Price Butcher Still Making Big Profits, How Does BYD Stand Out Among Competitors?

![]() 07/05 2024

07/05 2024

![]() 566

566

Those who have been following Dolphin Jun know that Dolphin Jun was not optimistic about BYD throughout 2023. After a year of adjustment, starting from 2024 (see the detailed quarterly performance review titled "<'Price Butcher' BYD: Bloody Battle Unleashes Killer Weapon, Dawn is Not Far Away>"), Dolphin Jun has begun to emphasize: "In 2023, investing in BYD requires attention to the risk of chasing highs, while in 2024, it is more important to focus on the opportunity for a turnaround."

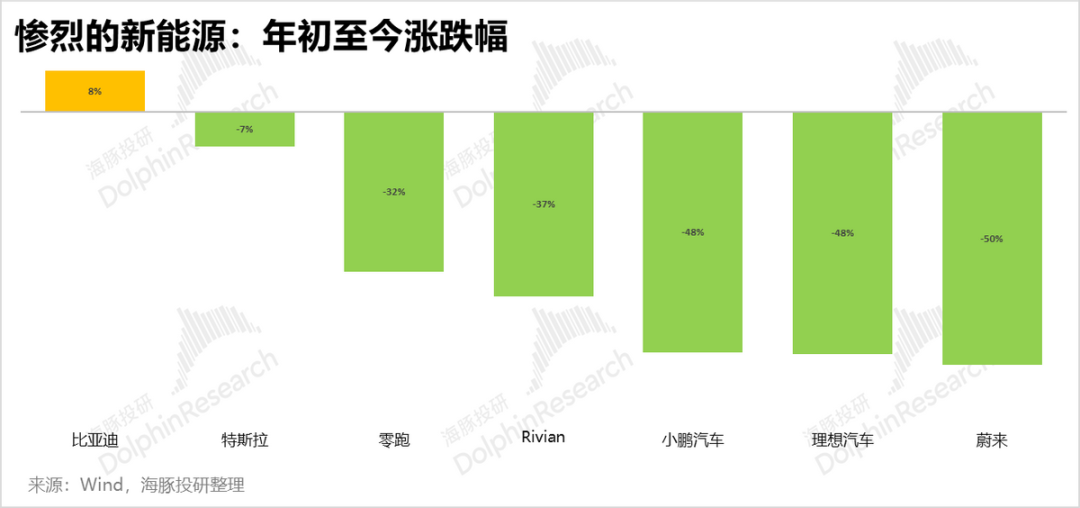

And so far this year, amidst the brutal new energy market, BYD indeed appears slightly alternative and is the only new energy vehicle company among Dolphin Jun's covered companies that has seen a positive share price increase.

Dolphin Jun's last in-depth analysis of BYD was still in 2021, during the DM 4.0 cycle. Taking this opportunity, Dolphin Jun will take a closer look at BYD, the unique one in China's new energy vehicle camp. This article focuses on analyzing:

I. What challenges did BYD encounter in 2023?

II. The counterintuitive logic of "the more price cuts, the more profit."

III. The soul of price-cutting brute force: Vertical integration?

Here are the details:

