''' The poor sales of joint ventures are blamed on the lack of new cars

![]() 06/27 2024

06/27 2024

![]() 472

472

After the gradual release of college entrance examination scores, it becomes clear that the underlying logic in China is screening rather than selection, and the same is true for the automotive industry.

"Honda will soon have a car as large as the Lixiang L9, equipped with plug-in hybrids, 7 seats, large sofas, TV sets, and more." Although no spy photos have leaked, accurate information from our sources has already proven that leading joint venture automakers are preparing for the next round of counterattacks.

With fluctuations in sales, the public opinion field has, as usual, entered a widespread speculation that XX is not doing well. It's not surprising that public opinion would speculate, as sales figures show that most are declining, and the previous best-selling models' ranking order has been disrupted, revealing new consumption patterns. On the other hand, despite the industry shouting the slogan of transformation since 2018, the upgrade scale of new car models is insufficient, and the number of new cars launched is also inadequate.

Moreover, a new trend is emerging. With the initial pause of the price war and the difficulty for the entire industry to recover in the short term, more and more automakers are turning to the next logic, using an unconventional number of new cars to overwhelm their competitors and break through with a sea of cars strategy.

LOOKAR's small number of new cars is the main reason for the difficulty in selling joint ventures

Layoffs, factory closures, fluctuating sales, the rise of new energy vehicle sales, and the decline of gasoline car sales have jointly shaped a new perception of Chinese car consumption. The current main tone of public opinion is that buying a joint venture car is not as good as buying a domestic car, buying a gasoline car is not as good as buying a new energy car, buying a pure electric car is not as good as buying a plug-in hybrid/extended-range car, and buying a car with intelligent driving is not as good as buying a Huawei car.

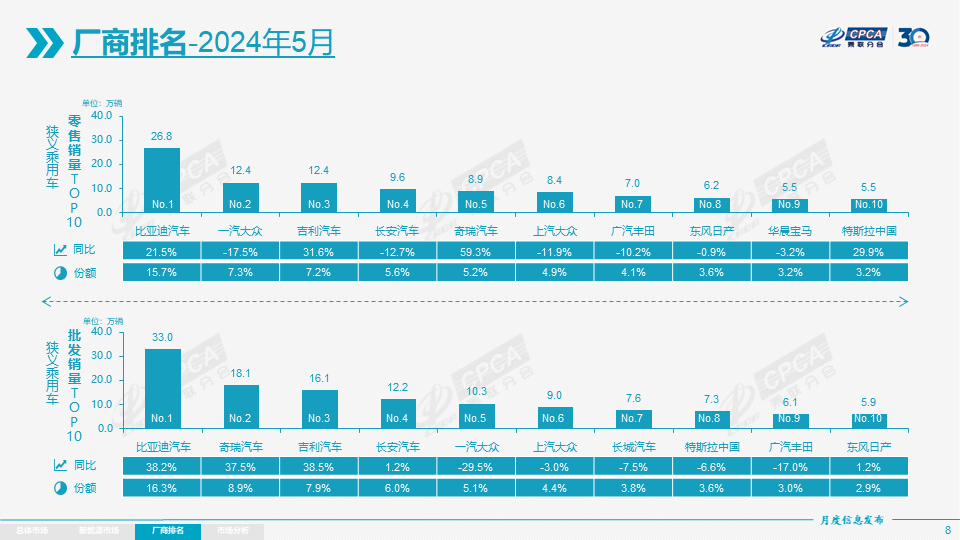

From a sales perspective, indeed, all patterns are changing. As 2024 nears its halfway mark, the main results from January to May are:

