Comprehensive Insights into China's Auto Export Market Data

![]() 03/12 2025

03/12 2025

![]() 623

623

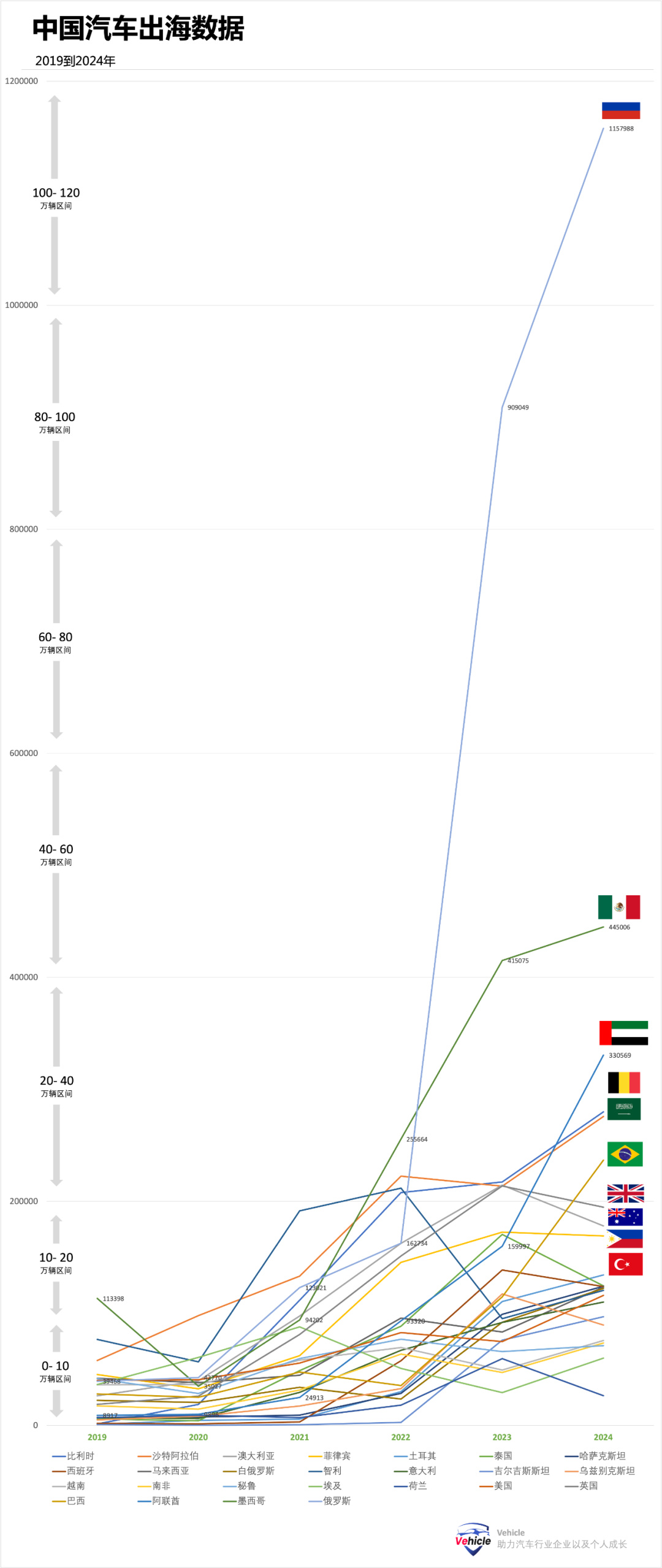

This extensive graphic aims to highlight the distinct differences among various markets and encapsulate the distinctive features of China's historical overseas data. Click on the image to enlarge it for a clearer view.

The data is sourced from the China Passenger Car Association, offering the following insights:

Russia as the Largest Export Market:

In 2024, China exported 1,157,988 vehicles to Russia, vastly outpacing other countries. This figure stood at only 39,468 vehicles in 2019, marking a nearly 30-fold increase over five years.

