ZEEKR: Overly Doting Parent, Toxic or Beneficial?

![]() 06/17 2024

06/17 2024

![]() 483

483

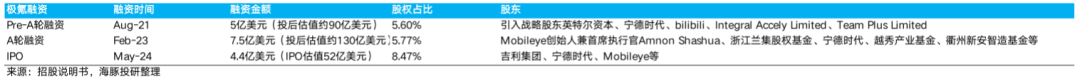

On May 10, ZEEKR, the pure electric vehicle holding company under Geely, officially listed on the New York Stock Exchange, becoming another Chinese pure electric asset to go public overseas after NIO, XPeng, and Li Auto. However, unlike the struggles faced by the previous four companies, ZEEKR, as a pure electric vehicle second-generation company born with a "golden key": a. Unlike others that take years to prepare from establishment to the release of their first car, ZEEKR released its first mass-produced model, the ZEEKR 001, in April 2021 upon its launch; b. Moreover, within three months of its establishment, Geely, its parent company, gave its core assets - R&D and battery, motor, and electronic control (BME) - to its son company at a "family discount." Because of this, ZEEKR, as a pure electric vehicle company, not only has the normal car sales revenue like NIO, XPeng, and Li Auto, but also has revenue from power batteries and R&D services that the first four lack.

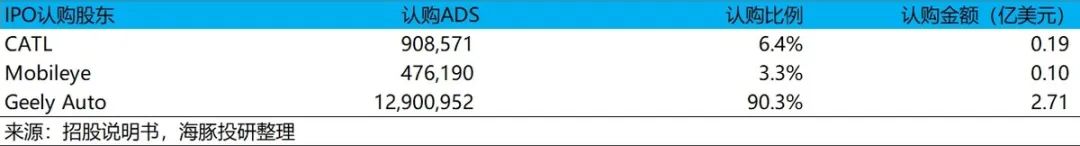

Even so, ZEEKR seems to have gone public with bloodshed: First, its listing was fraught with twists and turns, with suspensions and restarts; second, its final listing valuation was significantly lower than market financing expectations; third, it raised less than US$450 million in financing during its listing, with Geely Automobile subscribing for US$270 million, contributing almost 70% of the financing amount.

Fourth, although it gained momentum on its first day of listing, rising 35% in a day, it has almost fallen back to its IPO price recently. Up to now, its PS ratio is less than 0.7X, significantly lower than its peers. So the question arises: a. Is the low valuation due to a "toxic" relationship between Geely Automobile and ZEEKR? b. Are the BME and R&D businesses injected into ZEEKR high-quality assets or hidden liabilities? How should we view their valuations? c. Returning to the core: How about ZEEKR's capabilities and prospects in selling cars? d. Is ZEEKR, which is undervalued, really being wronged? This article focuses on the first two issues, clarifying its relationship with related parties and how to view the value of the two assets injected.

After clarifying the first two issues, we will delve into ZEEKR's business layout, core competitiveness, and its true value.

The following is the main text:

I. Geely and ZEEKR: An Overly Doting Parent?

From ZEEKR's original pure electric vehicle division to its establishment in 2021 and IPO in 2024, Geely has treated this son company like a "pearl in the palm": providing money, technology, resources, and production capacity, striving to make it bigger and stronger. Specifically:

a. Technology: Authorizing the use of the SEA architecture

We know that the core elements of carmaking - capital, BME system, and the vehicle platform/technology - almost constitute the soul of carmaking. ZEEKR's core elements have strong ties with Geely Holding and listed Geely Automobile.

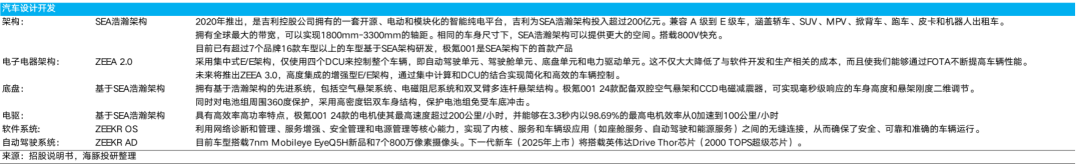

The SEA architecture, which began internal development at Geely in 2016, was officially launched in 2020 after four years and over 20 billion yuan in R&D investment. It is Geely Group's true pure electric vehicle platform, covering A-E class vehicles, a new BME system, high-performance pure electric chassis, and OS open systems.