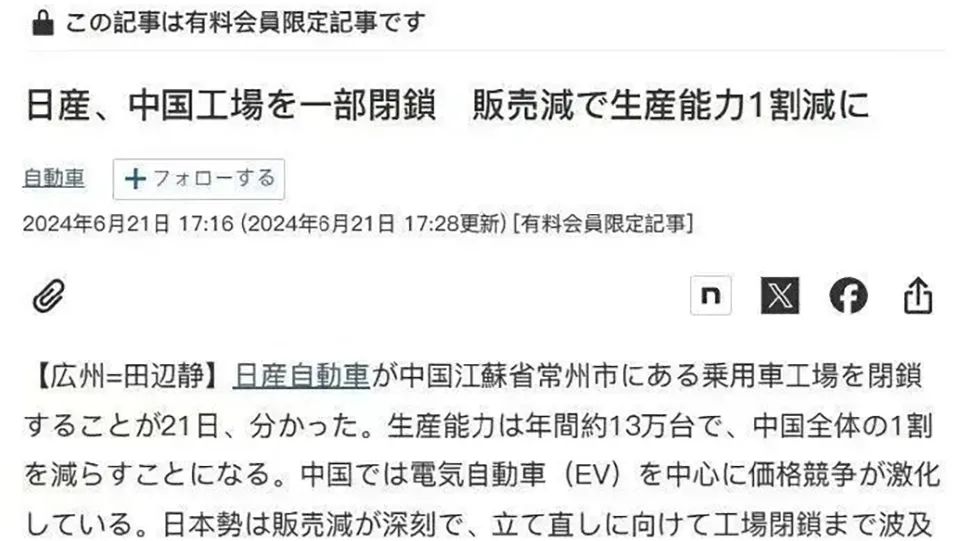

1. In terms of wholesale sales, Japanese and American cars are being rapidly replaced by domestic cars. In the TOP 10 lists for 2023 and 2024, GAC Toyota and SAIC GM disappeared, while Great Wall Motors (384,000 units) and Dongfeng Nissan (280,000 units) took their places. Moreover, the Matthew effect in the wholesale sales sector is becoming increasingly prominent, with significant growth in the sales of the top four in the TOP 10. BYD sold 270,000 more vehicles than the same period last year, while among the 5th to 10th places, Tesla experienced a decline of 27,200 units;

2. In terms of retail sales, Japanese and American cars continue to be overtaken, but the protagonists differ from wholesale sales. In retail sales, FAW Toyota and SAIC GM fell out of the top 10, and GAC Toyota's sales ranking dropped from sixth in 2023 to seventh, selling 50,000 fewer cars;

3. The variability of new energy retail sales is even greater. Geely doubled its sales from January to May 2024, replacing Tesla with 242,000 units, while Tesla slipped to third place. Changan grew by 108.8%, and the explosive Wenjie surged from outside the list to seventh place. NIO and Nezha left the TOP 10, replaced by Great Wall and Chery.

The main reason for the changes in sales figures is the further erosion of gasoline cars. According to data from the China Passenger Car Association, the total market volume of traditional gasoline cars from January to May was 4.82 million units, a year-on-year decrease of 9%, while the sales of new energy vehicles reached 3.895 million units. In some single weeks, the number of new energy insurance policies exceeded that of gasoline cars. Therefore, joint venture brands that have been in the gasoline car market for over 20 years have lost their basic market.

Of course, human groups' judgment of a thing is not only about the current situation but also about forward-looking. After the gradual failure of direct price reduction, only the launch of new cars can better stimulate consumers, and this level of competition has also led to a new intensity.

The transformation of joint venture cars basically follows their global pace. For example, taking SAIC GM on June 25 as an example, it was stated during the live broadcast that many automakers launch new cars every 2-3 years, but SAIC GM will not launch them until the testing is complete, with standards in place.

Breaking down the German brands, FAW-Volkswagen has several important new cars in 2024, including the Magotan replacement and the mid-term facelift of the Golf. SAIC Volkswagen has more, with three models, including the Passat, Tharu XR, and the new Polo. Plus Volkswagen Anhui, which has completed its controlling stake, will also launch a total of 8 models, including the Volkswagen ID.UNYX and others.

BMW's numbers are not many, with more focus on the localization of new-generation models in 2025. The largest number of new cars will be introduced in the M segment, with a total of 10 new models, but they obviously cater to a minority consumer group.

Among the entire German brand sector, Mercedes-Benz has the clearest vision. In 2024, it will launch over 15 major new products in China, including the Maybach EQS SUV, GLC plug-in hybrid, and long-wheelbase E-Class plug-in hybrid. Therefore, it is evident that in public opinion, Mercedes-Benz's reputation is still quite good.

Japanese brands other than Honda also basically maintain a similar pace. FAW Toyota has three models, including the Crown, Prado, and a pure electric crossover. GAC Toyota has three models, in addition to the Camry replacement, its self-incubated Pozhi brand will test the waters with large-size pure electric sedans and SUVs. Dongfeng Nissan has two models, with the gasoline model being the Terragraphy derived from the Infiniti QX60, and the new energy model being the first of four locally developed cars, but there is no news yet.

