Uncontrolled public opinion, Aion cannot stop

![]() 06/18 2024

06/18 2024

![]() 901

901

Introduction

Introduction

The market is experiencing pain, and Aion can only digest it itself.

Author: Cao Jiadong

Responsible Editor: Du Yuxin

Editor: He Zenrong

The popularity of the new energy vehicle market has become a topic that none of us can avoid. In 2024, coupled with the price war and the controversy war, the turmoil in the Chinese automobile market has reached a new peak.

During this period, we saw the once invincible Ideal falling into reflection due to the poor performance after the MEGA launch, saw Lei Jun teaching everyone a lesson with his Xiaomi SU7, playing with traffic clearly, and once again feeling the confusion and helplessness of joint ventures after being attacked by the group.

The market has become like this, which is indeed something we never expected. Perhaps it is the tragic status quo caused by Chinese-style internal competition, but for many Chinese companies not in the spotlight of public opinion, the anxiety generated during this period is enough to overshadow any previous moment.

The emergence of a series of new issues such as where product planning goes, how to innovate marketing techniques, and more, have increasingly made insiders uneasy when facing fierce market competition.

In the past month, from being passively caught up in the vortex of public opinion to publicly releasing a decisive attitude towards rumor mongers, GAC Aion has undergone the most rigorous external scrutiny.

"Faced with intense external competition, will Aion continue to increase the weight of B-end business?"

"Seeing the slowdown in the growth rate of the pure electric vehicle market, how should Aion continue to increase sales?"

"What are the next market targets for Aion and Hyper's dual-brand operation? Where are the expectations?"

"China's auto export strategy is becoming clearer and clearer. To what extent has Aion's global layout relying on the Southeast Asian market progressed?"

...

Too many people are asking this or that question to this new force company that sold the most pure electric vehicles last year, but in the end, if we look at the experience accumulated by Aion over the past few years, what we need to do more is to rationally look at the path this company will take next, rather than relying solely on sales trends as the sole criterion for judging it.

The drastic change in the overall environment can only be silently endured

Yes, this year's market is very different. Relying on the background of electric transformation, when the penetration rate of the new energy vehicle market exceeds 50%, companies that insist on making pure electric vehicles are not doing so well. As consumers rapidly tilt towards plug-in hybrid vehicles and extended-range vehicles, a large number of automakers have entered this segment market, which will greatly impact the interests of the former.

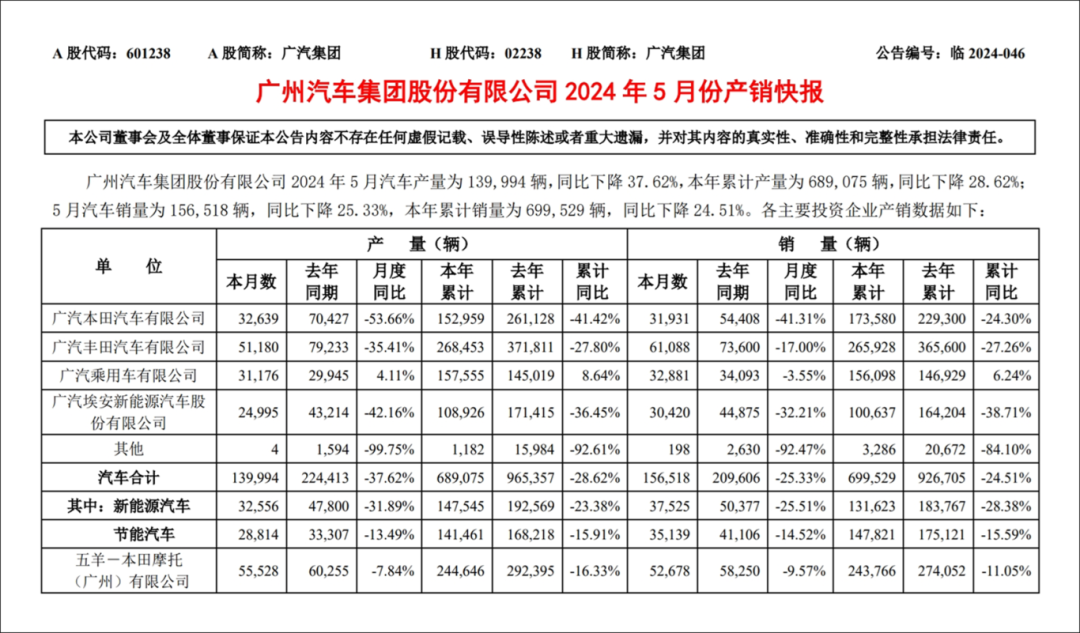

From Aion to NIO, Tesla, I believe they can undoubtedly feel this change. From January to May, compared with the same period last year, just the sales gap of Aion is clearly placed in front of us through GAC Group's monthly report.

During this period, how cruel the price war was, I don't need to say much. Aion, which focuses on silently making a fortune, needs several months to adapt to such market changes. I imagine that the industry pain generated during this period is almost unprecedented.

Perhaps, in the past few years of rapid market expansion, the ecosystem relied on by Aion indeed has a strong B-end lineage, which is also the main reason why it is often labeled as a "professional online car-hailing service".

Initially, Aion internally rejected the outside world's tendency to associate itself with online car-hailing services. On a larger scale, this move will create some obstacles for brand image building. On a smaller scale, it may not be conducive to the spread of Aion within the C-end user circle.