Due to its 1800mm-3300mm wheelbase, compatible with A-E class vehicles, this architecture is shared by more than 7 Geely brands and 16 models, meaning ZEEKR models have a high parts sharing rate and can jointly purchase parts, resulting in scale cost reduction advantages and good gross profit margins for the automotive business.

The SEA architecture is also the core of ZEEKR's vehicles. Its chassis and electric drive system are based on the SEA architecture, making ZEEKR's models excellent in BME and chassis quality, with leading advantages in safety and power performance. The ZEEKR 001 is also the first mass-produced model based on the SEA architecture and a star product under this platform.

The key issue here is how both parties account for ZEEKR's use of this platform. From the prospectus information:

a. Since the SEA architecture was developed by Geely, the initial investment of 20 billion yuan is recorded on Geely's books, and the property rights also belong to Geely;

b. ZEEKR needs to pay Geely an annual licensing fee for using the SEA architecture, priced based on the sales volume and average sales price of vehicles developed on the SEA platform. ZEEKR records this expense under R&D costs;

c. After obtaining the license, ZEEKR can not only use it for itself but also license it to other Geely brands, charging them sublicensing fees.

The question is whether this is economically feasible. After carefully examining ZEEKR's R&D resource allocation:

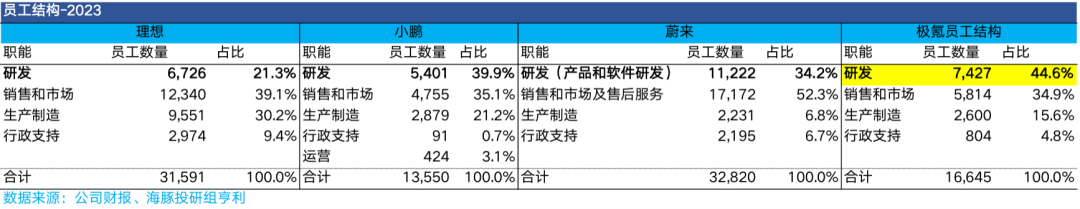

From the perspective of R&D personnel allocation, ZEEKR is clearly overstaffed - even excluding NIO, which spends lavishly on R&D, ZEEKR's R&D personnel are significantly more than XPeng and Li Auto.

Assuming that the Central Europe Vehicle Technology (CEVT) and Ningbo Weirui R&D centers lead to additional R&D personnel, I directly count half of the 700+ CEVT personnel and 2000 personnel from Weirui's factory as R&D personnel and exclude them from ZEEKR's total R&D personnel. ZEEKR still has over 5700 people, which is obviously excessive given the relatively weak in-house R&D capabilities in intelligent vehicle development.

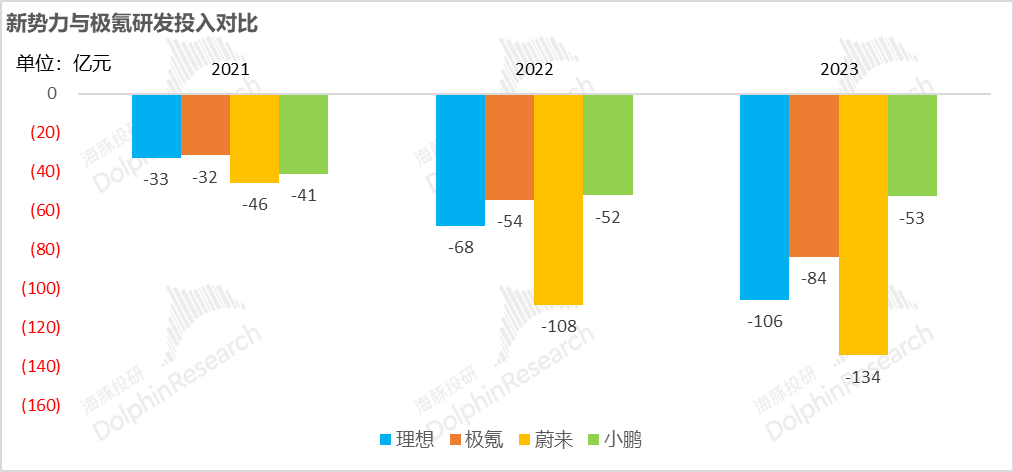

Looking at R&D expenses, due to the large number of R&D personnel and the fact that SEA is essentially an outsourced pure electric vehicle platform, R&D expenses are significantly higher. In 2023, ZEEKR's R&D expenses were significantly higher than XPeng's. Even considering the 3 billion+ yuan in R&D income brought by CEVT assets and the corresponding 2 billion+ yuan in R&D costs, ZEEKR's overall R&D investment absolute value should be close to Li Auto, which has a much higher sales volume, but its output effect is weaker than its peers, especially in intelligence.