Honda's changes are relatively significant. In 2024, Dongfeng Honda, in addition to the mid-term facelift of the Civic, will launch three all-new energy models. GAC Honda has not announced much, only mentioning the update of the second new energy vehicle from the e:NP brand, with no further announcements.

LOOKAR's Chinese brands' sea of cars strategy, dragging down competitors and killing joint ventures?

Living life mainly revolves around having something to look forward to, and the military march relies on the classic scene of quenching thirst with the hope of plums. Different companies will set KPIs or OKRs to incentivize efficiency or performance improvement, so the number of new cars represents the brand's explosive capabilities and gives people who want to buy a car something to look forward to.

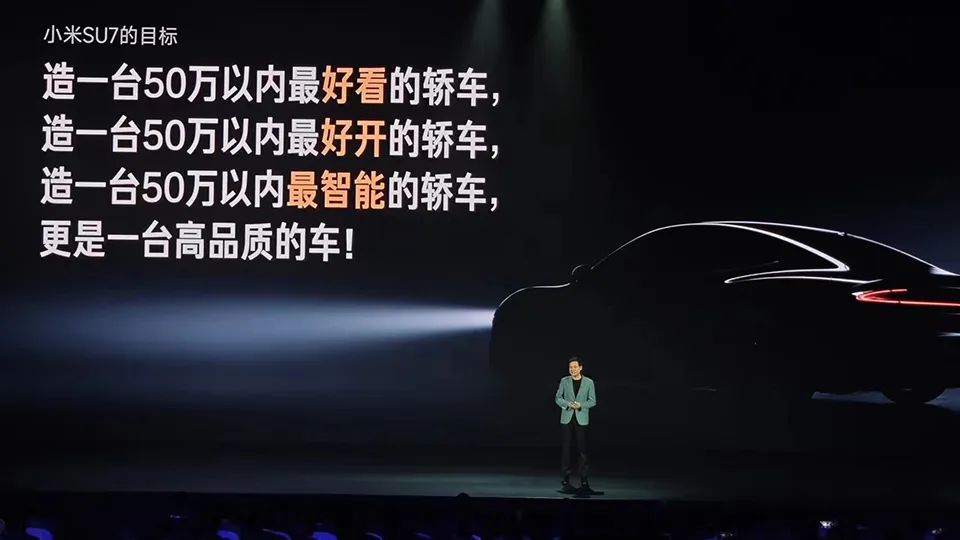

There are many examples. The Wenjie M9, which starts at less than 470,000 yuan, has gained immense popularity due to Yu Chengdong's redefinition of luxury cars within 10 million yuan. Lei Jun's Xiaomi SU7 news generated the most excitement with the claim of being the fastest mass-produced car under 500,000 yuan.

This frequent marketing approach is beginning to be widely used among Chinese brands, while transformation giants with better R&D reserves are also exploding in force.

As a result, the current situation is that domestic cars are launching new models at more than twice the efficiency (compared to joint ventures), effectively forming a sea of cars strategy.

