Private Equity Frenzy: State-Owned Assets Stand Aloof! Behind JAC Motors' RMB 3.5 Billion Private Placement Lurks a High-Risk Bet

![]() 02/12 2026

02/12 2026

![]() 446

446

Source: Shenlan Finance

JAC Motors' long-anticipated private placement plan has finally materialized, raising a staggering RMB 3.5 billion in one fell swoop. Notably, prominent private equity magnates have made substantial bets, while state-owned capital has remained conspicuously absent.

Since last year, the million-dollar luxury car, the 'Jianghuai-made' Zunjie S800, has been flying off the shelves. Yet, the company's financials continue to hemorrhage. Burdened by high debt and tight operating cash flow, its market capitalization has nonetheless soared past RMB 120 billion, reaching an all-time high!

It's a high-stakes gamble! Private equity tycoons are wagering heavily, and secondary market investors are following suit. But can JAC Motors become the next Seres? Everyone is eager to find out.

1

Private Equity Titans Invest Heavily, State-Owned Capital Stays on the Sidelines

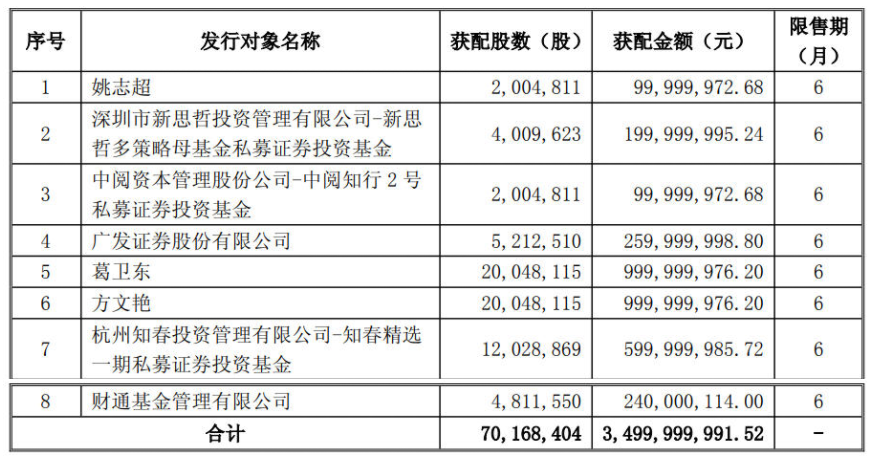

On the evening of February 10, JAC Motors (600418.SH) unveiled its private placement issuance report. The announcement revealed that JAC Motors issued a total of 70.1684 million shares to eight investors, including Ge Weidong, Fang Wenyan, Yao Zhichao, Shenzhen Xinsizhe Investment, Zhongyue Capital, Hangzhou Zhichun Investment, GF Securities, and Caitong Fund. The shares were issued at RMB 49.88 each, raising a total of approximately RMB 3.5 billion with a six-month lock-up period.

Remarkably, in this private placement, the largest subscription amounts came from individual investors Ge Weidong and Fang Wenyan. According to reports from multiple media outlets, including 'Red Star News,' Ge Weidong is a renowned investor, and Fang Wenyan is the spouse of 'super bull investor' Zhang Jianping. The two invested nearly RMB 1 billion each, subscribing for approximately 20 million shares, and became tied as the 8th largest shareholders of JAC Motors post-issuance, each holding a 0.89% stake.

Shenlan Finance also discovered through Tianyancha that Hangzhou Zhichun is wholly owned by Shenzhen Zhichun, whose major shareholder is Wang Yumei, holding a 78% stake. 'Well-known bull investor' Zhang Jianping holds a 10% stake in Shenzhen Zhichun. Wang Yumei is the founding partner of Atlas Capital, specializing in investments in the internet, consumer, and entertainment sectors. Hangzhou Zhichun's subscription amount in this round was approximately RMB 600 million.

From this perspective, Zhang Jianping is the undisputed 'big spender' in JAC Motors' private placement, investing a total of RMB 1.6 billion, including through associated enterprises, showcasing his optimism about this investment. Adding Ge Weidong's RMB 1 billion, the two tycoons have collectively poured RMB 2.6 billion into this high-risk venture.

Indeed, JAC Motors' private placement has been a turbulent journey.

In 2024, JAC Motors announced an ambitious plan to invest over RMB 20 billion in R&D over the next five years and launch more than 30 intelligent new energy vehicle products. For JAC Motors, with a struggling main business, fulfilling this investment commitment seemed like a pipe dream.

