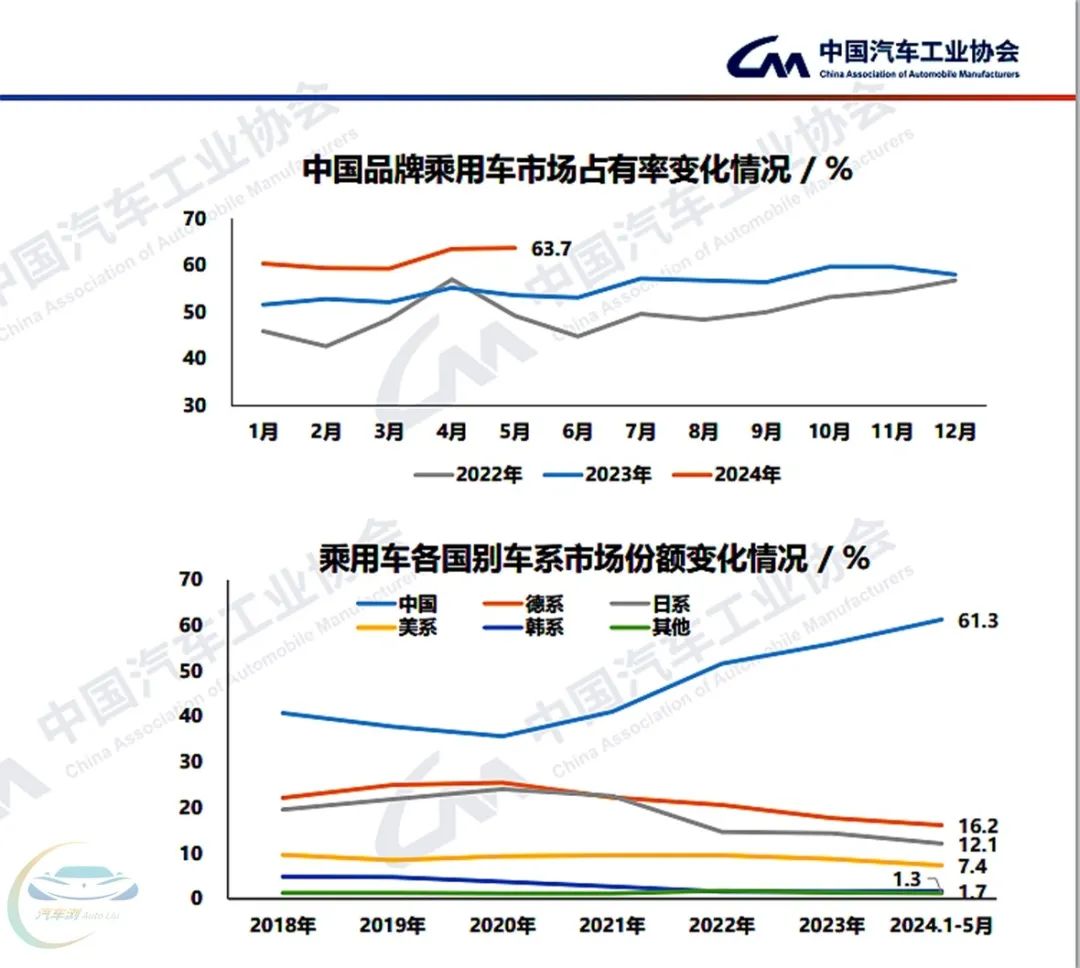

More and more consumers are choosing to buy Chinese brand passenger cars. In May, the sales of Chinese brand passenger cars reached 1.322 million vehicles, an increase of 20.4% year-on-year, and the market share increased by 10.2% to 63.7%—this is also the most encouraging data in the "mild growth" market.

From January to May, the cumulative sales of Chinese brands reached 5.987 million vehicles, with a year-on-year increase of 25.2%, and the market share increased by 8.2% to 61.3%.

