Who's Reaping the Profits in the Auto Industry?

![]() 02/10 2026

02/10 2026

![]() 547

547

Why Are Car Sales Booming, Yet Profits Shrinking?

Author | Li Dapeng Production | Electric Guild

Who Is Exactly Siphoning the Profits from Our Wallets?

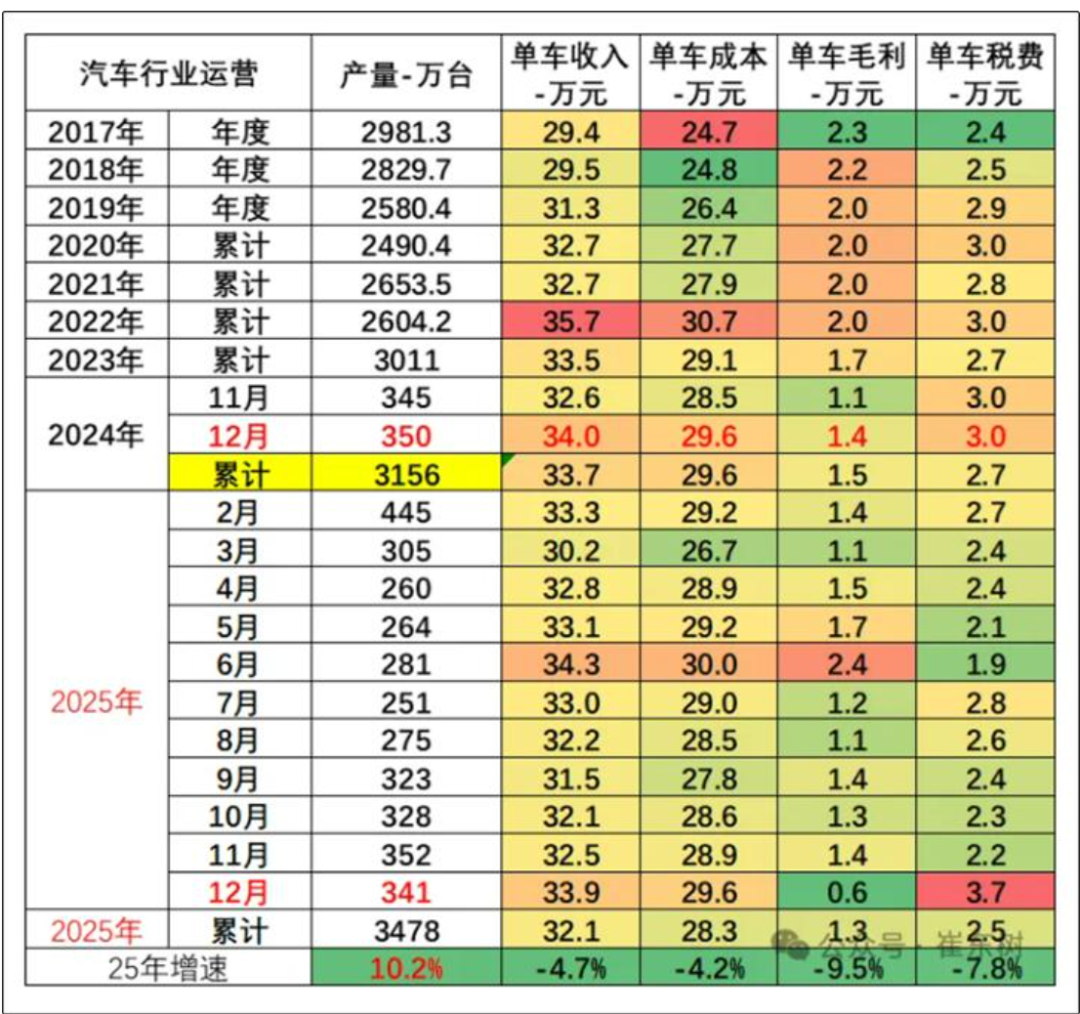

In 2025, China's auto market is ablaze once more, with annual production and sales both soaring past 34 million units, hitting an all-time high and cementing its global leadership for the 17th consecutive year. Sounds like a jubilant celebration with drums and fireworks, a picture of prosperity, doesn't it? But beneath this glittering surface lies a hidden truth that has all automakers' executives scowling—cars are flying off the shelves, yet profits are dwindling.

What's the real story here? How can the auto industry, this 'glutton', be consuming so much without bulking up in profits?

01

A Tale of Two Extremes

Let's delve into two sets of figures to experience the thrill of this 'scorching heat and icy chill' scenario.

On one hand, we have record-breaking sales: 34.4 million units.

On the other? Profitability levels have hit rock bottom, with the auto industry's sales profit margin plummeting to a mere 4.1% in 2025, marking a new five-year low.