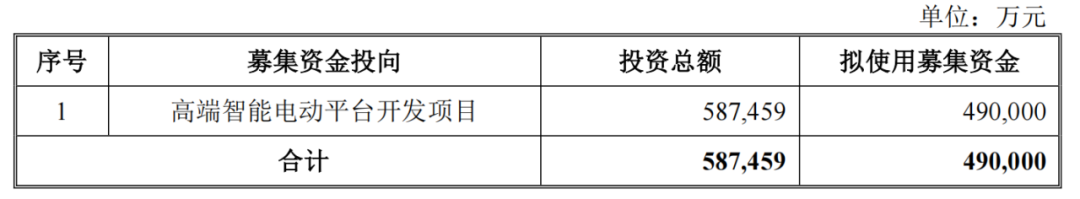

Thus, in September 2024, JAC Motors launched a massive private placement plan, aiming to raise up to RMB 4.9 billion. However, the scheme was delayed for an extended period.

On the evening of April 21, 2025, JAC Motors announced plans to reduce the fundraising amount by RMB 1.4 billion from the initial RMB 4.9 billion. Since 2024, JAC Motors has been incurring losses, and for investors, its collaboration with Huawei is the primary draw.

A crucial milestone came in June 2025 at the 'Future Mobility Pioneers' event, where JAC Motors and Huawei unveiled the first model of their collaboration, the Zunjie S800, priced between RMB 708,000 and RMB 1.018 million. Regarding this pricing, Yu Chengdong later admitted, 'Before the Zunjie's launch, I was very apprehensive, worried it wouldn't sell.'

However, the Zunjie's sales continued to climb post-launch, instilling confidence in investors.

Nevertheless, Shenlan Finance noted that the major shareholder, JAC Holdings, did not participate in this private placement. The only investor with state-owned background, Caitong Fund, subscribed for only RMB 240 million. The main participants were private equity tycoons. This situation suggests that capital remains cautious towards JAC Motors, primarily due to its severe financial losses.

2

Persistent Losses, High-Risk Bet on Ultra-Luxury Cars

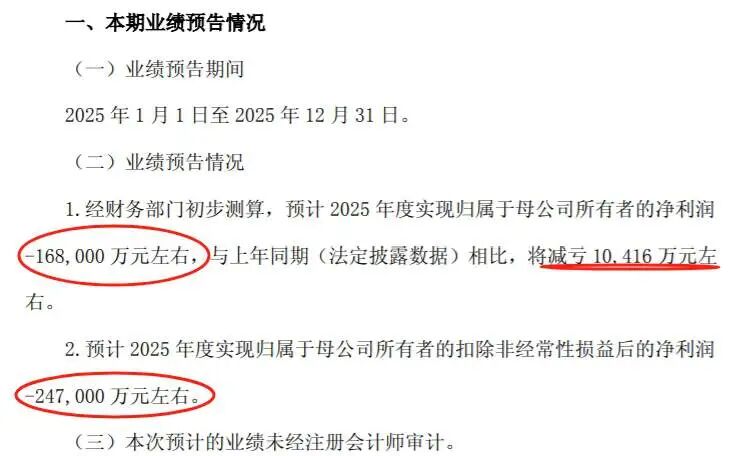

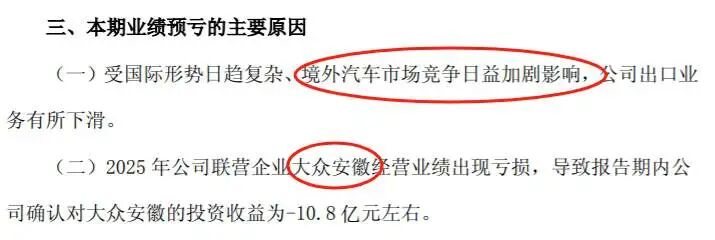

According to JAC Motors' 2025 annual performance forecast released on January 17, the company expects a net loss attributable to shareholders of RMB 1.68 billion for the year. In 2024, the net loss was RMB 1.784 billion, indicating a reduction in losses by approximately RMB 100 million in 2025 compared to the previous year. However, the net loss attributable to shareholders after excluding non-recurring items is expected to be RMB 2.47 billion, revealing even more severe actual losses in the company's core business.

Regarding the reasons for the losses, JAC Motors cited a decline in its export business, attributing it to increasingly fierce competition in the overseas automotive market.

However, leading domestic automakers such as Chery, BYD, SAIC, Changan, Great Wall, Dongfeng, and GAC have all achieved significant growth in their export businesses. Ultimately, it boils down to JAC Motors' inability to compete with its peers in the export market.

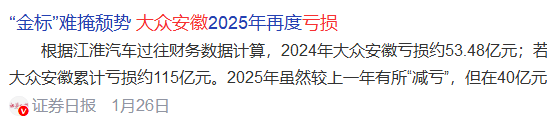

Secondly, the performance of the associated enterprise 'Volkswagen Anhui' fell short of expectations, leading JAC Motors to recognize an investment loss of RMB 1.08 billion. Volkswagen Anhui is Volkswagen Group's first joint venture in China focused on new energy vehicles, currently with only one main model on sale, the 'Zhongyu 06,' with cumulative sales of less than 10,000 units in 2025. Based on JAC Motors' 25% stake in the joint venture, Volkswagen Anhui's losses in 2025 are estimated at approximately RMB 4.32 billion.