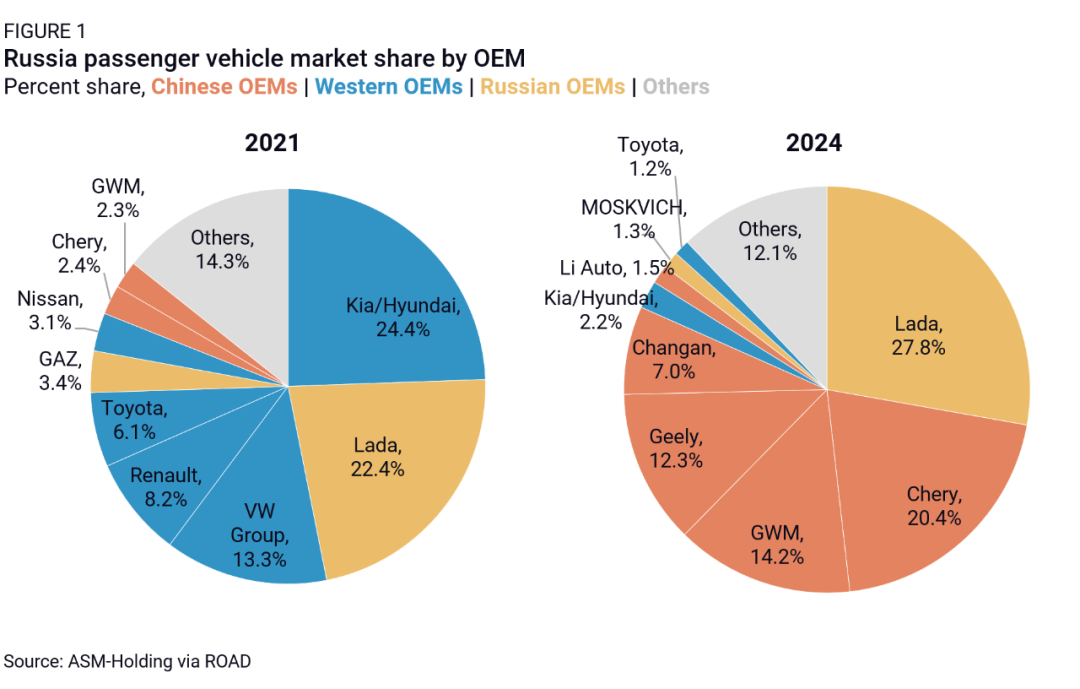

The reasons behind this growth are evident. As illustrated in the graph below, the Russian market was once dominated by European, American, Japanese, and Korean car brands, but now Chinese cars have seized the lead.

Last September, Russia imposed a "recycling fee" (akin to a tariff) on imported Chinese vehicles. In January of this year, Russia hiked this fee to 667,000 rubles (US$7,500) for most passenger cars, more than doubling the amount from September 2023. These fees will escalate by 10-20% annually until 2030.

Consequently, as revealed by data from the China Association of Automobile Manufacturers in February 2025, Chery's exports declined by 1.3% compared to the previous year. Additionally, Russian media reported a roughly 5% increase in car prices this year, primarily due to these additional fees.

Other Notable Growth Markets:

- Mexico: From 113,398 vehicles in 2019 to 445,006 in 2024, a nearly fourfold increase.

- UAE: From 8,917 vehicles in 2019 to 330,569 in 2024, a staggering 37-fold surge.

- Brazil: From 28,049 vehicles in 2019 to 236,789 in 2024, an over eightfold increase.

The Middle East and South America have witnessed steady growth. Changes in the US Market:

In 2019, China exported 40,126 vehicles to the US, which rose to 116,138 in 2024, albeit a modest growth compared to other markets. Most of these exports are resold in the US by domestic joint ventures such as Ford and GM. However, with tariffs and US regulations restricting the import or sale of connected vehicles using VCS and ADS software, the landscape is expected to become increasingly challenging.

European Market: Imports to countries like Belgium, Spain, and Italy have been gradually increasing each year, but the growth rate is slower compared to emerging markets, indicative of normal and healthy market expansion.

Southeast Asia: Drawing from China's experience, the Southeast Asian market encourages local factory construction. Therefore, pure exports to this region will see limited growth.

Outlook for China's Auto Exports: Have we peaked? Click on our previous article, "From Fast Lane to Bottleneck: Have China's Auto Exports Reached Their Peak?" to delve deeper.

*Reproduction and excerpts are strictly prohibited without permission. Reference Materials: Join our knowledge platform to access a vast array of first-hand automotive industry information, including the materials referenced above.