The results of the "midterm exam" of the new forces are released, with Ideal and Huawei-affiliated brands neck and neck

![]() 07/05 2024

07/05 2024

![]() 640

640

Lead

Previously, "NIO, Xpeng, and Ideal" were representatives of the new forces in the new energy vehicle market. However, as the new energy market has undergone multiple rounds of reshuffling, not only has the first batch of new forces experienced sales differentiation and a reversal of strength and weakness within, but there have also emerged new forces incubated by traditional automakers and "new" new forces represented by Huawei and Xiaomi. The competition among brands, coupled with the rise of plug-in hybrid models, has significantly changed the landscape of new forces in the first half of 2024.

Produced by | Heyan Yueche Studio

Written by | Guo Zi

Edited by | Heyan Zi

2695 words in total

4 minutes to read

In the first half of 2024, the Chinese automotive market experienced the most competitive half-year in history, with comprehensive competition from both price and product ends testing the financial strength and R&D capabilities of every automaker. Intense competition has driven up the temperature of the new energy vehicle market. According to estimates from the China Passenger Car Association (CPCA), the wholesale volume of new energy vehicles in the first half of this year reached 4.607 million units, with an estimated growth of 30%, and the new energy penetration rate in June is expected to reach 49.1%.

However, the growth in new energy vehicle sales is not evenly distributed, with winners and losers emerging in the rapidly advancing market.

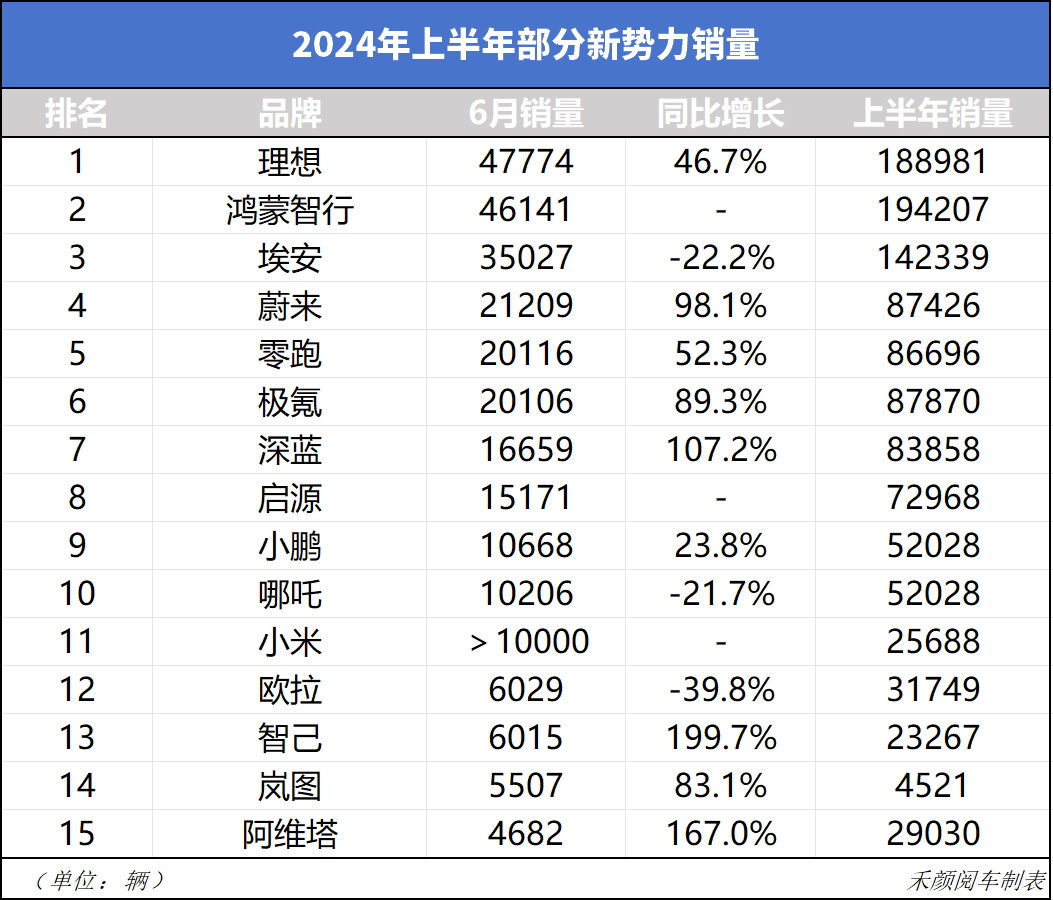

Based on the sales figures announced by various new forces in June, the new force automakers have clearly divided into several tiers.