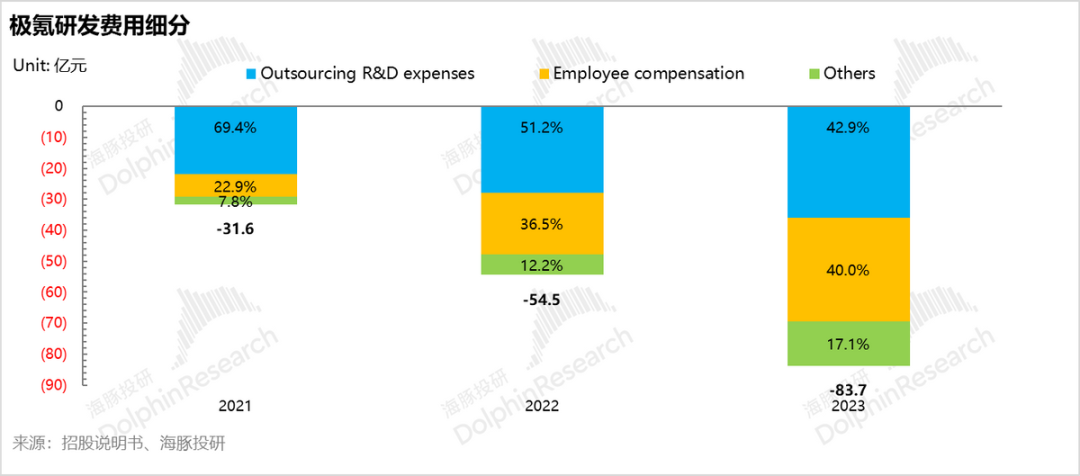

Looking at the breakdown of ZEEKR's R&D expenses, of the 8.4 billion yuan in R&D expenses in 2023, 3.6 billion yuan, or over 40%, was paid to external so-called outsourced R&D expenses - including consulting fees, SEA licensing fees, and certification and testing fees. Given the large number of in-house R&D personnel, the absolute value and proportion of outsourced R&D expenses are not low.

After comparing ZEEKR's R&D data with its peers, it is clear that ZEEKR and other Geely companies share the platform fee for the SEA architecture, presumably to save on R&D investment. However, in reality, although the outsourced R&D expenses have not increased at the same rate as sales growth, the nearly 4 billion yuan in outsourced R&D expenses in one year is obviously excessive.

Moreover, the company plans to further increase R&D investment in its latest quarterly earnings call, raising R&D expenses from over 8 billion yuan in 2023 to 10 billion yuan in 2024. This not only increases the total amount but also requires improving R&D efficiency.

b. Geely makes cars, ZEEKR sells

Unlike most new energy vehicle companies that build their own production capacity, ZEEKR still uses Geely's "OEM" production model:

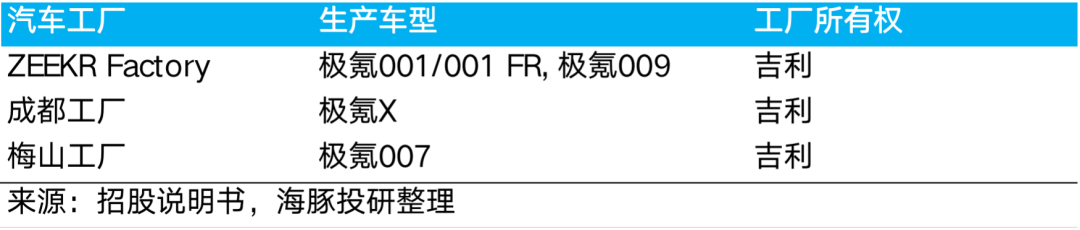

In terms of production and manufacturing, ZEEKR currently does not have its own factories. Its production facilities, including the ZEEKR Factory (Ningbo Factory), Chengdu Factory, and Meishan Factory, are owned by Geely. ZEEKR shares production capacity with Geely, and Geely Holding's manufacturing facilities produce ZEEKR cars through OEM methods, allowing ZEEKR to operate with light assets.

ZEEKR's car costs mainly come from procuring ZEEKR models produced by Geely, using a cost-plus pricing model (BOM cost + Geely manufacturing fees - typically 2.5%-3.5% of the ASP per vehicle). ZEEKR does not have fixed costs associated with factory production, resulting in lower operating leverage compared to new forces and more stable gross profit margins for its carmaking business.

