Xiaomi Auto Closes with 410,000 Deliveries + First Profit! Lei Jun Sets 550,000 Target, Four New Models to Target Extended-Range EV Market

![]() 01/05 2026

01/05 2026

![]() 568

568

Lei Jun's Candidness and Ambition.

Lei Jun’s 'Authenticity' Is More Than Just a Label.

During last night’s New Year livestream, Lei Jun didn’t make the all-around reveal of the Xiaomi YU7 the sole focus. Instead, he proactively addressed controversial topics that had sparked widespread online debate, such as 'fine-print marketing,' '1,300 km range on a single charge,' and 'closed comment section.' Facing malicious rumors, he responded fiercely without holding back; when discussing 'fine-print marketing,' he didn’t offer excuses but simply stated, 'This is a flaw we must correct,' clearly demonstrating his candor.

Image Source: Weibo @Lei Jun

Looking back at 2025, Xiaomi Auto pressed forward amid persistent market skepticism. As Lei Jun put it, 'The overwhelming public sentiment left us a bit stunned,' but fortunately, this pressure did not become a stumbling block—instead, the company delivered a bumper harvest in performance.

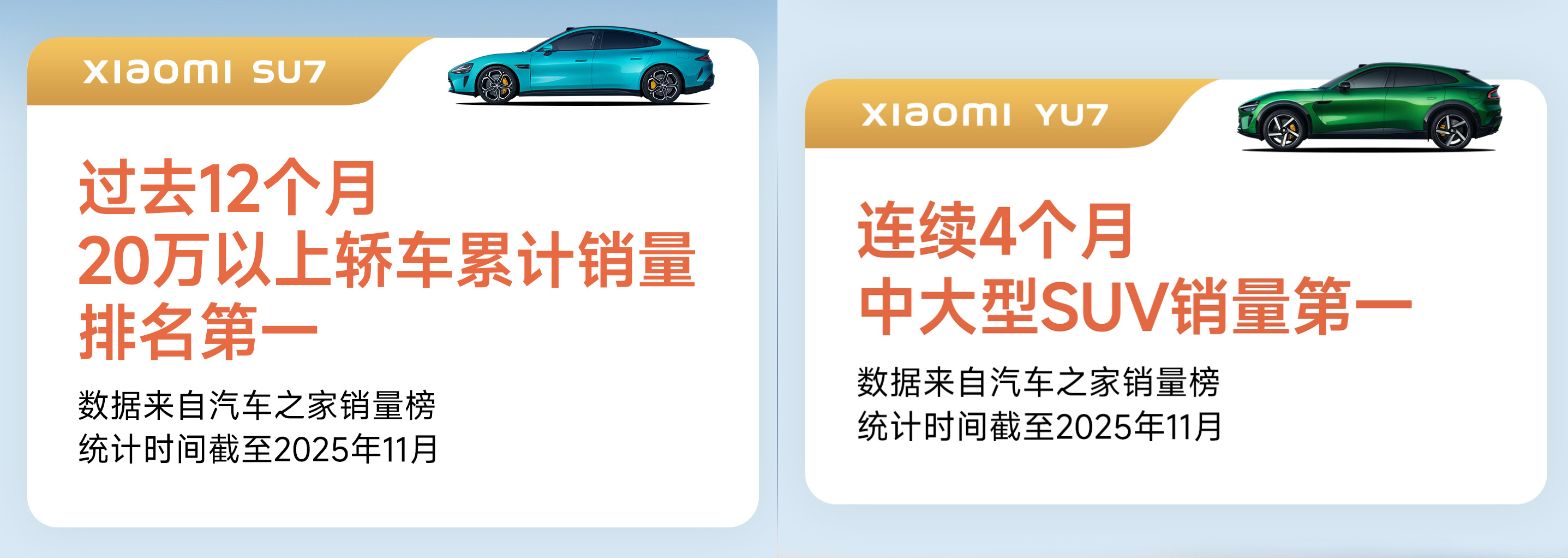

From setting an initial delivery target of 300,000 units at the start of the year to raising it to 350,000 units mid-year due to better-than-expected market performance, Xiaomi Auto ultimately closed the year with 410,000 actual deliveries, exceeding expectations. The performance of its core models was equally impressive: the Xiaomi SU7 ranked first in cumulative sales among sedans priced over RMB 200,000 in the past 12 months (as of November 2025); the Xiaomi YU7, launched just six months ago, surpassed 150,000 deliveries, becoming a key driver of sales growth; and the Xiaomi SU7 Ultra achieved its goal of 10,000 deliveries in less than six months after launch.

Even more milestone-worthy, Xiaomi’s Q3 earnings report clearly showed that its smart electric vehicle and AI innovation businesses achieved single-quarter profitability for the first time.