A comparison paints an even starker picture. Beverage and alcohol sellers can revel in profit margins exceeding 20%. Yet the automotive industry, the backbone of manufacturing, toils away to produce a single car, only to reap an average gross profit of around 13,000 yuan.

Bear in mind, just eight years ago in 2017, that figure stood at 23,000 yuan. That means, while car prices may not have plummeted, the rewards for the arduous work of car manufacturing have taken a hefty 40% hit.

02

Where Has All the Money Vanished?

'So, the question looms: where is the money from car sales flowing? In fact, it's primarily being 'diverted' by three forces.'

The first force originates upstream, spearheaded by batteries. Some automaker executives have lamented that they're now 'slaving away for battery factories.' The cost of power batteries can account for a staggering 40% to 60% of a vehicle's total cost.

How extreme is this situation? A closer look reveals that in the first half of 2025, the battery sector claimed a whopping 90% of the profits in the new energy vehicle industry. The market leader alone pocketed 68.1% of the net profits across the entire industry. Its profits dwarf the combined profits of a dozen listed automakers. Cars are manufactured by automakers, brands belong to automakers, yet the lion's share of profits is securely pocketed by upstream suppliers.

The second force is the relentless internal consumption wrought by the 'price war.' From 2023 to 2025, the auto industry's 'price war' has raged on unabated.

Last May, within just one month, prices plummeted on over a hundred models—you slash by 30,000, I'll cut by 50,000, some even officially reduced prices by a staggering 100,000. It's akin to a 'butchering competition' with no victors, where everyone frantically squeezes their profit margins to seize market share.

This has also led to severe discrepancies between purchase and sales prices across various channels, with dealers losing more money the more they sell. Some OEMs, aiming to boost volumes, sell new cars in bulk through major client channels. Dealers, to meet automakers' targets, register new cars as inventory in advance and then resell them as second-hand vehicles to recoup funds, giving rise to the chaos of '0-kilometer second-hand car reselling'.

Do you know how many small and medium-sized dealers have had their capital chains snapped and gone bust in the price war?

In 2025 alone, the number of 4S stores dropped by nearly 1,500, with only 27.5% of 4S stores meeting their sales targets. And in early 2026, a dealer default occurred, affecting over 180 4S stores nationwide. Cases of downsizing, cost-cutting, efficiency-boosting, or even fleeing overnight and shutting up shop, are all too common.

This 'scorched-earth' tactic, while snagging sales figures, directly obliterates profit margins. From 2022 to 2024, the price war alone has cost the industry hundreds of billions of yuan in lost revenue.

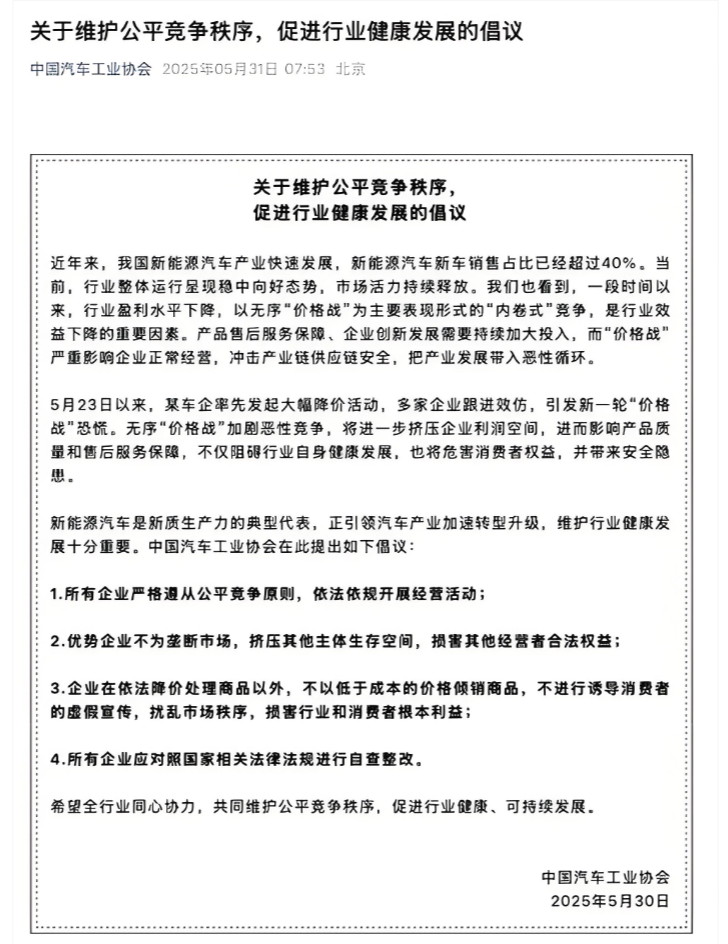

The China Association of Automobile Manufacturers has sent a clear signal opposing this disorderly 'price war.' Because such practices not only erode automakers' own profits but may also trigger a chain reaction of declining product and service quality, ultimately jeopardizing the health of the entire industry.

