Beyond New Year Revelry—Seize the Moment to Buy a Car! 62.5 Billion Yuan in 'National Subsidies' Unleashed

![]() 02/12 2026

02/12 2026

![]() 494

494

Lead

Introduction

In times of sluggishness in the automotive market, maintaining growth hinges on the implementation of preferential policies.

The dawn of the 2026 automotive market has been marked by pessimism.

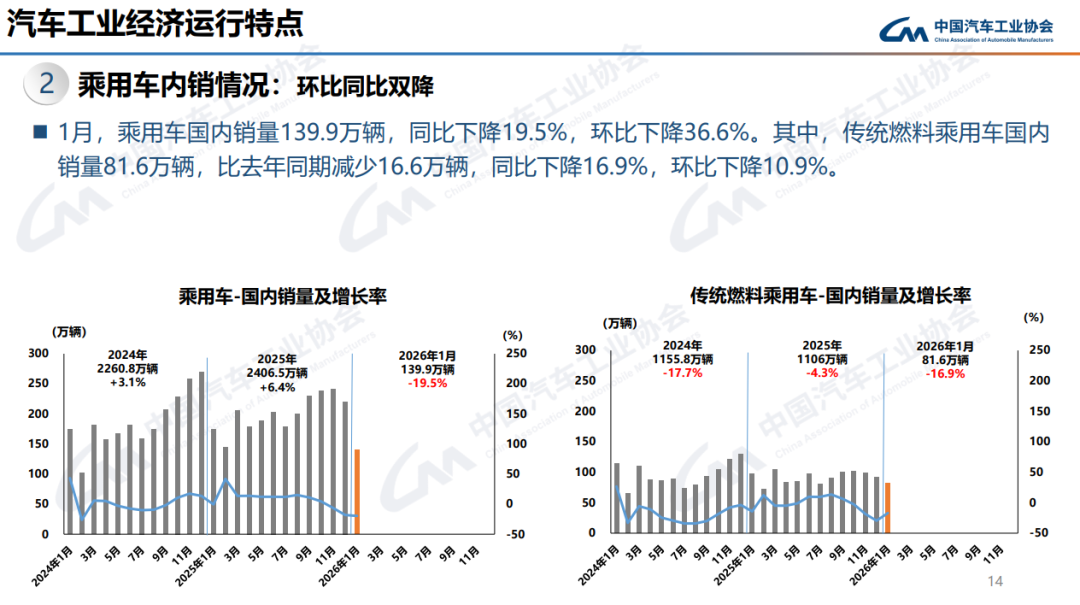

Data reveals that domestic auto sales in January 2026 plummeted by 14.8% year-on-year, with a mere 1.665 million vehicles sold. The passenger vehicle segment, the backbone of the market, fared even worse, with a year-on-year decline widening to 19.5% and sales tumbling to 1.399 million vehicles, hitting a recent low for the same period.

The chill in the retail market is palpable, as evidenced by the drop in foot traffic and orders at 4S stores. Numerous dealers report a significant downturn in customer inflows during the first half of January, with orders for key models from some brands being 'cut in half.' The sluggish start to the automotive market has caught the industry off guard.

Just as the automotive market entered a brief period of adjustment and industry confidence wavered, a significant positive development quietly emerged. Currently, the first tranche of 62.5 billion yuan in national subsidies for automotive trade-ins in 2026, allocated by the Ministry of Commerce in conjunction with the National Development and Reform Commission and the Ministry of Finance, has fully reached local commerce departments. These subsidies are poised to make a concentrated impact during the longest-ever Spring Festival holiday.

For the automotive market in January, which is grappling with policy transition pains and weak demand, the timely arrival of this substantial financial boost is expected to not only alleviate the pressure of declining retail sales and bolster consumer confidence in purchasing vehicles but also lay a solid foundation for steady growth in automotive consumption throughout 2026. This marks a pivotal turning point for the market to transition from sluggishness to recovery.

We all understand that the decline in the January automotive market is the result of a confluence of factors, including policy transitions and shifts in consumer spending patterns. This decline does not signal industry deterioration but rather reflects a short-term adjustment. The timely arrival of the 62.5 billion yuan in national subsidies precisely addresses market pain points and instills hope in the industry for a swift recovery. With the concentrated release of trade-in subsidies, it is anticipated to effectively unlock pent-up demand for vehicle purchases, drive a gradual market recovery, and inject momentum into a strong start for the 2026 automotive market.

01 Subsidy Policies: Vital for the Automotive Market

Reflecting on the automotive market trends over the past year, the steady growth of the domestic automotive market in 2025 can be largely attributed to the sustained impact of two major policies: preferential purchase tax incentives for new energy vehicles and automotive trade-in subsidies.

