Benz's Golden Decade Fades: Navigating Unprecedented Challenges

![]() 03/12 2025

03/12 2025

![]() 618

618

In the Chinese market, Mercedes-Benz faces unprecedented challenges. To reclaim its former glory, drastic systemic changes may be the only viable solution. Otherwise, the outcome could be dire.

Body

The latest luxury brand sales figures for last month have been released.

Mercedes-Benz sold fewer than 34,000 vehicles in February, marking a year-on-year decrease of approximately 43%, nearly halving its sales and registering the steepest decline among the BBA (BMW, Benz, Audi) trio.

Coupled with recent incidents involving canopy issues, layoffs, and the Zunjie controversy, the pressure on Mercedes-Benz is significant.

The source of this pressure lies in the increasingly powerful domestic brands.

More importantly, it stems from Mercedes-Benz's own past.

1. From Powerhouse to Parody: Mercedes-Benz's Electric Vehicle Struggles

Let me pose a question to readers: If you were to purchase an electric vehicle, would Mercedes-Benz be on your list?

The answer is likely no.

The reasons are multifaceted.

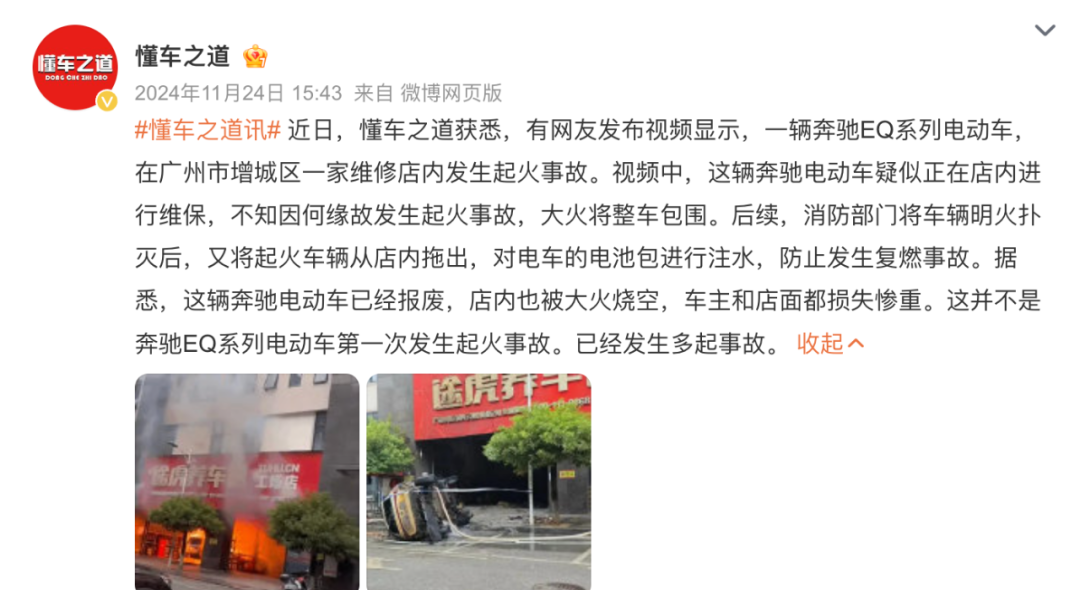

Starting with safety, a crucial aspect, Mercedes-Benz has experienced a series of spontaneous combustion incidents.

Last year alone, there were at least four such accidents involving the EQ series electric vehicles. Compared to the sales volume of the EQ series, this represents a significant proportion.

In 2022 and 2023, Mercedes-Benz's pure electric vehicles were recalled.

In 2022, a total of 11,423 EQ series models were recalled due to poor sealing of the cooling system in the electric drive system.

In 2023, another 1,051 EQ models were recalled, and the issue again involved the battery, specifically high-voltage battery malfunctions.

It appears that Mercedes-Benz is well aware of the quality issues plaguing its vehicles.

Perhaps such hidden dangers were inherent in the initial stages of product design.

The EQ series, while seemingly standalone electric vehicles, are essentially "oil-to-electric" conversions.

Take the EQB as an example; its body size, wheelbase, chassis suspension, and even interior are nearly identical to the GLB.

Electric vehicles converted from oil vehicles are not designed with native electrification in mind, whether it's battery cooling, protection, or isolation between battery packs.

Naturally, structural safety hazards remain to be verified.

Thus, the multitude of issues that have arisen are perhaps understandable.

