BYD, Geely, Xiaomi, Great Wall, SAIC, Didi, and More: Chinese Auto Companies Collectively Join NVIDIA's "Autonomous Driving Circle of Friends," Forming a Win-Win "Computing Power Alliance"

![]() 01/09 2026

01/09 2026

![]() 416

416

Introduction

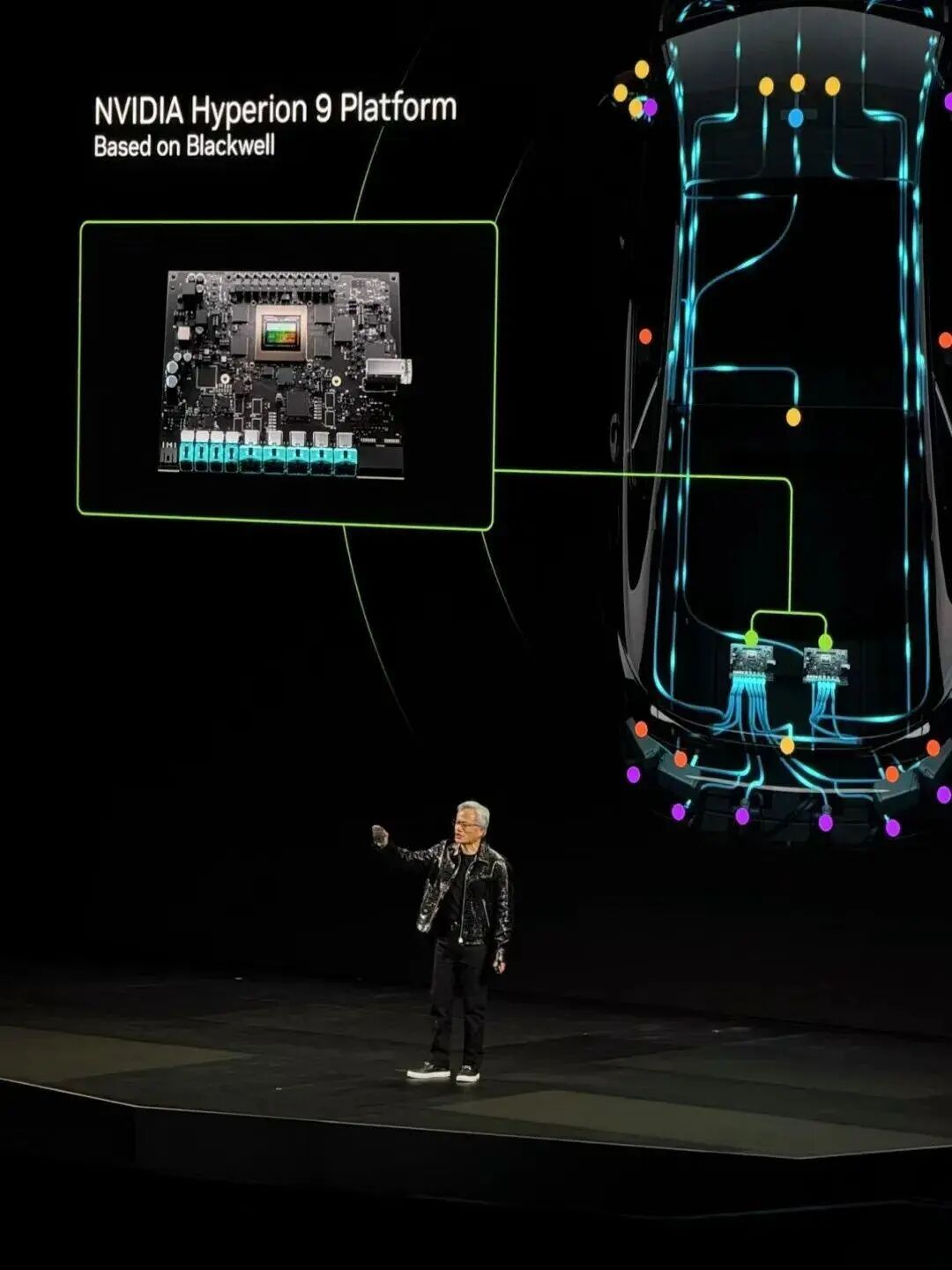

On the eve of CES 2026, Jensen Huang, CEO of NVIDIA, shifted the spotlight to Chinese automakers by unveiling a "family portrait" of the "autonomous driving circle of friends." This lineup included BYD, Geely, Xiaomi, Great Wall, SAIC, and Didi—six prominent Chinese names that simultaneously appeared on the L4-level autonomous driving ecosystem poster, representing over 40% of the global participants. This move is not merely a gesture of support; it signifies a profound integration based on NVIDIA's Drive Thor 600 TOPS computing power chip, CUDA software stack, and Omniverse simulation platform. Essentially, Chinese original equipment manufacturers (OEMs) are, for the first time, embedding themselves deeply into the foundational layer of NVIDIA's ecosystem at a "vehicle-level" stance, transitioning from merely "purchasing chips" to "co-developing operating systems."

When Jensen Huang shared the stage at CES 2026 with representatives from BYD, Xiaomi, Geely, and other companies, it marked a significant milestone: China's autonomous driving industry is entering a "new normal" characterized by increased openness, cooperation, and competition.

(For reference, please click: "NVIDIA Announces Multiple Advances in Autonomous Driving, Releases Automotive Platform Alpamayo! Jensen Huang Envisions: A Billion Cars Driving on Future Roads Will Be Driverless")

I. Ecological Integration: Computing Power as the "New Definition" of Smart Cars

NVIDIA's "circle of friends" underscores a clear industrial trend:

In the pursuit of high-level autonomous driving, high-performance, open centralized computing platforms are replacing traditional distributed electronic control units (ECUs) as the "technical foundation" and "soul" of smart cars.

