2025 New Energy Vehicle Year-End Report: BYD 4.55 million units, Geely 1.69 million units, Chery 870,000 units...

![]() 01/04 2026

01/04 2026

![]() 470

470

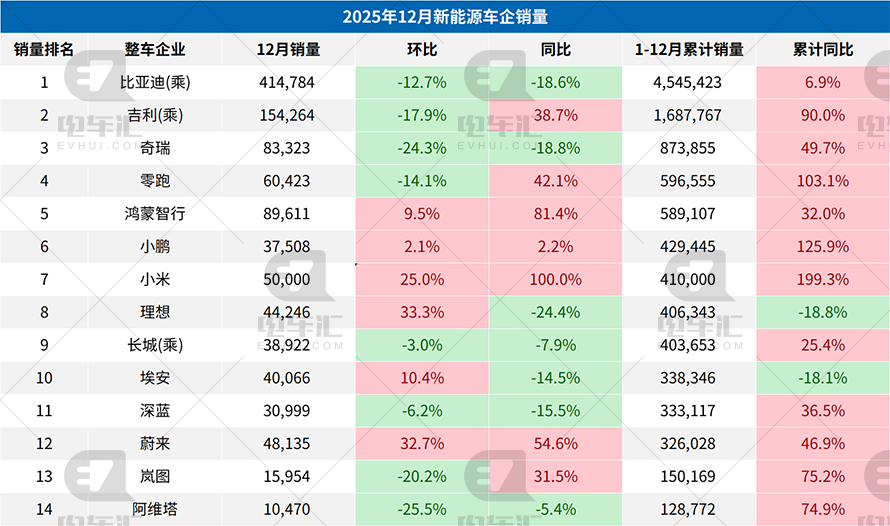

(The statistics only include vehicle companies that have consistently released monthly sales data on the 1st day of each month.) On January 1st, mainstream new energy vehicle companies successively released their final 'performance reports' for 2025. Stimulated by the dual factors of the 'Double 12' promotions and the rush to install vehicles before the reduction of local subsidies, new energy passenger vehicles maintained a strong sales trend in December. Combined with the annual data, the leading pattern has been completely solidified - BYD set a new global record with 4.55 million units, Geely and Chery ranked second and third respectively, Harmony Intelligent Mobility Alliance entered the top five in the industry, and the divergence among emerging players further intensified.

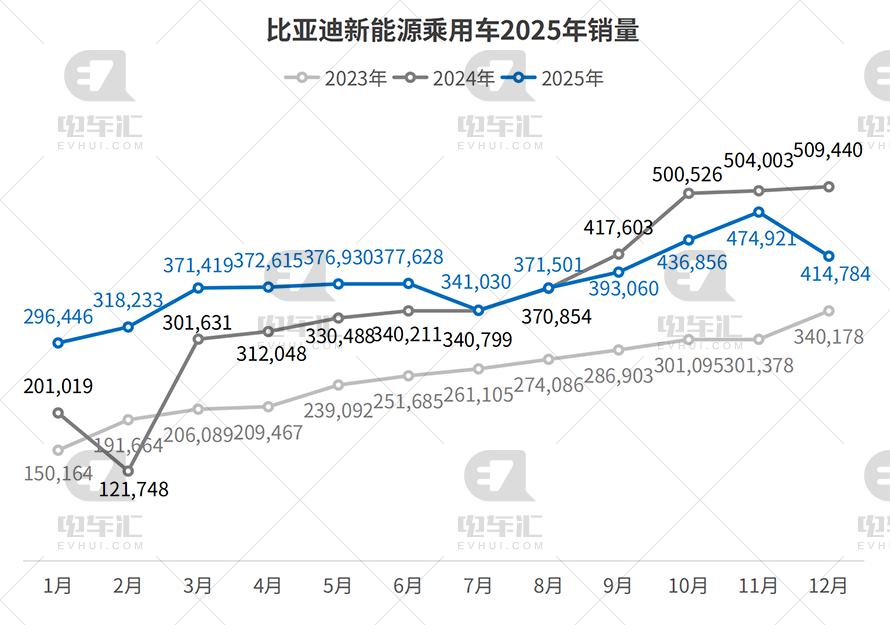

BYD Passenger Vehicles

BYD sold 414,784 new energy passenger vehicles in December, a 12.7% decrease from the previous month and an 18.6% decrease year-on-year due to the impact of a high base last year. From January to December, it sold a total of 4,545,423 units, a 6.9% increase year-on-year, retaining its title as the global sales champion in the new energy vehicle market.

