Nezha Auto Seeks IPO in Hong Kong

![]() 07/07 2024

07/07 2024

![]() 516

516

Nezha Auto, taking an unconventional approach.

On June 26, Hozon New Energy Auto Corporation, the parent company of Nezha Auto (hereinafter referred to as Hozon Auto), submitted a prospectus to the Hong Kong Stock Exchange. This is the first time since Nezha Auto's establishment that it has sought a listing on the Hong Kong stock market. China International Capital Corporation, Morgan Stanley, CITIC Securities, ABC International, and CMB International acted as joint sponsors.

According to the prospectus, Hozon Auto was founded by Dr. Fang Yunzhou in October 2014. After obtaining production qualifications from the Ministry of Industry and Information Technology in 2018, the "Nezha" brand was officially launched in June of the same year. The name is taken from an ancient Chinese mythological figure, aiming to embody the spirit of the Nezha Auto brand through the image of Nezha as a young, brave, determined, self-breakthrough, and justice-guarding character. However, this name has also brought considerable negative impact to the brand in recent years, and even led to the CEO of Nezha Auto, Zhang Yong, seeking renaming suggestions from netizens on short video platforms, sparking public attention.

Based on the data disclosed in the prospectus, Nezha Auto has lost more than 18 billion yuan in the past three years. Under continued heavy losses, there have also been difficulties in using cash on hand to cover short-term debts. Two months ago, Nezha urgently obtained a 5 billion yuan infusion from multiple institutions, which can alleviate the immediate pressure but is like a drop in the bucket in the face of the increasingly fierce competition in the domestic automobile market. Therefore, Nezha Auto's choice to seek a listing at this time is in line with expectations.

If Nezha Auto is ultimately able to successfully list, it will be the fifth new force automaker to land on the Hong Kong stock market after NIO, XPeng, Lixiang, and Zero Run.

01

The "Past and Present" of Nezha Auto

Although Nezha Auto has gradually widened the gap in sales with other brands since last year, it has also had its own "glory days" - the sales champion of new forces.

Nezha Auto's early progress was remarkable among the new forces in carmaking. According to the company history section in the prospectus, after Hozon Auto launched the Nezha brand in 2018, the first mass-produced car, the Nezha N01, was delivered in the same year. Two years later, in 2020, the second and third mass-produced cars, the Nezha U and Nezha V, were successively delivered. In 2021, Nezha Auto began to prepare for overseas expansion, developing right-hand drive models, and the same year, the self-developed intelligent vehicle platform - Shanhai Platform - was officially launched, taking a significant step forward in strength.

2022 was the most brilliant year, with Nezha Auto selling as many as 152,100 vehicles, successfully topping the list of new forces. Moreover, the Nezha S sports sedan launched in the same year was also a highly praised and popular product. However, in 2023, Nezha Auto fell behind in sales due to failures in new product launches, gradually being surpassed by brands like XPeng, which are also new forces in the domestic market. The rapid decline in sales has put Nezha Auto at risk of becoming a marginal brand.

At the beginning of this year, there were continuous news reports about Nezha Auto "falling behind": delayed year-end bonuses, factory shutdowns, etc. Zhou Hongyi, the founder of 360, one of Hozon Auto's investors, also stepped out from behind the scenes to personally "guide" Nezha Auto's marketing, bringing considerable traffic to the brand.

Nezha Auto is also undergoing large-scale rectification internally. Due to accusations of "poor marketing," CEO Zhang Yong has undergone a major overhaul of Nezha Auto's marketing department and personally stepped into the fray, fighting for attention for Nezha Auto on short video platforms. This move has received praise from some consumers and has brought tangible benefits to Nezha Auto - after the launch of the new Nezha L model, it has become a hit product for Nezha Auto this year due to the product's own reasons and early brand momentum. The company's sales have also recovered from a low of 6,000 vehicles in February to over 10,000 vehicles per month. However, the reality that Hozon Auto must face is that among the four companies already listed in Hong Kong, Lixiang sold nearly 48,000 vehicles in June and has achieved profitability; NIO and Zero Run have stabilized at 20,000 vehicles, and only XPeng's sales are close to Nezha's. XPeng has successfully listed on the New York Stock Exchange since 2020 and returned to Hong Kong for a secondary listing in 2021. Without a sales advantage and with a high loss, Nezha needs a new story to impress investors.