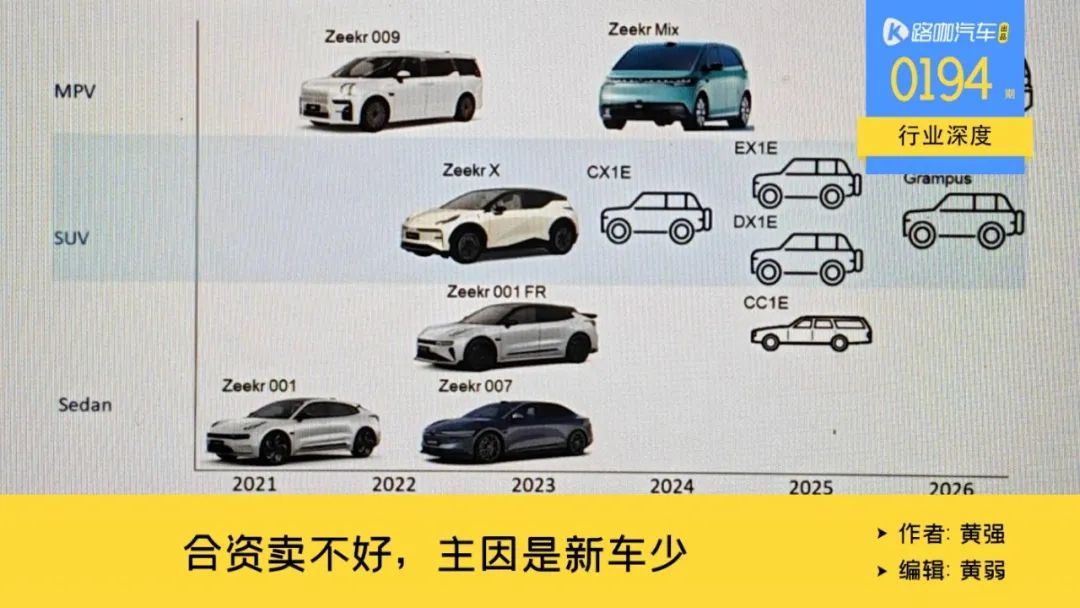

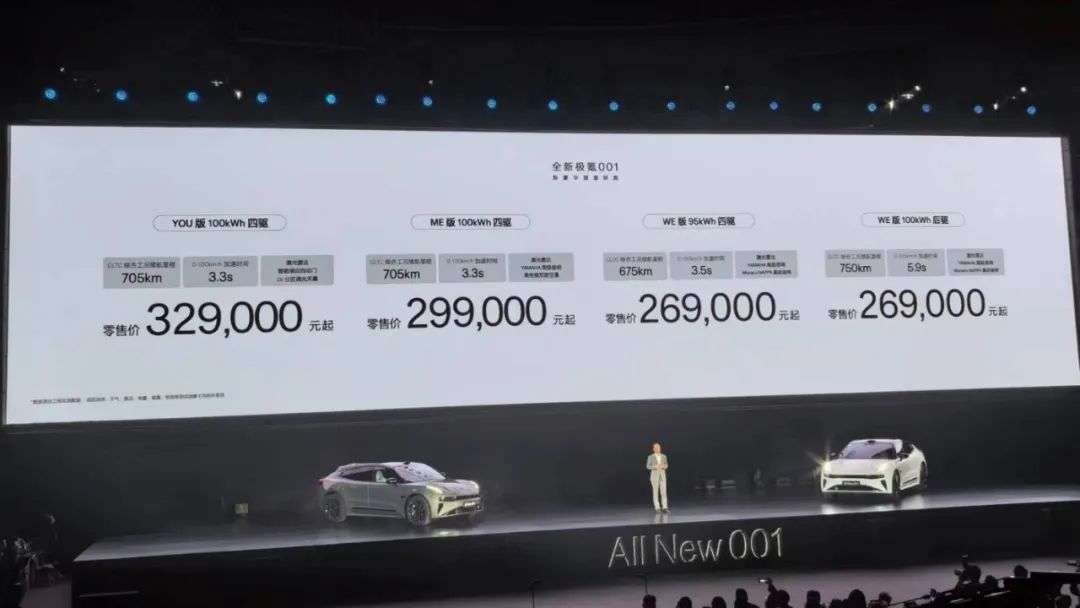

For example, the latest planning of ZEEKR revealed that in 2024, in addition to the Baby Bus MIX, CX1E, the biggest rival to the NIO ES6 and ZEEKR R7, will hit the market. And 2025 will be an even bigger product year, with EX1E, DX1E, and CC1E, which can be understood as pure electric rivals to the Wenjie M9, competitors to the off-road king, and new players in the pure electric travel car segment, respectively.

Moreover, although the number on the chart is similar to that of joint venture brands, the actual explosive power is much higher than that of joint ventures. Although ZEEKR 001 is not shown on the chart, it underwent a major facelift similar to a generation change in February of this year, indicating that ZEEKR has the ability to achieve a significant upgrade every two years, ultimately leading to a surge in orders and successfully sniping Xiaomi SU7.

Coupled with the launch of the ZEEKR 009 Glorious Edition and the launch of ZEEKR 007 at the end of December 2023, directly bringing sales into 2024, and in April, to withstand the competition from the launch of Xiaomi SU7, an enhanced rear-wheel-drive version with added configurations was introduced. To put it simply, ZEEKR has actually launched 5 major new cars in China in 2024, which equals the combined total of North and South Volkswagen.

Such cases are actually everywhere. For example, new news from Deep Blue Auto, Huawei, and BYD.