The first tier consists of Ideal, Huawei-affiliated Hongmeng Zhixing, and AION. The second tier includes NIO, Leapmotor, Zeekr, Shenlan, Qiyuan, Xpeng, Nezha, and Xiaomi. The third tier comprises new forces with sales of less than 10,000 units, including brands that have been operating for many years and high-end brands created by traditional automakers. These are the most pressure-bearing segments in the automotive market, and it may be difficult to change the status quo without making radical changes.

Competition Among the Top Brands

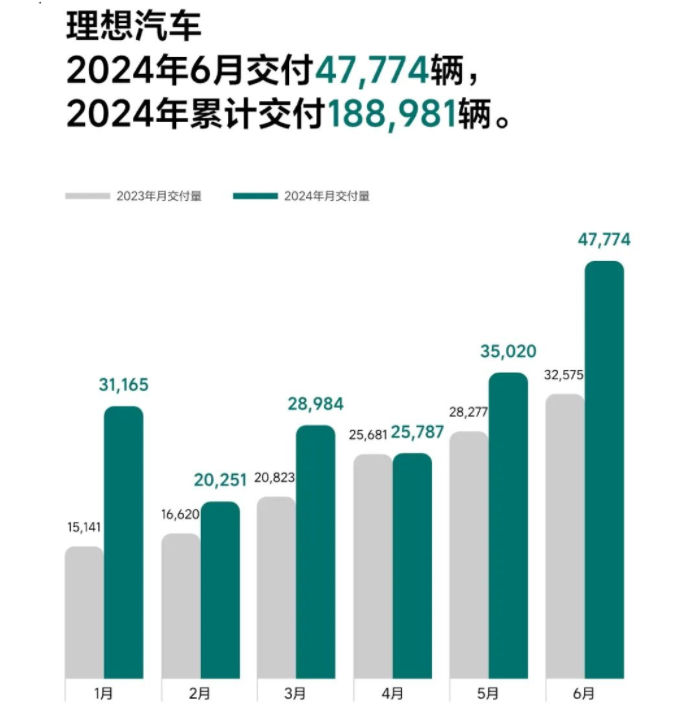

Ideal and Hongmeng Zhixing are among the new force brands with sales exceeding 40,000 units in June, demonstrating significant advantages. At the same time, these two brands are also the most attractive in the mid-to-high-end market among the new forces. The competition between the two sides has continued to intensify. Huawei-affiliated Hongmeng Zhixing surpassed Ideal in cumulative sales in the first half of this year to top the new force ranking, but in June, Ideal's monthly sales surpassed the Huawei series.

Ideal has grasped the home use needs of high-net-worth individuals. Currently, the cumulative sales of Ideal L7 and L8 have exceeded 16,000 units in May, surpassing Mercedes-Benz GLC and BMW X3 of the same price range. The monthly average sales of Ideal L9, priced at over 400,000 yuan, have also exceeded 6,000 units.

While the other two brands of NIO, Xpeng, and Ideal are exploring the market for survival, Ideal, which has stabilized in the 300,000-yuan market, is aiming for horizontal expansion of high-end products. Although the MEGA, which targeted the ultra-500,000 pure electric MPV market this year, failed, it is evident that Ideal will not give up on continuing to enter the high-end pure electric market and will continue to launch high-end pure electric SUV models next year. However, if Ideal wants to achieve its annual sales target of 480,000 units this year, the cheapest L6 in its lineup will be the key.

Relying on Huawei's brand power and robust intelligent driving and intelligent cabin capabilities, Hongmeng Zhixing has delivered good results in the past six months, with monthly sales averaging over 30,000 units, mostly achieved on products priced above 250,000 yuan. In May, the Wenjie M9 achieved over 16,000 units, surpassing Mercedes-Benz GLE and BMW X5, two evergreens, among passenger cars priced above 500,000 yuan.

