The era of BBA making money while lying down is over

![]() 07/05 2024

07/05 2024

![]() 715

715

BMW, Mercedes-Benz, and Audi selling for 200,000 yuan... The recent price reductions of BBA have been hotly discussed.

BMW and Mercedes-Benz are slashing prices, with discounts of up to 100,000 yuan for the Mercedes-Benz C-Class. BBA is轮番降价, with average discounts reaching over 100,000 yuan, and entry-level models have entered the era of starting with the number one. The prices of luxury cars are no longer holding up. "Couldn't afford a BMW before; now, even if I can't afford it, I can still buy a BMW." "If I don't work harder, I'll only be able to buy BBA." Luxury car brands have fallen to being mocked by netizens.

Some BBA dealership sales representatives claim that they are losing money on every sale, with the main profit coming from bank rebates.

These are high-end and luxury cars. The more luxurious the car, the more it needs to maintain its tone and emphasize its brand moat. Between the short-term growth brought by price reductions and the product pricing system, the latter is valued more.

However, in the face of the general trend and declining sales, high-end cars have had to tilt the scales towards the former, leading to the collapse of the pricing system for high-end cars.

So, can price reductions for luxury car brands have the effect of "dimensionality reduction attacks"? What exactly is the competition in the high-end automobile market?

1. Price reductions spreading to luxury cars

Last year, BBA began to reduce prices. This year, with the launch of new models, BBA continued to slash prices, with new energy models seeing the steepest drops.

Mercedes-Benz has the largest price reduction and the most models, including multiple new energy models such as EQS, EQA, EQB, and EQC. The Mercedes-Benz EQS has a maximum price reduction of up to 669,000 yuan, a decrease of 50%. Other fuel models like the Mercedes-Benz A-Class and GLA are also seeing price reductions.

BMW has three new energy models: iX1, i3, and iX3. Among them, the iX1 has a maximum price reduction of 50%, while the latter two have price reductions of 42%. The original price of the iX1 ranged from 299,900 yuan to 339,900 yuan, but now it can be purchased for only 150,000 to 179,900 yuan. The i3 35L has also dropped from a guide price of around 370,000 yuan to around 190,000 yuan. Other fuel models like the X1 and 2 Series have price reductions of over 40%.

Audi's new energy model, the e-tron, has a price reduction of 40%, with the discounted bare car price around 200,000 yuan. Fuel models like the A4L, Q5L, A3, and Q2L have maximum price reductions of over 30%, with the entry-level bare car price of the A4L dropping to over 190,000 yuan.

Other second-tier luxury brands are also reducing prices. Cadillac's XT6, CT6, XT5, CT4, and XT4 have considerable discounts, ranging from 70,000 to 75,000 yuan, with starting prices just over 200,000 yuan. Lincoln Motors is also having a big sale, with the new Lincoln Aviator receiving an official price reduction of up to 64,000 yuan in September last year.

