BMW's all-electric MINI, destined to be "killed" by EU tariffs

![]() 06/17 2024

06/17 2024

![]() 518

518

Unfortunately timed.

”

Author: Wang Lei | Editor: Qin Zhangyong

BMW's all-electric MINI has encountered a difficult hurdle before it has even officially gone into mass production and sales in China.

According to Reuters, BMW's fully electric MINI produced in China may face a maximum electric vehicle tariff of 38.1%, "which could deal a fatal blow to the sales prospects of this mid-range car."

Moreover, if the all-electric MINI produced in China in the future faces the maximum tariff, MINI's global new energy vehicle strategy will also be disrupted.

The all-electric MINI is a crucial step in BMW's electric strategy, playing a role similar to Smart in the Mercedes-Benz system. However, as Smart surges ahead in the field of electrification, MINI must accelerate its pace.

Now, before even officially entering the market, it has encountered such "force majeure," which adds a touch of pessimism.

01 Affecting "Family Members"

The reason for the imposition of the highest tariff level is due to the initial failure to cooperate with the EU investigation.

Insiders revealed that as the pure electric MINI model was still in the early stages of development, it seemed that Beam Auto was unable to complete the European Commission's investigation, and was therefore classified as a company that "failed to cooperate with the investigation."

So far, BMW has not responded.

However, some media outlets have revealed that BMW Group is urgently discussing internally how to handle this matter after the phased tariffs are imposed, to avoid MINI becoming the European automaker most severely affected by this anti-subsidy investigation.

This is interesting, as the EU's policy of imposing temporary tariffs has paradoxically hurt its "own people" the most.

Of course, strictly speaking, the pure electric version of MINI already has half "Chinese blood." In July 2018, Great Wall and BMW signed a joint venture agreement to form Beam Auto, with each holding 50% of the shares, and a total investment of 5.1 billion yuan, located in Zhangjiagang.

At that time, Beam Auto's mission was to jointly develop a new generation of pure electric vehicle platforms. In addition to producing BMW MINI electric vehicles, it will also produce Great Wall's own brand of electric vehicles.

According to the plan, Beam Auto's products will enter BMW Group and Great Wall Motor's respective sales and service networks by brand.

When BMW and Great Wall first joined forces, BMW said, "China has become the world's largest electric vehicle market, and realizing localized production of MINI pure electric models has become a key factor for MINI's sustained development."

Last September, BMW Group announced that the next-generation MINI pure electric model will be produced in China, with Beam Auto, a joint venture between BMW Group and Great Wall Motor, serving as the global first production site and main export base for the new car.

Behind this announcement was BMW Group's intention to stop producing MINI electric models at its Oxford plant in the UK and transfer the production line to China.

At that time, Stefanie Wurst, head of BMW's MINI brand, said that the Oxford plant was "not ready for electric vehicles" as it had to produce both electric and gasoline cars on the same production line, making it inefficient.

Therefore, the responsibility now falls on Beam Auto. According to the plan, there are two next-generation pure electric MINI models, a brand-new three-door MINI Cooper and a brand-new MINI compact crossover (MINI Aceman). The two cars are scheduled to be produced successively at the Beam Auto plant, supplying both the international and domestic markets in 2024.

One month later, the domestically produced all-new three-door pure electric MINI Cooper officially went into mass production at Beam Auto's Zhangjiagang plant, with the first batch of SOP models being exported only.

However, it should be noted that according to the original plan, Beam Auto's first mass-produced new car should have gone into production around 2022. Due to various issues such as production qualifications, it has been delayed in entering the market.

But the current pure electric vehicle market is rapidly changing, and whether it's price or timing for market launch, the pure electric MINI seems to have missed the opportunity.

In December 2019, Geely Group and Mercedes-Benz jointly invested to establish Smart Automobile (Smart), with each holding 50% of the shares. Smart is designed by Mercedes-Benz and developed and produced by Geely, based on Geely's SEA Haohan platform.

