"Did the EU's tax increase leave them lonely? The automotive sector rose against the trend

![]() 06/17 2024

06/17 2024

![]() 637

637

Evaluating automotive stocks for the week and observing the diverse trends in the automotive market.

After the Dragon Boat Festival, the European Commission's sudden tariff measures stirred up a ripple in the otherwise calm automotive sector. Notably, this seemingly bearish news acted like a shot in the arm, as several listed automakers demonstrated resilience and disregard for the tariffs.

On June 12, the European Commission issued a related announcement, imposing additional tariffs of 17.4%, 20%, and 38.1% on BYD, Geely Automobile, and SAIC Motor Group, respectively. Other manufacturers cooperating with the investigation will face a 21% tariff, while those not cooperating will face a 38.1% tariff. The additional tariffs are imposed on top of the standard 10% import tax. Additionally, Tesla cars imported from China may be subject to a separate tax rate.

A day later, on June 13, against the backdrop of declines in the three major indices in the A-share market, the automotive sector rose slightly by 0.11%, extending its upward trend for four consecutive trading days. The Hong Kong automotive sector also ended several days of volatility with a strong rebound, with an overall increase of 3.01%, leading the Hong Kong stock market.

BYD shares once led the gains with an increase of over 8%, while NIO Inc. touched a high of 5% and Geely Automobile also rose by over 4%. Although the gains of various stocks subsequently moderated, most automotive stocks still closed in the green.

Regarding the European Commission's sudden tax increase policy, associations and automakers such as the German Association of the Automotive Industry, the European Chamber of Commerce in China, BMW Group, and Volkswagen Group have expressed opposition.

Some securities firms have analyzed that based on historical cases of the EU imposing "anti-dumping and countervailing" taxes on China, the current magnitude of tariffs imposed on pure electric vehicles is at a mid-level. On the other hand, independent automakers currently export mainly to Asia, Africa, and Latin America, and Chinese pure electric models have significant cost-performance advantages in Europe. While the tariff increase will have a short-term impact on European exports, its overall impact is limited due to the relatively low proportion of European exports in China's passenger car exports.

It can be said that the EU's anti-dumping tax policy has more symbolic significance than practical significance. Moreover, excluding regions where independent automakers from Europe, the United States, Japan, South Korea, and India find it difficult to enter, there is still a significant market space globally, and the market remains vast for independent automakers.

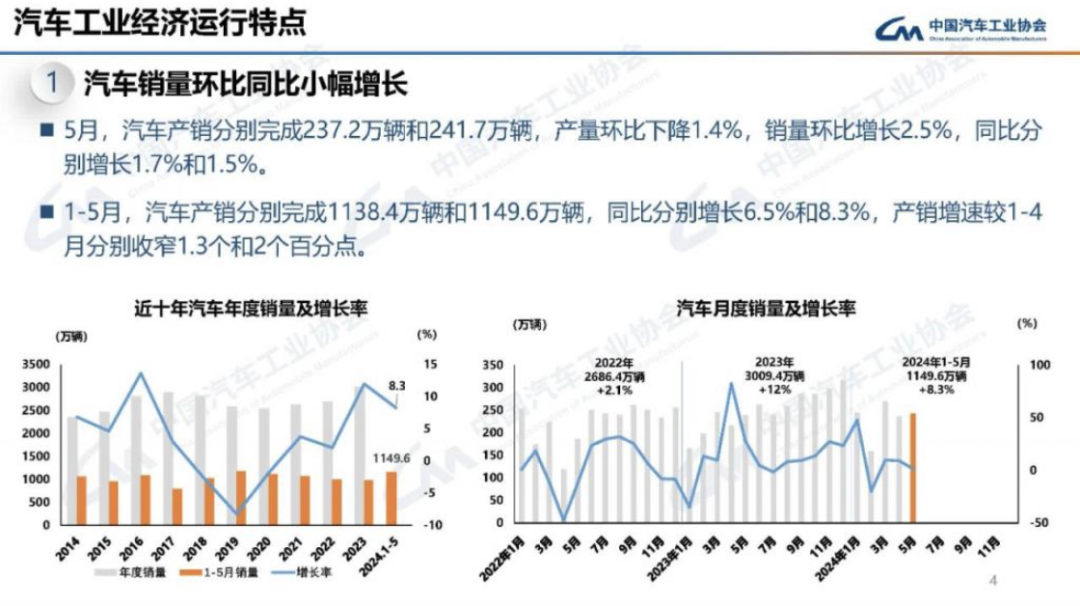

On June 14, the China Association of Automobile Manufacturers released automotive production and sales data for May: In May, China's automotive production and sales reached 2.372 million and 2.417 million vehicles, respectively, representing year-on-year increases of 1.7% and 1.5%. So far this year, cumulative automotive production and sales have reached 11.384 million and 11.496 million vehicles, representing year-on-year increases of 6.5% and 8.3%, respectively.