Data indicates that in 2025, the number of applications for automotive trade-in subsidies surpassed 11.5 million, directly driving new vehicle sales exceeding 1.6 trillion yuan and becoming a core driver of automotive consumption stimulation. Meanwhile, the purchase tax exemption policy for new energy vehicles continued to promote an increase in the penetration rate of new energy vehicles, supporting sustained high-speed growth in the new energy vehicle market.

The combined effect of these two policies not only stimulated retail consumption but also drove the automotive industry's transition towards green and intelligent technologies, achieving bidirectional empowerment of consumption growth and industrial upgrading.

However, the transition and switching of policies inevitably bring about short-term market fluctuations. Starting from the end of 2025, the domestic automotive consumption market entered a transitional period of policy switching—the existing purchase tax exemption policy for new energy vehicles and the automotive trade-in subsidy policy gradually came to an end, while the new policies for 2026 had not yet been officially implemented, and the details had not been fully clarified. This 'policy gap' directly influenced consumers' vehicle purchase decisions and also placed dealers' promotional efforts in a passive position, becoming one of the core factors contributing to the decline in the automotive market in January 2026.

Specifically, the adjustment of the purchase tax incentive policy for new energy vehicles had the most significant impact on the new energy passenger vehicle market.

In 2025, the full exemption of purchase taxes for new energy vehicles significantly reduced consumers' vehicle purchase costs and became an important support for driving the growth of new energy vehicle sales. However, with the policy's expiration, the purchase tax incentive for new energy vehicles in 2026 was adjusted to a 50% reduction. Although still offering some incentive, compared to the previous full exemption, consumers' vehicle purchase costs increased.

More critically, at the end of 2025, many consumers rushed to purchase vehicles to take advantage of the 'last train' of full exemption, leading to a premature release of demand for new energy vehicles. As a result, the new energy passenger vehicle market in January 2026 saw a significant decline in demand, further dragging down overall passenger vehicle market sales. According to statistics, new energy passenger vehicle sales in January 2026 fell by more than 25% year-on-year, far exceeding the 19.5% decline in the overall passenger vehicle market and becoming the main force dragging down the January automotive market.

Meanwhile, the transition of the automotive trade-in subsidy policy also exacerbated the market's sluggishness.

In 2025, the automotive trade-in subsidy policy, with its broad coverage and flexible subsidy standards, effectively activated the market for scrapping old vehicles and drove new vehicle consumption. However, with the policy's expiration at the end of 2025 and the details of the new trade-in subsidy policy not yet announced, many consumers holding old vehicles and with a need to replace them chose to wait and see, hoping to benefit from more favorable subsidy terms under the new policy. This wait-and-see attitude directly led to a significant decrease in trade-in demand, and since trade-ins are an important force supporting growth in the passenger vehicle market, the shrinking demand directly impacted overall retail sales.

In addition to the impact of policy transitions, changes in consumer spending patterns due to the Spring Festival travel rush also had a certain impact on the automotive market in January this year.

The 2026 Spring Festival holiday is the longest ever, lasting nine days, and it falls earlier in the year. Many consumers began returning to their hometowns from mid-to-late January, especially those in third- and fourth-tier cities, who focused more on preparing for the trip home and temporarily shelved their vehicle purchase plans. Third- and fourth-tier cities have been important potential markets for automotive consumption growth in recent years and are also the regions with the most concentrated demand for trade-ins. The temporary shelving of consumer demand in these markets further exacerbated the sluggishness of the automotive market in January.

Feedback from the retail market shows that in the first half of January, foot traffic and orders at auto 4S stores in most domestic cities declined significantly, with more pronounced declines in third- and fourth-tier cities.

Many dealers report that starting from mid-to-late January, foot traffic and orders have noticeably decreased. To alleviate inventory pressure, some dealers have had to increase discounts, but even so, they have found it difficult to effectively drive sales growth. Additionally, factors such as the suspension of logistics operations before the Spring Festival and adjustments in manufacturers' production capacities have also led to insufficient supply of some vehicle models, further hindering the increase in retail sales.

02 Injecting Confidence: More Crucial Than 'Bailing Out'

Faced with the sluggishness of the automotive market in January, the market was not caught off guard. The national level had already made early arrangements to pave the way for steady growth in automotive consumption in 2026.