In addition, Hongmeng Zhixing has deployed two high-end sedans, the Zhijie S7 and Xiangjie S9, targeting the core market of BBA, and has also created the Aojie high-end MPV, hoping to find a second growth curve. However, the Zhijie S7 has remained lukewarm despite two launches, and the market volume and attention of the Xiangjie S9 are average. It remains to be seen whether it can snatch market share from Mercedes-Benz E-Class and Audi A6L.

If only Wenjie succeeds among the four, then it remains questionable whether the Hongmeng Zhixing model can be replicated.

AION ranked third among the new forces in June with sales of 35,000 units. However, AION is a rare new energy brand that has experienced negative monthly sales growth. The reasons for this are two-fold. On the one hand, AION is deeply tied to the online car-hailing market, which is now saturated, having the greatest impact on AION. On the other hand, against the backdrop of rapid growth in plug-in hybrids and slower growth in pure electric vehicles, AION only has pure electric vehicles and has not launched any new models in the past six months, making it difficult to adapt to the fast pace of the market.

However, AION has announced that it will launch multiple new models in the second half of the year, including the second-generation AION V, which is expected to raise the core price range of AION products to the 150,000-200,000 yuan level, and the Haopai AH8, which targets the high-end large 6-seater market. These two models will compensate for AION's shortcomings in ultra-fast charging and intelligent driving. Notably, AION has clarified that it will add hybrid models to its product lineup next year. It is believed that after the adjustment period, AION will be able to continue to stabilize its position in the first tier with its product strength.

Accelerated Differentiation in the Second Tier

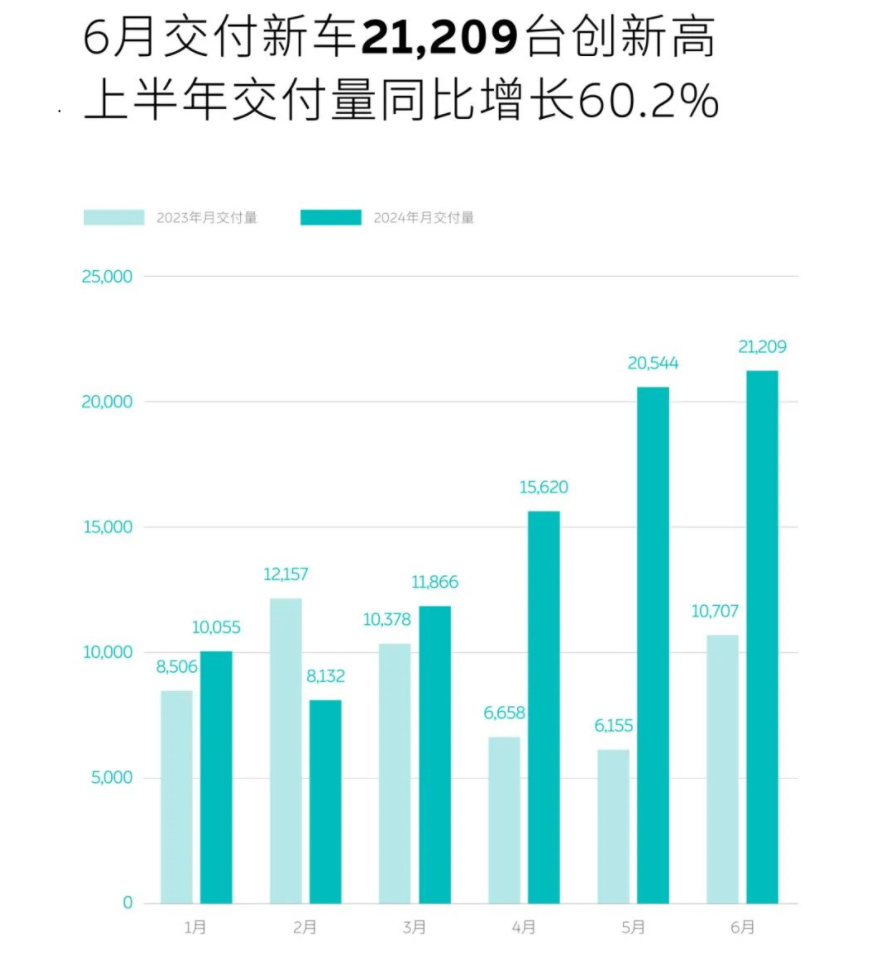

NIO achieved a record high of 21,209 units in June. To achieve this result, NIO has built a rather large lineup of 8 vehicles among the new forces and established an expensive battery swap system. Now, to boost sales and spread costs, NIO has also created a second brand, Ledao. It remains to be seen whether the highly competitive 200,000-yuan market can support NIO's profit hopes.