At the same time, ZEEKR does not need to build its own factories, significantly saving capital expenditures in the early stages of carmaking. From 2020 to 2023, ZEEKR invested only 4 billion yuan in property, plant, and equipment. Compared with NIO, which has a similar sales volume as ZEEKR and paid about 3.2 billion yuan to acquire JAC Motor's factory, ZEEKR could save at least 2-3 billion yuan in initial capital investment.

Similarly, ZEEKR's charging stations are operated by Zhejiang Haohan Energy, with ZEEKR holding only a 30% stake. Geely Automobile Holding (holding a 70% stake) shares the charging network with other companies within the Geely Group, so ZEEKR does not need to bear capital expenditures for charging stations and only shares investment income from Zhejiang Haohan Energy.

Since ZEEKR does not need to bear capital expenditures for factories and charging stations, its capital expenditures in 2023 were only 1.9 billion yuan, accounting for only 3.6% of its total revenue.

ZEEKR's capital expenditure guidance for 2024 is also maintained at around 1.9 billion yuan or slightly higher, significantly lower than the capital expenditure levels of new forces (Li Auto and NIO's capital expenditure guidance for 2024 is over 10 billion yuan), mainly used for investing in Weirui's production facilities and expanding ZEEKR's sales network.

c. Providing funds

From its establishment to the present, apart from two external equity financings, ZEEKR mainly relies on Geely for operating funds:

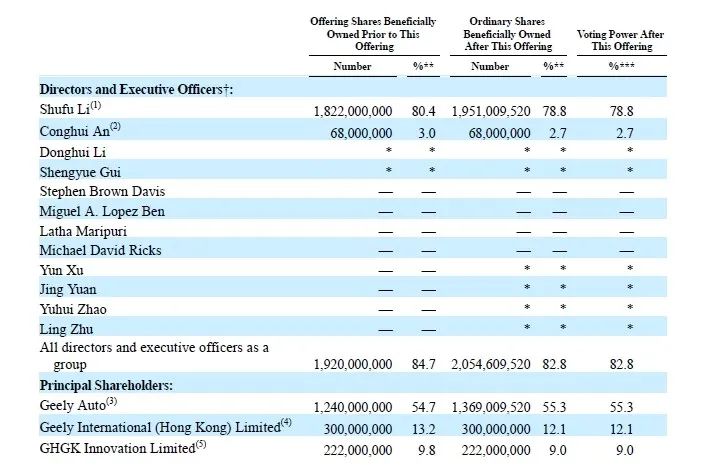

① Equity subscription: For ZEEKR's IPO, Geely subscribed to about 61% of the ADS issued by ZEEKR, bringing about US$270 million in financing for ZEEKR. After the IPO, Geely's stake in ZEEKR did not dilute but increased to 55.3%.

② Geely loans: In April 2022, ZEEKR signed a 10-year loan agreement with Geely Automobile for a total of 9.7 billion yuan, which ZEEKR has fully repaid. In November 2022, ZEEKR's subsidiary, Ningbo Weirui, signed another 10-year loan agreement with Geely Automobile for a total of 1.6 billion yuan, of which 1.1 billion yuan remains outstanding;

From the description, these two loan agreements seem more like revolving loans, meaning that if ZEEKR runs out of money, it can draw funds from these agreements at any time. So, with Geely's backing, ZEEKR may be short of funds but will not have cash flow risks.

③ Occupying Geely funds: Another issue related to Geely's funding is how much money ZEEKR really needs. Judging from the company's losses, ZEEKR has lost over 20 billion yuan in net profit from 2020 to the present, plus 3.5 billion yuan in net capital expenditures adjusted for amortization and depreciation, resulting in a cash operating loss of 23.5 billion yuan. However, the company has raised less than 12 billion yuan from external equity financing, indicating significant capital losses.

However, like other new forces, ZEEKR has strong operating capital occupation capabilities (mainly reflected in accounts payable to related parties and normal accounts payable). For example, in 2023, the company lost over 8 billion yuan, but its operating cash flow was actually a net inflow of 2.3 billion yuan, mainly due to an 8.5 billion yuan increase in accounts payable to related parties. Since ZEEKR uses Geely's factories to make cars, this single item of accounts payable to related parties can turn the operating cash flow positive.