02

Nezha Auto's Unconventional Approach

The main models promoted by Nezha Auto - Nezha AYA, Nezha X, Nezha L, Nezha S, and Nezha GT - mostly fall within the 200,000 yuan range. This price range has the broadest market in the domestic market and is also a fiercely contested area for various automakers. Product homogenization is also severe. Nezha Auto faces numerous difficulties and challenges in breaking through in this price range.

We found in the prospectus that Hozon Auto's overall description mentions "overseas" up to 178 times, which indicates the intended use of funds raised after Nezha's listing - going overseas.

Although Nezha Auto has not shown sufficient advantages in domestic competition, its performance in the Southeast Asian market is noteworthy. As mentioned earlier, since 2021, Hozon Auto has been developing right-hand drive models for export to Southeast Asia. Starting in 2022, it officially entered the Thai market and achieved exports of 17,019 vehicles in 2023, accounting for 13.7% of total sales for the year and contributing 12.0% of sales revenue for the same year. According to Frost & Sullivan's report, in terms of insurance volume, Nezha was among the top three brands of new energy passenger cars in Southeast Asia in 2023, and the Nezha AYA series ranked first in sales of small pure electric vehicles in Southeast Asia, with a market share of up to 52.0%.

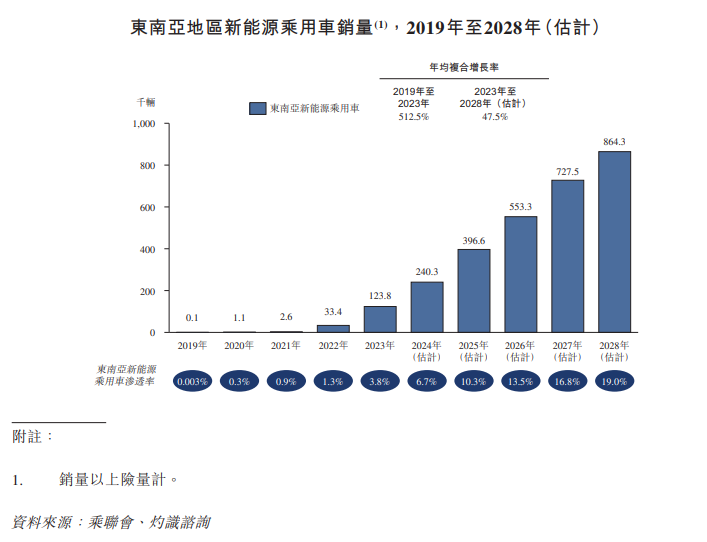

Hozon Auto has also further expressed its optimistic estimate of the Southeast Asian market in the prospectus: The passenger car market in Southeast Asia has significant growth potential. According to Frost & Sullivan's report, as of the end of 2023, the passenger car ownership per thousand people in major Southeast Asian countries was only 92.0 vehicles, significantly lower than that of developed economies such as the United States (about 767.7 vehicles per thousand people) and European countries (about 567.8 vehicles per thousand people). As of the same date, it was also lower than China (about 205.3 vehicles per thousand people), equivalent to China's ownership level per thousand people in 2014. According to general market rules, Southeast Asia is expected to replicate the logic of new energy vehicle development in mainland China and usher in explosive growth.

In addition, Hozon Auto has also made optimistic estimates for the Latin American region, the Middle East region, and the African region. Given the advantages of Chinese new energy automakers in technology, research and development, and supply chains, the overseas market prospects are broad.