I. What challenges did BYD encounter in 2023?

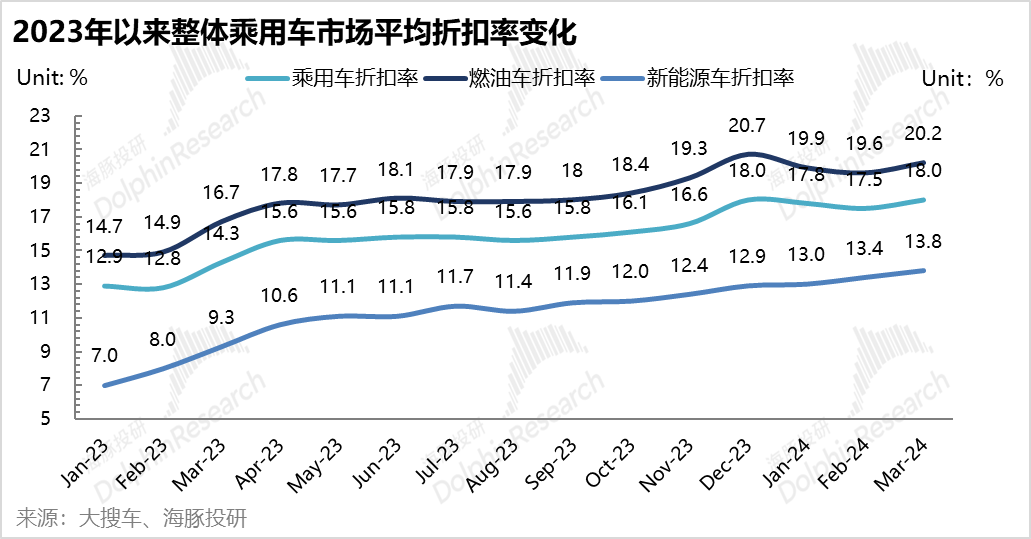

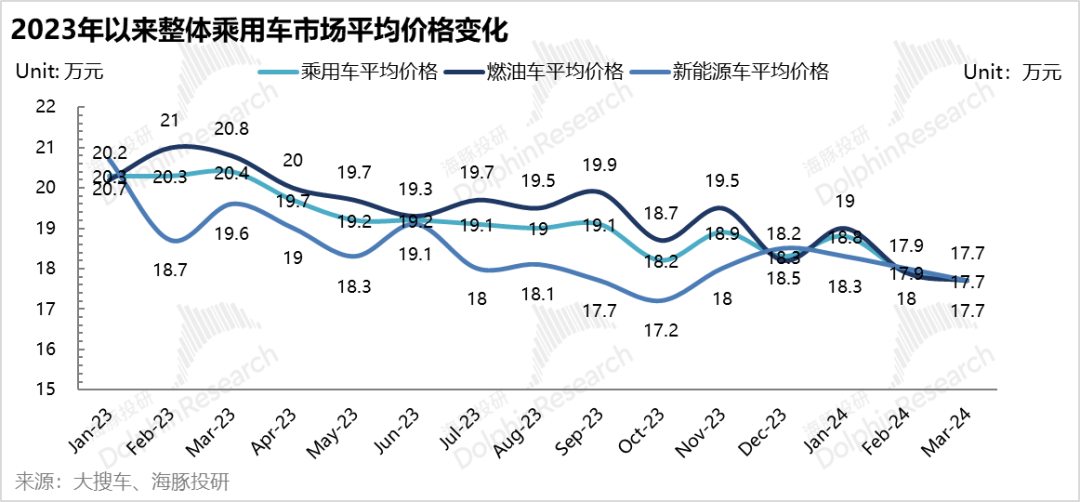

Starting in 2023, under the advantage of high gross margins, Tesla aggressively set production based on sales, determining the direction of China's new energy vehicles in 2023 and pushing the domestic auto industry into a substantial price war stage.

The actual result was industry-wide price deflation amid declining penetration rates - whether it was the falling price of lithium carbonate, the raw material for batteries, or the price of complete vehicles:

① Industry Challenges: Full-chain deflation + chaotic competition for complete vehicles

Compared to the rising 2020 and the rapid penetration of 2021 and 2022, China's new energy industry in 2023 experienced rapid expansion in the previous two years. With the industrial chain becoming sound and mature, the government's subsidy policies for new energy gradually withdrew, and the slope of new energy vehicles' penetration slowed down after three years of rapid growth. The combination of these three factors led to price deflation across the entire automotive supply chain from top to bottom:

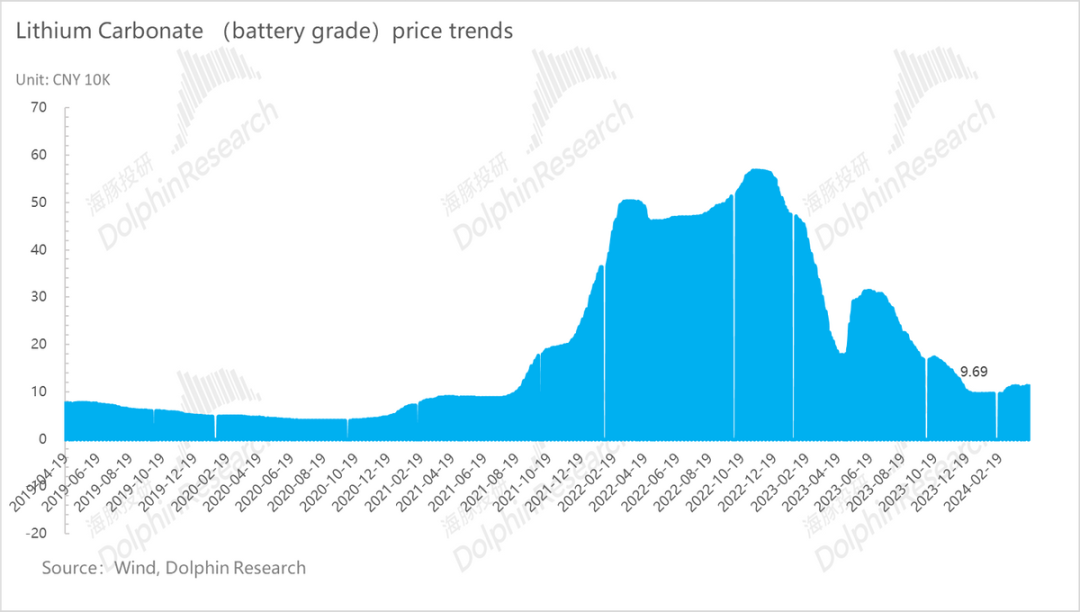

1) The cost of lithium carbonate, the core raw material for new energy vehicle batteries, decreased: The average price of battery-grade lithium carbonate was 500,000 yuan per ton at the beginning of 2023, and by 2024, it had fallen to nearly 100,000 yuan per ton.