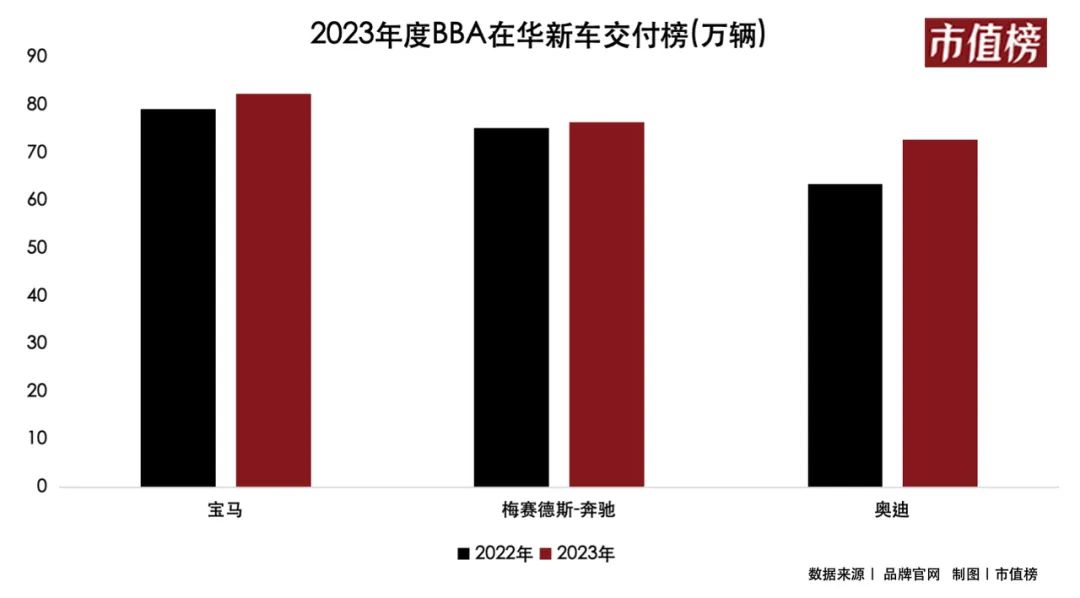

Due to their brand value, BBA has achieved volume growth through price reductions. Last year, BMW, Mercedes-Benz, and Audi saw sales growth in China of 4.2%, 1.8%, and 13.5%, respectively. However, BBA has also fallen into a dilemma of increasing revenue without increasing profits. For example, in 2023, Beijing Benz's revenue was 22.484 billion euros, down 9.4% year-on-year; after-tax profit was 2.999 billion euros, down 17.8% year-on-year.

Other second- and third-tier luxury brands are faring even worse, with some automakers on the verge of exiting the Chinese market.

The difficulties faced by traditional luxury brands stem from the price war launched by domestic new energy vehicles such as BYD, new carmakers, and Tesla.

In April 2022, BYD announced that it would stop producing pure gasoline vehicles and focus entirely on new energy vehicles. In 2023, it launched the Champion Edition model focusing on "equal pricing for gasoline and electricity," and in 2024, it launched the Glory Edition model focusing on "electricity cheaper than gasoline." In January 2023, Tesla reduced the prices of its main models, the Model 3 and Model Y, by 20,000 to 48,000 yuan. Subsequently, brands like Lixiang, Chery, NIO, Zeropound, and Zeekr have launched their own limited-time preferential policies.

BYD's main sales models are all priced below 200,000 yuan, giving it strong pricing power in this price range. Tesla, NIO, Lixiang, and other brands are gaining pricing power in the mid-to-high-end vehicle segment.

Under the onslaught of new energy vehicles, the sales share of gasoline vehicles is declining rapidly. Even at certain times, the sales of new energy vehicles have exceeded those of gasoline vehicles. In March 2024, Wang Chuanfu predicted that the penetration rate of new energy vehicles will exceed 50% in the next three months and may not stop there. According to the China Passenger Car Association, the sales share of new energy vehicles exceeded 50% in early April, reaching 260,000 units.

Brand power has always been the moat of high-end gasoline vehicles. Now, even if a gasoline vehicle is high-end, with a long history and fascinating stories, it no longer enjoys the privilege of "immunity" or even the ability to achieve "dimensionality reduction attacks" with slight price reductions.

2. What is the competition in the high-end market?

Cui Dongshu, secretary-general of the China Passenger Car Association, said that traditional high-end brands are mainly in the gasoline vehicle segment. Although multinational brands have a century of brand accumulation and foundation, they have not been recognized by consumers in the new energy vehicle market. Instead, Chinese brands focusing on high-end new energy vehicles have gained market acceptance and become "new high-end brands."

From the user perspective, the post-80s generation has become the main force in purchasing mid-to-high-end models. New energy vehicles are more youthful than gasoline vehicles, with a higher proportion of post-90s buyers. In the future, as time goes by, the post-90s generation will become the main consumer group for mid-to-high-end cars.

This generation of consumers grew up in the information age and have a natural affinity and high demand for technology. They pursue personalized and intelligent lifestyles, which is also reflected in their car purchasing choices. Younger users pay more attention to the technological feel of cars, such as intelligent driving assistance systems, connected car services, and electric powertrain systems.