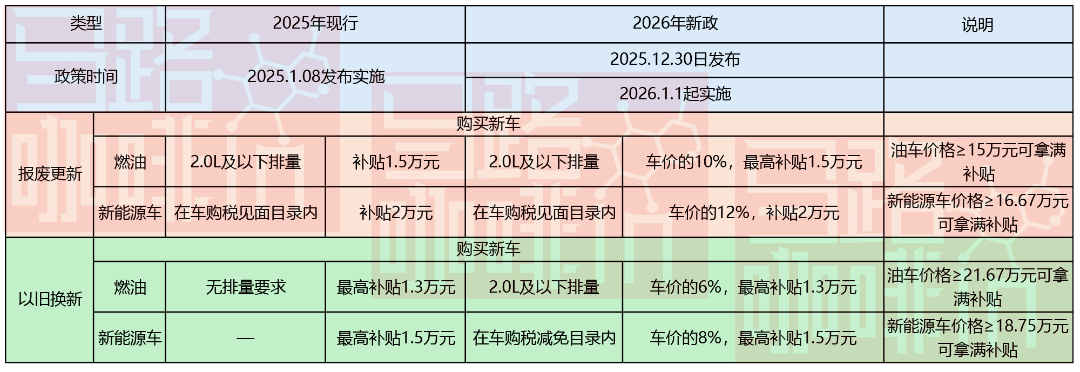

In fact, as early as the end of December 2025, seven departments, including the Ministry of Finance and the Ministry of Commerce, jointly issued the 'Implementation Rules for Automotive Trade-In Subsidies in 2026' (hereinafter referred to as the 'Rules'), which clarified in advance the scope, standards, implementation mechanisms, and other content of the automotive trade-in subsidies for 2026. This broke the market's policy wait-and-see attitude and laid the foundation for a smooth transition of policies.

A careful review of the 'Rules' reveals that the automotive trade-in subsidy policy for 2026 is not a mere continuation of the 2025 policy but rather an optimization and improvement that builds on the existing subsidy intensity. It is more closely aligned with the current needs of the automotive consumption market and is more targeted and operable, demonstrating the national guidance of promoting high-quality upgrades in automotive consumption and facilitating green industrial transformation.

For example, in terms of subsidy scope, the 'Rules' further expand coverage to include more old vehicles in the subsidy program while clarifying the type requirements for newly purchased vehicles, taking into account the consumption needs for both fuel-powered and new energy vehicles. In terms of subsidy standards, the 2025 subsidy intensity is maintained, while differentiated subsidy standards are formulated based on the type of newly purchased vehicle. For those who scrap eligible old vehicles and purchase new energy passenger vehicles, the maximum subsidy amount reaches 20,000 yuan.

The early issuance of the 'Rules' provides clear guidance for the smooth transition of the automotive trade-in policy in 2026. However, for the policy to take effect, timely allocation of funds is essential as support. The allocation of the first batch of 62.5 billion yuan in national subsidies in 2026 is a crucial step in policy implementation, ensuring that the provisions of the 'Rules' are truly put into practice.

It is reported that the 62.5 billion yuan in national subsidies allocated this time is the first batch of funds for automotive trade-in subsidies in 2026 and has fully reached local commerce departments. Various regions are now urgently formulating specific subsidy distribution plans to ensure that the subsidy funds are promptly and fully distributed to consumers.

At the same time, many automakers have seized this opportunity to launch activities such as 'New Year Vehicle Purchase Subsidies' and '叠加折扣(Superimposed Discounts) for Trade-Ins,' forming a synergy with national and local subsidies to further enhance the cost-effectiveness of vehicle models and attract consumers to make purchases.

For the sluggish automotive market in January 2026, the allocation of 62.5 billion yuan in national subsidies is expected to quickly alleviate the pressure of short-term sales declines.

On the one hand, the availability of subsidy funds will effectively activate trade-in demand, driving the scrapping of old vehicles and the consumption of new vehicles. Especially with the concentrated subsidy distribution during the Spring Festival holiday, it is expected to unlock a portion of pent-up demand for vehicle purchases and drive a rebound in retail sales in February. On the other hand, the implementation of the subsidy policy will break consumers' wait-and-see attitude, boost their confidence in purchasing vehicles, and promote the gradual recovery of the retail market, enabling the automotive market to quickly emerge from the short-term adjustment caused by policy transitions.

More importantly, the allocation of 62.5 billion yuan in national subsidies is not just a 'bailout' for the sluggish automotive market in January but also lays a solid foundation and sets a strong start for steady growth in automotive consumption throughout 2026.

In 2025, the automotive trade-in policy achieved remarkable results, with the number of subsidy applications exceeding 11.5 million throughout the year, directly driving new vehicle sales exceeding 1.6 trillion yuan. This solid foundation has laid a strong groundwork for the implementation of policies in 2026. Based on this, industry institutions remain optimistic about the automotive market in 2026, predicting that the number of trade-in applications in 2026 is expected to exceed 12 million, driving an increase in new vehicle sales of over 2.6 million.

Editor-in-Chief: Cao Jiadong Editor: He Zengrong

THE END