Domestic auto group sales diverge, with joint venture brands becoming the biggest variable

![]() 07/04 2024

07/04 2024

![]() 588

588

Recently, various automakers/groups have successively released their latest monthly and half-year sales data. Previously, among independent brand enterprises/groups, the five major auto groups (SAIC, FAW, Changan, Dongfeng, and GAC) held an absolute advantage. Compared to individual automakers, auto groups have a larger scale as they usually tally the sales of all their brands, including joint venture models.

However, in recent years, with the rapid development of companies like BYD and Geely, the original market landscape has been disrupted. According to data from the China Association of Automobile Manufacturers (CAAM), independent brand cars have seen rapid growth recently, with their market share even exceeding 60% in May. Correspondingly, the sales space of joint venture automakers has been compressed, dragging down the sales figures of some auto groups.

▍Are joint venture models becoming "marginalized" in sales?

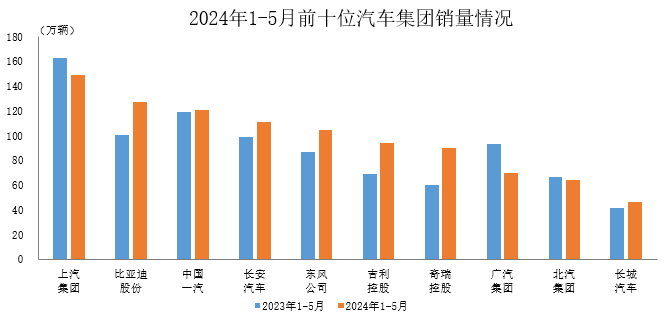

According to statistical analysis by the CAAM, from January to May 2024, the top ten enterprises (groups) in terms of car sales sold a total of 9.754 million vehicles, accounting for 84.9% of total car sales. From the data table released by the CAAM, it can be seen that among the ten enterprises, compared with the same period last year, the sales of SAIC Group, GAC Group, and BAIC Group have declined to varying degrees, while the sales of other enterprises have increased to varying degrees.

Taking Chery Group, which has the most significant growth rate, as an example. The latest data shows that in June, a total of 200,412 new cars were sold, representing a year-on-year increase of 38%. Among them, exports accounted for 97,034 vehicles, a year-on-year increase of 22.7%; and new energy sales reached 44,851 vehicles, a year-on-year increase of 230.6%. From January to June, cumulative sales reached 1,100,621 vehicles, a year-on-year increase of 48.4%. Starway, Jietu, OMENDA, iCAR, and ZIJIE are all in a good growth period.

The rapid decline in sales of joint venture models, which were once the "profit cows," has become the reason for the decline in auto group sales.

Taking SAIC Group as an example, although it still led BYD with 1,526,409 vehicles sold from January to May, occupying the top position among automaker groups, SAIC Group's sales declined by 8.4% compared to the same period last year. Among them, SAIC-GM plummeted by 44.3% year-on-year, with a single-month year-on-year decline of up to 58.3% in May. On July 1, SAIC Group announced its June and first-half new energy vehicle sales data, which were 93,000 and 460,000 vehicles respectively, without mentioning sales in other market segments.

Image source: China Association of Automobile Manufacturers

GAC Group's sales from January to May declined by 24.5% compared to last year. Among its four major business lines of GAC Toyota, GAC Honda, GAC Passenger Vehicle, and Aion, only GAC Passenger Vehicle achieved positive growth. GAC Honda fell by 24.3%, and GAC Toyota fell by 27.3%. In a previous interview with the media, Feng Xingya, General Manager of GAC Group, admitted, "Currently, almost all joint venture brands are facing severe challenges in the new four modernizations wave and are generally under pressure." Currently, fuel vehicles are under multiple pressures from electric vehicle incentives, emission regulations, purchase tax, etc., but they will accelerate development towards energy-saving vehicles in the future. Therefore, GAC Honda and GAC Toyota cannot give up their advantages in energy-saving vehicles. At the same time, they must also accelerate the pace of electrification, increase independent R&D to support joint ventures, and provide a common platform for joint development.

Changan Group, which has a low proportion of joint ventures, has achieved significant growth. With the rise of independent brands, Changan achieved a 12% growth from January to May in an era of普遍下跌 (widespread declines) in joint venture cars. The latest data shows that Changan's independent brand new energy sales in June reached 63,600 vehicles, an increase of 60.03% year-on-year; cumulative sales from January to June reached 299,100 vehicles, an increase of 69.87% year-on-year.

▍Can "price cuts to maintain sales" regain the market?

Against the backdrop of an overall decline in the fuel vehicle market, the new energy products of leading independent brands have penetrated into the core segment market of joint venture brands. However, joint venture brands that missed the incremental market of new energy vehicles are facing pressure from shrinking segment markets. This is reflected in the terminal market through significant price cuts.

Currently, price cuts have become the main way for joint venture cars to regain market share. From sales data, the price reduction strategy has achieved certain results in stopping the decline in sales in the short term, but it remains questionable whether the price reduction strategy can achieve long-term sales growth.

Image source: QianTu.com

According to the May market analysis by the China Passenger Car Association (CPCA), the domestic market share of independent brands reached 57.5%, a record high. Correspondingly, mainstream joint venture brands saw a year-on-year decline of 20.8% in sales, with their market share falling to 28.8%. The retail shares of German and Japanese brands were 18.6% and 14.8%, respectively, down 2% and 3.2%, while the retail share of American brands accounted for only 6.7%, a year-on-year decline of 1.4%. The shares of the three major joint venture car series have all been lost.

A joint venture brand management team told Auto Market Insight that the penetration rate of new energy vehicles in the Chinese auto market has developed faster and more fiercely than expected. Many joint venture automakers were not fully prepared and made strategic mistakes. Although joint venture automakers have been deploying new energy models in the past, they have always adhered to the strategy of advancing both oil and electricity in the general direction. After investing a lot of money, they did not receive corresponding returns, leading to a "vicious cycle" and being unable to fully launch new energy models, missing market opportunities.

Image source: QianTu.com

From the sales data disclosed so far, most leading independent brands have achieved considerable gains in the first half of the year with the growth momentum of new energy vehicles and overseas expansion. Mainstream joint venture brands have shown signs of "retreating to the second tier." However, in the next six months or even longer, independent brands need to address the situation of increasing revenue without increasing profits. For joint venture brands that still regard fuel vehicle sales as their basic disk, it is indeed a "trial" under the pressure of price cuts and changes in consumers' evaluation standards for products. How to build new brand labels and "moats" will become the key to the next stage.