The 200,000 yuan price tag is unholdable, as extended-range models see depreciation

![]() 06/20 2024

06/20 2024

![]() 539

539

The year 2024 is highly competitive, so when the auto market suddenly experiences a half-month slump, many people are unaccustomed to it.

The reason it is called a sudden slump is because the traffic drop was almost unpredictable. At the end of May, first it was BYD Qin L, followed by Wenjie M7 Ultra, both of which achieved significant order volumes, too large to be easily disclosed, and the M7 Ultra sold over 12,000 units on its launch day.

However, after entering June, the auto market suddenly shifted into a calm period. Four new extended-range technology models were launched in succession, but they did not create a significant public opinion peak. Notably, extended-range is currently the hottest segment in the auto market and is considered a sales magic weapon by automakers. While the auto market's May sales volume declined by 2.8% year-on-year compared to 2023, extended-range models bucked the trend, increasing by over 100% with wholesale sales of 91,000 units, a growth of 105%, with Huawei-affiliated brands and Lixiang selling well.

Nonetheless, despite 618 promotions and the successive launches of new extended-range models, what sparked a small sales ripple in the auto market was the release of suppressed shopping desires among many parents after the college entrance exam. If the child performs well, the budget for buying a car will increase, or even a commuter car may be gifted to the child. If the child's performance is not optimistic, then whether to change cars or how much to spend on a new car becomes another topic of discussion.

In short, June 2024 is truly different from previous years. It is no longer like the 618 in 2023, when models like the Song PLUS Champion Edition, Honda CR-V, Buick E4, and four other brand-new cars flooded the market all at once. Instead, it has transformed into an era of cold gunshots.

LOOKAR: In 2023, extended-range models safeguarded the 300,000 yuan price tag, while in 2024, it is protecting the 200,000 yuan mark.

The technology is popular, car prices are cheaper, and sales of extended-range models are booming, but it is becoming difficult to maintain previous prices.

The Great Bay Area Auto Show, the traffic was centered on Yu Chengdong;

The Chongqing Auto Show, the traffic was centered on the chairmen of Changan Automobile and GAC Group, as well as Li Xiang, the founder of NIO, who is directly involved in autonomous driving.

Regarding car traffic, a small portion fell on four SUVs, and their commonality is not surprising: extended-range.

On June 13, Deepal's medium-to-large SUV, the G318, was launched, with a starting price of 175,900 yuan for the two-wheel drive version and 199,900 yuan for the four-wheel drive version. Even with the addition of air suspension, the price does not exceed 230,000 yuan.

On June 14, the LANVIGATOR FREE 318 was launched, with a price range of 228,900 to 266,900 yuan. During the initial sales period (the earliest period attracting consumers), the prices were reduced by 9,000 yuan and 19,000 yuan respectively, resulting in a final price of 219,900 yuan for the two-wheel drive version and 247,900 yuan for the four-wheel drive version.

On June 14, the Dongfeng eπ008 was launched, with a guidance price of 216,600 yuan for both the extended-range and pure electric versions. After a series of official subsidies and preferential policies, the limited-time purchase price with a refrigerator and TV included is 188,600 yuan. If one desires a sofa, it is not expensive, with an optional zero-gravity seat for an additional 6,000 yuan. This achieves a fully equipped car except for intelligent driving, which is quite impressive.

On June 17, the confidentiality agreement for the Leapmotor C16 test drive expired, revealing that the fully equipped price will not exceed 200,000 yuan, with a likely starting price of 150,000 yuan. It was previously referred to as a half-price version of the Lixiang L7.

In summary, the successive launches of the above four models are all telling consumers one thing: the prices of new extended-range technology models are declining.

In 2023, extended-range models were still safeguarding prices above 300,000 yuan, but by 2024, they have directly plummeted to within 200,000 yuan.

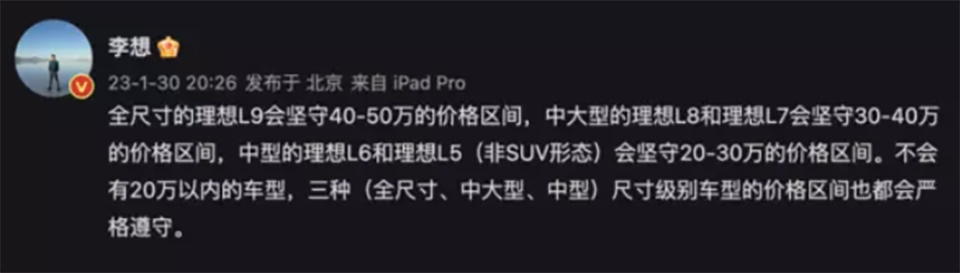

Returning to the data from 2023, apart from Li Xiang personally stating on Weibo in January 2023 that the key information on Lixiang Auto's fourth-quarter financial report conference call was that Lixiang would not release models priced below 200,000 yuan in the next five years, its average vehicle price in 2023 was 320,000 yuan, and 331,000 yuan in 2022. The launch of the Lixiang L7 somewhat lowered the average price.