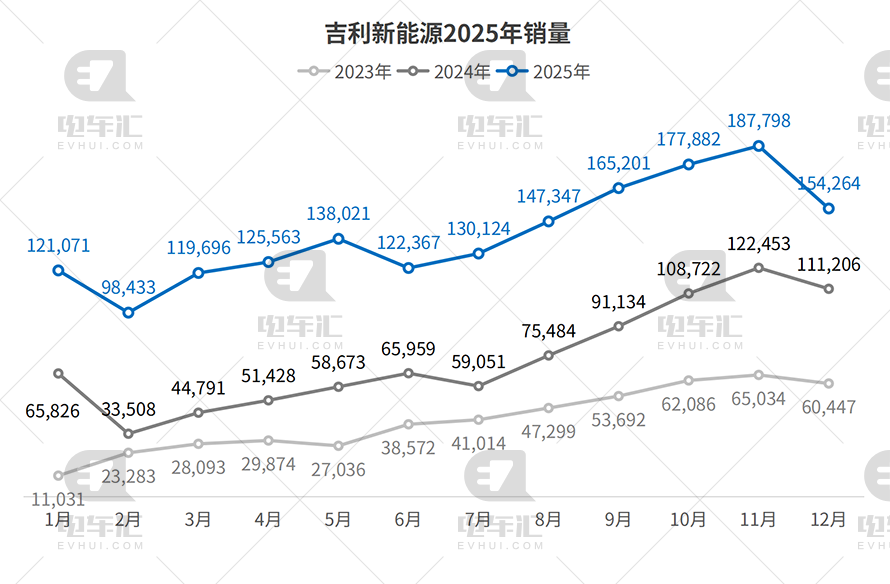

Geely New Energy

Geely sold 154,264 new energy passenger vehicles in December, a 17.9% decrease from the previous month but still a significant 38.7% increase year-on-year. For the whole year, it sold a total of 1,687,767 units, a staggering 90% increase year-on-year, making it the fastest-growing traditional vehicle company among the TOP 10.

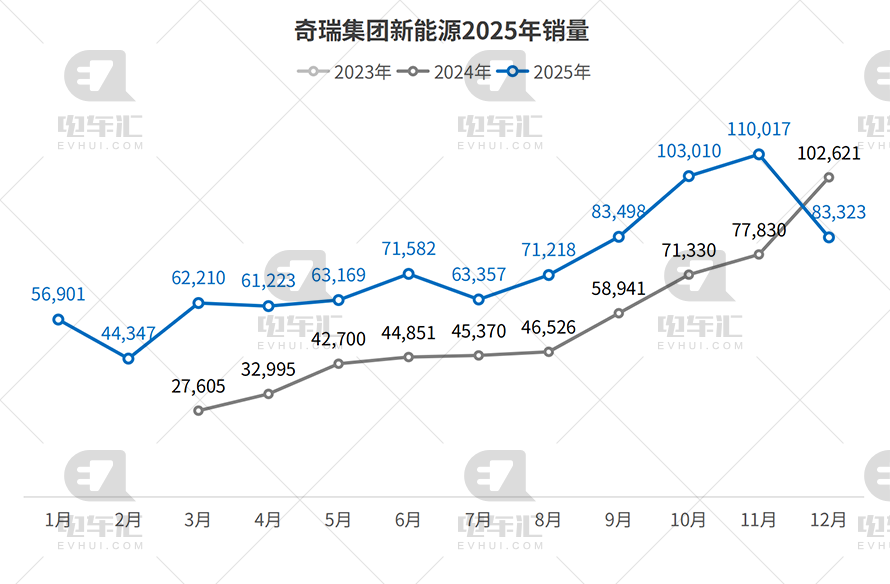

Chery New Energy

Chery sold 83,323 new energy passenger vehicles in December, a 24.3% decrease from the previous month and an 18.8% decrease year-on-year. For the whole year, it sold a total of 873,855 units, a 49.7% increase year-on-year. The multi-product layout of Fengyun A8, iCAR 03, and Stellar Era ET has yielded significant results. The C-DM hybrid technology has achieved simultaneous growth in domestic and international markets. Chery's global layout has entered a harvest period, with sustained high-speed growth in annual sales, making it a key player in the domestic new energy vehicle camp (Chinese term meaning 'group' or 'sector').

