SAIC MG4 EV enters the Taiwan market, aiming to crush Japanese cars with new energy?

![]() 06/18 2024

06/18 2024

![]() 456

456

In 2023, SAIC Passenger Vehicles ranked second in Chinese car exports with 685,018 vehicles exported, second only to Chery. Among all SAIC's products, MG (Morris Garages) has the largest export volume. This British-born automotive brand has truly flourished under SAIC's acquisition.

However, the EU recently announced an increase in tariffs on SAIC Group to 38.1%, causing SAIC significant headaches. For SAIC, MG has a high brand influence and audience in the European market, which cannot be abandoned. However, with the increase in tariffs, MG will likely see its profits compressed in the short term, whether it raises prices or builds factories in Europe.

To cope with the decline in profits, MG needs to explore other markets, increase product sales, corporate revenue, and profits. Recently, the MG4 EV landed in the Taiwan market, priced at NT$999,000 to NT$1,199,000 (approximately RMB 220,000 to 270,000). Combined with the previous MG HS landing in Taiwan, it is likely that Taiwan will become SAIC's next major market in its planning.

Expanding into the Taiwan market, SAIC breaks the monopoly of Japanese cars

Generally speaking, in economically developed countries and regions such as Europe and the United States, the prices of mid-to-low-end models are generally higher, while the prices of luxury cars are relatively cheaper compared to other markets. In the mainland market, relying on supply chain advantages, mid-to-low-end models and independent brand luxury cars are relatively cheap, while imported fuel vehicles, especially those with large displacement taxes, are even more expensive. However, with independent brands supporting them, automakers dare not set prices at will.

Taiwan is different. In terms of independent brands, only Luxgen performs slightly better, but Luxgen's fuel vehicles suffer from high energy consumption. The newly launched Luxgen N7, a new energy vehicle, has also failed to enter the top five in monthly sales in Taiwan, leading to Luxgen gradually exiting the mainland market and not having high sales in Taiwan, unable to play a role in competing against Japanese cars.

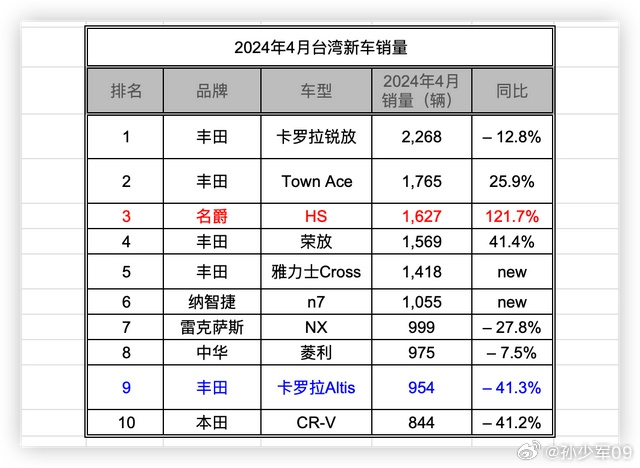

Looking at Taiwan's car sales in April, except for the MG HS, Luxgen N7, and Zhonghua Lingli, all other top-selling models belong to Japanese brands. The monopoly of Japanese cars is not scary, but what is scary is that the prices of these Japanese cars are too expensive. Take the compact SUV Toyota Corolla Cross, the top-selling model, as an example. The Taiwan version starts at NT$859,000 (approximately RMB 193,000), while the mainland version is only priced from RMB 129,800. It is unfair for Taiwan consumers.

This is even more so for new energy vehicles. The Taiwan price of Toyota bZ4X is NT$1,599,000 (approximately RMB 358,000), while the mainland version, Platinum 4X (renamed), starts at only RMB 179,800. Moreover, automakers such as GAC and FAW usually offer discounts, and the actual starting price is below RMB 150,000.

The lack of competitiveness of independent brands in the Taiwan market has led to the market being basically monopolized by Japanese cars. MG entering Taiwan is a good thing for local consumers from any angle - it helps increase market competition, breaks the monopoly of Japanese cars, prompts price reductions, and gives local consumers the opportunity to experience better products. In addition, the rapid entry of MG HS into the top three in monthly Taiwan car sales is sufficient to show the lack of competitiveness of local automotive products.