As for the Wenjie M7, it was the first to lower its price from 300,000 yuan to under 250,000 yuan in September 2023, which was crucial to Huawei's revival in the automotive sector that year.

In general, some have already suggested that "by looking at the latest new car prices, you can tell how much Lixiang and Huawei earn from each car." Many consumers are also confused about what the price of extended-range models should be.

Length, width, and height are 4905*1950*1645mm, with a wheelbase of 2960mm, which are the dimensions of the 200,000-250,000 yuan LANVIGATOR FREE 318;

Length, width, and height are 5002*1972*1732mm, with a wheelbase of 3025mm, which are the dimensions of the 216,600 yuan Dongfeng eπ008;

Length, width, and height are 5010*1985*1895mm, with a wheelbase of 2880mm, which are the dimensions of the hardcore off-road Deepal G318;

Length, width, and height are 4915*1905*1770mm, with a wheelbase of 2825mm, which are the dimensions of the fully equipped Leapmotor C16, priced at no more than 200,000 yuan.

The maximum difference in length is no more than 10cm, and the maximum difference in width is no more than 8cm, but the prices of the four are roughly similar. In contrast, the best-selling Wenjie M7 and Lixiang L6 currently offer body dimensions of 4925*1960*1735mm and a wheelbase of 2920mm for the L6, and 5020*1945*1760mm and a wheelbase of 2820mm for the M7.

With almost the same body size and similar styling, the pricing can differ by 50,000 yuan, or even up to 100,000 yuan. This situation is far more intense than the SUV competition among Chinese brands a decade ago, when they could still differentiate themselves with different features, such as哈弗H6 being safer, CS75 having higher configurations, and Ruifeng S7 being cheaper.

LOOKAR: After dipping below 200,000 yuan, has the price of extended-range models hit bottom?

In summary, extended-range models can no longer maintain high prices, and it is difficult to replicate cases like the Look U8 and Wenjie M9.

So, the next question is: has the price of extended-range models preliminarily hit bottom? In the segment of medium-to-large SUVs and above, the answer is yes.

Like price declines in other markets, consumers will pay close attention to how the benchmark prices in submarkets perform. The prices of the best-selling models determine the upper limit of the entire submarket.

Obviously, the pricing power of extended-range models in this segment has been firmly fixed by the 290,000 to 330,000 yuan price tag of the Wenjie M7 Ultra and the 250,000 to 280,000 yuan of the Lixiang L6. Just as in the pure electric segment, models in the same submarket as Tesla will default to being several thousand yuan cheaper than the Model 3 and Model Y, even models like Xiaomi SU7, which have mastered the traffic password, or the rapidly rising Zeekr, follow the same principle.

In summary, the downward trend in extended-range pricing is irreversible. To increase prices, automakers can only rely on increasing vehicle size and strengthening intelligent configurations. Discussing whether extended-range is backward is meaningless, as long as there is consumer market recognition, it has value. However, the low technical threshold of series-parallel hybrid technology is an undisputed fact about extended-range.

Therefore, unlike pure electric and plug-in hybrid models, which can be differentiated in terms of electricity consumption, fuel consumption, number of gears, fast charging, or battery swapping, to distinguish technical advantages and create consumer perception gaps. From a purely technical perspective, extended-range models can only do two things: first, stack relatively larger batteries to provide 200 km or even higher pure electric range; second, optimize the range extender to improve power generation efficiency. Currently, the industry's better numbers are that Chang'an's new Blue Whale super range extender can achieve 3.63 kWh of electricity generation per liter of fuel, while Wenjie's range extender can achieve 3.13-3.44 kWh per liter, and Lixiang's 1.5T four-cylinder range extender can also achieve over 3 kWh per liter.

Therefore, even with these differences, the gap is much smaller than that of plug-in hybrids or pure electric models. In the new energy era, with the support of electric motors, it is easy for automakers to achieve a 0-100 km/h acceleration time of less than 8 seconds for extended-range family cars. The difference in power generation between range extenders is not significant, and the resulting difference in fuel consumption per 100 km is only about 0.5L. However, the scenario where one can truly compare technical capabilities is one that most people will hardly encounter in their lifetimes. That is, running out of pure electric range and relying solely on the range extender to generate power, seeing who has relatively lower energy consumption.

As a result, the entire competition has entered an era of comparing configurations. Unless a company can establish a very unique moat, they can only compare who provides more generous features like refrigerators, TVs, and sofas.

For example, the newly launched Dongfeng eπ008. With a guidance price of 216,600 yuan, it offers a pure electric range of 210 km under CLTC conditions and comes with almost all the benefits upon launch. It includes double-layer laminated soundproof glass, a movable smart refrigerator, a 15.6-inch rear entertainment screen, and headrest and lumbar support. In other words, apart from not having four-wheel drive or urban NOA, this car already has everything the current market demands.

The most crucial point is that its limited-time price is less than 190,000 yuan. Although this