03

Does Going Overseas Mean All Opportunities?

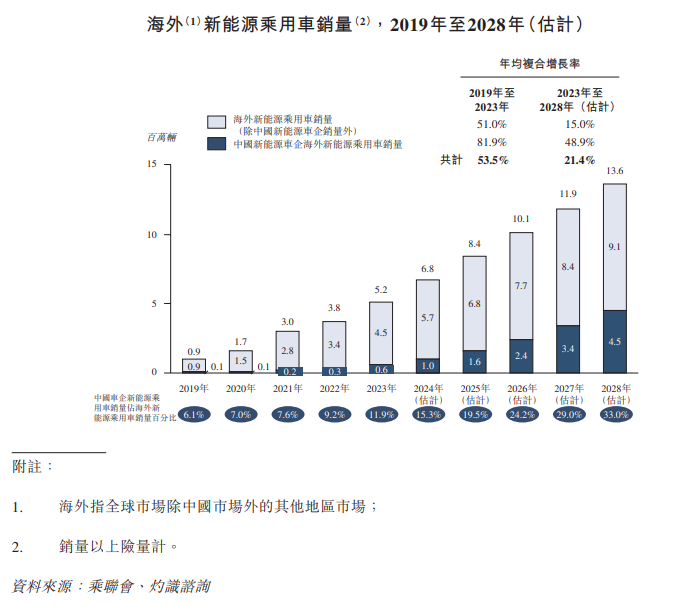

According to data from the China Passenger Car Association (CPCA), China's passenger car exports reached 4.4 million vehicles in 2023, surpassing Japan's export volume for the same year for the first time, becoming the world's largest automobile exporter. The process of domestic new energy vehicles going overseas is accelerating. According to Frost & Sullivan's report, in terms of overseas market retail sales, Chinese new energy automakers sold 600,000 overseas new energy passenger cars in 2023, accounting for 11.9% of the total overseas new energy passenger car sales for the year. It is expected that by 2028, the overseas sales of new energy passenger cars by Chinese new energy automakers are expected to grow rapidly to 4.5 million vehicles, accounting for 33.0% of the total overseas sales of new energy passenger cars for the same year.

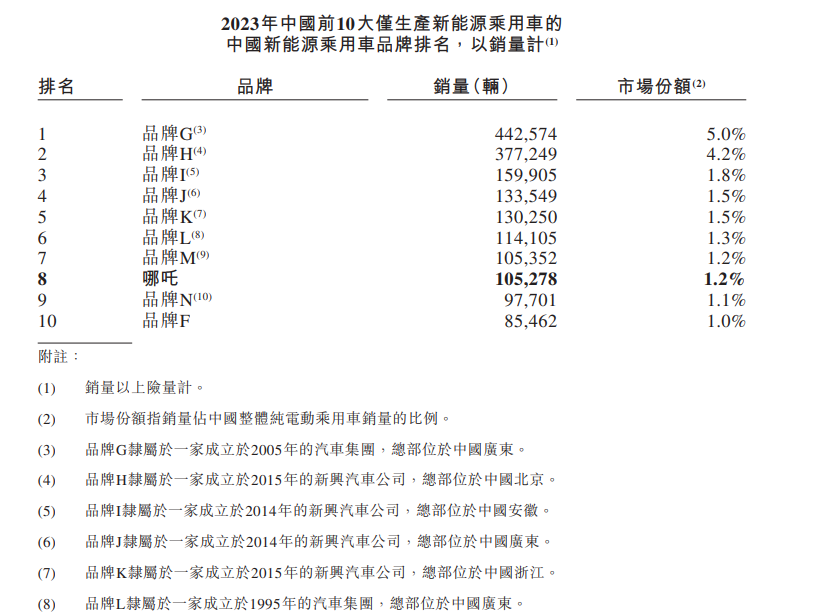

Looking back at Nezha's 2023 data: 17,019 vehicles were exported, accounting for about 2.8% of the total number of exported domestic new energy vehicles in the same year, which is higher than its 1.2% market share in the domestic market, but there is no particularly significant advantage.