Now, let's examine the third force: the increasingly exorbitant 'new entry tickets.' Car manufacturing costs are under immense pressure from both ends. In the past, the competition revolved around engines and transmissions; now, it's about large screens, chips, and intelligent driving. These new technology R&D investments are enormous, with BYD, for instance, having invested over 220 billion yuan in R&D to date.

Automakers face fierce market competition, forcing them to cut prices, while production costs continue to soar. Raw material prices for battery-grade lithium carbonate and copper have been climbing year after year, and demand and prices for chips have also surged, even leading to competition for resources with AI and consumer electronics industries, further exacerbating cost pressures. These factors pose significant challenges to automakers' cost control.

Moreover, new entrants like Huawei and Xiaomi entering the market have brought new cooperation models, such as Huawei's HI (Huawei Inside) vehicle model, which takes about 15% of a vehicle's total sales, far higher than traditional suppliers. Not investing means being eliminated; investing sends costs skyrocketing. Automakers are caught in the middle, torn between two difficult choices.

So, when you sell a car, the battery cost takes a hefty chunk, price cuts and promotions give away another chunk, and R&D for new technologies spends yet another chunk. The net profit that ends up in automakers' pockets is naturally as thin as a sheet of paper.

This is the classic case of 'increasing volume without increasing profits'.

03

Breaking Free from the 'Sell More, Earn Less' Auto Market Dilemma

So, what can be done? Where's the way out? Automakers can't keep 'powering on with passion' indefinitely, can they? The industry's brightest minds are already seeking solutions. The direction is clear, encapsulated in six words:

Venture out, ascend upwards.

Venturing out means seeking profits in the global market. In 2025, China's auto exports surpassed 7 million units, a year-on-year increase of over 20%, becoming the most crucial growth engine.

More importantly, we're no longer just synonymous with 'cheap goods.' The average export price of new energy vehicles is steadily rising. Leading automakers like BYD, Chery, Geely, and Great Wall have already established factories overseas and engaged in localized operations, which is the sustainable path forward.

Take the strength honed in domestic 'cutthroat' competition and bring it to the broader international market to compete and earn.

Ascending upwards means mastering core technologies to gain control over profit distribution, so bracing oneself (biting the bullet) on technology is a must.

Bitter lessons have proven that without core technologies, there's no say in profit allocation. Positive examples include BYD and Leapmotor, with self-research ratios of 75% and 65%, respectively. By mastering core components like batteries and electronic controls themselves, they naturally retain more profits. On the flip side, some international giants that transformed slowly saw their operating profits plummet due to falling behind in intelligence.

Future competition will undoubtedly be a 'technology war.' Whoever leads in intelligent driving, electronic architecture, and other fields will be able to escape low-price competition and gain brand premium.

Of course, relying solely on enterprises isn't enough; good 'competition rules' are also needed. Since 2025, industry associations and regulatory bodies have been loudly calling for 'anti-internal competition,' opposing disorderly price wars, and advocating for 'long-termism'.

At the same time, policies are promoting a fair competition environment of 'equal rights for fuel and electric vehicles.' It's like setting reasonable rules for a marathon, preventing everyone from sprinting at the start and collapsing, but rather competing on endurance and true strength.

04

Farewell to Wild Growth, Embrace the Era of Value

So, 'selling more but earning less' isn't simply an industry downturn; it's a necessary growing pain as an industry transitions from adolescence to maturity. It reminds us that the past model of wild growth relying on scale and low prices is no longer sustainable. Low profits cannot support the high-intensity, high-risk R&D investments of the future.

Only when the entire industry returns to rational competition, stopping the race to the bottom on price, and instead competing on 'who offers higher value,' 'who has stronger technology,' and 'who provides better service,' can the industry truly move towards high-quality and sustainable development.

In essence, automakers should ponder how to earn 'smart money,' 'technology money,' and 'brand money'.

Although profit margin pressures may persist in the short term, with industry consolidation, technological breakthroughs, and business model innovations, we have reason to expect the auto industry to navigate through cycles and embrace a healthier, more valuable future.

The 2025 data has already sent a signal: the domestic sales share of new energy vehicles has historically surpassed 50%, and the market share of Chinese-brand passenger vehicles is nearing 70%. Electrification, intelligence, and globalization—these 'three trends' are the steering wheel for China's auto industry future.

This profound transformation is a challenge for automakers but potentially good news for consumers. When companies no longer focus solely on price wars but instead concentrate on technology and service, the cars we ultimately drive will be more valuable and reliable.

The auto industry's grand drama has just begun its second act.

— END —