Save the joint venture auto companies

![]() 06/14 2024

06/14 2024

![]() 465

465

Lead

Introduction

In the future, joint venture auto companies that fail to establish a foothold in the new energy sector will face even greater difficulties.

Author: Li Sijia

Responsible Editor: Cao Jiadong

Editor: He Zhengrong

May this year was undoubtedly a memorable month for the Chinese auto market.

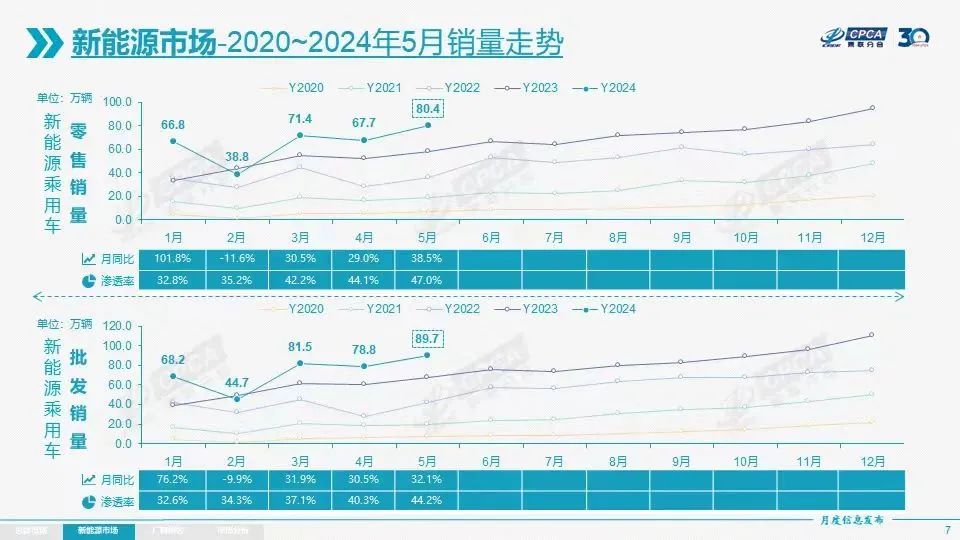

In this month, the retail market share of domestic new energy vehicle manufacturers has reached 47%, an increase of 14 percentage points compared to the same period in 2023. We seem to have the opportunity to witness the historic moment in recent years, from breaking the 50% "red line" of independent brand market share to challenging the 50% market share of new energy vehicles.

According to data released by the China Passenger Car Association, 1.71 million passenger cars were sold in the national passenger car market in May, of which 804,000 were new energy vehicles, an increase of 38.5% year-on-year. The continuous rise in the performance of the new energy vehicle market is undoubtedly driven by the continued high performance of independent brands, with a retail penetration rate of over 71.2% for independent brand new energy vehicles being the most direct and powerful evidence.

Some rejoice, some sorrow.

In contrast to the multi-pronged approach of independent brand new energy vehicles and their successful expansion of the market base, joint venture/foreign auto companies have suffered a comprehensive defeat in the Chinese market.

On one hand, they struggle in the "traditional" field of fuel vehicles. In May, the retail sales of mainstream joint venture brands reached 490,000 units, a year-on-year decrease of 21%. Among them, the German retail share was 18.6%, down 2 percentage points year-on-year; the Japanese retail share was 14.8%, down 3.2 percentage points year-on-year; and the American brand retail share was 6.7%, down 1.4 percentage points year-on-year.

On the other hand, they have always lacked presence in the new energy vehicle sector where they are not proficient. The penetration rate of new energy vehicles for mainstream joint venture brands in May was less than 10%, and their overall performance in recent years has also been lukewarm.

With continuous defeats in the field of fuel vehicles and insufficient competitiveness in the field of new energy, joint venture brands are gradually entering a difficult period as independent brands continue to increase their market share and influence.

Fuel vehicles are struggling

If it weren't for the wave of new energy in the Chinese auto market, joint ventures might not be facing such difficult times now.

After all, in the era of independent brand development in fuel vehicles, joint venture auto companies dominated the Chinese auto market, representing the "majority" of that era. With years of accumulated user reputation, although independent brands have been attacking continuously in the fuel era, fuel vehicles have always been the dominant area of joint venture brands, accounting for more than 70% of the market share before 2014.

Among them, mainstream joint venture brands represented by North and South Volkswagen and the three major Japanese brands have long dominated the top three positions in the domestic auto company rankings, and even among the top ten companies, there are rarely any names of Chinese auto manufacturers.