In June 2023, its first model, the Smart #1, officially went on sale. Currently, Smart has two models on sale: the Smart #1 and the Smart #3. Data shows that in the first quarter of this year, Smart brand's cumulative sales have already approached 5,000 vehicles.

The upcoming mass-produced MINI Aceman has a similar positioning to the Smart #1, both being small pure electric SUVs. When it finally goes on sale, MINI Aceman will not only have to face competition from Smart but also the high tariffs imposed on sales.

Based on MINI's brand positioning and market audience, if calculated based on a comprehensive tariff of 48.1% (10% + 38.1%), will MINI still have an advantage in Europe?

02 European automakers are the most affected?

Of course, the root cause lies in the EU's "tariff stick."

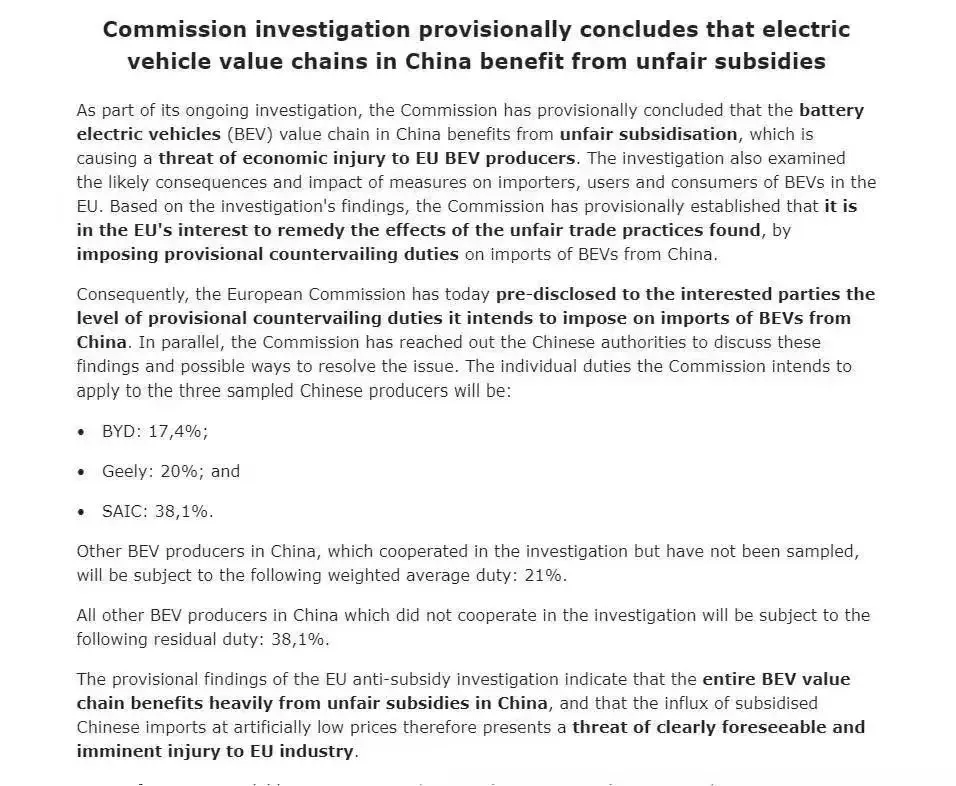

On June 12, the European Commission decided to impose additional tariffs ranging from 17.4% to 38.1% on electric vehicles imported from China, starting next month, on top of the current 10% tariff.

This means that Chinese automakers will face tariffs ranging from 27.4% to 48.1% after the existing 10% import tax is stacked on top.

The reason for this decision is that the European Commission believes that the Chinese government has provided unreasonable subsidies to its electric vehicle industry, harming the interests of European manufacturers.

As for the additional tariffs, they are euphemistically called "temporary countervailing duties."