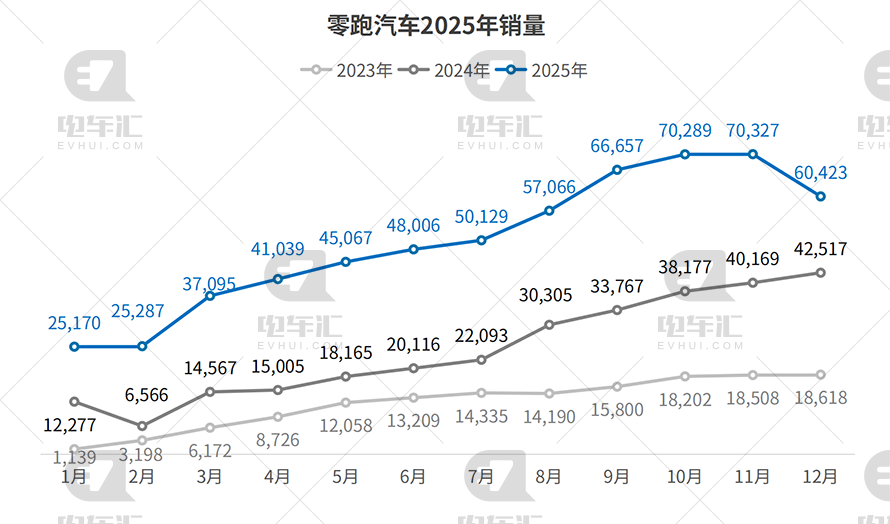

Leapmotor

Leapmotor delivered 60,423 vehicles in December, a 14.1% decrease from the previous month but a 42.1% increase year-on-year. For the whole year, it delivered a total of 596,555 units, a significant 103.1% increase year-on-year. Orders for the B10 and C16 models under the LEAP3.5 architecture accounted for over 60% of the total. The full-size SUV D19 has started deliveries, and the brand's average price has stabilized at 200,000 yuan, with the profit inflection point approaching.

Harmony Intelligent Mobility Alliance

Harmony Intelligent Mobility Alliance delivered 89,611 vehicles in December, a 9.5% increase from the previous month, surging to the forefront of the industry, and an 81.4% increase year-on-year. From January to December, it sold a total of 589,107 units. The AITO M7 Intelligent Driving Edition and M9 Ultra continue to be in short supply. Huawei's full-stack intelligent ecosystem has demonstrated a significant empowerment effect, rapidly enhancing its influence in the high-end intelligent electric vehicle market.