However, further interpretation of this data reveals an interesting phenomenon: Although Nezha's export volume is not high, it is still among the top ten domestic new energy vehicle exporters in 2023. Among the brands on the list, except for Tesla, BYD, and MG, the differences between the other brands are minimal. Moreover, Nezha Auto is the only new force automaker on the list, indicating that in terms of overseas layout, Nezha is ahead of NIO, Lixiang, XPeng, and Zero Run.

However, we are generally cautious about Nezha's future performance in overseas markets, mainly from the perspectives of the industry and products. Nezha Auto faces a series of significant challenges in going overseas, despite the broad prospects of overseas markets. The "fierce competition" in the domestic market will inevitably spread overseas with the export of domestic new energy vehicles.

First, there is currently a confrontation between BYD of China and Tesla of the United States, and their battle has spread from the domestic market to overseas markets. Currently, BYD has established, is constructing, or is seeking to establish factories in Southeast Asia, Central Asia, and Europe. In the near future, BYD may replicate the domestic situation and occupy most of the overseas markets for Chinese automakers, leaving little time and space for other brands. Recently, at an unofficial automotive forum in China, the forum chairman delivered a speech on the theme of "anti-involution." Although BYD was not mentioned explicitly, the intention of targeting BYD was evident, which also indirectly confirms the tremendous pressure BYD is putting on other automakers, a situation that is likely to continue overseas.

Second, in terms of products. Nezha's products are more like a student who wants to develop in all aspects of morality, intelligence, physique, aesthetics, and labor. Although such students develop evenly, they are not as popular as students who have special talents in music, sports, or the arts. For example, after Lixiang first introduced the concept of "big sofa, big TV, big refrigerator," its products sold well and became profitable. This year, Nezha introduced a similar product at only half the price, receiving good market feedback, but there are suspicions of "trading price for market share." In terms of intelligent driving, although Nezha Auto's level is considered first-tier, people first think of XPeng when it comes to domestic brands in intelligent driving. As for other aspects such as range extenders and batteries, there is severe product homogeneity in the market, and there are no particularly noteworthy highlights.

Moreover, Nezha may lack in marketing. Until this year, ten years after the founding of Hozon Auto and six years after the launch of the Nezha brand, this domestic new force brand has only become widely known to consumers because of Zhou Hongyi. It used to be more like a "playful brand." Even Zhou Hongyi complained, "Did you give the brand this name because you never intended to make it last in the first place?" Compared to Lixiang CEO Li Xiang, who is known as the "King of Weibo," Huawei and Xiaomi automobiles that come with topic traffic, NIO CEO Li Bin who frequently appears in major media, and state-owned enterprises that aggressively advertise, Nezha CEO Zhang Yong's marketing is slightly immature, and he has not yet formed an entrepreneur IP. Nezha Auto's wallet is also getting increasingly dry, and it lacks the strength to advertise.

However, there is also good news. Although Nezha Auto has lost 18 billion yuan in three years, new forces such as NIO, XPeng, and Zero Run are also still losing money. According to the financial report in the prospectus, Nezha Auto's loss margin is shrinking. Nevertheless, time is running out for Nezha Auto, a carmaker on the edge of domestic new forces brands. It urgently needs to obtain new funds from the market and regroup to go overseas.

Conclusion

Since its establishment, Nezha Auto has experienced a period of rapid development but still faces huge losses and increasingly fierce competition. This Hong Kong stock market listing is an important measure for Nezha Auto to address its financial difficulties and expand overseas markets. In the future, Nezha Auto needs to continue to exert effort in product innovation, market strategies, and brand building to cope with the dual pressures at home and abroad. The success or failure of the IPO is crucial for Nezha.