Based on the average battery capacity of 48kwh in the new energy vehicle industry, the cost reduction in the battery segment alone compared to the beginning of 2023 was 12,000-14,000 yuan, contributing to almost half of the decline in the price of a single vehicle.

2) Intensified competition in the new energy vehicle industry and accelerated reshuffling: The mature supply system in the industry has made OEMs not significantly different from each other, and the demand and configuration of new energy vehicles have gradually become homogenized. Scale effects have become the decisive factor in the elimination race of new energy vehicles - determining the cost and survival status of enterprises.

With most manufacturers prioritizing sales, price competition has further intensified. "Trading volume for price" may become a medium- to long-term pricing strategy for automakers.

② BYD's Challenges:

a. Narrowing hybrid technology advantage: BYD, which has been focused on the new energy track and has always held a first-mover advantage, saw its advantage gradually shrink in 2023:

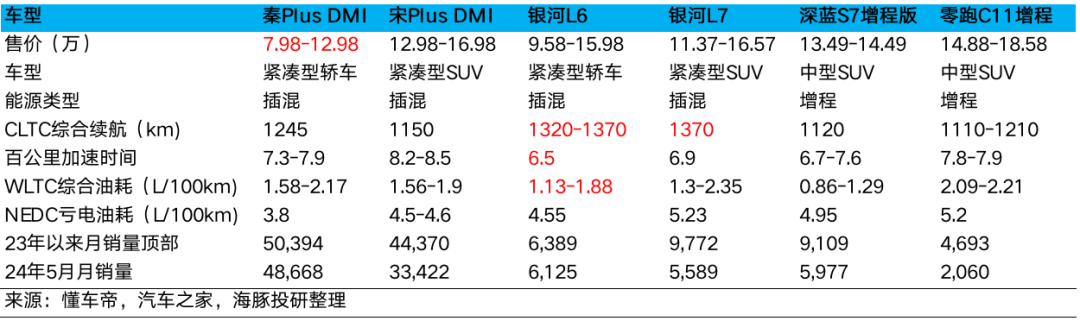

BYD's 2023 models and 2024 Glory Edition models still use DM 4.0 technology. Since its launch in 2021, DMI 4.0 technology has achieved a comprehensive range of 1100km-1300km and a maximum fuel consumption of 3.8L/km when the battery is depleted, far surpassing similar competitors. However, more than three years after the introduction of DM 4.0 technology, its technical advantages are gradually being caught up by competitors.

Compared to hybrid competitors launched in 2023, BYD's DMI 4.0 technology still has advantages in fuel consumption when the battery is depleted, but it begins to lag behind the Galaxy L6/Galaxy L7, which use the new generation of Leishen hybrid system, in terms of comprehensive range and fuel consumption.