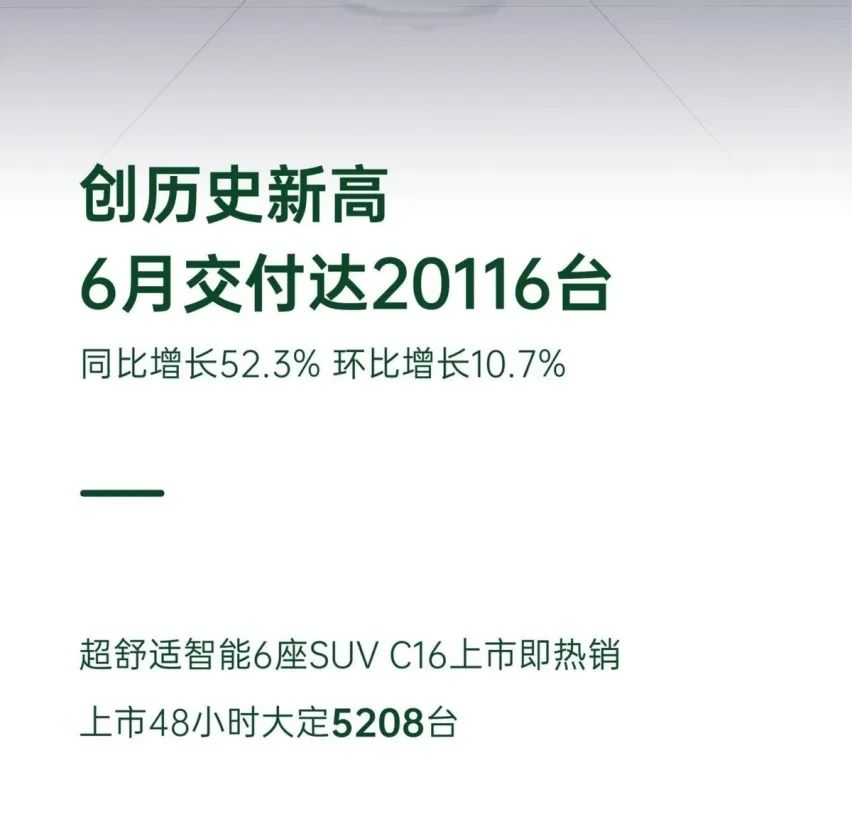

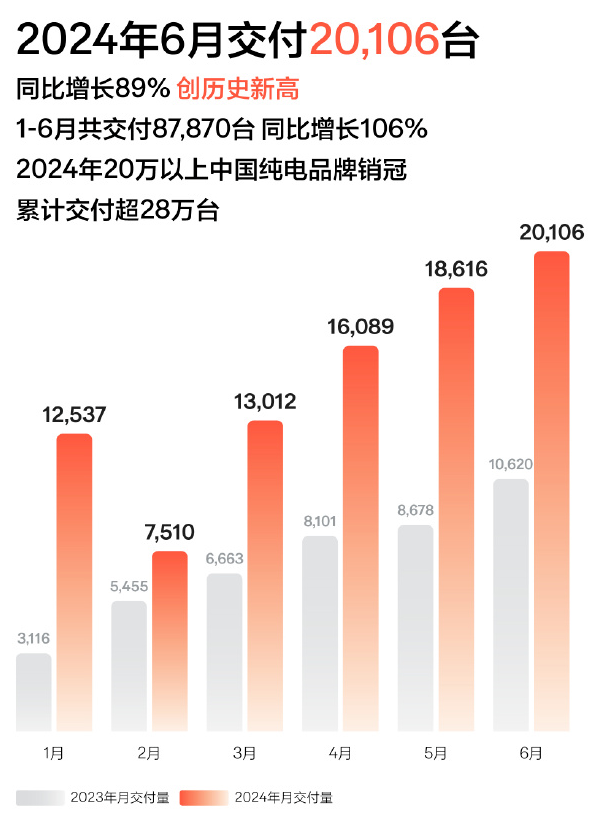

Leapmotor achieved 20,116 sales in June with multiple cost-effective models such as the C10 and C01, and its growth rate reached 106% in the first half of the year. Leapmotor's strategy of insisting on core self-research has finally borne fruit. As a small-scale new force, it has been able to keep up with the pace of top players like BYD and Geely in terms of cost-effectiveness and even achieve profitability, demonstrating its brand competitiveness. The upcoming Leapmotor C16 will also continue the route of being half the price of the Ideal L8.

Relying on the monthly sales of over 10,000 units of the Zeekr 001, Zeekr also achieved monthly sales of over 20,000 units in June. Achieving such a result for a car that focuses on sporty individuality is quite remarkable, indicating that there is still significant room for exploring niche categories in China's youthful market. Among the many high-end new energy brands created by traditional automakers, Zeekr is a benchmark brand. However, as Lynk & Co. has also begun to focus on new energy, how the two brands can develop synergistically to avoid internal friction will be an issue that Geely needs to address.

The rapid rise of plug-in hybrids continues, with a growth rate of 70.1% from January to May this year, and a penetration rate of 40.7%. This has driven the rapid growth in sales of Shenlan and Qiyuan, with their combined sales exceeding 30,000 units in June, which is a considerable performance among traditional automakers. Last month, Shenlan also launched the G318, which has become a key piece in Shenlan's deep layout.

Xpeng and Nezha have achieved sales of over 10,000 units for two consecutive months, which is quite remarkable for these two automakers that are going through difficult times.

Xpeng X9 has performed well in the high-end pure electric market this year, achieving both quantitative and qualitative growth for Xpeng. However, its previous mainstay models, the P7i and G6, are now performing poorly. If they cannot be revamped in time, they may be drowned out among the flood of new energy vehicles. In the second half of the year, Xpeng will pin its hopes on the MONA, which targets the 150,000 yuan segment. But can this red ocean support Xpeng's future sustainable development?

