Acquisition of Wenjie Trademark and Patents for 2.5 Billion: A Win-Win for Seres and Huawei

![]() 07/07 2024

07/07 2024

![]() 519

519

Written by Wan Tiannan

Edited by Chen Jiying

Recently, Seres has had double joy.

From January to June this year, Seres' cumulative sales of new energy vehicles reached 200,949 units, with a year-on-year growth rate of 348.55%, easily winning the championship among various new energy vehicles.

AITO Wenjie M9, which focuses on the high-end luxury car market, has also made rapid progress, with cumulative orders exceeding 100,000 units, firmly occupying the top spot in sales of models priced above 500,000 yuan.

On July 2, Seres announced that its holding subsidiary, Seres Automobile Co., Ltd., intends to acquire 919 registered or pending text and graphic trademarks, including Wenjie, as well as 44 related design patents held by Huawei Technologies Co., Ltd. and its affiliates. The total acquisition price for these assets is only 2.5 billion yuan.

Since joining hands in 2021, the cooperation between Seres and Huawei can be described as a perfect match. Seres has surged to the forefront in the competitive new energy vehicle market, while Huawei's car BU has also achieved a "grand slam" in automotive ecological services and infrastructure construction, successfully running through its business model.

However, this acquisition deal worth 2.5 billion yuan has abruptly interrupted the positive momentum. What variables and benefits will this acquisition bring to the future development of this partnership?

Seres Wins Both "Face" and "Substance" with This "Floor Price" Acquisition

Currently, AITO Wenjie is in full swing, winning back-to-back grand slams in the mid-range and high-end markets.

In June this year, AITO Wenjie delivered over 40,000 units in a single month, setting a new record.

Among them, in the high-end market, AITO Wenjie M9 delivered 17,241 units in June, with cumulative orders exceeding 100,000 units.

AITO Wenjie New M7, which focuses on the mid-to-large SUV market, delivered 18,493 units in June, with cumulative sales exceeding 110,000 units in the first half of the year, firmly occupying the top spot among emerging models in China.

The high-profile urban performance SUV Wenjie New M5 has delivered over 10,000 units since its launch, with 7,046 units delivered in June.

Apparently, AITO Wenjie has evolved from an "underdog" to a "steady high-growth" white horse. In the first quarter of this year, Seres achieved operating revenue of 26.561 billion yuan, a year-on-year increase of 421.76%; net profit attributable to shareholders was 220 million yuan, an increase of 845 million yuan compared with the same period last year.

With sales soaring, the brand value of AITO Wenjie has also been on the rise. According to an independent assessment by the third-party Beijing Zhongjing Minxin Asset Appraisal Co., Ltd., the market value of the target assets acquired by Seres on May 31, 2024, is 10.233 billion yuan.

Considering the rapid growth in sales of AITO Wenjie in June, with a year-on-year increase of 372.04%, its current brand asset value obviously exceeds the evaluation price at the end of May.

Compared to the value of tens of billions of assets, the acquisition price of 2.5 billion yuan is equivalent to a discount of two or three times, making it a steal for Seres. It has won both the "face" of the brand and the "substance" of development.

The so-called "face" refers to Seres regaining the complete brand assets of Wenjie at a discounted price of two or three times.

In the past three years, AITO Wenjie has gradually established itself in the mid-range and high-end markets, but there have always been doubts among users and the capital market. The products come from Seres, but the trademarks belong to Huawei, creating a certain conflict. The capital market has also worried whether Seres is just paving the way for Huawei.

After this acquisition, Seres has regained the complete brand assets of Wenjie, giving it more say in brand building and long-term development. With the alignment of market perceptions between products and trademarks, both users and the capital market have completely dispelled doubts, significantly increasing the certainty of Seres' value consensus.

The so-called "substance" refers to the fact that after regaining brand assets, Seres has received increased support from Huawei. Moreover, with the clarification of the relationship between the two parties, cross-business has been reduced, enhancing the complementary nature of their industrial layouts and continuing to safeguard the long-term development of AITO Wenjie.