Among the three sampled Chinese automakers, BYD is proposed to be subject to a temporary tariff of 17.4%, Geely 20%, and SAIC Motor 38.1%. Chinese electric vehicle manufacturers that participated in the investigation but have not yet been sampled will be subject to a weighted average tax of 21%; other Chinese electric vehicle manufacturers that failed to cooperate with the investigation will be subject to a residual tariff of 38.1%.

Tesla produced in China will use a separate tax rate, which is not yet known.

The European Commission said that if a solution cannot be reached with China, the additional tariffs will be implemented around July 4.

Before the final implementation of this resolution, the EU and its member states will make a final vote. If the number of反对票exceeds the number of赞成票, the resolution can be canceled. However, it is certain that if this resolution is implemented, it will significantly increase the cost of car purchases for European consumers, a true case of "hurting others without benefiting oneself."

Many Wall Street analysts have also warned that the European Commission's decision to impose tariffs on Chinese imported electric vehicles may have limited impact on Chinese automakers but will have a significant impact on European automakers.

Kevin Lau, an analyst at Daiwa Securities in Japan, said that in the first four months of this year, the contribution of the European market to the total sales of BYD, Geely, and SAIC was only between 1% and 3%, indicating that the EU market has a very limited impact on the overall sales of Chinese automakers.

On the other hand, EU tariffs are unlikely to prevent Chinese automakers from continuing to enter the European market, as Chinese automakers have sufficient cost advantages to absorb additional tariff costs while still maintaining profitability.

At the same time, many Chinese automakers have been rapidly expanding into the European market in recent years, achieving localization.

But the situation for European automakers is not so rosy.

China is an important single market for many European automakers. It is not so much that China is taking over the European market as that China is providing a "soil" for these foreign-funded enterprises to thrive.

In the first quarter of this year, the Chinese market accounted for nearly 32% of BMW's sales, and about 30% of Volkswagen and Mercedes-Benz's sales. Therefore, these automakers are generally concerned that tariffs on China may lead to countermeasures against German automakers such as BMW, Porsche, Volkswagen, and Mercedes-Benz.

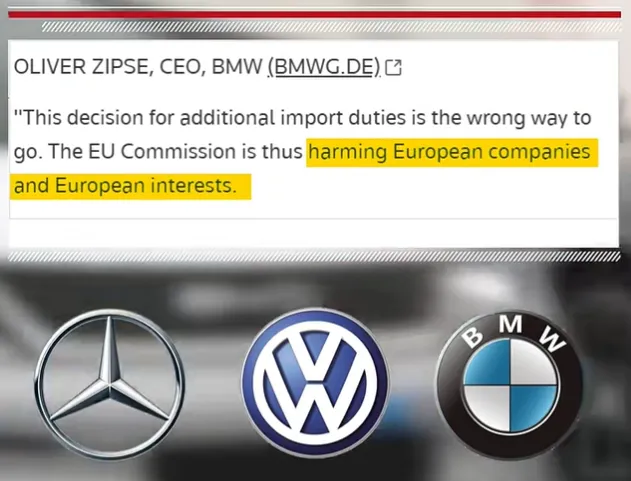

It is not difficult to understand why the news of the imposition of temporary tariffs has met with the most pessimism precisely from the EU's "own people."

BMW Group Chairman Oliver Zipse has already stated that the EU's decision to impose tariffs on Chinese electric vehicles is a wrong one. Imposing tariffs not only hinders the development of European automakers but also harms Europe's own interests. Such a policy "will only lift a rock to hit its own foot."

Volkswagen CEO Herbert Diess even warned, "Just wait for China's countermeasures."

Now, BMW's all-electric MINI has become the first "victim" of this innocent shooting, and BMW's iX3, which is in a similar situation to the all-electric MINI, has also been affected. BMW Brilliance has been producing electric BMW iX3 exported to Europe from China since 2021.

As more and more "family members" are affected, it is the EU itself that should be worried next.