Image Source: Weibo @Xiaomi Auto

With this impressive double harvest of sales and profitability, Lei Jun used the occasion of the New Year livestream to firmly set his sights on the year ahead.

Technology and AI as 'Dual Drivers': Selling 140,000 More Units This Year!

During the livestream, Lei Jun explicitly announced, 'Over the next five years, we will invest at least RMB 200 billion in R&D,' averaging RMB 40 billion per year.

This massive investment will primarily focus on two areas: one is solidly deepening core technologies, such as batteries, electric drives, and intelligent driving—key areas that directly impact a vehicle’s hard power; the other is developing generative AI large models.

The former needs little explanation—it is the foundation for automakers, directly relating to product performance and market competitiveness. The latter, however, is crucial for upgrading a product’s intelligent experience—with generative AI large models, vehicle interactions become more intuitive and personalized, learning capabilities are enhanced, and the overall intelligentization (smart) experience takes a significant leap forward.

Lei Jun put it plainly: 'Xiaomi will insist on using AI technologies and methodologies to 'completely redo' all internal businesses, achieving full AI empowerment and adhering to the creation of an ultimate 'human-vehicle-home full ecosystem' experience.'

Image Source: Xiaomi Auto Official

The development of the industry over the past few years has fully proven that whether it’s intelligent driving or smart cockpits, both rely on the computational power and learning capabilities of AI large models. Today, in the automotive sector, AI is increasingly regarded as a core weapon by automakers, permeating every key link from R&D and design to manufacturing and end-user experience.

Take Geely, for example—as one of the most AI-enthusiastic automakers, it released the industry’s first 'Intelligent Vehicle Full-Domain AI' technology system, integrating AI throughout the entire automotive R&D, production, and usage chain: the GEA architecture, 3.0 electronic and electrical architecture, and automotive-grade chips all incorporate AI technologies. It also developed an AI digital chassis, enabling better coordination between chassis control, intelligent driving, and power systems. The AI simulation testing system introduced during the R&D phase can simulate thousands of extreme scenarios in areas like chassis tuning and collision safety, directly reducing testing cycles by over 40%.

Similarly, Zhang Xinghai, Chairman of Seres Group, put it bluntly: 'AI is not an optional choice but a mandatory one!' The 'Seres Industrial Brain,' driven by AI, not only improved R&D efficiency by 20% but also increased on-time order delivery rates by 13%.

AI empowerment throughout the entire automotive manufacturing process has completely overturned the inefficient traditional model, making AI a must-have for automakers to reduce costs, increase efficiency, and build core competitiveness. This is undoubtedly one of the key reasons Lei Jun is willing to bet big.

Competition in the global automotive market is no longer about power performance or space configuration—it’s about intelligent experience, and AI is the core battleground. More critically, AI technologies are reshaping the entire automotive industry ecosystem: from upstream AI chips and sensors to midstream vehicle design and manufacturing, and downstream intelligent mobility services, a new AI-centric industrial chain has taken shape.

Under this major trend of industry transformation, Xiaomi Auto’s RMB 200 billion R&D investment over the next five years is not only a precise recognition of AI’s strategic value but also an inevitable choice aligned with the tide of industrial upgrading.

When mentioning the 2026 delivery target, Lei Jun set an ambitious goal of 550,000 units—compared to the 410,000 units delivered in 2025, this requires an additional 140,000 units.

However, achieving this 140,000-unit increase requires more than just technological confidence—it demands technological implementation, with core support coming from the four heavyweight new models set to launch this year.

Image Source: Weibo @Lei Jun

Four New Models to Launch! Xiaomi Set to Enter Extended-Range EV Segment

According to 36Kr Auto, Xiaomi Auto plans to launch four new models this year, including a new Xiaomi SU7, a Xiaomi SU7 Executive Edition, and an extended-range five-seat SUV and seven-seat SUV.

The arrival of the new Xiaomi SU7 is not surprising. Previously, Dianche Tong (Electric Vehicle News) verified with Xiaomi Auto sales staff that the new model is likely to be unveiled in March or April this year, aligning with Xiaomi’s traditional spring product launch schedule.

Image Source: Dianche Tong

In contrast, the other three new models offer even more intrigue.

The Xiaomi SU7 Executive Edition has already been spotted in spy photos. Compared to the current Xiaomi SU7, the most significant change is an extended wheelbase. To match its 'Executive Edition' status, rear passenger space will be further enhanced, likely featuring premium configurations such as zero-gravity seats and rear entertainment screens. Additionally, the larger size will probably accommodate a higher-capacity battery pack, boosting range capabilities.

Xiaomi’s extended-range SUVs are hardly a secret in the industry. However, what surprised Dianche Tong was that Xiaomi plans to launch two all-new extended-range SUVs this year.

