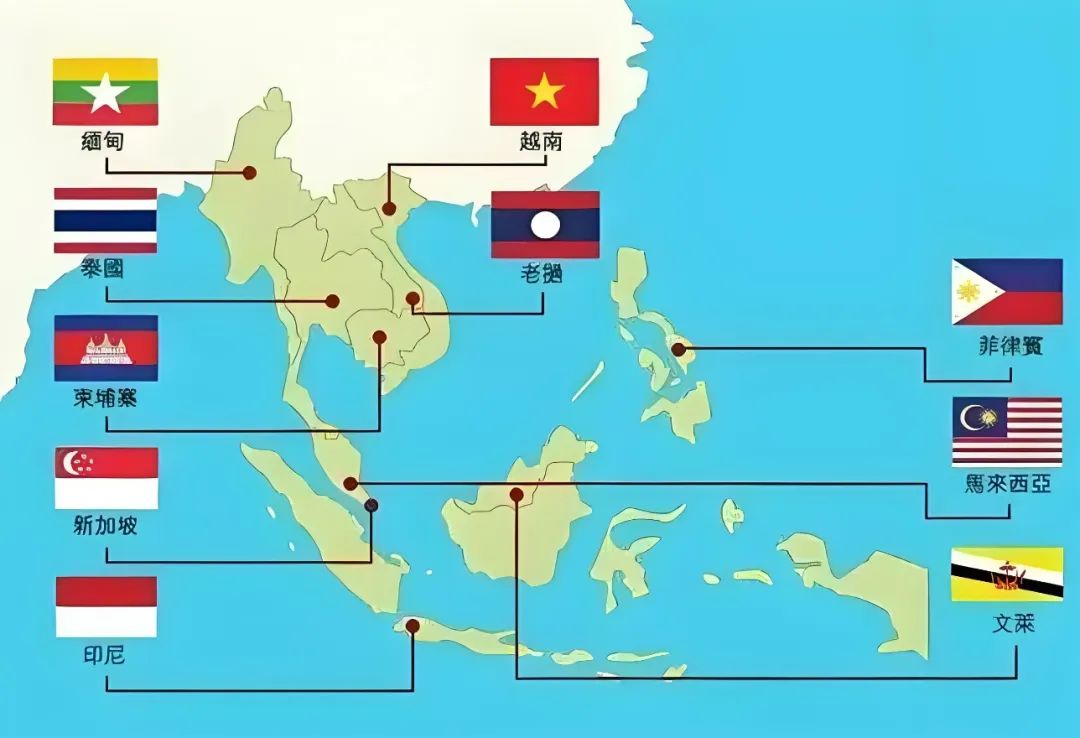

Chinese Automakers Go Global in ASEAN: Learning from Japan, Battling Japan

![]() 06/19 2024

06/19 2024

![]() 545

545

Automobile exports and tariff skirmishes have become hot topics in the current automotive industry. On one hand, China has surpassed Japan to become the world's largest exporter, and on the other hand, Chinese automobile exports have encountered tariff barriers from the United States and the European Union, aiming to hinder China's global expansion and growth.

So, what might be the optimal solution for Chinese automobile exports? It seems that every automaker is exploring, from SAIC and Chery to Geely and BYD, their actions to a certain extent represent a microcosm of Chinese automakers' overseas exploration.

As many believe, Chinese automakers going overseas must be accompanied by the full establishment of factories and industrial chains, much like Japanese and Korean automakers' expansion into global markets. However, this is also influenced by political and economic situations and government relations. Which place and path best represent China's new thinking on going overseas? Geely's expansion in Malaysia is undoubtedly a typical case and overseas sample.

This year marks the 50th anniversary of diplomatic relations between China and Malaysia. The two countries have extensive economic and trade exchanges, with bilateral trade increasing 1,000-fold over 50 years. China has maintained its status as Malaysia's largest trading partner for 15 consecutive years.

On June 18, Proton, Malaysia's first national automotive brand, rolled off its 5 millionth new car. Minister of Industry and Information Technology Jin Zhuanglong witnessed the event and said that the automotive industry, as a highlight of economic and trade cooperation between China and Malaysia, has become an important force in driving global automotive industry transformation and development, making significant contributions to global climate change and green transformation.

All this began with a major acquisition seven years ago. In June 2017, Geely Holding Group signed an agreement with Malaysia's DRB-HICOM Group to officially acquire a 49.9% stake in Proton, a subsidiary of DRB, and a 51% stake in Lotus, a luxury sports car brand.

Seven years later, the results are evident. With Geely's technology, products, and management, Proton has achieved profitability and continued growth, while Geely has explored a new path in exporting to ASEAN and even the global market.

"The cooperation between Geely and Proton is actually a microcosm of Chinese enterprises going global. Both parties have walked this path based on the principle of mutual benefit and win-win. Now, they are on the right track," said Ouyang Yujing, the Ambassador of the People's Republic of China to Malaysia, in a recent CCTV Finance Channel interview.