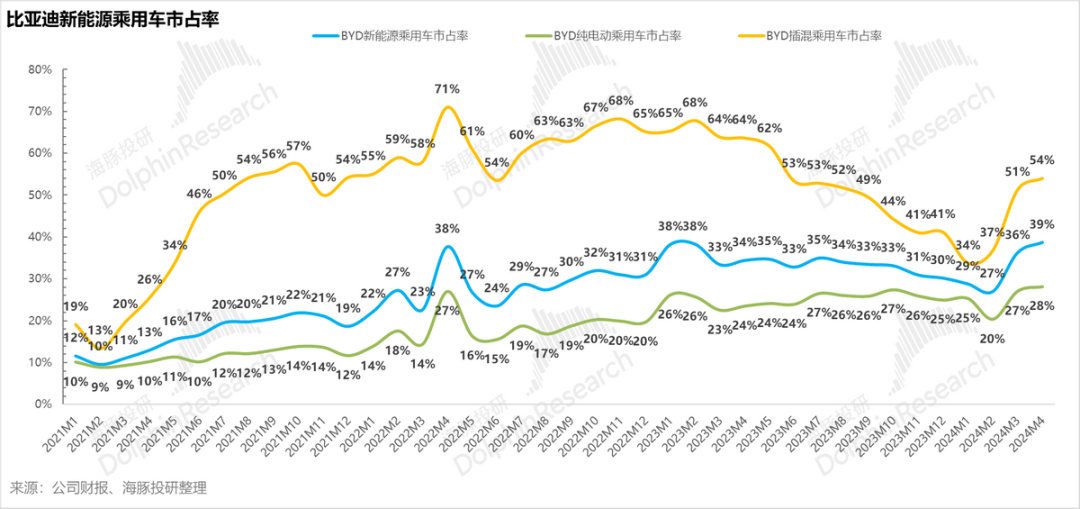

As competitors like Zero Run, Geely Galaxy, and Shenlan successively launched models targeting BYD's affordable hybrid models in 2023, BYD's market share of plug-in hybrid models has also been declining, falling from a high of 68% in 2023 to a low of 34% in January 2024.

b. Unable to compensate for the shortcoming of high-end pure electric vehicles: During the continuous decline in hybrid market share, BYD has not made a breakthrough in the pure electric market.

Looking at different models, BYD's pure electric sales seem to have increased in 2023, with market share steadily rising from less than 20% to over 25%. However, looking closely at the structure of pure electric sales, the main contributor to the increment was the launch and popularity of the low-priced pure electric car Seagull in 2023. Its peak monthly sales exceeded 50,000 units, contributing 42% of BYD's pure electric sales increment in 2023. However, the pricing of the Seagull model is only 7-90,000 yuan, which further lowered the ASP (average selling price) of pure electric models.

Among pure electric models priced above 200,000 yuan, BYD's performance was very mediocre, with rare monthly sales exceeding 10,000 units, and no standout models emerged.

The result of the resonance of points (a-b) is unstoppable price declines:

On one hand, BYD has actively responded in the hybrid segment by successively launching Champion Edition models since February 2023, with prices across the entire lineup down by 0.4-98,000 yuan compared to the original versions, driving down the overall price range. In November 2023, facing increasing inventory pressure, BYD further reduced the already low prices of the Champion Edition.

On the other hand, the overall selling price of pure electric vehicles declined after the price range shifted downwards: As incremental models were mainly the 7-90,000 yuan Seagull, and pure electric models priced above 200,000 yuan struggled to make breakthroughs, the ASP of pure electric vehicles also declined.

In 2023, BYD did not escape the curse of industry-wide price deflation.

II. The counterintuitive logic of "the more price cuts, the more profit."

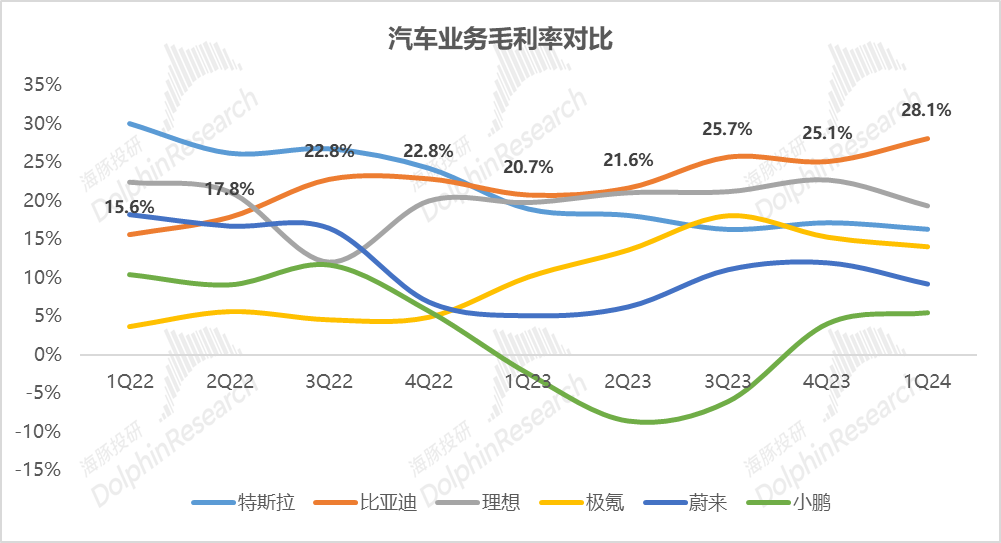

Among all the companies Dolphin Jun has observed, the result of excessive price declines is the compression of automakers' gross margins, including Tesla, whose gross margins once soared to over 30% at their peak, let alone companies like NIO, Xpeng, and Li Auto.

If BYD's challenges mentioned earlier were something Dolphin Jun anticipated at the beginning of the year, then what was unexpected was BYD's "counterintuitive" automotive (inclusive) business gross margin: From the perspective of single-vehicle economics, although vehicle prices have continued to decline since 2023, the gross margin of the vehicle manufacturing business (including the battery business) has been on an upward trend.