According to calculations by 'Securities Daily' based on JAC Motors' past financial data, Volkswagen Anhui incurred losses of approximately RMB 5.348 billion in 2024. Adding the losses of RMB 1.8 billion in 2023, Volkswagen Anhui's cumulative losses over the three years from 2023 to 2025 amount to approximately RMB 11.5 billion.

Some analysts stated that in the new energy era, the alliance between Volkswagen and JAC Motors has failed to achieve a synergistic effect of '1+1>2.'

For JAC Motors, its commercial vehicle business performs moderately, while its passenger vehicle business struggles to gain an edge in the fierce market competition due to insufficient product competitiveness. The performance of the joint venture Volkswagen Anhui has also fallen short of expectations, even becoming the primary culprit dragging down the company's performance. Under the combined impact of multiple factors, JAC Motors has sustained losses in recent years, leading to a continuous shrinkage of its net assets.

Financial data shows that JAC Motors' net assets were RMB 15.242 billion at the end of 2021, but by September 2025, they had fallen to RMB 9.929 billion, equivalent to a loss of RMB 5.3 billion for shareholders over four years.

To fully promote its transformation, JAC Motors' outstanding bills payable and accounts payable have accumulated to RMB 22.808 billion, with current liabilities reaching RMB 32.167 billion and total liabilities amounting to RMB 37.309 billion, resulting in a debt-to-asset ratio as high as 77.45%. In the first three quarters of 2025, the company's operating cash flow was negative RMB 2.448 billion, highlighting significant financial pressure.

Therefore, under the dilemma of the main business's inability to effectively 'generate blood' and the joint venture's continuous 'blood loss,' if the Zunjie fails to succeed, JAC Motors' high-risk bet may end in a complete loss.

3

Conclusion

In May 2025, the first 'Jianghuai-made' Zunjie S800 was officially launched, priced between RMB 708,000 and RMB 1.018 million. Initially, few in the market were optimistic, with skepticism and ridicule dominating.

However, after its launch, the Zunjie S800's sales continued to rise: 1,006 units delivered in August, increasing to 1,896 units in September, 1,970 units in October, surpassing 2,200 units in November, and exceeding 4,300 units in December... leaving traditional ultra-luxury models like the Porsche Panamera, BMW 7 Series, and Maybach S-Class far behind.

The Zunjie has initially succeeded. However, even with rising sales, it will not be easy for JAC Motors to achieve a turnaround and profitability.

Shenlan Finance takes Seres as a reference: In 2021, Xiaokang Corporation (the predecessor of Seres) released its first annual report after collaborating with Huawei on the AITO Wenjie M5, incurring a massive net loss of RMB 1.824 billion due to significant R&D and production capacity investments. In 2022, Seres incurred another loss of RMB 3.832 billion, and in 2023, the loss narrowed to RMB 2.45 billion. After four consecutive years of cumulative losses nearing RMB 10 billion, Seres finally turned a profit in 2024, earning RMB 5.946 billion, primarily due to the hot sales of the Wenjie M7 and M9. In the first three quarters of 2025, the company continued to earn RMB 5.312 billion in profits.

From Seres' case, despite the initial success of the Zunjie S800, JAC Motors still has a long way to go for a complete turnaround, and its subsequent performance will depend on market feedback for more new products.

Starting this year, Huawei's automotive resources will be more dispersed: In addition to the five 'Jie' series - Wenjie, Zhijie, Xiangjie, Shangjie, and Zunjie - there are also the 'Jing' series - Huajing, Qijing, and Yijing - under Huawei's BU mode, as well as cooperative models like Avita and Arcfox. The overlap among peer products continues to increase, and market competition is becoming increasingly fierce.

Therefore, at the beginning of 2026, Xiang Xingchu, the Party Secretary, Chairman, and General Manager of JAC Group Holdings, led a team to Shenzhen to visit Huawei's founder Ren Zhengfei and others, personally presenting a Zunjie S800 car model. Some analysts pointed out that this move aims to secure more Huawei-related resources for the Zunjie.

This year's new car plans for the Zunjie have also been revealed. It is rumored that one is an SUV targeting the Land Rover Range Rover, and the other is an MPV targeting the Lexus LM. If these two products also achieve success, the 'Jianghuai-made' Zunjie will have the potential to become China's most successful million-dollar luxury brand.

Do you think the Zunjie has succeeded? And how do you view this high-risk bet by private equity tycoons?

Shenlan Finance New Media Cluster originated from the Shenlan Finance Journalist Community and has a 15-year history. It is a well-known domestic finance and economics new media outlet, with accounts focusing on China's most valuable companies, cutting-edge industry developments, and emerging regional economies, providing valuable content for investors, corporate executives, and the middle class. Welcome to follow.