Currently, Mercedes-Benz's new energy vehicles have little competitive advantage beyond brand power.

No wonder netizens have ridiculed Mercedes-Benz as a "knockoff" electric vehicle brand.

Consumers have also voted with their wallets.

In 2024, Mercedes-Benz sold fewer than 700,000 vehicles in China, marking a year-on-year decrease of 7.3%, with electric vehicle sales plummeting by 23%.

This is the predicament Mercedes-Benz faces: new energy vehicles have always struggled to gain traction.

2. The State of Mercedes-Benz Sales

There are multiple reasons behind Mercedes-Benz's significant decline.

In addition to product-related issues, there are also numerous problems on the marketing front, which is closest to consumers.

In fact, Mercedes-Benz Sales is one of the four main systems in China, responsible for the marketing, promotion, pre-sales, and after-sales services of Mercedes-Benz products.

It can be said that when there are market issues, the sales company bears significant responsibility.

On one hand, Mercedes-Benz's sales system no longer holds a clear advantage.

Mercedes-Benz employs a dealer model, with authorized dealers handling both sales and service, which reduces its own staffing needs and allows for quick market capture.

While this system may have propelled Mercedes-Benz into its "golden decade," compared to the direct sales model of new players today, its personnel efficiency does appear somewhat low.

This explains why the company's Chairman of the Board, Ola Källenius, stated at the earnings conference: "To ensure the company's competitiveness, we are taking measures to make the company faster, leaner, and stronger."

In simpler terms, this means layoffs, primarily affecting Mercedes-Benz Sales.

On the other hand, Mercedes-Benz's marketing and public opinion management have indeed lagged behind.

Currently, Duan Jianjun oversees Mercedes-Benz Sales.

Mr. Duan is no novice, having been involved in marketing at Mercedes-Benz since 2013, experiencing the brand's golden decade in China in its entirety, and being well-versed in marketing strategies.

However, generals from the old era often struggle to keep pace in the new era.

For instance, what impression do you have of Mercedes-Benz's new products in recent years?

The lack of marketing efforts has diminished the brand's positive voice, while negative sentiments have never been in short supply.

Take the three-color canopy incident as an example. A car owner spent over 2 million yuan on a Maybach, but upon delivery, discovered water leakage. Despite multiple attempts to communicate with the 4S store and Mercedes-Benz officials, no resolution was reached. Starting in August, the car owner began advocating for their rights on Douyin, and within two months, the account gained 400,000 followers. Even Maybach owners across the network began hanging three canopies on their vehicles in solidarity.

What started as a routine quality issue eventually evolved into a public relations crisis for the entire brand.

Failing to provide a satisfactory solution within two months starkly contrasts with the prompt response of domestic brands to user issues.

While Mercedes-Benz appears somewhat indifferent to user concerns, it responds very promptly to competition from peers, such as its response to Zunjie.

Facing marketing failures, Mr. Duan harshly criticized the industry: "Manipulating online water armies to smear and engage in malicious competition."

Is such an attempt to shift blame for market failures onto the external environment truly effective?

3. Looking Ahead for Mercedes-Benz

Unfortunately, the road ahead for Mercedes-Benz is fraught with challenges.

Currently, new players and joint venture new energy vehicles have already embarked on a new round of price wars. Domestic brands are worried about survival, while Mercedes-Benz's pure electric platforms—MMA, MB.EA, AMG.EA, and VAN.EA—have yet to be officially launched.

However, the growth of new players is measured quarterly.

At the beginning of this year, in the performance car segment, Xiaomi's SU7 Ultra, priced at 530,000 yuan, surpassed 20,000 orders upon launch. In the family SUV segment, Wenjie's M9, priced at 480,000 yuan, surpassed 20,000 small orders within three days. Even the ultra-luxury high-end segment where the Mercedes-Benz S-Class resides has been targeted by Zunjie's S800.

Under such intense competition, Mercedes-Benz's pure electric vehicles will only be further eroded.

The market pie has long been divided up by domestic brands.

Moreover, Mercedes-Benz's core internal combustion engine vehicles are accelerating their decline.

For instance, in February of this year, Mercedes-Benz sold over 30,000 vehicles, marking a year-on-year drop of more than 40%, making it the BBA brand with the steepest decline.

In the Chinese market, Mercedes-Benz faces unprecedented challenges. To reclaim its former glory, drastic systemic changes may be the only viable solution.

Otherwise, the outcome could be dire.

Good luck.