NVIDIA's DRIVE platform offers more than just chip hardware; it provides a comprehensive "turnkey" solution that includes development toolchains, simulation systems, pre-trained models, and middleware.

Chinese automakers, particularly newcomers eager to establish a competitive edge in intelligence (such as Xiaomi) and traditional giants accelerating their digital transformation (such as Geely and BYD), are opting to join this ecosystem as a shortcut to "standing on the shoulders of giants."

This approach significantly shortens the cycle from algorithm development to mass production, allowing companies to concentrate their limited resources on their core strengths in vehicle integration, user experience design, and localized scenario optimization.

This "ecological integration" based on a global technology stack is an inevitable outcome of a deeper industrial division of labor. It also implies that the value distribution within the smart car industrial chain is being reshaped, with computing power and ecosystem providers gaining unprecedented influence.

II. A New Landscape of Competition and Cooperation: China's "Dual Approach" and Strategic Autonomy Considerations

The collective presence of Chinese players does not imply a uniform technological path.

Instead, it highlights China's current strategy of "walking on two legs."

One path is the "open integration" route, centered around international ecosystems like NVIDIA and Qualcomm, which aims to rapidly integrate global top-tier technologies to seize market opportunities.

The other is the "autonomous and controllable" route, represented by Huawei and Horizon Robotics, which promotes domestic computing platforms and full-stack solutions. An example is the applications behind Chang'an Deepal's L3-level autonomous driving, which are supported by domestic chips and algorithms.

This "dual approach" is a pragmatic strategic choice.

Joining global mainstream ecosystems ensures that Chinese products remain competitive in terms of technical specifications on a global scale and facilitates integration into international standard systems for future overseas expansion.

Meanwhile, insisting on independent research and development (R&D) is crucial for mitigating potential technological risks, meeting security requirements in specific fields, and nurturing local supply chains.

The choices made by Xiaomi and Geely present an interesting contrast to NIO's commitment to self-developed chips and XPeng's deep dive into full-stack algorithms. Together, they form a rich and multi-layered technological landscape in China.

Future winners are likely to be enterprises that can strike the optimal balance between "global ecological cooperation" and "autonomous core capabilities," rather than those adhering to a single path.

III. Ascending Challenges: The Leap from "Ecosystem Participants" to "Value Contributors"

Joining a top-tier "circle of friends" is merely the first step. The next challenge for Chinese automakers is to evolve from "members" to "partners."

This necessitates a fundamental transformation in their roles:

1. Data Feedback and Scenario Definition:

China's complex urban scenarios, such as Chongqing's 8D interchanges and Beijing's ring road congestion, are invaluable resources for training and validating autonomous driving algorithms.

Chinese automakers should not merely be users of NVIDIA's solutions but also providers and co-definers of core data and scenario challenges. By translating localized experiences into technological contributions within the ecosystem, they can enhance their influence.

2. Application Innovation and Software-Hardware Synergy:

Above a unified bottom-layer platform, creating differentiated user experiences and efficient vehicle intelligence integration capabilities is key to forming brand moats.

The challenge lies in translating chip computing power into user-perceptible "comfortable, safe, and efficient" driving experiences, which tests automakers' integration and innovation capabilities.

3. Supply Chain and Cost Control:

While NVIDIA's platform offers powerful performance, it is also costly.

How to effectively control costs while reaping technological dividends through large-scale applications, architectural optimizations, or combining local edge computing solutions is crucial for the breadth and depth of commercialization.

IV. Global Chess Game: The Smart Mobility Competition Enters the "Ecological Cluster" Era

NVIDIA's aggregation of Chinese automakers, Uber's alliance with Lucid and Nuro to create a Robotaxi consortium, and the advancement of China's local "vehicle-road coordination" national team collectively reveal a trend:

The future mobility competition is no longer a duel between individual automakers or tech companies but a confrontation between ecosystems.

In this global chess game, China possesses the world's largest and most complex application market, the most complete electric vehicle industrial chain, and rapidly advancing vehicle-road coordination infrastructure guided by policies.

These are irreplaceable competitive advantages.

By accessing globally leading computing power ecosystems, China's industry can quickly strengthen its relative weaknesses in bottom-layer AI computing and toolchains, thereby focusing more on leveraging its strengths in scenarios, data, manufacturing, and markets to the fullest.

V. Conclusion: Building Foundations in Openness, Defining the Future in Competition and Cooperation

The appearance of China's mainstream automakers in NVIDIA's "circle of friends" is a confident "open-book exam."

It demonstrates that China's autonomous driving industry has reached sufficient maturity to participate in global top-level technological division of labor and collaboration with an equal and proactive stance.

This does not mean abandoning autonomy; rather, it is about honing core capabilities in integrating global resources, defining product experiences, and overcoming local challenges through higher-level open competition.

The ultimate goal is not just to become an indispensable market and application innovation hub in the global smart mobility ecosystem but also to gradually grow into a key technology and value contribution hub with core influence.

In short, the Driverless Car Era (WeChat public account: Driverless Car Era) believes that:

This path of open competition and cooperation will be an inevitable test for China's transition from an automotive powerhouse to an automotive superpower and represents China's choice in shaping the global smart mobility landscape.

Hey! What are your thoughts?

#DriverlessCarEra #Driverless #AutonomousDriving #DriverlessVehicles