However, facing the MG4 EV, which may change the structure of the Taiwan automotive industry and bring benefits to local consumers, Taiwan netizens seem unwilling to accept it, and even criticisms continue.

Continuous criticisms, Taiwan consumers are not optimistic about the MG4 EV?

I took a look at Taiwan netizens' opinions on the MG4 EV. The comments on platform X (Twitter) were relatively intense, with many abnormal remarks, and most people generally viewed MG as a domestic brand rather than a British brand, thus belittling MG. Since the comments were too extreme, I won't post screenshots.

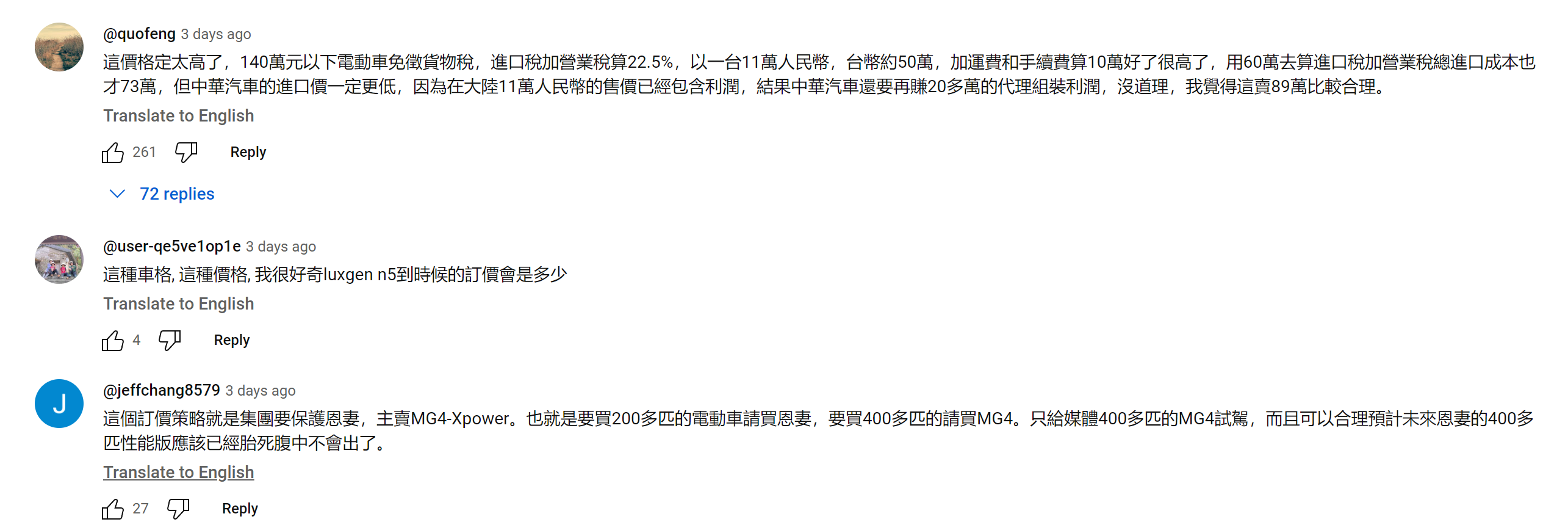

The comments on the YouTube platform were more objective. Some Taiwan netizens said that the price of the MG4 EV is too expensive. Calculating the exchange rate based on the mainland version's starting price of RMB 109,800, even adding tariffs, freight, handling fees, etc., it would not exceed NT$730,000. Moreover, the mainland price of RMB 109,800 already includes profits. Even if it sells at a higher price, a starting price of NT$890,000 (approximately RMB 199,000) would be reasonable.

Indeed, compared to the mainland price, the Taiwan version of the MG4 EV is indeed a bit expensive, but the main reason for this is the lack of competitiveness of new energy vehicles in Taiwan. Apart from Japanese cars with exorbitant prices, the only competitor of the MG4 EV is the Luxgen N7. According to the understanding of Electric Vehicle News, the configuration of the Luxgen N7 is comparable to that of the previous generation BYD Song PRO EV, especially in terms of intelligence, which is equivalent to domestic cars five years ago. Under such circumstances, don't blame the MG4 EV for being priced too high. It's mainly because there are really not many competitors.

