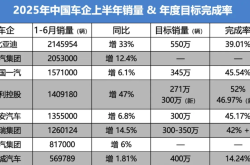

China's largest auto group encounters setbacks: Sales plummet by 2 million vehicles, market value evaporates by 270 billion yuan!

![]() 06/17 2024

06/17 2024

![]() 457

457

Who could have imagined that SAIC, which has been China's largest auto group for 18 consecutive years, would experience a stunning drop of 2 million vehicles in sales and a market value evaporation of 270 billion yuan in just five years.

Success came from joint ventures, and failure also came from joint ventures. The time left for SAIC to turn things around is truly limited.

1. Sales plummet by 2 million vehicles in five years

In 2006, SAIC Group sold 1.224 million vehicles.

As a local state-owned automaker, SAIC surpassed FAW, Dongfeng, and Changan, the three major state-owned automotive enterprises, to become China's largest auto group and held this leading position for 18 years.

In 2018, under the influence of multiple factors such as "dual credit" and "National VI emission standards," the Chinese auto market entered a winter.

However, SAIC defied the trend and sold 7.0517 million vehicles that year, approximately equal to the combined sales of FAW and Dongfeng. Every four new cars sold nationwide came from SAIC.

But after the high point and peak, SAIC's sales entered a downward spiral. By last year, SAIC Group's annual sales had declined for five consecutive years.

In 2023, SAIC's sales were 5.0209 million vehicles, still the top-selling auto group in the country, but a staggering drop of 2.0308 million vehicles compared to five years ago.

It is worth noting that SAIC's sales in 2013 were 5.1058 million vehicles. SAIC's sales last year were roughly the same as ten years ago, or even less.

In other words, from a sales perspective, SAIC has gone back to where it was ten years ago, stagnating for a decade.

2. Market value evaporates over 270 billion yuan

Horizontally compared, SAIC is still China's largest auto group, but vertically compared, the foundation of this "super leader" is far from sufficient.

At its peak sales moment in 2018, SAIC's total revenue reached 902.2 billion yuan, not only leading the auto industry but also a giant even when compared across industries - equivalent to three and a half Alibabas. The combined revenue of the top 60 enterprises in Shanghai only equals SAIC.

In this year, SAIC's net profit reached 36.01 billion yuan. In March of that year, SAIC Group's market value reached nearly 440 billion yuan, attracting much attention.

However, with the continuous decline in sales, SAIC's revenue in 2023 dropped to