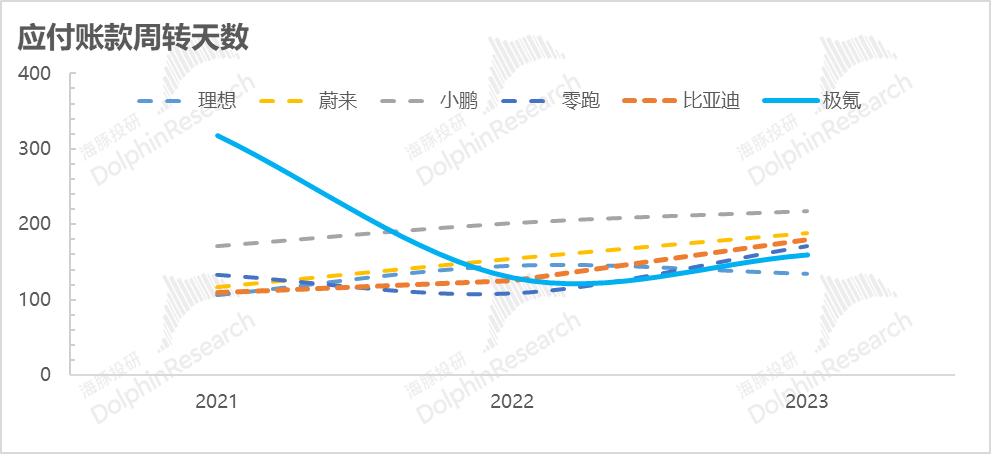

However, looking at the current days of accounts payable turnover (ZEEKR's calculation includes accounts payable, notes payable, and accounts payable to related parties), except for the initial 2021, in 2022 and 2023, whether it was insufficient increases in accounts payable in 2022 or increased occupancy in 2023, ZEEKR's occupancy time of upstream funds compared to peers seems to be within a reasonable fluctuation range.

II. Under Overindulgence: ZEEKR Also Provides Feedback

When I read this part, I made an interesting but crucial discovery for investment judgments: Although ZEEKR may have Geely's loan backing and will not face cash flow crises, this does not prevent it from having an inherent motivation to raise funds through equity dilution. Why?

Looking at ZEEKR's cash flow situation from 2021 to 2023, in 2021 and 2023, due to its occupation of upstream funds (mainly accounts payable to Geely and other related parties), ZEEKR, despite its huge losses, actually had net positive operating cash flows.

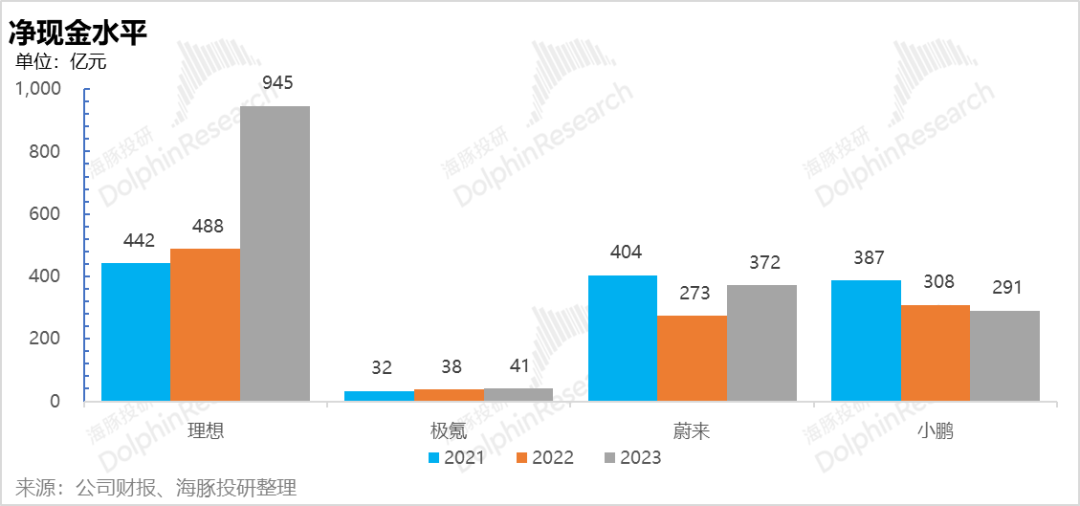

Even now, compared to its already listed peers, ZEEKR's funds are in a precarious state.

Since ZEEKR does not have its own factories and has minimal capital investment other than a certain amount for sales outlets, from the perspective of cash required for pure business operations, ZEEKR's operating funds were basically balanced in 2021 and 2023, and there was no need to supplement operating funds from external sources.

So what happened in the cash-strapped 2022? After reviewing the cash flow statement, I believe the main reasons are:

a. Operationally: The accounts payable to related parties did not increase synchronously with sales volume increases, and instead, decreased by 5-