Due to the launch of BYD's Champion Edition in 2023 and the Glory Edition in 2024, the average vehicle price dropped from 170,000 yuan in the first quarter of last year to 140,000 yuan in the first quarter of this year. However, the gross margin of the vehicle manufacturing business (including the battery business) increased from 21% in the first quarter of last year to 28% in the first quarter of this year, almost reaching a historical high!

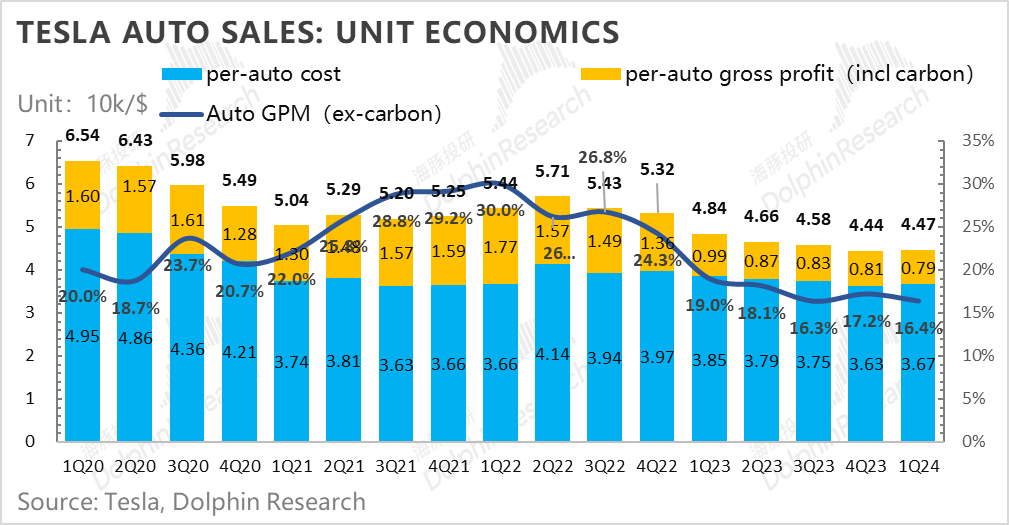

In contrast, Tesla, also a leading new energy vehicle company, saw a continuous decline in its vehicle manufacturing gross margin as vehicle prices continued to decline, falling from 19% in the first quarter of last year to 16.4% in the first quarter of this year, almost halving compared to its peak gross margin of around 30%.

Dolphin Jun is curious about why, despite being leaders in the same industry and facing declining vehicle prices due to fierce competition in the new energy vehicle market, the gross margins of the vehicle manufacturing businesses have taken such different trends? How does BYD achieve such a commanding gross margin?

Of course, the immediate and clichéd answer to this question would be economies of scale. But if you think carefully, Tesla was also increasing its sales volume during the price cuts, so why didn't Tesla experience economies of scale, where declining prices led to同步下滑的gross margins?