Currently, Huawei's automotive business is divided into three major categories: components, HI, and the Smart Selection model, with the depth of involvement gradually increasing.

Currently, Seres Automobile is the only automaker that has signed comprehensive strategic cooperation agreements with Smart Selection, Car BU, and Huawei Digital Energy.

Among the various cooperative brands, Wenjie corresponds to the Smart Selection model. In the first half of this year, Huawei announced the sales of the Smart Selection model (HarmonyOS Smart Drive) on a monthly basis, with Wenjie accounting for about 80% of the total. It can be said that the success of Huawei's Smart Selection model hinges on Wenjie, and their interests are highly aligned.

After the announcement of this acquisition plan, Huawei also responded explicitly, stating that it will continue to support Seres in manufacturing and selling Wenjie. Huawei has always adhered to the principle of not manufacturing cars but rather utilizing leading intelligent connected vehicle technology to continuously help automakers manufacture and sell good cars.

After the announcement of the acquisition plan, both parties have successively pledged to continue strengthening their cooperation, and the end-user experience of consumers will not be affected in any way. They will give full play to their joint business advantages and build AITO Wenjie into a world-class leading brand of new luxury vehicles.

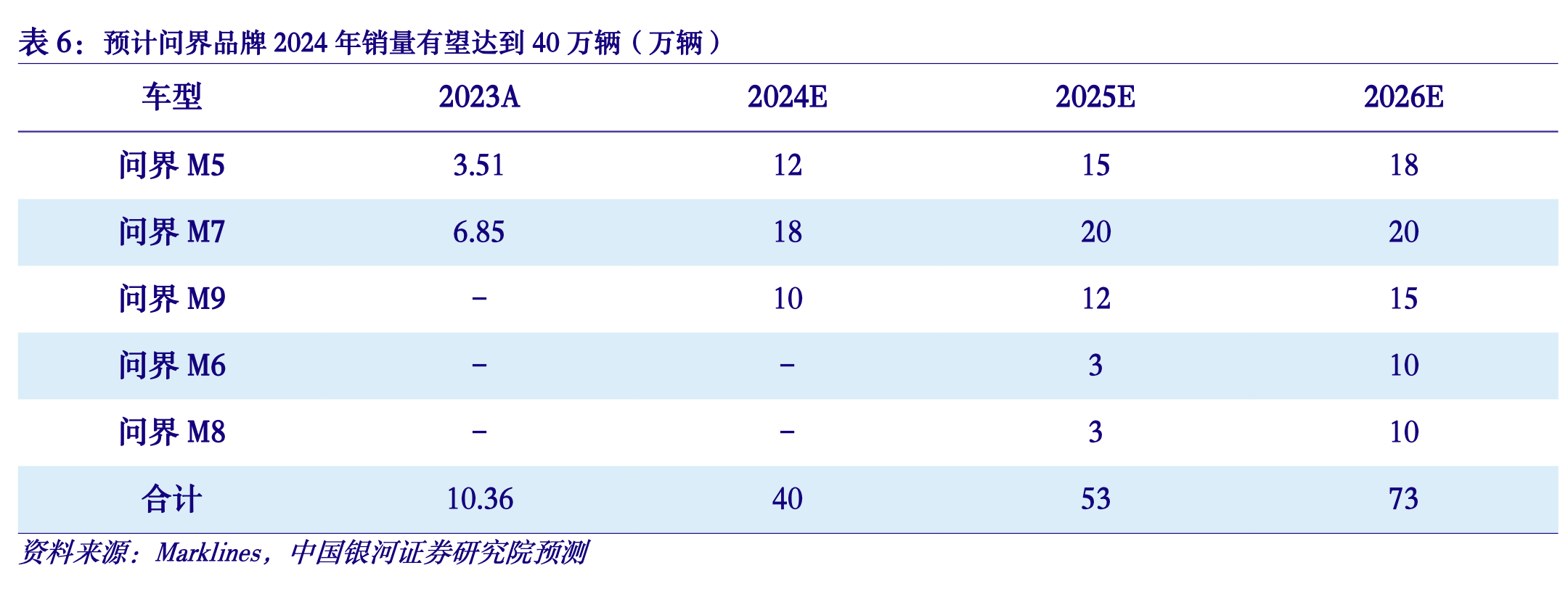

According to estimates by China Galaxy Securities, relying on Huawei's leading software and hardware capabilities, Wenjie's sales are expected to maintain strong performance, and it is anticipated that Wenjie's brand sales in 2024 will reach 400,000 units, establishing a leading position in the domestic new energy luxury brand market.

In summary, through this acquisition, Seres has won both "face" and "substance" with a steal price of 2.5 billion yuan.

Win-Win Game: Clarifying Boundaries and Deepening Cooperation

Has Huawei lost by "selling cheaply" assets worth tens of billions of yuan for 2.5 billion yuan? In fact, this acquisition is also a far-sighted move by Huawei.

Huawei has also benefited greatly from its cooperation with Seres.

In 2021, when the two parties started their cooperation, Huawei's terminal business was in a downturn, with the company's revenue recording its first decline in nearly five years. After cooperating with Seres, Huawei's automotive business became a new growth pole, making up for the growth pressure caused by the suspension of its mobile phone business.

Relying on the rapid growth of Wenjie, Huawei has also achieved Yu Chengdong's goal of achieving 300,000 annual sales in three years. From January to June this year, Wenjie's sales exceeded 200,000 units.