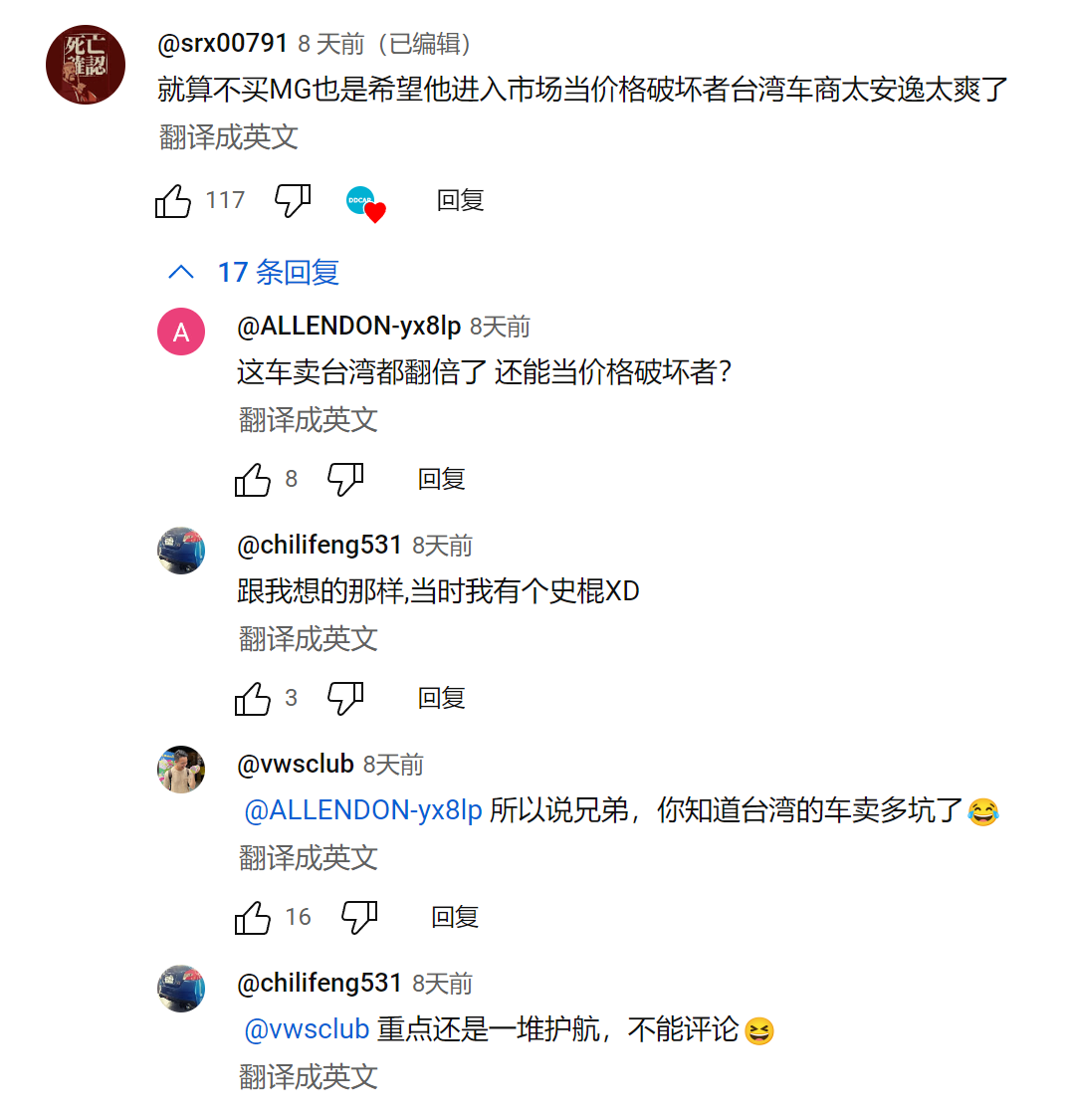

Another YouTube netizen said that even if they didn't buy MG's products, they supported MG entering the Taiwan market to play the role of a "price disruptor." He believes that the local automakers in Taiwan are too comfortable, which has led to the high prices of mid-to-low-end family cars.

