Who will break the curse of MPV hitting the ceiling?

![]() 07/03 2024

07/03 2024

![]() 504

504

Only by finding the real reasons for MPV's lack of momentum can the curse of hitting the ceiling be broken.

There are numerous MPV products, but the entire market segment has not flourished despite the proliferation of products. Many people inside and outside the industry believe that MPVs with limited capacity have reached their peak.

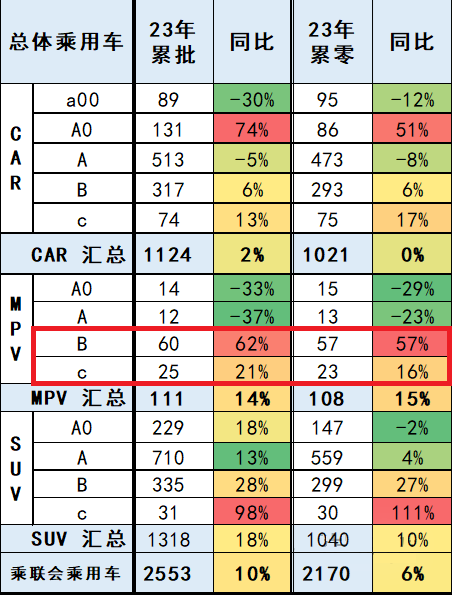

Data from the China Passenger Car Association shows that in the first five months of this year, both wholesale and retail sales in the entire MPV market saw a negative growth of 8%-9%. Among them, only 80,000-90,000 C-class high-end MPVs were sold in the first five months, with retail and wholesale trends heading downwards. The current market situation desperately needs a phenomenon-level MPV product to boost the morale of the entire MPV market and push it back onto a growth trajectory.

This product is undoubtedly LEVC L380, under Geely Holding Group. Not long ago, L380 was launched at a price of 379,900 yuan to 479,900 yuan. Judging from the effect of the launch event and subsequent evaluations from all parties, this price is very competitive, making it a traction product in the high-end MPV market. Especially its innovative cabin layout with 3-8 seats, bringing more imagination to the MPV market.

On the one hand, there is the sluggish MPV market trend, and on the other hand, there is the aggressive momentum of L380. The outside world is very concerned about one topic: how will this product perform in the future? What will this product bring to the market? How will the competition it triggers change the overall landscape of the high-end MPV market?

Why is it difficult to make MPVs successful? Where should we look for the reasons?

Since the beginning of this year, MPV has always been a hot topic. Whether it's the ill-fated Li Xiang MEGA, the luxurious ZEEKR 009 priced at 789,000 yuan, or the PHEV-powered Buick GL8 counterattacking Tengshi D9, not to mention the eagle-eyed Xiaopeng X9 and Land Rover's Dreamliner, the influx of new players proves that although the total annual volume of the MPV market is only over 1 million vehicles, the liveliness of this market segment has long exceeded imagination.

Although the first five months of this year made the entire MPV market seem somewhat sluggish due to market and product factors, from historical data, there is actually a very strong demand for mid-to-high-end MPVs priced above 300,000 yuan. In 2023, retail sales of B-class MPVs increased by 57% to 570,000 vehicles, while C-class MPVs increased by 16% to 230,000 vehicles, with total high-end MPV sales reaching 800,000 vehicles, accounting for 74% of the total MPV market.

Moreover, new energy MPVs have surged from only 12,000 units in 2020 to 248,000 units in 2023, showing a gratifying growth trend. In particular, pure electric MPVs account for more than 34% of new energy MPVs, indicating that electric MPVs do have consumer demand and a market, contrary to what many people say. More independent MPVs are being recognized and accepted by the market due to improvements in their product strength.

The boom in the MPV market is, of course, a product driven by numerous products. On the one hand, high-end MPVs are an objective demand for consumption upgrades and a rigid choice for consumers to upgrade or replace their cars. Their spacious and diversified spaces are very in line with Chinese people's vehicle usage needs.

On the other hand, high-end MPVs have great value and significance for a brand. After all, such products have a very strong boosting effect on a brand, just like the Mercedes-Benz V-Class for Mercedes-Benz, the Alphard for Toyota, and the LM for Lexus. The sales of these high-end MPVs are not large, with most sales around 1,000 units, but their brand value, popularity, and the support of the brand's system capabilities, technical strength, revenue, and profits are all very important.

However, judging from the current MPV market landscape, whether it's Buick GL8, Tengshi D9, Toyota Sienna + Gracia, or GAC's MPV, Honda Odyssey, and Ailishen trailing closely behind, most products are products of the traditional fuel vehicle era. Apart from the large interior space brought about by the large size of the car and the improved overall ride comfort due to the price increase and enhanced configurations, these products have not made any upgrades to the value perception of MPVs in the new era.

Especially driven by current trends of electrification and intelligence, pure electric MPVs have ushered in a good opportunity for maturity. Pure electric MPVs, which eliminate the need for a fuel tank and engine, bring more spacious interior space, a flatter floor, a more diversified layout, and more scenario-based usage and experiences such as long-term parking with the air conditioning on for rest. This is an effect that traditional fuel or even hybrid MPVs cannot achieve.

Moreover, as pure electric MPVs are often not the only vehicle owned by customers, the demand for space is far greater than the demand for internal combustion engines or battery range. Therefore, the electrification of MPVs should be more easily accepted by potential customers than household SUVs.

As for why many previous pure electric MPVs have been fleeting? There are actually many reasons. For example, MEGA was due to its overly futuristic design and styling, which deviated from people's perception of MPVs. Xiaopeng X9 suffered from its brand image, which could not support such a high price point, and its sales, service, and other systematic capabilities were not sufficient to better reach users with this product and brand. Tengshi D9 EV did not meet enough user demand for disruption, at least it did not have more advantages compared to hybrid products.