Huawei's financial situation has also improved significantly, with a net profit of 87 billion yuan last year, a year-on-year increase of 144.4%. Yu Chengdong revealed that Huawei's Car BU will also achieve profitability this year.

Now, with the continued validation of the aforementioned models, Huawei's automotive industry circle continues to expand. In addition to Seres, there are also three central enterprises (FAW, Dongfeng, and Changan), three local state-owned enterprises (BAIC, SAIC, and GAC), four private enterprises (BYD, Geely, Great Wall, and Chery), as well as some emerging automakers.

However, there has always been uncertainty in the industry about whether Huawei will enter the vehicle manufacturing business. This doubt has led some automakers to hesitate in fully cooperating with Huawei.

To dispel concerns, both Ren Zhengfei and Yu Chengdong have repeatedly stated publicly that "Huawei resolutely does not make cars."

Now, by "selling cheaply" brand assets to Seres, Huawei has also transferred the ownership of the Zhijie and Xiangjie brands to Chery and BAIC. So far, Huawei has completely exited the entire vehicle business, fulfilling its strategic commitment and completely dispelling automakers' concerns, strengthening its platform attributes and infrastructure positioning, enabling it to continue expanding its automaker circle and building a larger automotive service ecosystem.

Through this transaction, Huawei has also obtained 2.5 billion yuan, which can help Huawei address financial issues in its automotive business and reduce losses, while also further investing in the research and development of its core components to continue enhancing its competitiveness.

Therefore, on the surface, it seems that Huawei is selling assets cheaply, but in fact, Huawei is planning for the long term.

After this acquisition, the boundaries between Huawei and Seres in their cooperation are clearer, and their strategic goals are fully aligned - to build AITO Wenjie into a world-class leading brand of new luxury vehicles.

Just recently, Seres and Huawei have signed the "Further Deepening Joint Business Cooperation Agreement." This is the second time that Seres and Huawei have signed a related agreement after signing the Deepening Joint Business Agreement in February 2023, demonstrating their determination to continue deepening their cooperation.

According to the aforementioned agreement, under the premise that the original cooperation framework remains unchanged, Seres and Huawei will leverage their respective strengths, resources, and endowments, focusing on the AITO Wenjie brand under Seres Automobile, jointly designing and marketing, providing users with high-end intelligent electric vehicle products and smart travel solutions, building AITO Wenjie into a world-class leading brand of new luxury vehicles, and jointly achieving business success.