Seven Years, Steady Growth

In many cultures and traditions, seven years is considered an important time node or a timeframe for setting goals and assessing progress, marking growth, change, or a significant turning point. For Geely or Proton, seven years is both worth looking back on and exploring, as it relates to new thinking about Chinese automakers going overseas. On the other hand, these changes can indeed be considered qualitative leaps.

Seven years later, stepping onto Malaysian soil again, it feels both strange and familiar.

On the highway from the airport to the city, Huawei's giant billboards still exist, displaying products that have been updated to the Pura 70 series. The cars zooming down this road are no longer just Northland, Toyota, and Honda as they were seven years ago. Proton X50 (domestically known as Geely Binyue) has a high visibility, and Proton X70 (domestically known as Geely Boyue), Chery Omoda, BYD Dolphin, and other products can also be seen.

"I originally wanted to buy the X50. It's very good-looking and has high configurations, but I heard that there's a long wait for delivery, too long, starting from three months." On the way, the driver who picked us up in a Northland ARUZ kept praising the Proton X50 and said that Geely and Proton have developed rapidly in recent years, and local people's views on Proton and Geely have changed a lot.

Honestly speaking, in terms of design, the X50 leads the Northland and Toyota Honda cars of the same class and price range by one or two generations. After all, as the most competitive automotive market globally, China has advanced to the forefront globally in terms of status and strength, thanks to its huge consumer volume and technological progress brought about by extreme investment.

Therefore, when China's leading independent automakers enter the relatively conservative Southeast Asian market with regard to product update cycles, their advantages are self-evident. In these seven years, Geely has brought positive momentum to Proton and the Malaysian automotive market, from products to image, from management to efficiency.

If we follow the objectives set during Geely's negotiations for acquiring Proton and the three main goals mentioned in the first ten-year development plan (achieving profitability as soon as possible, becoming the market leader in Malaysia, and entering the top three in the ASEAN market), Geely has already accomplished more than half.

The data speaks for itself. Before Geely's investment, Proton had been losing money for nine consecutive years, with an average annual loss of 1.6 billion Malaysian ringgit. Behind this was Proton's sales volume, which was only around 70,000 units, ranking third or fourth among Malaysian automakers, below Honda and Toyota. However, since Geely's investment, Proton achieved profitability in just over a year, achieving a healthier development situation. By the end of 2022, it had achieved a revenue of 93.9 billion Malaysian ringgit, tripling its previous level.

In particular, Proton's flagship product, the Soga, which has a 38-year history, sold only about 2,000 units a year before Geely's arrival due to its relatively low competitiveness among products of the same class. However, after Geely's technology introduction and quality improvement, this product sold 70,000 units in 2023, becoming Proton's sales leader.

Overall macro numbers represent the company's overall situation, but micro-level data can better reflect a brand's upward path, such as brand sales prices, which are closely related to brand image and influence.

Before Geely's investment, Proton's average price was only 40,000 to 50,000 Malaysian ringgit, which is also the average price level of Northland, the current market leader in Malaysia. However, after Geely introduced products such as Boyue, Binyue, Haoyue, and Emgrand, Proton's average price has risen to 70,000 to 80,000 Malaysian ringgit, and the proportion of new Geely models has reached over 40%.

The increase in average prices means that the brand's models are becoming more expensive. According to the irreconcilable contradiction between quantity and price, most can only achieve a compromise. However, in 2023, Proton sold a total of 154,000 units, a year-on-year increase of 9%, setting its best performance since 2012. Its overall market share reached 19.4%, and Proton has steadily ranked second in Malaysian sales for the fifth consecutive year, further narrowing the gap with the first-place Northland. In particular, Proton's strategically introduced models, the X70, X50, and X90, have sold over 217,000 units, all becoming champions in the SUV segment.

"After seven years of cooperation, our sales have increased by 100%, market share has increased by 100%, and overseas exports have reached number one, setting a new historical high. Both quality and technology have made significant progress, and Proton's brand strength in Malaysia has been reinvigorated," said Tengku Zafrul Tengku Abdul Aziz, Malaysia's Minister of Investment, Trade, and Industry, believing that this is a very successful partnership.

In fact, this is not only the success of Geely and Proton but also a tangible transformation visible to dealers.

Seven years ago, Proton mainly had over 300 1S and 2S stores in Malaysia, with only 30 4S stores. There were many problems with both brand image and service systems. "Proton's dealers only know how to sell cars, not how to repair them," concluded Li Chunrong, Proton's CEO, after inspecting Proton dealers seven years ago.

Over these seven years, with advanced management processes, integration of pre-sales and after-sales services, and improvement in customer feedback mechanisms, Proton's dealers have undergone qualitative changes in store image, service quality and level, and after-sales capabilities. This includes Proton cafes, transparent workshops, and other configurations and facilities that are very popular in China and can now be found in Proton's 4S stores in Malaysia, pioneering local automotive services. According to 2023 performance results, single-store sales increased by 140% year-on-year, and 3S/4S profitability reached 81%.