But to be honest, just like the feedback given by many real users, Aion has a set of tricks in product definition to grasp a large number of B-end orders in this segment market. Otherwise, the earliest company occupying this market in the north could not have experienced a sales roller coaster in two years, with quality issues leading to a collapse in reputation, and has not been able to pull its new energy business out of the sales quagmire so far.

Furthermore, as the market gradually becomes magical, in the face of survival, as the earliest national team new force and a Guangdong company with strong geographical characteristics, Aion has never wanted full-screen future visions and empty fantasies. In my opinion, the desire for sales will certainly not allow it to give up investment in the B-end market.

And when time enters 2024, regardless of how the outside world equates Aion with online car-hailing, seeing the growth rate of the entire pure electric vehicle market begin to slow down, and a large number of plug-in hybrid models emerging in the 100,000-200,000 yuan new energy vehicle market, I think Aion has even less reason to screen the market.

It is said that new force brands with national titles are difficult to succeed. Arcfox, AVATR, ZM-Auto, and Voyah have not been able to complete their original accumulation within their own spheres of influence, which is the best evidence.

Against this background, if we look back at Aion's development in recent years, although there are deficiencies, overall, the steady establishment of the sales base has strong benefits for the subsequent development of Aion and the entire GAC Group.

As everyone knows, due to the status occupied by Japanese joint ventures within the group and Chairman Zeng Qinghong's comments on the current state of the industry, GAC has been placed at the forefront of public opinion in recent days.

Too many people only see the impact of changes in consumer trends on GAC's sales. To put it bluntly, the situation of GAC Toyota and GAC Honda inherently determines the development of the group. Right now, when a large number of consumers switch to Chinese brands, everything GAC does is seen as a very means that goes against the development of the overall environment. And Aion, which is within the group, if it fails to maintain its original trajectory under this posture, it will naturally fall into people's mouths.

"How did the overall environment of the Chinese auto market become like this?"

I know that by now, such similar complaints are no longer strange. For OEMs, especially new energy automakers, they could rely on the chaos of transformation to make a breakthrough many years ago, and ride on policy advantages to be ahead of the pack. But when everything returns to order, they should understand that if they want to win this battle, they must only turn around and ask themselves. Aion, of course, is no exception.

Nothing is more important than survival

Previously, due to the impact of the decline in the auto market, there were indeed rumors that Aion would face a wave of layoffs and terminations of contracts with a large number of fresh graduates.

However, things turned around quickly. On June 13, Gu Huinan, General Manager of GAC Aion, responded to the recent "layoff and contract termination controversy," "The outside world says we are going to lay off 20%, but we only have 7,000 people in total. Are we going to lay off 1,400 people? In the second half of the year, our factories in Changsha, Thailand, Indonesia, etc. will go into production, and we will build 100 direct-sales stores, adding more than 2,000 job openings."

In a nutshell, Aion is still in an expansion phase and is unlikely to conduct layoffs.

In other words, if you ask if Aion will, as rumored by the outside world, experience development slowdown and have its sales surpassed by latercomers, I think the answer is still no.

At this stage, the changes in the Chinese auto market will largely influence the planning of various automakers, which is not something that cannot be understood. For every brand in the Chinese auto market, which is evolving so dramatically, it is not easy to rise to the challenge. Whether it's Aion or other new energy companies, how to add more insurance to their own development is nothing more than the latest requirements given by the external environment.

With the significant public opinion offensive today, no company can escape attacks. While giving responses, what Aion and others can do is to find ways to let the outside world see their determination and capabilities.

Since April, Aion has brought its latest model, the second-generation AION V, to various auto shows around the country and actively launched the refreshed version of Hyper's existing models to the market quickly. On the other hand, relying on existing market trends, from re-selecting technical paths to new thinking on marketing changes, and even actively following up on overseas operations, Aion has not deviated from the general direction of industry development.

Returning to the original question, when Aion no longer avoids emphasizing its importance to the B-end market, and even the company internally does not care about the fact that "the weekly new energy sales chart never includes Aion," but chooses to face its real problems head-on, as a bystander, it is reasonable to give it a chance to voice its opinions at this time.

In fact, as the most important business segment of the group in the future, Aion undertakes the mission of how the entire company transforms. In special times, there is nothing more important than survival.

In the first half of this year, neither Hyper nor Aion brands have launched any new models. In addition, Aion has not yet placed significant emphasis on PHEV in terms of overall technical paths. These are all reasons for Aion's temporary difficulties. But under the jungle law, Aion has also said that as long as the market needs it, it is completely possible to launch new plug-in hybrid and extended-range models, and plans to launch them next year.

Without doubt, under the premise of achieving nearly 500,000 annual sales last year, Aion's 2024 will undoubtedly be a very tricky year.

Reviewing the gains and losses of dual-brand operations, taking over the assets left by GAC Mitsubishi, and strengthening investment in product planning, it will take some time for Aion to digest. Not to mention the high demands placed on Aion internally to complete overseas expansion in such a complex overseas trade environment.

How much everyone in the industry dislikes "convolution" is believed to be something that anyone can give a very specific answer. But unfortunately, the world cannot do without this main theme. Once someone takes the lead in raising a knife against a "competitor," the only scene we can see is this kind of intense competition.

In fact, with the industry transformation so far, whether the electrification is pure or not is no longer important. Everything has returned to the origin of automotive market competition, which is to seize the market. In May, monthly sales returned to 40,000 units, giving Aion confidence, but it will certainly also attract more concrete "attention" from the market. Next, it will be another tough battle. No matter how much is said, Aion's current plan can only be quickly implemented. Otherwise, the pain in the industry will not improve at all.