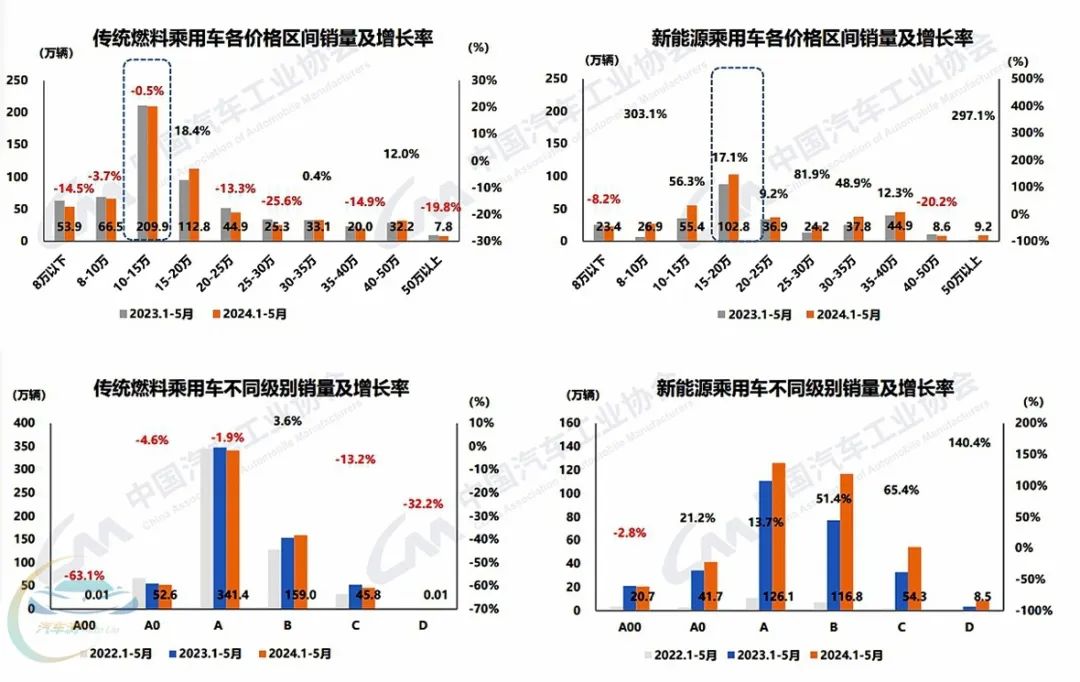

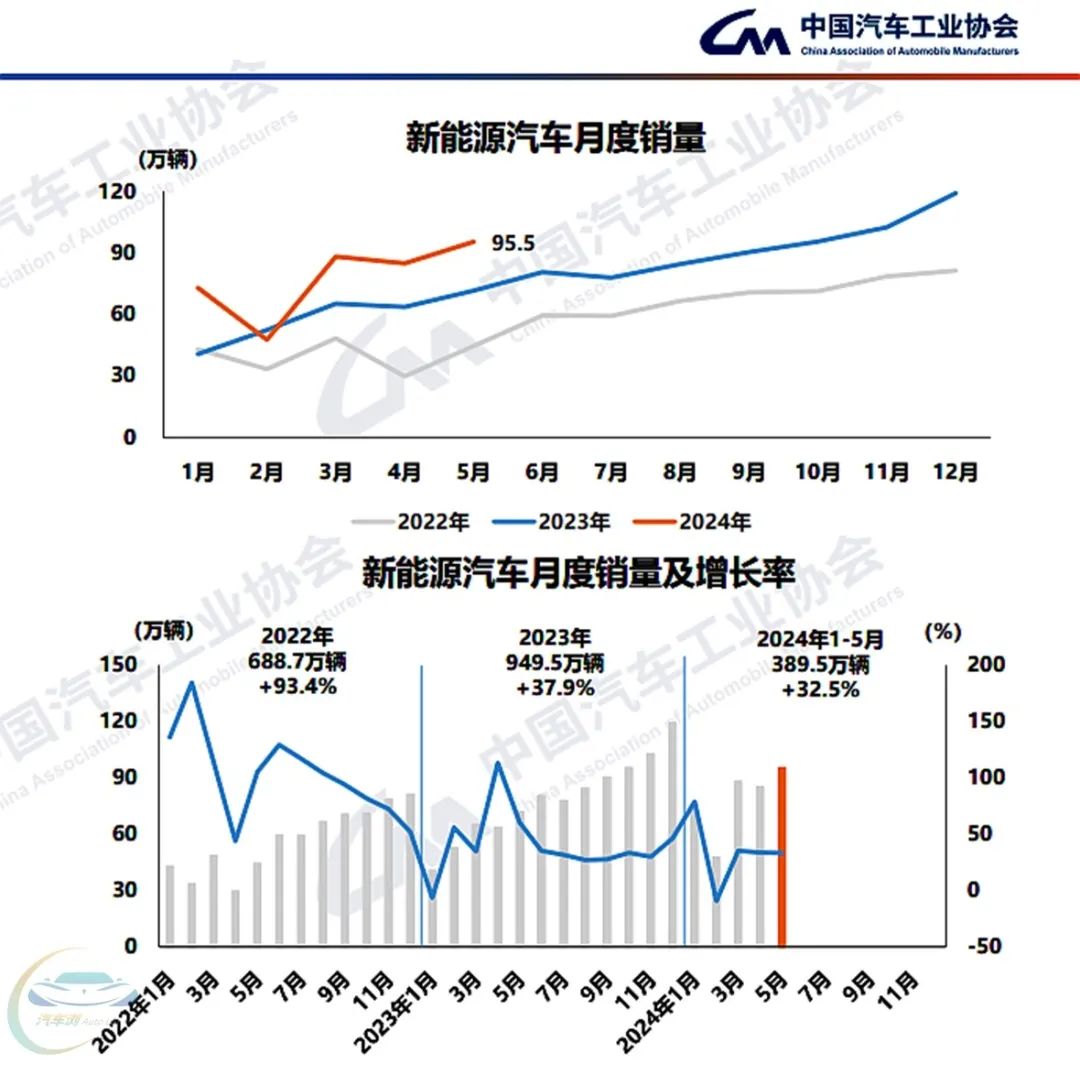

New energy vehicles still maintain their core driving force as a growth pole: in May, new energy vehicle production and sales reached 940,000 and 955,000 vehicles respectively, with year-on-year increases of 31.9% and 33.3%, and a market share of 39.5%. From January to May, new energy vehicle production and sales reached 3.926 million and 3.895 million vehicles respectively, with year-on-year increases of 30.7% and 32.5%, and a market share of 33.9%.

While maintaining rapid growth, the segmented market is also undergoing subtle changes: among the segmented models of new energy vehicles, the proportion of plug-in hybrid models is rapidly increasing. According to CAAM data, in May, the production and sales of plug-in hybrid models reached 383,000 and 371,000 vehicles respectively, with a year-on-year increase of 87.7%. In contrast, pure electric models, which have always been the mainstay, produced 557,000 vehicles and sold 583,000 vehicles, with a year-on-year increase of 12.5%. The key is that the sales of plug-in hybrid models in May have approached those of pure electric models.

In terms of cumulative data, from January to May, the sales of pure electric vehicles reached 2.407 million vehicles, with a year-on-year increase of 12.7%, and the sales of plug-in hybrid models reached 1.486 million vehicles, with a year-on-year increase of 85.2%.

On June 13, the China Association of Automobile Manufacturers issued a statement expressing strong dissatisfaction with the temporary anti-subsidy tariff rate disclosed by the European Commission, which is the latest barrier encountered in global automotive trade.

