The Great Battle of New Energy Vehicles, "Monthly Sales of 20,000" Becomes the "Lifeline" for New Forces

![]() 07/03 2024

07/03 2024

![]() 677

677

From the sales figures in June, some achieved new highs while others struggled to break through.

Entering a new month, various automakers will rush to release their latest performance reports, but perhaps coinciding with the halfway mark of 2024, the speed at which automakers announce their results has been significantly faster than in previous months.

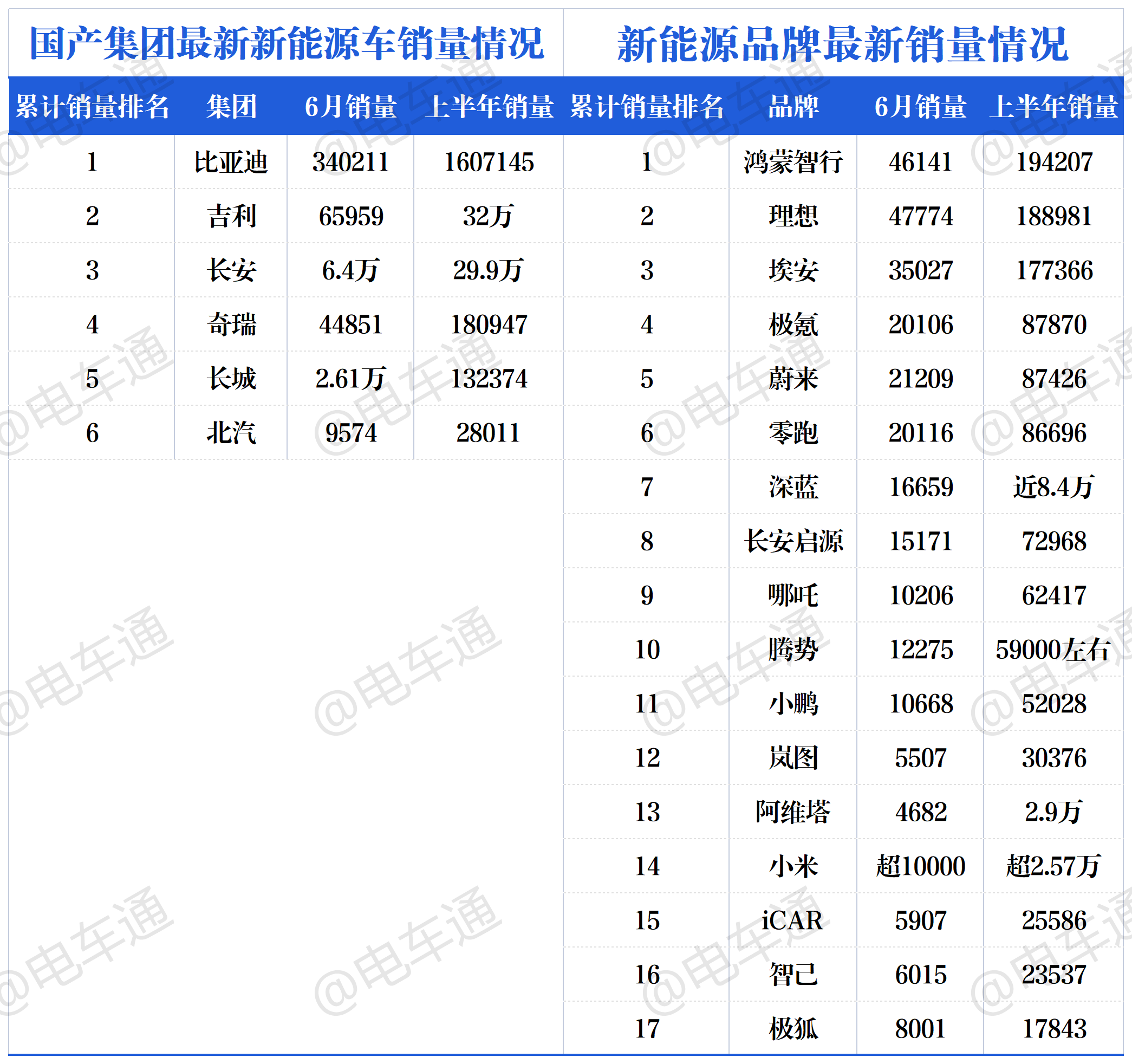

To help everyone see the new energy sales data of various automakers more clearly, Xiao Tong has ranked the sales based on both groups and brands, and the specific data is shown in the figure below.

From Xiao Tong's statistics on the new energy sales ranking, although a few new energy automakers have seen a decline in ranking or sales, most new energy automakers have experienced a surge in sales, making it easy to explain why the speed of announcing the ranking is faster than in previous months. In addition, Xiao Tong has also noticed that there are more new faces among new energy automakers with monthly sales exceeding 20,000 vehicles, perhaps indicating that the competitive landscape of the domestic new energy vehicle market is entering a new phase.