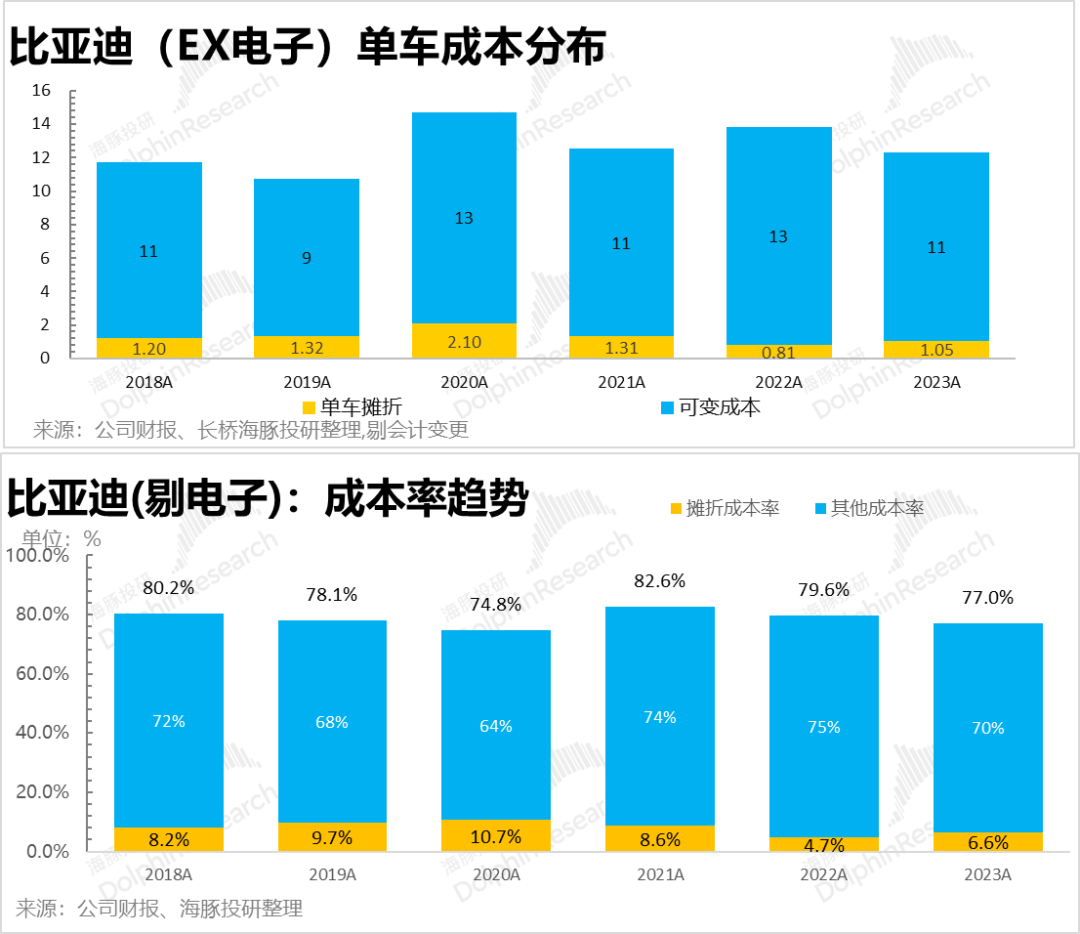

In fact, when Dolphin Jun broke down the components, it was found that BYD's automotive business in 2023 not only did not experience economies of scale, but the depreciation costs per vehicle were still increasing with rising sales.

Even after excluding the depreciation amount of over 3.35 billion yuan due to the shortened depreciation period from five years to three years caused by rapid technological updates in battery assets, BYD's depreciation per vehicle, in the context of increasing its car sales from less than 2 million to nearly over 3 million in 2023, was not just the depreciation rate, but even the absolute value of depreciation itself was rising, returning to over 10,000 yuan per vehicle in 2023.

And since its vehicle prices are still declining, the relative depreciation cost rate per vehicle is even more apparent.

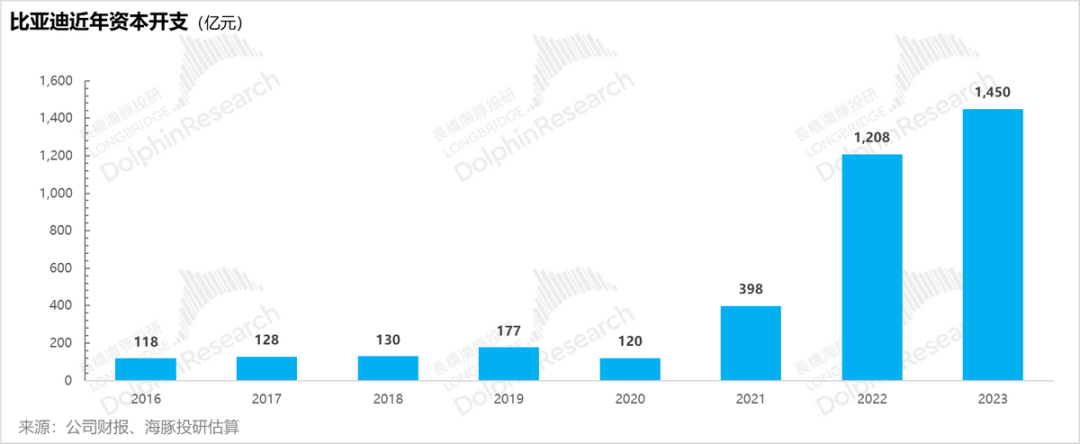

The reason behind this is easy to understand: BYD has aggressively increased its capital expenditure in the past two years, tripling it consecutively in 2021 and 2022, and continuing to grow at a high level in 2023.