Among them, spy photos of the seven-seat extended-range SUV test vehicle have already surfaced. This model is substantial, with a length expected to exceed 5.2 meters, likely competing with large SUVs such as the AITO M9 and Li Auto L9—potentially becoming Xiaomi Auto’s flagship SUV.

Image Source: Weibo

As for the five-seat extended-range SUV, while there isn’t much concrete information yet, it can be inferred that its positioning will be slightly lower than the seven-seat version, similar to the AITO M8 and Tengshi N8L. Its core competitiveness will likely focus on 'cost-effectiveness' and 'practicality,' targeting practical-minded family users.

Currently, the market enthusiasm for large SUVs continues to rise. Xiaomi’s decision to launch two extended-range SUVs at once clearly targets the premium family market, aiming to establish a strong foothold in this highly competitive segment.

The success of models like the Li Auto L Series and AITO M Series has already revealed the core demands of this niche market: users want more than just 'a vehicle to drive'—they seek 'a mobile space convenient for the entire family.'

Large SUVs are now engaged in an intense 'experience war': the five-seat version of the AITO M9 offers custom storage boxes, limiters, and other configurations precisely tailored for outdoor activities. The new NIO ES8 transforms its trunk into a 'mobile wardrobe,' with attention to detail at every corner.

However, this approach of 'digging deep into users’ daily needs' is precisely where Xiaomi excels.

Image Source: Li Auto Official

While the Xiaomi SU7 and Xiaomi YU7 focus on sportiness and performance, let’s not forget that Xiaomi boasts a vast ecosystem and mature supply chain. Daily essentials like phone mounts, car sunshades, custom headrests, and flashlight storage boxes can easily be integrated into new models. Moreover, leveraging its 'human-vehicle-home full ecosystem' advantage, Xiaomi can seamlessly connect in-car experiences with smart home devices—a capability few competitors can match.

Dianche Tong even believes that the market enthusiasm for Xiaomi’s two extended-range SUVs may surpass that of the performance-focused Xiaomi SU7 and Xiaomi YU7.

The 140,000-unit target increase also reflects Xiaomi Auto’s confidence not only in the upcoming 'experience war' but also in its production capacity. After all, achieving such a significant increase requires both strong product appeal and delivery capabilities.

Image Source: Dianche Tong

Currently, after merging its Phase 1 and Phase 2 factories, Xiaomi Auto’s base annual production capacity has reached 300,000 units. If dual-shift production is implemented, actual annual capacity could likely reach 450,000 units, fully meeting current market delivery demands. More critically, in June 2025, Xiaomi Auto secured land for a third factory, expected to commence production this year, further boosting total capacity.

With ample production capacity as a safety net, Xiaomi’s product offensive is poised to make a significant impact on the industry. Especially for new energy brands like Li Auto, AITO, and Leading Ideal, which rely heavily on large SUVs for sales, they are likely to face direct and intense competition. After all, Xiaomi excels at leveraging its ecosystem advantages, cost-effectiveness, and precise understanding of user needs to compete in the fiercely contested premium family market.

The large SUV market is destined for a major reshuffle.

Blessings in Disguise

2025 was a year of both harvest and controversy for Xiaomi Auto.

'Blessings in disguise'—just as Lei Jun demonstrated his candor during the livestream, both the eye-catching (impressive) achievements of exceeding delivery targets and achieving first-time profitability, as well as controversies like 'fine-print marketing' and 'closed comment sections,' have become nutrients for this automaker’s rapid growth.

More critically, the RMB 200 billion R&D investment over the next five years, coupled with the imminent launch of a full lineup of products this year, indicates that this automaker is not merely pursuing short-term sales but is also preparing for long-term development.

However, it’s worth noting that NIO and XPeng have already established a solid presence in overseas markets and achieved substantive progress. After partnering with Stellantis Group, Leapmotor’s overseas expansion has gained significant momentum, and Li Auto recently announced its entry into international markets.

Lu Weibing, President of Xiaomi Group, previously revealed that Xiaomi Auto plans to enter overseas markets in 2027. This means that the 140,000-unit increase target for this year can only be achieved by deepening its presence in the domestic market and achieving breakthroughs domestically.

In terms of global expansion, Xiaomi has already fallen behind. This year’s decisive battle leaves Xiaomi Auto with no retreat—it must go all in.

This battle will not only determine whether Xiaomi Auto can establish a strong foothold in the domestic red ocean but will also lay the groundwork in product strength and brand reputation for next year’s overseas expedition, setting a critical foundation for its future global success or failure.

(Cover Image Source: Weibo @Lei Jun)

Xiaomi Year-End Review: New Energy New Forces

Source: Leitech

Images in this article are from 123RF Licensed Image Library