According to a report from Dongchedi, as users age, their requirements for car exteriors and interiors gradually decrease. Currently, post-90s buyers consider functionality more heavily when purchasing a car, with high-configuration and good-looking luxury cars becoming their main focus.

In today's high-end competition, it's all about understanding users. New energy vehicle brands clearly understand the current main force of car buyers.

Although the core technologies of traditional cars mainly consist of three components - engine, transmission, and chassis - they have numerous mechanical and hydraulic parts with complex structures, making it difficult to make significant changes. Therefore, the product replacement cycle in the gasoline vehicle era was very long, leading to a relatively stable pricing system. There are relatively fixed price ranges for gasoline vehicles across different levels and types.

The core technologies of new energy vehicles include batteries, cabins, and autonomous driving. The definition of high-end core technologies has become more diverse. At the same time, components are more standardized and modular, leading to faster updates and changes in innovation methods and pricing systems for new energy vehicles.

For example, innovative methods can range from large-sized features to wireless car phone holders and zero-gravity seats - all of which are personalized pursuits of this generation of car buyers. Some of these innovations may become standard in the future, but they are still popular now.

In addition, new energy vehicle brands tend to face consumers directly, making them more user-oriented.

The pricing system of new energy vehicles is no longer based solely on the model but is more market-oriented. It focuses on what users need and creates cars accordingly, pricing them based on costs and market competition.

In the field of new energy vehicles, different technical routes such as pure electric, plug-in hybrid, and extended-range electric vehicles are competing for market share. Each technical route has its advantages and disadvantages, suitable for different usage scenarios and consumer needs.

First, pure electric models are more suitable for sedans that prioritize driving experience.

Pure electric models offer instant high torque output, smooth and silent acceleration, and excellent handling stability due to their lower center of gravity. Advanced intelligent driving assistance systems redefine the pleasure of modern driving.

This is the ultimate driving experience pursued by more post-90s and even younger users. New energy vehicles priced above 200,000 yuan are mainly sedans, with some mid-to-high-end brands such as Tesla, Zeekr, Huawei (Zhijie/Avita), NIO, XPeng, and Xiaomi having a certain scale. However, most pure electric sedans have low individual sales.

Currently, only the Tesla Model 3 and Zeekr 001 can reach a monthly sales volume of 10,000 units. According to official information from Xiaomi Motors, it is expected that the pure electric sedan Xiaomi SU7 will reach a monthly sales volume of 10,000 units in June 2024.

Second, hybrid models are more suitable for SUV models that prioritize home use.

While pure electric vehicles have advantages in operating costs, they are inferior to hybrid models in terms of range and charging convenience. Hybrid SUV models aim to find a balance between pure electric and gasoline vehicles. Hybrid SUVs provide smooth driving performance due to their fuel economy while also accommodating the spaciousness and versatility required by SUVs, making them ideal for family use, whether for city commuting or weekend outings.

Brands with a certain scale include Tesla, Lixiang, Tank, and NIO. Except for Tesla, the sales volumes of other pure electric SUVs are not high.

Third, high-end gasoline vehicles, due to their stable and mature technology and brand power, have also become an important choice for users.

High-end gasoline vehicles, with their brand heritage, mature and reliable technology platforms, excellent craftsmanship, and performance, provide a better driving experience, exquisite interior design, and superior power performance, enabling them to maintain a place in the market.

In the future, as gasoline vehicles continue to see significant price reductions, dropping to 200,000 yuan or even lower, they may be able to maintain their current sales volumes but may not see significant growth. Data from the first quarter of this year shows that sales of BMW and Mercedes-Benz have declined by 3.8% and 10.4%, respectively, while only Audi has seen a year-on-year increase of 14% in sales.

However, their profits have all declined sharply, with BBA profits down 24.6%, 30%, and 58.4%, respectively. But it seems there is no other choice but to hope that they can weather the current chaotic pricing situation and emerge into an orderly future.