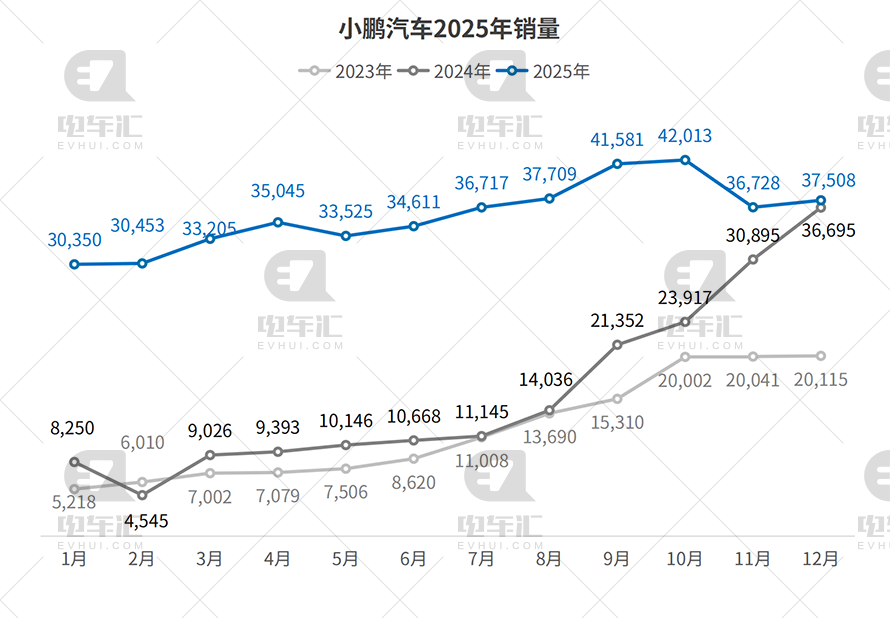

XPENG Motors

XPENG Motors delivered 37,508 vehicles in December, a 2.1% increase from the previous month and a slight 2.2% increase year-on-year. For the whole year, it delivered a total of 429,445 units, a 125.9% increase year-on-year. The MONA M03 continues to contribute incremental sales. The localized production of the G6 and G9 in Europe is progressing steadily, with the proportion of exports gradually increasing. The gross profit advantage in overseas markets effectively aids overall profit improvement. The globalization strategy has shown initial success, with annual sales doubling.

Xiaomi Automobile

Xiaomi Automobile delivered over 50,000 vehicles in December, a 25% increase from the previous month, and a total of over 410,000 vehicles for the whole year. As a 'latecomer' to the industry, Xiaomi Automobile has accelerated its channel expansion to third-tier cities, with 477 stores nationwide. Orders for the YU7 model have surpassed those of the SU7, becoming a new sales pillar. In December, it successfully achieved a new monthly delivery high of 50,000 vehicles, with annual sales nearly tripling, strongly entering the mainstream camp (Chinese term meaning 'group' or 'sector').

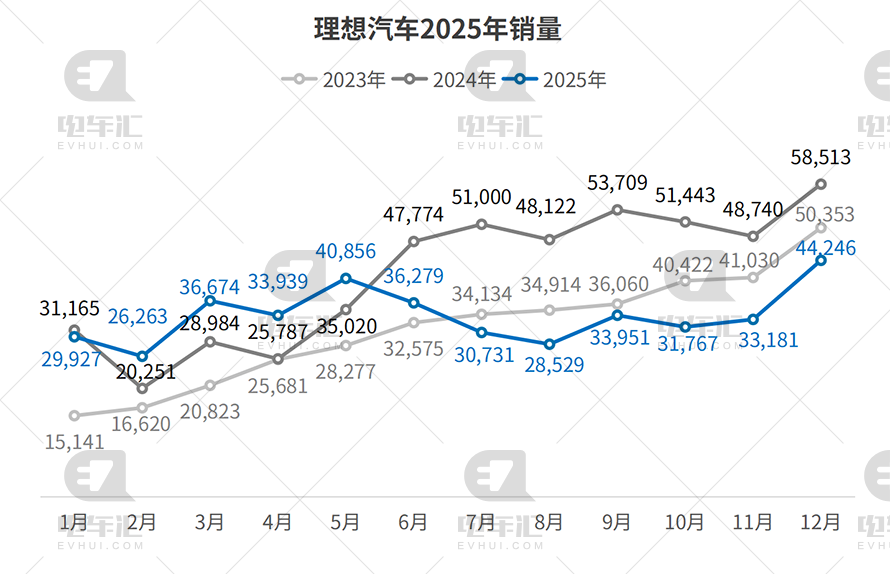

Li Auto

Li Auto delivered 44,246 vehicles in December, a 33.3% increase from the previous month but a 24.4% decrease year-on-year due to the impact of a high base last year. For the whole year, it delivered a total of 406,343 units, an 18.8% decrease year-on-year. The pure electric i6 has started mass deliveries, and the L series facelift models continue to optimize their product competitiveness. In the fourth quarter, it successfully returned to the channel of monthly growth. Although annual sales decreased year-on-year, the breakthrough in the pure electric business has laid a foundation for subsequent development.

