In 2026, energy storage will become the automakers' 'second battlefield'.

![]() 01/04 2026

01/04 2026

![]() 365

365

Extending the Boundaries of Crossover Capabilities

Written by/ Chen Dengxin

Edited by/ Li Ji

Layout by/ Annalee

The energy storage track has welcomed new players.

Not long ago, Ford announced a $2 billion investment to retrofit existing factories for the production of battery energy storage system modules and 20-foot DC containerized energy storage systems.

This signifies another automaker venturing into energy storage.

Currently, both overseas and domestic automakers are increasingly setting their sights on energy storage, attempting to leverage their proximity advantages to establish a 'second curve.'

So, what are the odds of success for automakers venturing into energy storage?

Chinese and Foreign Automakers Enter the Same River

Ford, a century-old automaker, once viewed new energy vehicles as a key strategic pivot.

Ford CEO Jim Farley boldly stated, 'As our massive investments in electric vehicle and battery manufacturing begin to pay off, we are rapidly expanding our electric vehicle lineup with the goal of becoming the world's largest electric vehicle manufacturer.'

Lofty ideals, harsh realities.

According to Cox Automotive, the inventory cycle for new energy vehicles in the U.S. has reached 136 days, significantly higher than the 78 days for the overall automotive market.

It is evident that new energy vehicles face the risk of slow sales across the ocean for various reasons.

Against this backdrop, some traditional automakers have been forced to abandon or slow down their previously aggressive strategic transformation plans, reverting to more conservative approaches to ensure survival.

Ford is just one example.

Overseas media reported that Ford terminated multiple pure electric vehicle projects, including the all-electric F-150 Lightning pickup, the next-generation electric truck codenamed T3, and electric commercial vans, resulting in a $19.5 billion write-down.

Ford Chooses to Cut Losses

Correspondingly, automakers are actively embracing the energy storage track to open up a 'second battlefield' in new energy.

In fact, Ford is not the only automaker viewing energy storage as the next strategic high ground. Renowned automakers such as BMW, Mercedes-Benz, Nissan, Tesla, and Volvo have also entered the fray.

For instance, Tesla was an early entrant into the energy storage sector and has become a formidable force. In the third quarter of 2025, Tesla's energy storage shipments reached 12.5 GWh, up 81% year-on-year; energy storage revenue was $3.415 billion, up 44% year-on-year, marking the 13th consecutive quarter of sequential growth. Tesla's energy storage gross margin was 31.4%, significantly higher than the 15.4% for new energy vehicles.

This success is closely tied to the launch of Tesla's Shanghai Energy Storage Superfactory.

Tesla Senior Vice President Xiao Tong Zhu said, 'This factory not only represents another important move in Tesla's global energy storage layout but also proves its key role in the global energy transition.'

Source: Tesla's official Weibo account

Another example is BMW, which has been exploring the secondary use of retired power batteries. At its Leipzig plant in Germany, BMW repurposed 2,600 retired BMW i3 batteries into a 700 kWh energy storage system to balance grid loads and optimize factory electricity usage.

Additionally, Chinese companies are also participating.

BYD, a versatile player, offers products covering industrial, commercial, residential, and grid applications, rivaling Tesla. Its new-generation energy storage product, 'Haohan,' features the world's largest 2,710 Ah energy storage-specific blade battery, showcasing notable technological barriers.

NIO, an innovative player, combines energy storage with new energy vehicle battery recharging. Its battery swap stations use vehicle-to-grid (V2G) technology to charge during off-peak grid hours and discharge during peak hours, reducing operational costs.

Industry Shakeout May Be Inevitable

There are three main reasons behind automakers' collective interest in energy storage.

First, market demand.

With the rapid development of clean energy sources like photovoltaic and wind power, the grid faces increasing challenges. The grid prioritizes reliability and stability, which are weaknesses of photovoltaic and wind power, often labeled as 'junk electricity.' Energy storage can address issues such as intermittent generation, high volatility, and mismatched generation.

In short, energy storage is not an option but a necessity.

Energy storage is also a favored topic in capital markets.

