The price war in the automotive industry enters the second half: "Financial War" is even fiercer than price cuts!

![]() 07/02 2024

07/02 2024

![]() 479

479

Halfway through 2024, I'm sure everyone has become accustomed to the price cuts of various star models during this period. Entering the second half of the year, when automakers realize that there's no more room to squeeze out product prices, they choose to take a different approach - starting with financial policies.

On July 1, Tesla China announced a new car purchase financial policy, offering 1-5-year interest-free and low-interest installment plans for Model 3 and Model Y models, and reducing the limited-time low-interest annualized interest rate for July to 0.5% or above. In addition to limited-time purchase discounts for its Geely Geometry G6 model, Geely Auto also provides five-year interest-free financial services and free/discounted options.

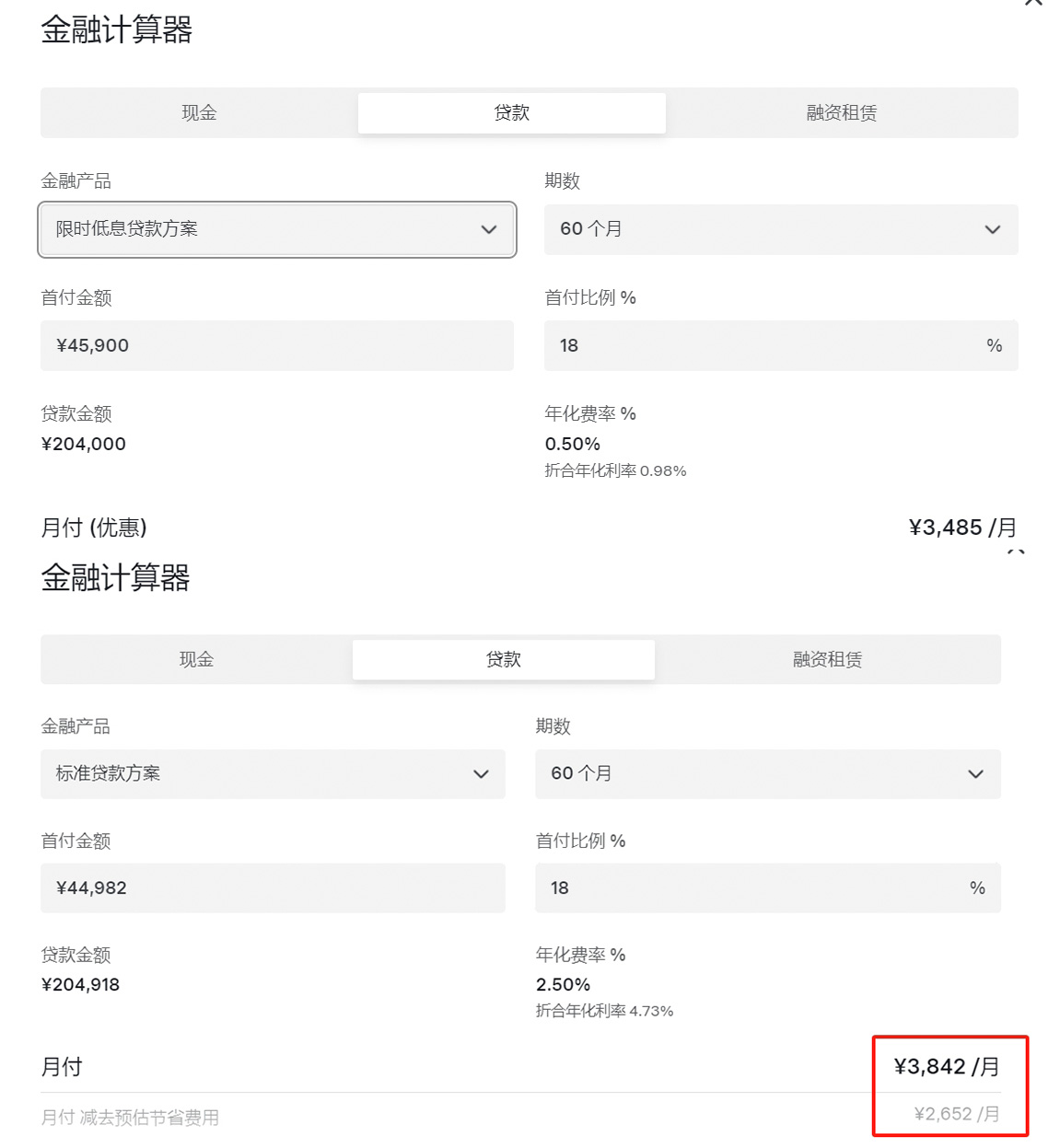

I'm sure everyone knows what "zero-interest" installment plans mean. Taking Tesla as an example, if you purchase a standard range Model Y in July, according to the official "limited-time 0% interest loan plan," you can enjoy zero interest as long as you can provide a 32% down payment (79,900 yuan). To enjoy the "limited-time low-interest loan plan," you need to provide at least a 18% down payment (45,900 yuan).

After a simple calculation, comparing the "limited-time low-interest loan plan" and the "standard loan plan," with the same 18% down payment and a term of 60 months, the "limited-time low-interest loan plan" can save 357 yuan per month, totaling 21,420 yuan over five years. Needless to say, the zero-interest loan plan is even cheaper.