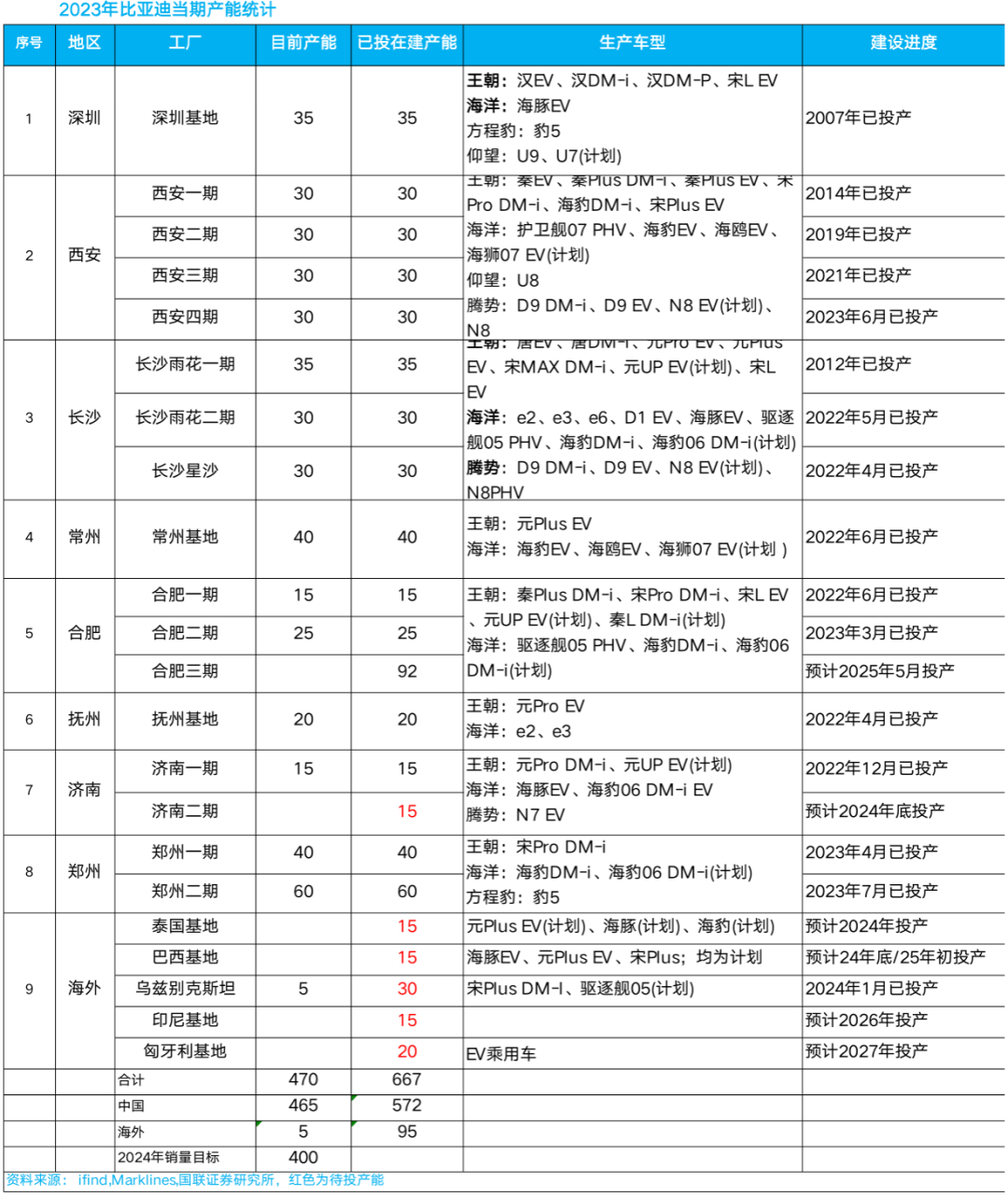

Looking at the production capacity that BYD has rolled out in recent years:

a) Overcapacity suspicions: If not overcapacity, BYD's automotive production capacity is at least equivalent to its sales targets, which are ample;