Great Wall Motors New Energy

Great Wall Motors sold 38,922 new energy passenger vehicles in December, a 3.0% decrease from the previous month and a 7.9% decrease year-on-year. For the whole year, it sold a total of 403,653 units, a 25.4% increase year-on-year. The Tank 300 PHEV and Gaoshan MPV have become the main incremental models. The Hi4-T off-road hybrid technology has established a differentiated competitive advantage. Although there was a short-term fluctuation in sales at the end of the year, the long-term track barriers remain solid, with sustained and steady growth in annual sales.

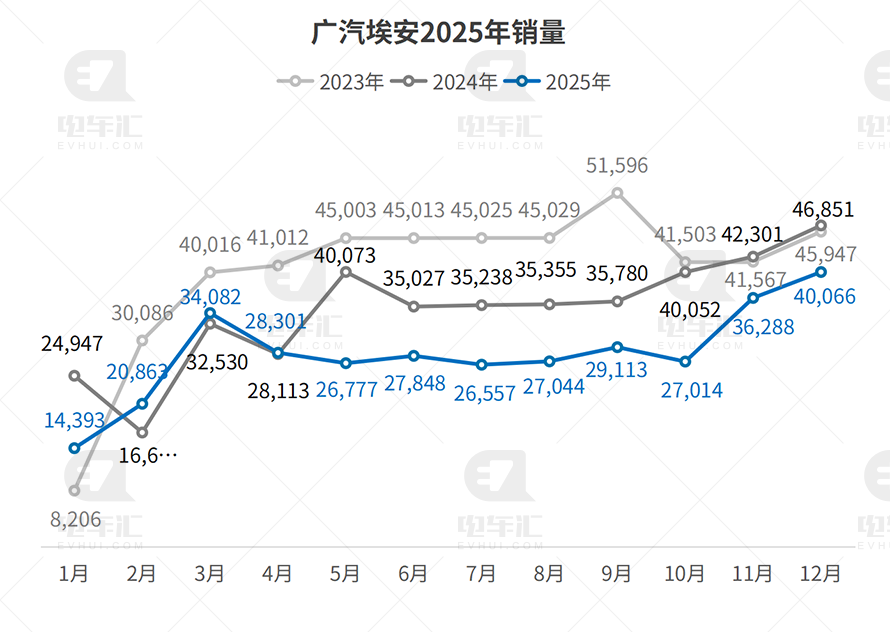

GAC AION

GAC AION delivered 40,066 vehicles in December, a 10.4% increase from the previous month but a 14.5% decrease year-on-year. For the whole year, it delivered a total of 338,346 units, an 18.1% decrease year-on-year. The year-end sales push was effective, but the product cycle still needs to be adjusted.

Seres Deepal

Seres Deepal delivered 30,999 vehicles in December, a 6.2% decrease from the previous month and a 15.5% decrease year-on-year. For the whole year, it sold a total of 333,117 units, a 36.5% increase year-on-year. The SL03 Extended Range Champion Edition and G318 Off-Road SUV have performed well in dual lines. The selection rate for Huawei's ADS SE high-level intelligent driving system remains stable, and the brand's high-end path is clear. Although there was a month-on-month decrease in sales at the end of the year, the annual sales still achieved a growth rate of over 30%, showing a steady development momentum.

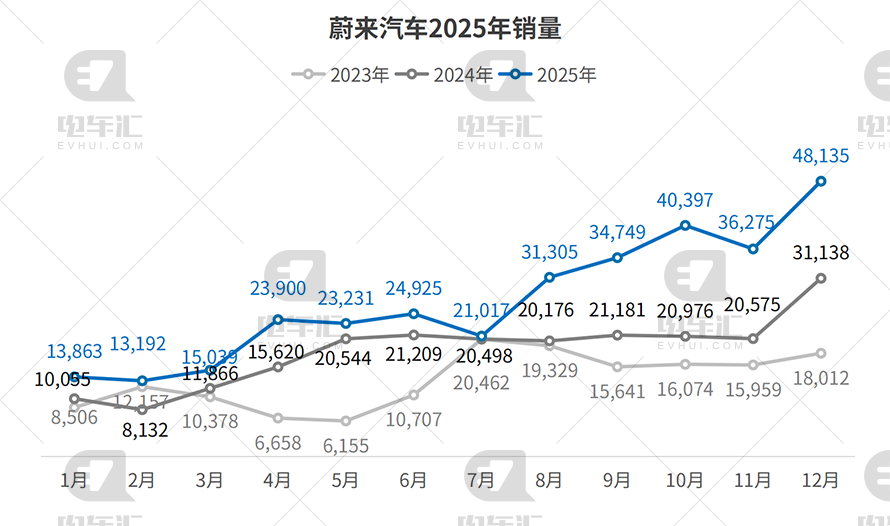

NIO Inc.