Therefore, the emergence of a high-end pure electric MPV puts even more pressure on a brand's comprehensive capabilities, from products to technology, from brand to pricing, from operation and maintenance to the system. Any link may affect its market performance and final results. Only by deeply analyzing these products in the market, finding the real reasons for the lack of momentum in these MPV products, and learning from experience and lessons, can we break the so-called curse of MPV hitting the ceiling.

Space Innovation, L380 Redefines MPV

In fact, to lead the MPV market out of its temporary downturn and drive stronger consumer and market demand, the core key is to find out where the current issues with MPVs lie. As mentioned above, brand, price, product strength, actual driving experience, corporate strength, and system capabilities will all determine the success or failure of a product. However, for MPVs, which have a core pursuit of space, the breakthrough point should be space.

Named after 380, L380 is a tribute to the world's largest passenger aircraft, the Airbus A380, and is committed to becoming a true terrestrial Airbus. In fact, in the automotive manufacturing field, LEVC, which is older than Airbus by a full cycle, has always been a redefiner of space on wheels.

The brand is the footnote of L380. For 116 years, LEVC has been focused on innovative development in on-wheel space, pioneering technologies such as safety privacy cabin partitions, opposing passenger seats for travel, co-pilot luggage compartments, hidden ramp pedals, and barrier-free care functions, opening one milestone after another for the spatial revolution in the automotive industry.

Standing under the new era's demands and trends, how to make the space of a pure electric architecture superior to any other brand and company is a test of LEVC's ability to innovate MPV space. The industry's first space-oriented architecture, SOA, is LEVC's answer.

When the industry is saying that pure electric architectures can achieve higher cabin utilization rates, LEVC is thinking about how to disrupt space in the era of smart electric vehicles, iterate on the constraints of current automotive architectures, and reshape the value and experience of automotive space. Centralizing components such as electronic control elements, low-voltage batteries, and air suspension cylinders, which are difficult to find better solutions in the industry, and moving the steering gear to the front to break the front bulkhead limitations, maximizes the mechanical space in the front cabin.

Based on this architecture, L380 achieves a cabin utilization rate of up to 75%, a passenger cabin aisle width of 200mm, and an ultra-long seamless electric sliding rail of over 1.9 meters under the flat floor. This allows the MPV to accommodate six aviation seats, with both the second and third rows of seats achieving independent first-class treatment without any difference. Even people with a height of 2 meters can sit comfortably in the third row. At the same time, there are seat layouts ranging from 3 to 8 seats (with a sunken floor, a magical fourth row, and a hidden and reversible viewing seat), allowing the seats to move forward and backward, creating diverse spaces according to user needs, making L380 unique in the MPV market.

Of course, space is only the core pursuit of MPVs, but in today's fiercely competitive market, aspects such as luxury, handling, and intelligence also need to reach industry-leading levels, leaving no weaknesses.

For example, in terms of luxury and quality, the seats in the entire industry use semi-aniline leather material, which accounts for less than 10% of the total, with a delicate touch. The roof and pillars are covered with Italian original Alcantara "superfiber fabric." Electric suction doors, various in-car electric adjustments, and seat layout modes, as well as a smart compressor cooling and heating refrigerator, offer a luxurious level and experience comparable to that of a Cullinan. In terms of handling, the 5.5-second 0-100km/h acceleration performance successfully breaks the stereotype of MPVs having "insufficient speed." The unique front double-ball joint MacPherson suspension and rear high-load multi-link air suspension system, combined with advanced CDC technology and preview systems, maximize driving and riding comfort.

In terms of intelligence, it is equipped with two Longying No. 1 7nm chips, 5G networking, Flyme Auto interactive system, supported by the Shang Tang AI large model, and 9-screen linkage, leaving no shortcomings in the intelligent experience. In terms of experience, the extra-wide doors provide ample boarding space, and the low-profile tailgate threshold brings convenience for boarding, alighting, or loading. The 140kWh battery offers a CLTC range of over 800km, with 260kW fast charging technology that adds 350km of range in just 15 minutes. It also accesses the ZEEKR charging network, covering all cities nationwide, ensuring no anxiety when fully charged.

It is worth mentioning that the pricing and competitive positioning of L380 also demonstrate its advantages. The listed price of L380 starting at 379,900 yuan and the limited-time price starting at 349,900 yuan basically cover the price range of the most popular Xiaopeng X9 and Tengshi D9 EV. If we consider competitors in the fuel vehicle market, whether it's Tengshi D9 DM-i, Buick GL8 Avenir, or Mercedes-Benz V-Class, they basically overlap with these product price bands as well. This undoubtedly poses a dilemma for potential users, making them wonder whom to compromise with. Once consumers start considering this, it proves that L380 has already succeeded halfway.

It can be said that in the MPV market, there is probably no vehicle that has as extreme a space as L380. Moreover, it truly realizes the concept of "one car for multiple uses" in terms of brand, quality, configuration, price, and other aspects, fully satisfying users' diverse needs of "wanting it all." It deserves to be a phenomenon-level product, reigniting the MPV market and returning it to consumer value and rational demand.

To answer the question at the beginning of the article, with such a powerful product strength, L380's market performance will undoubtedly surpass its peers, injecting new vitality into the pure electric MPV market. With the comprehensive expansion of subsequent channels and service outlets, the focus of the entire high-end MPV market will also undergo new changes. Pure electric, intelligent, and new experiential MPV products will undoubtedly become new growth points in the MPV market.