In terms of exports, this year has generally continued the strong growth momentum of last year. In May, customs statistics showed that automotive exports reached 569,000 vehicles, representing a year-on-year increase of 30%, and the export value for the month reached US$10.5 billion, representing a year-on-year increase of 17%. From January to May this year, overall automotive exports reached 2.45 million vehicles, representing a year-on-year increase of 27%, and the automotive export value reached US$46.4 billion, representing a year-on-year increase of 20%.

Focusing on individual stocks, unlike most companies, SAIC Motor Group, which was subject to the most severe tariff sanctions by the European Commission, still showed a certain disadvantage in its share price, and SAIC Motor is also an automaker with a relatively high export proportion in the EU region.

On June 13, SAIC Motor's share price once fell by 3% to 13.7 yuan, close to its historical low. SAIC Motor also chose to launch a large-scale share repurchase plan at this time.

According to the announcement from SAIC Motor, on June 11, the company completed its share repurchase, actually repurchasing a total of approximately 70.39 million shares through centralized competitive bidding, accounting for 0.6081% of the company's total share capital. The highest repurchase price was 15.29 yuan per share, the lowest repurchase price was 13.03 yuan per share, and the average repurchase price was 14.21 yuan per share, using a total amount of approximately 1 billion yuan.

As a result, SAIC Motor has become one of the more active listed companies in this year's A-share share repurchase wave. This year, large-scale share repurchase plans by listed companies have frequently emerged. In terms of repurchase amounts, the total repurchase amounts of the 964 plans mentioned above range from 59.626 billion yuan to 113.082 billion yuan. Among them, 16 repurchase plans have upper limits exceeding 1 billion yuan, mostly led by centrally administered state-owned enterprises.

Analysts believe that the valuations of most companies in the current A-share market are at historical lows, and share repurchases can convey positive signals to the market about stable earnings and undervalued corporate value, enhancing investor confidence and benefiting the stock price performance in the capital market.

Similarly, BYD's 400 million yuan share repurchase plan initiated in April this year is expected to be completed this month. Since the beginning of this year, BYD's share price has also risen along with its sales, increasing from a low of 172 yuan at the beginning of the year to a high of 258.28 yuan per share this week, representing a gain of over 45%.

Especially last month, the launch of the fifth-generation DMI technology led to a rise of about 10% in BYD's share price within a few days. As of now, BYD's share price stands at 253 yuan per share, unrivaled.

Globally, the only new energy automaker that can rival BYD is probably Tesla. At the shareholders' meeting that just ended this week, Tesla also ushered in new changes.

On June 14, Beijing time, the highly anticipated Tesla 2024 shareholders' meeting officially approved Musk's massive US$50 billion compensation package, representing a significant victory for Musk's small shareholders. At the same time, this also means that Musk's control over Tesla has reached a new height.

Additionally, following this shareholders' meeting, Tesla will officially relocate its headquarters from California to Texas. Musk had started to disagree with the California government two years ago, threatening to relocate. When Tesla was founded, it received significant support from the California government and enjoyed various preferential policies and financial incentives. However, over time, the partnership became strained, and Tesla began to criticize the California government's regulations and bureaucracy, accusing them of inhibiting the development of start-up companies.

It is understood that Texas does not have a personal income tax, while California's personal income tax rate is as high as 13.3%. For billionaires like Musk, this represents billions of dollars in tax savings.

In addition to these two major resolutions, Musk introduced that Tesla's supercharger network is accelerating its expansion. In the second half of this year, the deployment of the supercharger network will surpass the entire industry, with an estimated investment of US$500 million, covering every major transportation route and even unmapped areas.

Moreover, Tesla is willing to provide assistance to any fuel vehicle manufacturer planning an electric transformation, allowing their electric vehicles to use Tesla's supercharger network for energy replenishment through a dedicated adapter.

As of June this year, Tesla has cumulatively produced over 6 million electric vehicles and is expected to exceed 7 million in total production by the end of the year. Meanwhile, Musk also announced that Tesla is developing three new models, which, based on the mock-ups, are expected to be a Robo Taxi, an entry-level model, and possibly an MPV model.

It is worth noting that Tesla's share price has not increased significantly due to this series of positive developments. Many investors still believe that the board's resolutions are essentially maintaining Musk's interests and have higher requirements for the company's operational level.