The "Annual Champion" of New Forces is Basically Locked In

Since the end of last year, the competition between HarmonyOS Smart Mobility and Li Auto has entered a white-hot stage. Initially, HarmonyOS Smart Mobility relied on the Wenjie M7 model to compete with Li Auto's L series. In the first half of 2024, HarmonyOS Smart Mobility's Wenjie and Li Auto's L series are still the basic sales of their respective brands, and they have already enjoyed a certain position in the high-end new energy SUV market.

Based on current results, Li Auto's product matrix mainly relies on the L series, while HarmonyOS Smart Mobility, in addition to Wenjie and Zhijie, also has the upcoming Xiangjie, which has a broader market audience than Li Auto. At the beginning of this year, Zou Liangjun, Senior Vice President of Li Auto, said that the company would launch three high-voltage pure electric models this year, but based on Li Auto's current energy replenishment system and subsequent actions, Li Auto is likely to rely mainly on the L series for sales this year to compete with Wenjie's three M series models.

In the end, the competition between these two major new forces brands will likely depend on which of the Li Auto L series and Wenjie M series is more powerful.

AION's sales have declined month-on-month for five consecutive months, and it no longer has the ability to easily exceed 40,000 monthly sales like at the end of last year, but it still contributed 35,027 vehicles in June. The official did not release specific sales figures for each model, but it should be roughly half each for AION Y and AION S. The online car-hailing market brings a large sales base to AION, but it poses greater difficulties in accumulating private users. The newly released second-generation AION V gradually sheds the design tone of AION S and AION Y, showing that AION is trying to tear off the "online car-hailing" label.

As a new force automaker that only launches pure electric vehicles, it is actually not easy for NIO to achieve a monthly sales level of 20,000 vehicles. Xiao Tong believes that in addition to the technological advantages of NIO's products in their respective pure electric vehicle markets, its comprehensive energy replenishment system is also the main reason for attracting consumers.

ZEEKR and Leapmotor Officially Join the "20,000 Club"

In addition to the above four automakers, the "20,000 Club" has newly added ZEEKR and Leapmotor.

As a high-end pure electric brand under Geely Group, ZEEKR bears the heavy responsibility of competing with numerous new forces in the automotive industry. Xiao Tong once thought that after ZEEKR launched the all-new entry-level ZEEKR 007, it would become the brand's main source of sales, after all, the prices of ZEEKR 009 and ZEEKR 001 are indeed quite expensive, and the market positioning of ZEEKR X is also niche.

However, Xiao Tong guessed wrong. The newly launched ZEEKR 001 is the brand's main sales force, with ZEEKR 007's sales reaching only half the level of the all-new ZEEKR 001. Data shows that ZEEKR 001 has delivered over 10,000 units for three consecutive months, outperforming traditional luxury models such as BMW 5 Series, Mercedes-Benz E-Class, and Audi A6L, and becoming the sales champion in the full range of medium and large sedans for the first time.

After the upgrade and facelift of ZEEKR 001, its performance, intelligence, and range have all been significantly improved, greatly alleviating consumers' pain points in using the car. Moreover, in terms of design, it is close to ZEEKR 001 FR and is even 30,000 yuan cheaper than the 2023 ZEEKR 001, making it a more cost-effective option. This allows it to cope with the current price war in the automotive market. There are actually competitors in the market for ZEEKR 001, such as AVATR 12, Xiaomi SU7, NIO ET5T, etc., but in terms of sales, the new ZEEKR 001 still has better sales performance. It has to be said that this model has a good chance of becoming an important product that "leaves a lasting impression".

Looking at Leapmotor, whose monthly deliveries first exceeded 20,000 vehicles. Among the models delivered in June, more than 11,300 were Leapmotor C10 and Leapmotor C11. For Leapmotor's entire product matrix, the importance of the SUV category speaks for itself.

Leapmotor is often referred to by many industry insiders as the "Xiaomi of the automotive world" because the Leapmotor C series models offer high cost-effectiveness. The newly launched six-seat SUV Leapmotor C16 has a top-of-the-line model priced at less than 200,000 yuan, while competitors like Dongfeng Yipi eπ008 and BYD Tang have higher prices.

However, the price range of the Leapmotor C series is almost within the range of 100,000 to 200,000 yuan, with not much difference in positioning. But Leapmotor CEO Zhu Jiangming does not seem to be worried about the models cannibalizing each other's market share, and is more concerned with making the entire C series bigger and stronger. He said that he hopes to saturate the price range around 150,000 yuan and strive to achieve a monthly sales level of over 30,000 vehicles.

Xiao Tong believes that in the domestic market at the 150,000 yuan level, BYD occupies the vast majority of the market share. To achieve a monthly sales level of 30,000 vehicles, deploying more models in this segment market will have little effect. The most important thing is to continuously leverage Leapmotor's cost-effectiveness advantage, and intelligent driving will be one of the important directions.