"By introducing high-quality products and reorganizing Proton's dealer network in Malaysia, we have increased local consumers' confidence in Proton," said Xu Danjin, the head of Proton dealer AAPICO Hitech. Nowadays, AAPICO has shifted from primarily selling Japanese products to focusing on Proton. In 2023, Proton brand sales contributed nearly 2,000 units, accounting for two-thirds of the group's new car sales.

New energy vehicles, which are very popular in China, have also sprouted new seeds in Malaysia, led by Geely. In 2022, smart signed a distribution agreement with Proton for the Malaysian and Thai markets. Later, the cooperation deepened, including exploring the feasibility of "building overseas production capacity." Currently, smart #1 has begun deliveries in Malaysia.

Although Malaysian gasoline prices are very cheap, and there is no pressure on new energy vehicles in terms of energy strategy, national security, and air pollution, Proton believes that Malaysia has its own needs in transitioning to new energy, given the trend towards new energy in the automotive industry, including Malaysia's annual pressure of 80 billion Malaysian ringgit in fuel subsidies.

Proton itself is also pursuing a new energy transformation, launching Malaysia's first domestic electric vehicle brand, e.MAS, on June 12. It is expected that the first batch of cars will roll off the production line by the end of 2025. Geely's recently launched Galaxy E5 may enter the country for production and sales under the Proton new energy brand.

In Malaysia, new energy vehicles mainly target the top 30% of the customer base. On one hand, local infrastructure cannot be as developed as in China. With a high per capita car ownership, those who can afford new energy vehicles are generally middle to high-income individuals. They have parking spaces at home to install charging facilities to compensate for the relative lack of public charging facilities. They value the experience rather than saving costs.

Li Shufu's Far-Sighted Plan

Against the backdrop of China's automotive globalization, major automakers are vowing to enter developed markets such as Europe and the United States to prove their capabilities and strength. We have every reason to believe that China's automotive strength is no longer comparable to the past, and entering the global market is only a matter of time. However, the routes and paths to take may vary among automakers.

In Li Shufu's eyes, he is well aware of the problems and difficulties facing Chinese automakers on their globalization path, especially the global political and economic landscape and changes, as well as the occasional signs of anti-globalization, which will have the most direct and fatal impact on Chinese automakers going overseas. Focusing on Southeast Asia, especially Malaysia, which has good relations with China, may be a better solution.

Although Malaysia's annual passenger car capacity is only about 500,000 to 600,000 units, this market has great potential. With a 25% Chinese population, they naturally have a deep emotional connection to Chinese cars and companies. As the center of ASEAN and a strategic location for the Malacca Strait, a world maritime passage, Malaysia is a springboard for entering ASEAN and global markets, including the Belt and Road Initiative, which is closely related to ASEAN.

ASEAN is a market with 623 million people and annual sales of over 3.5 million vehicles. Zooming out, ASEAN's global radiation will open up Geely's share of 8 million right-hand drive vehicles annually, leveraging a larger market pie.

In the 1980s, under the leadership of Mahathir, Malaysia looked eastward to Japan, introducing Japanese car models and platforms to create Proton and developing it into a national car brand. In China, nearly 20 years after Proton's establishment, Geely Automobile only obtained its production permit, showing that Malaysia's automotive industry started very early.

In the early 21st century, Proton fully introduced western automotive industrial equipment and developed products in a standardized manner, becoming Malaysia's leading national automotive brand in terms of sales and market share. It was also around this time that the seeds of cooperation with Proton were planted in Li Shufu's mind.

However, due to policy protection, Li Shufu was unable to contact Proton as he wished. During his inspection, he could only gaze at Proton's Tanjung Malim factory from afar. Considering that Geely's cars were very competitive in China at the time, Geely later signed a CKD contract with Malaysia, transporting production lines and parts for assembly. Reality was not as simple as Li Shufu imagined. When the parts arrived at the port, customs did not allow them to enter, despite seeking help from various connections. "At that time, Malaysia attached great importance to protecting its national automotive brand," said Li Shufu.

Perhaps because of his unfulfilled wish and frustration 20 years ago, Proton, which was declining in 2012, heard that it was seeking a partner. Upon hearing this news, Li Shufu was very excited and told his team that they must make it happen. At that time, Geely already had experience acquiring Volvo and was ranked second among independent automakers in China with annual sales of about 500,000 units.

Later came a long marathon of background checks and negotiations, from initial contact in 2013 to formal bidding in 2016. This four-year-long investigation and one-year-long negotiation and acquisition case was signed in Kuala Lumpur on June 23, 2017. In fact, Geely's offer was not the most favorable, as PSA's offer was five times higher.

As for why Geely won in the end, there may be many factors behind it, including China-Malaysia relations, government-enterprise ties, development strategies, business networks, technology transfer, market logic, merger and acquisition experience, policy protection responses, and the proportion of local suppliers. Including Geely's previous story with Proton, Geely's own R&