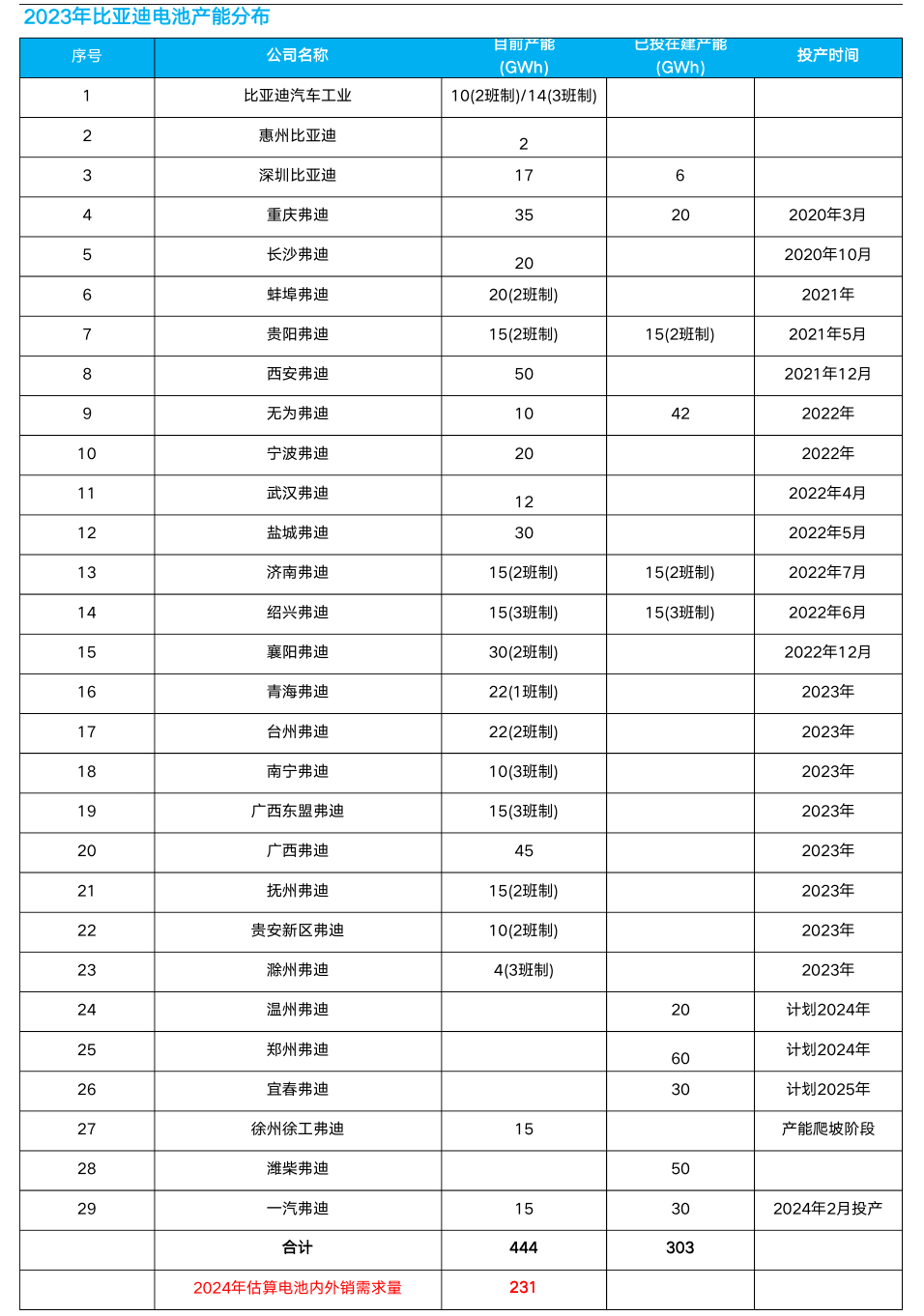

In the past two years, battery capacity has not truly ramped up in external supply (according to information collected, external battery supply may account for only about 5% of BYD Fudi Battery's sales). By the end of 2023, battery capacity had reached around 450GWh. Even considering the multi-shift factors of many factories, the actual capacity still significantly exceeds Dolphin Jun's estimated actual internal and external customer demand for Fudi Battery.

b) Scattered capacity distribution: The main issue lies in the distribution of capacity. While the distribution of automotive capacity is relatively normal (although still far from Tesla's highly concentrated production in Shanghai), the distribution of battery capacity is scattered everywhere, which is quite bizarre.

And from what Dolphin Jun has learned, a likely factor is that in recent years, as new energy has been a policy-encouraged industry, various localities have been fiercely competing for investment, and BYD, as a domestic leader, has ended up with a scattered distribution.

In this scenario, from the perspective of the enterprise, managing these scattered production capacities would likely pose significant challenges in supply chain management and material transportation.

So with vehicle prices declining further and the depreciation costs per vehicle still rising, the source of the gross margin increase becomes very clear - the reduction in variable costs:

① Declining lithium carbonate prices: BYD's average battery capacity per vehicle is 30kwh (including 40kwh for pure electric vehicles and 18kwh for plug-in hybrid models). The average price of lithium carbonate dropped from 500,000 yuan per ton at the beginning of last year to about 100,000 yuan per ton in the first quarter of this year.

Dolphin Jun estimates that BYD's cost reduction in the battery segment is approximately 7,000 yuan.

② Cost reduction through large-scale procurement

BYD's annual sales exceeded 3 million vehicles in 2023, an increase of 62% year-on-year. Higher sales volumes mean BYD has stronger bargaining power in raw material procurement;

③ Cost reduction through reduced configurations

In addition, BYD's Champion Edition launched in 2023 generally saw price cuts of around 10,000 yuan. However, unlike the Glory Edition in 2024, which reduced prices without reducing configurations, the Champion Edition in 2023 generally reduced configurations while reducing prices, such as adjusting battery capacity/motor power/central control screen size, to achieve cost reduction while maintaining profit margins and achieving lower