Disruption Rocks New Energy Vehicle Market! 'Mi Xiaoling' Takes the Lead in 2025, Li Auto Falters, AITO Hits a Slowdown

![]() 01/05 2026

01/05 2026

![]() 447

447

Written by | Guanchejun

A single sales growth ranking chart can narrate half the tale of the industry's ebb and flow.

The battle in the 2025 new energy vehicle (NEV) market unfolds like an unscripted suspense thriller. As the once-ubiquitous policy incentives gradually wane and the growth in penetration rates decelerates, the market swiftly transitions from a vast 'blue ocean' brimming with opportunities to a cutthroat 'red ocean' where existing market shares are fiercely contested.

In this red ocean, the struggle for dominance rages on.

After compiling the 2025 sales changes of prominent NEV brands, Guanchejun observed that the industry landscape has undergone a remarkable transformation at a breakneck pace.

As depicted below, despite encountering controversies along the way, Xiaomi Auto emerged as the top performer in terms of growth rate for 2025, boasting a staggering 199.59% increase and surpassing 410,000 units in annual sales. XPeng followed closely with a 131.2% growth, while Leapmotor achieved a 103.1% surge.

Meanwhile, Li Auto, once hailed as a benchmark among the new forces, witnessed an 18.81% year-on-year decline in sales, marking it as a rare negative grower on the list.

From Guanchejun's perspective, the common thread among 'Mi Xiaoling' lies in their impressive growth rates, yet their paths diverge significantly, embodying three distinct survival strategies.

Xiaomi Auto's ascent is essentially a testament to the success of the 'internet hit model' within the automotive sector. Transitioning from smartphones to ecosystems and now to automobiles, Xiaomi has flawlessly replicated its strategy of offering 'high-end configurations at affordable prices + leveraging fan economy + employing viral marketing.' However, as previously noted, Xiaomi Auto has faced persistent controversies, some of which have been perceived as 'fatal flaws.'

Guanchejun posits that 2026 will be a pivotal year for Xiaomi Auto. Whether it can continue to innovate amidst controversies, ascend, and solidify its reputation will largely dictate its ability to secure a foothold in the fiercely competitive rankings in the future.

XPeng, on the other hand, is a 'technology enthusiast.' In the high-stakes race for intelligent driving, XPeng has opted for the most challenging and resource-intensive path. In 2025, it rolled out urban Navigation Guided Pilot (NGP) across hundreds of cities, essentially betting on a future where intelligent driving becomes a pivotal factor in car purchases, and today's investments will serve as tomorrow's competitive barriers.

In 2025, XPeng brought 'high-end intelligent driving' to the 150,000-yuan price bracket for the first time, utilizing the MONA hit model to penetrate the market and then capitalizing on technological cost reductions and channel expansion to widen the gap. Its growth is a testament to the market's growing recognition of its technological prowess.

However, XPeng still grapples with profitability issues. Excluding revenue from technological cooperation with Volkswagen Group, its primary car-making business remains under substantial profitability pressure.

Leapmotor is the 'cost assassin.' While the industry collectively aims for higher-end markets, Leapmotor has remained steadfast in the mainstream 100,000-200,000-yuan segment, prioritizing cost-effectiveness. Its in-house research and development capabilities have enabled it to maintain profitability amidst price wars.

However, this approach is a double-edged sword. Leapmotor's high growth has been achieved through extreme cost control and a high-volume, low-margin model, but this profit model harbors vulnerabilities, potentially leading to financial burdens and a brand ceiling that is difficult to surpass.

Nevertheless, both Leapmotor and XPeng have showcased remarkable resilience by turning the tide in their respective ways.

Now, let's turn our attention to Li Auto. In Guanchejun's view, Li Auto's core dilemma stems from the fading of its 'leading advantage in product definition.' Early on, the Li ONE precisely captured the unmet needs of family users for range, space, and configuration, creating the 'dad car' category.

However, as other players have adopted this methodology, Li Auto's first-mover advantage has become a competitive benchmark. Its sluggish transition to pure electric vehicles has left it struggling to balance dual fronts.

Also noteworthy is AITO, the collaborative brand between Seres and Huawei. In 2024, AITO rose to prominence with Huawei's technological and brand support, significantly boosting Seres' market value.

However, in 2025, AITO's sales growth has significantly decelerated. Its single-digit growth pales in comparison to the 268% surge in 2024. It's evident that in a fiercely competitive market, a single technological or brand enhancement is no longer sufficient to sustain sales growth.

Now, Huawei's roster of partners is expanding, from AITO to Luxeed, Enjoya, Majesty, and Shangjie... Seres' exclusive benefits are gradually being diluted.

Next, Seres needs to rapidly enhance its intrinsic capabilities in research and development, supply chain management, and user operations.

Also deserving of mention is BYD. Amidst the rapid rise and occasional stumbles of new forces, BYD has demonstrated another form of strength: 'certainty' built through scale and vertical integration.

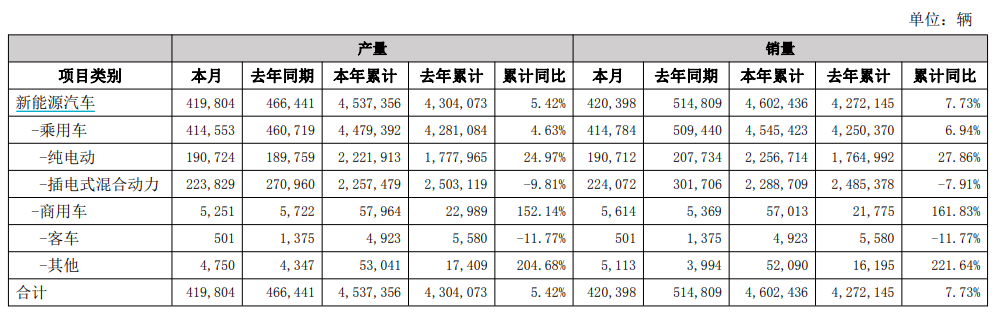

With 4.545 million units in annual sales and a 6.94% growth, this stability in a volatile market is itself a strategic asset. In Guanchejun's view, BYD's competitive edge lies not in a single breakthrough technology but in its autonomous control over the entire industrial chain, from batteries, motors, and electronic control to semiconductors. This enables it to withstand supply chain fluctuations and exert absolute control over cost management.

Therefore, BYD's real concerns do not stem from external competition but from within: after becoming a 'market incumbent,' how to find a new equilibrium amidst multiple contradictions, such as scale vs. efficiency, premiumization vs. mass-market appeal, and technological leadership vs. market saturation.

The charts in this article, unless otherwise specified, are sourced from publicly disclosed information from various channels. We hereby acknowledge and express our gratitude! The views expressed in this article are for reference only and do not constitute investment advice.