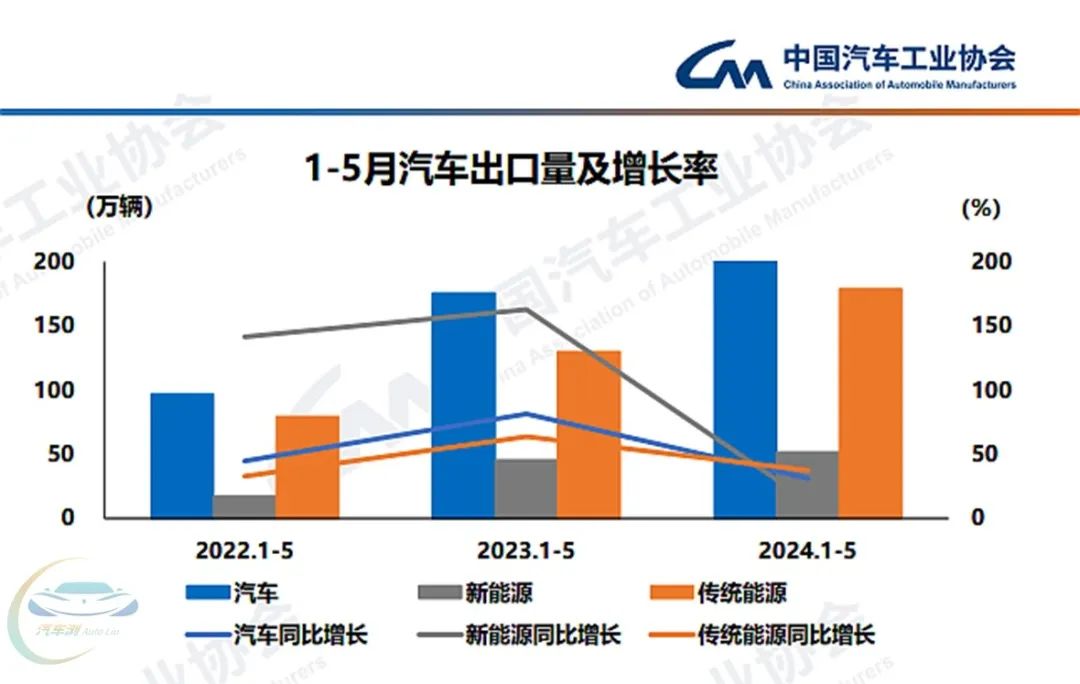

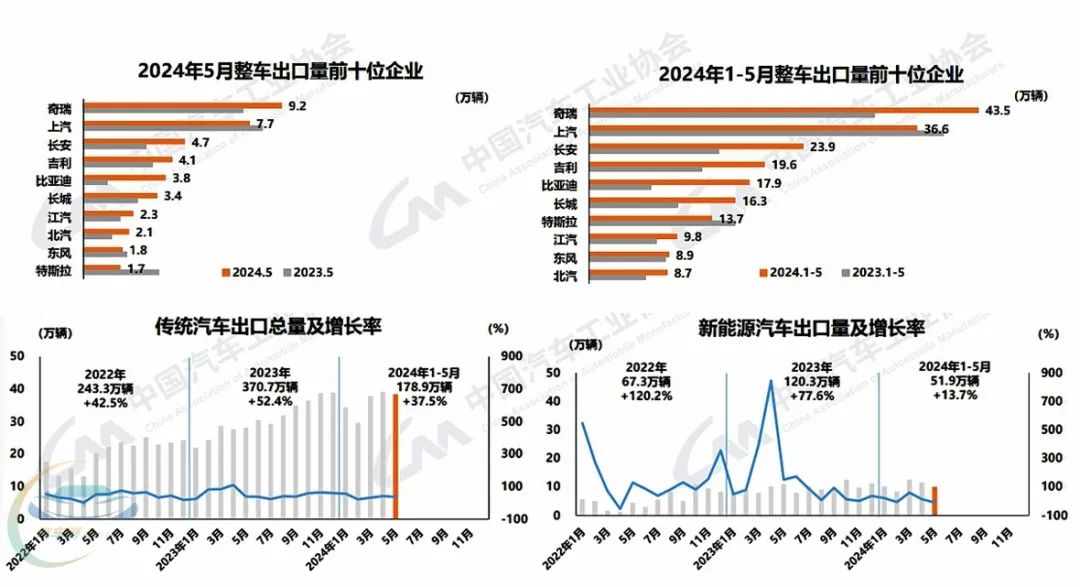

Although the data shows that in May, automobile exports reached 481,000 vehicles, a decrease of 4.4% month-on-month and an increase of 23.9% year-on-year. From January to May, automobile exports reached 2.308 million vehicles, an increase of 31.3% year-on-year, and are still in a rapid growth stage. However, CAAM also mentioned that "the situation of international trade protectionism is still severe."

It is difficult to predict how much impact the EU's temporary anti-subsidy tariff rate will have on future automobile exports. In fact, we can see some traces from the ranking of automobile export enterprises this year—SAIC, which had been advancing rapidly before, has dropped one place in the export ranking, and SAIC's largest single market for vehicle exports is in Europe. Therefore, soon after CAAM issued the statement yesterday, SAIC Group also issued a public statement, mentioning: "As one of the world's leading automakers, SAIC Group has always been committed to serving global consumers through innovative and high-quality products. We firmly believe that free trade and fair competition are the keys to promoting global economic prosperity and sustainable development. We are deeply disappointed with the European Commission's decision, which not only violates the principles of market economy and international trade rules but may also have a significant adverse impact on the stability of the global automotive industry chain and China-EU economic and trade cooperation... We urge the European Commission to carefully consider its decision and engage in constructive dialogue with global automotive industry partners, including China, to jointly find solutions that promote fair competition and sustainable development."