I believe that these YouTube netizens have a normal mindset. The reason why mid-to-low-end models in the mainland are inexpensive is that the competition is too fierce, and price wars follow one after another. If you dare to sell at a higher price, you have to bear the consequences of consumers refusing to buy. Admittedly, both MG HS and MG4 EV are marginal models in the mainland market with not much competitiveness, and the former has even been discontinued. However, their product power in the Taiwan market still stands out.

Perhaps due to long-term reliance on Japanese cars, many Taiwan consumers have biases against MG. But sales are the hard truth. MG HS entering the top three in Taiwan sales has already demonstrated its product competitiveness. The MG4 EV is also a dimensional reduction blow to other new energy vehicles sold in Taiwan. Although it is much more expensive than in the mainland, it is still worth buying.

For Taiwan, the only way to reduce car prices is to accelerate the introduction of mainland brands, intensify competition in the automotive industry, and prompt automakers to engage in price wars. However, attracting mainland brands to enter the Taiwan market is not an easy task, as the Taiwan market is too small, and the local government and many consumers have biases against mainland brands.

The sadness of a small market, low configuration and high prices are inevitable

Taiwan's annual new car sales are approximately 400,000 vehicles. According to netizens, this is roughly the size of Tianjin, slightly higher than Vietnam but far below markets such as Malaysia and Thailand.

It was previously reported that a large number of independent brands would enter the Taiwan market, but this was later refuted by the Taiwan authorities. From the perspective of mainland automakers, their current main focus is still on the mainland market, and they have little interest in going abroad, let alone paying attention to smaller markets like Taiwan.

In addition, Taiwan consumers have less understanding of mainland brands and more biases, so introducing products may encounter resistance.

Fortunately, for SAIC, the importance of the Taiwan market is far less than that of Southeast Asia. Even if SAIC Group encounters setbacks in the European market due to tariff increases, it will only use the Taiwan market to share the pressure and will not bet on the Taiwan market. Relatively speaking, larger markets like Thailand and Malaysia are more valuable.

In May last year, SAIC announced the construction of a factory in Thailand for the local production of new energy automotive parts. Earlier this year, it also met with dealers in multiple countries and regions such as Vietnam, the Philippines, Indonesia, and Malaysia, established a Malaysian company, and continued to expand into Southeast Asian markets.

In fact, Taiwan Yulon Motor, which has cooperated closely with mainland automakers, has been working hard to build an image of "Taiwan-made" and "British brand" for MG, and has brought more jobs to the local area, but it still cannot avoid criticisms. I can only say that the attitude of the "Taiwan authorities" and some consumers towards mainland brands is the core reason why they need to pay high prices for low-configuration Japanese cars.

Taiwan's car ownership per thousand people is only 332 vehicles, which is ultimately just the size of a "province." With similar per capita GDP, there is still a significant gap in car ownership compared to Japan and South Korea. In addition, in terms of the distribution of transportation, local consumers in Taiwan prefer motorcycles. There is even some room for growth in both new energy vehicles and even fuel vehicles. The Taiwan automotive market still has potential for development and growth, but it requires the local government and consumers to accept mainland automakers to tap into Taiwan's market potential.

Places like Hong Kong and Macao increase car taxes due to high population density and traffic congestion. Taiwan's area is comparable to Hainan Province. Considering the population and car ownership, it is not particularly crowded. Reducing tariffs and introducing mainland automakers such as BYD and Chery can promote healthy competition, force Japanese cars to lower prices, allow local consumers to purchase more affordable products, and may even promote technological research and development of local automakers.

As the YouTube netizen mentioned above, even if you are unwilling to buy MG or other mainland automotive brands, or even have biases against mainland brands, you should still welcome mainland automakers to enter the Taiwan market, break the monopoly of Japanese cars, and provide Taiwan consumers with low-priced and high-configured automotive products.

Source: Leitech