NIO delivered 48,135 vehicles in December, a 32.7% increase from the previous month and a significant 54.6% increase year-on-year. For 2025, it sold a total of 326,028 units, a 46.9% increase year-on-year. The L60 continues to maintain strong sales momentum. The Firefly brand has started small order conversions. The density of the battery swap network and service experience remain its core competitive advantages. The year-end sales increased significantly month-on-month, with steady annual sales growth, continuously consolidating its competitiveness in the high-end market.

VOYAH

VOYAH delivered 15,954 vehicles in December, a 20.2% decrease from the previous month but a 31.5% increase year-on-year. For the whole year, it sold a total of 150,169 units, a 75.2% increase year-on-year. Orders for the ZGUANG L and Dreamer PHEV equipped with the Harmony cockpit continue to grow. The high-end new energy model of central enterprises has gradually taken shape, with annual sales achieving a growth rate of over 70%, steadily establishing itself in the high-end new energy market.

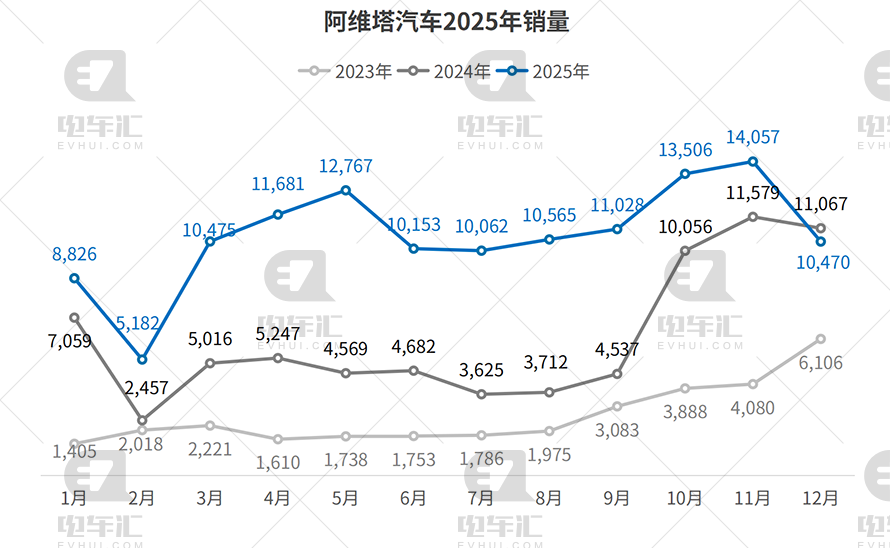

Avatr

Avatr delivered 10,470 vehicles in December, a 25.5% decrease from the previous month and a 5.4% decrease year-on-year. For 2025, it sold a total of 128,772 units, a 74.9% increase year-on-year. The Avatr 12 and 07 dual flagship models continue to sell well. The Huawei HI full-stack intelligent driving system has received leading user reviews, solidifying its position in the high-end intelligent electric coupe market segment. It has become a key pivot for Changan's electric transformation, with significant annual sales growth.

Among the 14 new energy vehicle companies that have released detailed sales data so far, the combined sales volume has reached 11.22 million units, with most companies showing significant growth momentum. The current leading pattern in the new energy vehicle sector has been settled: BYD is far ahead, Geely and Chery are accelerating their pursuit, Harmony Intelligent Mobility Alliance is emerging as a strong contender, and the 'Chinese' high-end sector is taking shape. Among the emerging players, Leapmotor, XPENG, and Xiaomi are accelerating their growth, while Li Auto is adjusting and setting off again. Traditional central enterprises are making collective efforts, with Seres Deepal, VOYAH, and Avatr on the verge of profitability. Looking ahead to 2026, intelligence, globalization, and high-endization will become the core competition points in the next stage.