Using a similar calculation method, we can also learn that automakers like Geely Auto and ZM-EV also offer similar discounts. Discounts of tens of thousands of yuan are essentially disguised price cuts by automakers, but it begs the question: in the fierce price war in the automotive market, Tesla could have followed the old method of attracting users through price cuts, but why only offer limited-time financial incentives?

"Direct price cuts" are difficult to predict

Tesla can be considered a "veteran" in price adjustments, with large and frequent adjustments. Looking across the global market, there is no other like it. Multiple price cuts in previous years easily caused dissatisfaction among new car owners, leading to protests and维权 actions, although these eventually subsided. However, these protests did have a certain impact on Tesla's reputation.

Regarding these price adjustments, Tao Lin, Tesla's Vice President of External Affairs, responded positively, stating that "at any given time, Tesla always offers consumers the best price." Additionally, Tesla CEO Elon Musk has a strong obsession with cost control, believing that "many people have demand but cannot afford it, and only price cuts can satisfy demand."

Of course, Tesla doesn't always reduce prices. In April this year, when the domestic automotive market was embroiled in a price war, Tesla went against the grain and directly increased the price of the Model Y. However, the resulting sales fluctuations were also evident. Data shows that Tesla sold over 60,000 vehicles in March, but the monthly sales in April dropped to just over 30,000, recovering to around 55,000 in May.

The prices of Tesla's Model 3 and Model Y have remained unchanged, ranging from 231,900-335,900 yuan and 249,900-354,900 yuan, respectively. But why don't automakers like Tesla and ZM-EV directly reduce prices and instead offer financial incentives like "zero interest"? In my opinion, there are two main reasons.

First, to improve market competitiveness while maintaining brand image. Tesla's main sales force in the domestic market is the Model 3 and Model Y, and these two high-volume models now face many competitors in the domestic new energy vehicle market. Model 3 needs to compete with models like the Xiaomi SU7, ZM-EV L6, and Zeekr 007, while Model Y faces competition from the Geely Geometry G6, Xpeng G6, and the upcoming ZM-EV R7 and LeDao L60.

Consumers have many options, and if every price adjustment results in a price cut, it may attract potential buyers. However, this is not always the case. No one wants to be "freshly harvested," so they might as well choose other competitive models. On this basis, relatively attractive financial plans can greatly stimulate potential buyers' consumption while avoiding the vicious cycle of a price war.

Second, Tesla's ability to squeeze costs may have reached its limit, leaving no room for price reductions. However, facing fierce domestic market competition, Tesla can only maintain high sales levels by finding new sales stimuli.

It's worth noting that Geely Auto not only introduced a corresponding "five-year interest-free" policy but also offered a limited-time cash discount of up to 20,000 yuan for its models. For Geely Auto, the Geely Geometry G6 can compete with the Model Y in many aspects, but there is still a significant gap in brand influence and sales volume. The official can only attract more users by offering discounts.

However, Tesla's single-vehicle profit has almost reached its lowest point under its current production technology and scale, and there is no significant competitive pressure. It has not yet reached the point where it needs to "sell cars at a loss." Musk once said that the ideal state is to make money through FSD, and the car itself can be unprofitable. However, the current FSD adoption rate is worrying, and losing single-vehicle profits is not conducive to Tesla's future development.

Combating the off-season becomes the core proposition

After automakers introduce zero-interest financial incentives, they may quickly attract consumers in the short term. But frankly, such financial policies also bring risks to automakers.

Financial incentives often mean that automakers need to bear higher financial costs because zero-interest incentives mean automakers bear the loan interest for users. Moreover, most automakers rely solely on car sales as their only business. Without other value-added services to hedge against the cost of interest subsidies, these loan interests will only increase automakers' financial pressure, thereby reducing profitability.

Of course, weaker profitability is not a big deal for a well-known automaker. What automakers care most about is sales.

In my opinion, compared to competing on price and configuration, competing on financial policies will only exacerbate the vicious cycle of the automotive market price war. When multiple automakers follow suit with corresponding financial policies, they indeed offer consumers significant discounts. However, this will only attract consumers who were already considering purchasing their models and not potential buyers of other models. Of course, financial policies like "zero-interest incentives" are limited-time offers, so such extreme situations are unlikely to occur.

Why did automakers launch new incentives in July? July is traditionally an off-season for the automotive market, with weak consumer demand for car purchases. Additionally, there are no large international auto shows during this period, and many important models scheduled for release in the second half of the year have already been announced at large auto shows in the first half. In other words, automakers' purpose in rolling out financial policies is simply to boost sales figures.

Therefore, it is almost certain that other automakers will follow suit and introduce corresponding financial policies. However, the possibility of joint-venture brands introducing "zero-interest" financial plans is not high.

On the one hand, the business segment of car sales personnel is not just selling cars but also increasing the financial penetration rate of car dealerships. At this stage, most joint-venture brands already offer significant discounts, so they may introduce limited-time "low-interest" financial plans, but "zero-interest" financial plans have a significant impact on corporate profit margins.

On the other hand, unlike Tesla and Geely Auto's direct sales models, joint-venture brands mostly adopt a dealer agency sales model. This model essentially determines that dealers cannot recommend zero-interest car loans to users. The car loan interest rate provided by financiers is merely the "wholesale price" for automakers, and dealers need to mark up the price two or even three times to obtain greater profits.

Of course, facing this automotive market price war, joint-venture brands have already put in enough effort. Competing on price is fine, but they cannot compete with new energy automakers on financial policies, as the dealer agency system is too powerful and they cannot sacrifice their own interests for sales.

Source: Leitech