The cooperation is not limited to AITO Wenjie, as Seres and Huawei will continue to strengthen cooperation across the entire industrial chain.

Yu Chengdong has repeatedly stated publicly that based on long-term development considerations, it is necessary to introduce more automaker partners to "build an open platform for electric and intelligent vehicles with the participation of the automotive industry, an open platform with a locomotive."

As an old friend, Seres is also actively supporting this initiative and is actively planning to participate in strategic investment and cooperation with Yingwang (a new company established by Huawei Car BU).

After the completion of the aforementioned series of acquisitions and shareholdings, the two parties are positioned upstream and downstream of the industrial chain, with reduced overlap and continued enhanced complementary attributes, highly aligned interests, and smoother and more profound cooperation.

After the Acquisition, Seres Plays a New Card

In their public statements, Seres and Huawei share the same goal of building AITO Wenjie into a world-class leading brand of new luxury vehicles.

Implicitly, after the acquisition plan is implemented, the globalization journey of AITO Wenjie will also be put on the agenda, officially signaling its overseas expansion.

In the past, due to US sanctions against Huawei, the Wenjie brand, which belonged to Huawei, faced many restrictions in overseas expansion.

Now that the brand belongs to Seres, this obstacle has been eliminated.

China exported 4.91 million vehicles in 2023, becoming the world's largest automobile exporter, with new energy vehicles being the main force in overseas expansion. According to predictions by the globally renowned consulting firm AlixPartners, Chinese brand automakers are expected to account for 33% of the global automotive market by 2030.

The mid-to-high-end car segment that Wenjie focuses on is already quite advantageous for Chinese companies in overseas expansion. As early as 2019, Chinese luxury car sales accounted for 31% of the global market, followed by the United States, Germany, and the United Kingdom, accounting for 24%, 11%, and 8%, respectively. The combined sales of luxury cars in these four countries accounted for 74% of the global market share.

With favorable timing, geography, and human resources, Seres also has rich experience in overseas expansion.

Since 2005, Seres' vehicles have been exported to more than 70 countries and regions worldwide, with cumulative exports exceeding 500,000 units. It has over 1,000 marketing service outlets overseas. These resources and capabilities can be reused when Wenjie expands overseas.

With favorable timing, geography, and human resources, the growth dividends of globalization are highly anticipated. Once the overseas expansion channel for AITO Wenjie is opened, there is a complete opportunity to recreate another Seres in overseas markets.

The comprehensive assets of AITO Wenjie acquired this time have an estimated value of over 10 billion yuan. Seres has successfully acquired the relevant trademark rights and intellectual property rights held by Huawei, undoubtedly adding important weight to the assets of the listed company.

With the clarification of brand asset ownership, the continued high growth in Wenjie's sales, and the further opening of globalization growth channels, the capital market is optimistic about Seres' prospects. In the past year, Seres' share price has more than doubled, from less than 40 yuan at the end of June last year to over 80 yuan now.

Currently, multiple securities firms are optimistic about Seres' prospects, giving it "recommend" and "buy" ratings.

For example, China Galaxy Securities predicts that the Wenjie brand will become the main driver of Seres' revenue growth, driving the rapid expansion of the company's business scale. It is expected that the Wenjie brand will contribute revenues of 122.761 billion yuan, 155.227 billion yuan, and 210.039 billion yuan in 2024-2026, respectively. It will also drive the net profits attributable to shareholders of listed companies to 2.567 billion yuan, 5.7 billion yuan, and 9.715 billion yuan in 2023-2025, corresponding to EPS of 1.70 yuan, 3.78 yuan, and 6.43 yuan, respectively.

Based on the above data, the reasonable per-share value range of the listed company is 115.74-120.81 yuan, thus maintaining a "recommend" rating.

With face and substance won, and the whistle blown, this acquisition is a win-win situation for all parties involved.