Zou Ji, CEO and China President of the Energy Foundation, said, 'When the proportion of fluctuating power sources in the grid exceeds 20%, the pressure on the grid cannot be resolved by simply building more transmission lines. The pressure is physical. Traditional grid stability mechanisms relying on rotational inertia are ineffective for fluctuating sources like wind and solar. New grid stability measures must be adopted to offset the issues caused by fluctuating power sources.'

Through peak shaving and frequency regulation, the economic viability and safety of photovoltaic and wind power are enhanced, while grid reliability and stability are ensured, achieving a win-win situation.

Second, tapping into a blue ocean.

According to the Global Energy Storage and Grid Commitment, global energy storage capacity is set to reach 1,500 GW by 2030, a sixfold increase from 2022.

This indicates that energy storage is a high-growth, high-certainty sector.

More critically, it is widely acknowledged in the industry that 'the end of AI is computing power, and the end of computing power is electricity.' Pairing energy storage with data centers not only reduces energy consumption during computing tasks but also enables green AI.

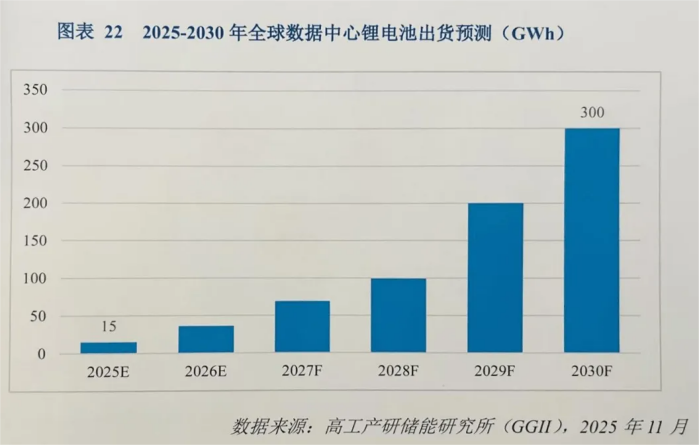

The 2025 Blue Book on China's AIDC Energy Storage Industry Development shows that the global data center energy storage market is experiencing explosive growth. By 2030, data center energy storage lithium battery shipments are expected to exceed 300 GWh, a 20-fold increase from 2025.

Chu Pan, an expert member of the Energy Storage Application Branch of the China Industrial Association of Power Sources, said, 'AI data centers have stable power consumption and high utilization hours (generally over 6,000 hours). If the comprehensive power supply cost of 'new energy + energy storage' is lower than traditional methods, large-scale energy storage deployment in AI data centers will become a trend.'

Third, technological alignment.

The energy storage and power battery sectors share similar technologies, manufacturing processes, software systems, and safety standards. Automakers with in-depth knowledge in these areas have a natural advantage.

Looking back, domestic and foreign automakers like Tesla and BYD have invested in power batteries to control the new energy vehicle supply chain, accumulating rich experience. Venturing into energy storage simply extends their capabilities. From a long-term perspective, they aim to master both energy storage and power batteries.

In short, automakers' foray into energy storage is not impulsive but aims to Improve ecological layout (improve ecological layout) and gain greater momentum.

Nevertheless, beneath the surface prosperity of energy storage, challenges lurk. Rising upstream raw material costs inevitably pressure downstream sectors, driving up energy storage costs. However, with an increasing number of players entering the market, competition intensifies, making it difficult to pass on cost increases. The industry may face a dilemma.

An industry insider told Xinkedu, 'Different countries have varying cultures, rules, grid connection standards, and consumer habits. Automakers venturing into energy storage must offer personalized, customized, and localized products to secure a foothold.'

The insider further noted that energy storage expansion overseas is a trend. Establishing stable overseas distribution partnerships, understanding overseas user profiles, coordinating communication, and deeply binding overseas channels test automakers' global capabilities.

Additionally, with adjustments to peak-valley price difference mechanisms in some regions and increasing marketization of the energy storage market, profit expectations continue to decline. The year 2026 may not be as easy.

As a result, competing on technology, branding, and differentiation becomes imperative, and an industry shakeout may be inevitable.

In conclusion, energy storage is an emerging blue ocean market that has withstood the transition from mandatory deployment to market-driven growth. Future growth is certain, making it reasonable for automakers to view energy storage as the next 'gold mine.'

As for how much of the pie automakers can ultimately secure, time will tell.