Previously, Zhu Jiangming revealed in an event that the current goal is to deploy intelligent driving capabilities to 150,000 yuan models, and there are plans to add advanced intelligent driving to A-class cars in the 100,000 yuan range in the future.

It should be noted that there are very few models priced around 150,000 yuan that support advanced intelligent driving. BYD's current plan is to offer it as an option for models priced at 200,000 yuan and above, and it comes standard on models priced above 300,000 yuan. Perhaps intelligent driving is not yet a rigid demand for consumers, but if advanced intelligent driving can indeed be deployed, it will be one of Leapmotor's advantages in the C series.

Before that, the upcoming XPeng M03 may be a demonstration sample for Leapmotor. This car is positioned as an A-class car with a price tag of around 100,000 yuan and equipped with advanced intelligent driving. If XPeng M03 can achieve good results, it is believed that it will greatly boost Leapmotor's confidence.

Each Automaker Faces Different Difficulties in Breaking Through the 20,000 Barrier

Monthly sales of 20,000 vehicles mean selling 667 vehicles per day, which means almost all stores are open every day. Six new force brands breaking through the monthly sales of 20,000 vehicles not only represents their high consumer acceptance but also indicates the main market segments of the domestic new energy vehicle market.

AION and Leapmotor are representatives of new forces in the mainstream new energy vehicle market, taking away a considerable share of the market from BYD; HarmonyOS Smart Mobility and Li Auto are in the high-end new energy SUV market, representing the mainstream consumption trend of the current high-end market audience, while ZEEKR and NIO are doing well in the high-end pure electric vehicle market.

Looking at other new energy brands, Deep Blue Automobile and Changan Qiyuan, whose monthly sales are close to 20,000, are also following the mainstream market route. Relying on Changan Automobile's manufacturing system and brand influence, it is believed that by introducing several new energy vehicles, it will be easy to unlock the achievement of monthly sales exceeding 20,000 vehicles. Next is Denza, which currently mainly relies on Denza D9 DM-i. Its hybrid MPV positioning is very suitable for the needs of the target audience, but its Denza N7 and Denza N8 models seem to have not found a precise market positioning, unlike Li Auto's L series, which is positioned for family users, and its sales have been flat.

Then there are XPeng and NIO. As an established new force, XPeng does not have many issues with brand awareness, but the three models that were supposed to bear the volume task, XPeng G6, XPeng G9, and XPeng P7, have not reached their previous peak sales levels. XPeng G6 and XPeng G9, which have a high cost-effectiveness advantage, only have monthly sales of around 4,000 vehicles, possibly reaching a critical moment where upgrades and facelifts are urgently needed. The latest XPeng X9 has already achieved the highest sales level among pure electric MPVs, but frankly speaking, a monthly sales volume of over 1,000 vehicles does not play a significant role in increasing the brand's total sales.

NIO also encounters similar issues. Although Zhou Hongyi's popularity has indeed increased, it has not helped NIO much. NIO focuses on the mainstream pure electric vehicle market, where BYD is still the "leader," and there are also many other automakers deploying their strategies. NIO's brand awareness is not that strong, and it may be difficult to achieve monthly sales of 20,000 vehicles. However, NIO is currently exploring overseas markets, and after achieving certain results in the future, it will not be far from achieving monthly sales of 20,000 vehicles.

As for LANVIGATOR, AVATR, IM Motors, and FOXTRON, it is difficult for their monthly sales to exceed 10,000 vehicles, let alone break through the 20,000 barrier. Overall, the reason why the sales of these four new energy brands are difficult to break through the bottleneck is either that they have too few volume-driving models or their product positioning is niche, or their brand influence is insufficient.

In the second half of the year, competition in the automotive market will only become more intense

Looking back at the first half of the year, the automotive market experienced a crazy price war. Automakers have been competing not only in products, prices, and technology but also in financial policies. In such a fiercely competitive automotive market environment, the fact that ZEEKR and Leapmotor have entered the "20,000 Club" proves that although the current market has entered a red ocean stage, it is not completely without opportunities. As long as the products and sales strategies are appropriate, there is still a chance to achieve considerable growth.

In Xiao Tong's opinion, the new energy vehicle market is facing challenges from emerging technologies and new business models and may soon enter a new stage of competitive stratification. If automakers want to survive in this "elimination round" and enter a higher competitive tier, the price war may continue.

More importantly, automakers also need to make significant progress in new products and technologies to meet consumer demand, such as in intelligence, cost-effectiveness, charging speed, battery technology, etc. Although this may not rapidly improve their market position, it can at least give them a certain degree of discourse power in a certain field and narrow the gap with leading companies.

In other words, automakers still need to continuously adjust their business structure in the second half of the year and find breakthrough points in technology research and development and marketing systems as soon as possible to adapt to market changes. Based on past patterns, automakers will release many preferential policies in the second half of the year to boost sales, and the sales of the new energy vehicle market will increase significantly. It is foreseeable that we will see even more intense price wars in the automotive market, and the membership of the "20,000 Club" may increase by a few more.