Deep Blue Auto will launch 3 new cars in the second half of 2024, plus the launch of the G318 in the first half of the year, for a total of at least 4 new products in a single year. Among them, one of the new cars is the Deep Blue S05, which is smaller than the current Deep Blue S7 and uses pure electric and extended-range technology. The entry-level version is likely to cost less than 120,000 yuan. The current Deep Blue S7 and Deep Blue SL03 are expected to be launched in the form of a generation change and renaming. Huawei's intelligence will empower the new cars, so this brand, which has only been launched for over 2 years, has exploded with 4 major new products in 2024, with a quantity twice that of Dongfeng Nissan.

Even more exaggerated is the rumored news of BYD's 2024 new car plan, as the fifth-generation DM appears, almost every model can carry the ability for major model changes or even generation changes.

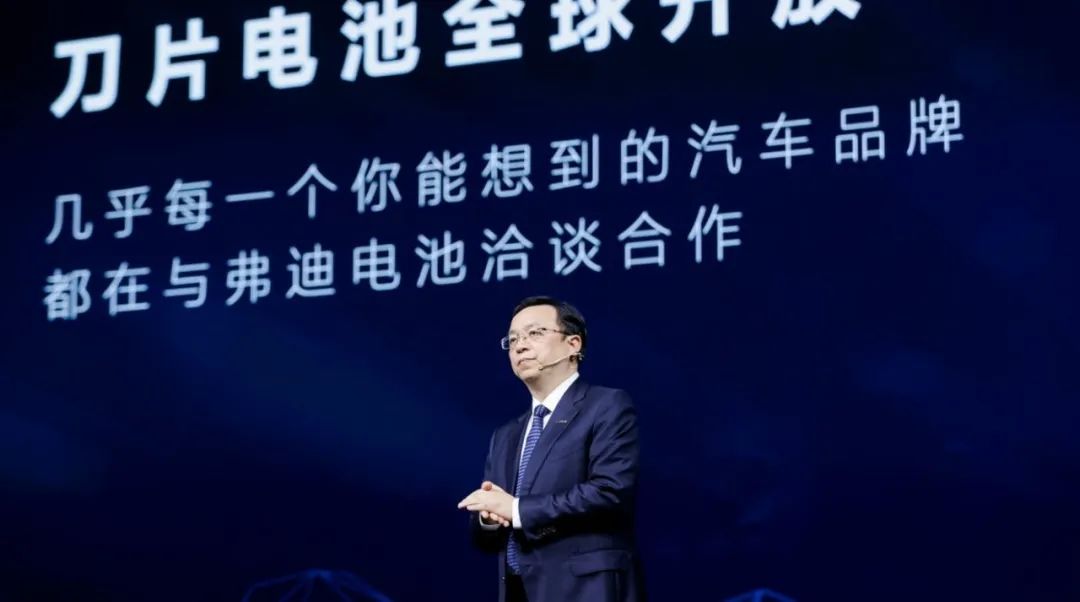

First is the most significant news, BYD's second-generation Blade Battery will debut, expected as early as August 2024. Therefore, as long as it is a new car equipped with the Blade Battery, it can have new selling points at the level of a generation change, with a quantity of over 20 models. The energy density will approach 200Wh/kg, and lithium iron phosphate can charge and discharge in low-temperature scenarios, surpassing many ternary lithium batteries.

The Seal 07 DM-i (facelift of the Seal DM-i), expected to be launched in September, has already had its application information released. The fifth-generation DM equipped with a 1.5T engine version will also appear, with a maximum drive motor power of 200kW and a maximum internal combustion engine power of 110kW. When the two are optimally driven together, the power performance figure can exceed 400 horsepower, surpassing the Audi S4's 3.0T. More importantly, the 1.5T engine matched with the fifth-generation DM can be used across the entire brand lineup, except for the仰望 series.

Moreover, rumors about BYD's Han L and Tang L are also increasing. The Tang L may be the size of the Lixiang L9, equipped with 6 to 7 seats, but at a price comparable to the Lixiang L6. HUD heads-up display and a new 160kW motor will become standard equipment for BYD's new cars in 2025.

If BYD is willing to combine the battery, the 1.5T fifth-generation DM, and keep up with vehicle hardware like refrigerators, TVs, large sofas, dad cars, or Huawei's technological executive style, it can create over 40 combinations.