Nezha's situation is more complex. After BYD disrupted the market around the 100,000 yuan segment, Nezha was directly impacted. Now, Nezha is also actively embracing plug-in hybrids and has launched the Nezha L extended-range version, hoping to replicate Leapmotor's success. However, with traditional automakers全面推进10万元级产品插混化, has Nezha missed the opportunity?

Xiaomi is the most special in the second tier. Relying on Xiaomi's brand appeal, it has crossed the 10,000-unit threshold in just the third month of delivery with only one car. The SU7 has even received over 100,000 orders. Neither brand nor capital is lacking. The biggest challenge facing Xiaomi is actually production capacity. Recently, there were rumors of its factory shutdown, but it was later辟谣as production line optimization, showing that Xiaomi still faces inexperience in many aspects, but these issues are expected to be resolved in the future.

Commentary

The cumulative sales of the first tier of new forces in the first half of the year all exceeded 100,000 units, but such volumes have not yet formed sufficient self-sustaining capabilities. Expanding the market volume remains the top priority for these three automakers. Among the second tier, automakers such as NIO, Xpeng, and Nezha are facing a bottleneck period, with some even trapped in a vicious cycle where new models cannot sell well. Instead, the sales growth of new forces under Geely and Changan is quite rapid, but a significant portion of this growth is achieved by replacing traditional fuel vehicles with plug-in hybrids. Whether such performance can be sustained in the long term remains to be seen. Brands in the third tier are more difficult, with their sales hovering around a few thousand units for a long time and maintaining a certain sales volume only through continuous price concessions, which poses severe challenges to their brand power and market recognition. Currently, for new forces, if they cannot seize the opportunity to form independent self-sustaining capabilities, the challenges they will face in the future will become increasingly severe.

(This article is originally created by Heyan Yueche and may not be reproduced without authorization.)