After June, it's even harder for gasoline cars

![]() 07/08 2024

07/08 2024

![]() 528

528

Introduction

The eagerly anticipated "turning point" is right in front of us.

Responsible Editor: Cui Liwen

Editor: He Zengrong

"I don't understand why anyone is still buying gasoline cars?"

During the post-event interview after the 2021 NIO Day conference, Li Bin, the founder of NIO, made such a statement. Instantly, it sparked widespread criticism. Rationally and objectively speaking, there is relevant context to support this statement: In an environment where refueling is very convenient, the user experience of new energy vehicles does indeed surpass that of gasoline cars.

However, at that time, although the new energy transformation of the Chinese auto market had shown signs of hope, it had not yet ushered in a truly splendid bloom.

Therefore, Li Bin was inevitably subjected to intense criticism. And in the NIO media communication meeting held at the end of last year, he finally responded to the above "插曲" (插曲: a small incident or episode).

"This is the thing I regret the most. Now it has become a label for me, making me seem arrogant, ignorant, and out of touch with reality. I said the wrong thing because there are so many gasoline car users, and there are definitely many reasons why they buy gasoline cars."

"I think I said that too early, maybe it would be more appropriate in another five years."

Obviously, in order not to trigger unnecessary controversy and bring so-called "black spots" to his own company, Li Bin's words were filled with caution. But in my opinion, this time Li Bin's prediction is too conservative.

Because considering the overall progress of the Chinese auto market this year, especially the just-passed June, new energy vehicles are achieving a comprehensive dominance over gasoline cars. Although the latter still holds a lead in sales and ownership, the former, in terms of both volume and momentum, is gradually gaining ground.

The "turning point" we have been eagerly anticipating may have really arrived.

When the diehards start to be broken

"I think the monthly retail penetration rate of new energy vehicles will exceed 50%."

At the beginning of this year, Wang Chuanfu, the chairman of BYD, made a judgment that sparked intense discussion throughout the Chinese auto market. In the eyes of many skeptics, his prediction was perhaps too optimistic.

After all, based on last year's situation, the inherent share of gasoline cars was still deeply entrenched, and new energy vehicles still had a long way to go before they could truly "destroy the city and capture the fortress".

But no one could have predicted that earth-shaking changes would come so quickly.

In May, the retail penetration rate of new energy passenger cars reached a record high of 47.0%. Just past June, although the official data has not yet been released, it is increasingly anticipated whether it will further approach or even successfully reach the 50% mark.

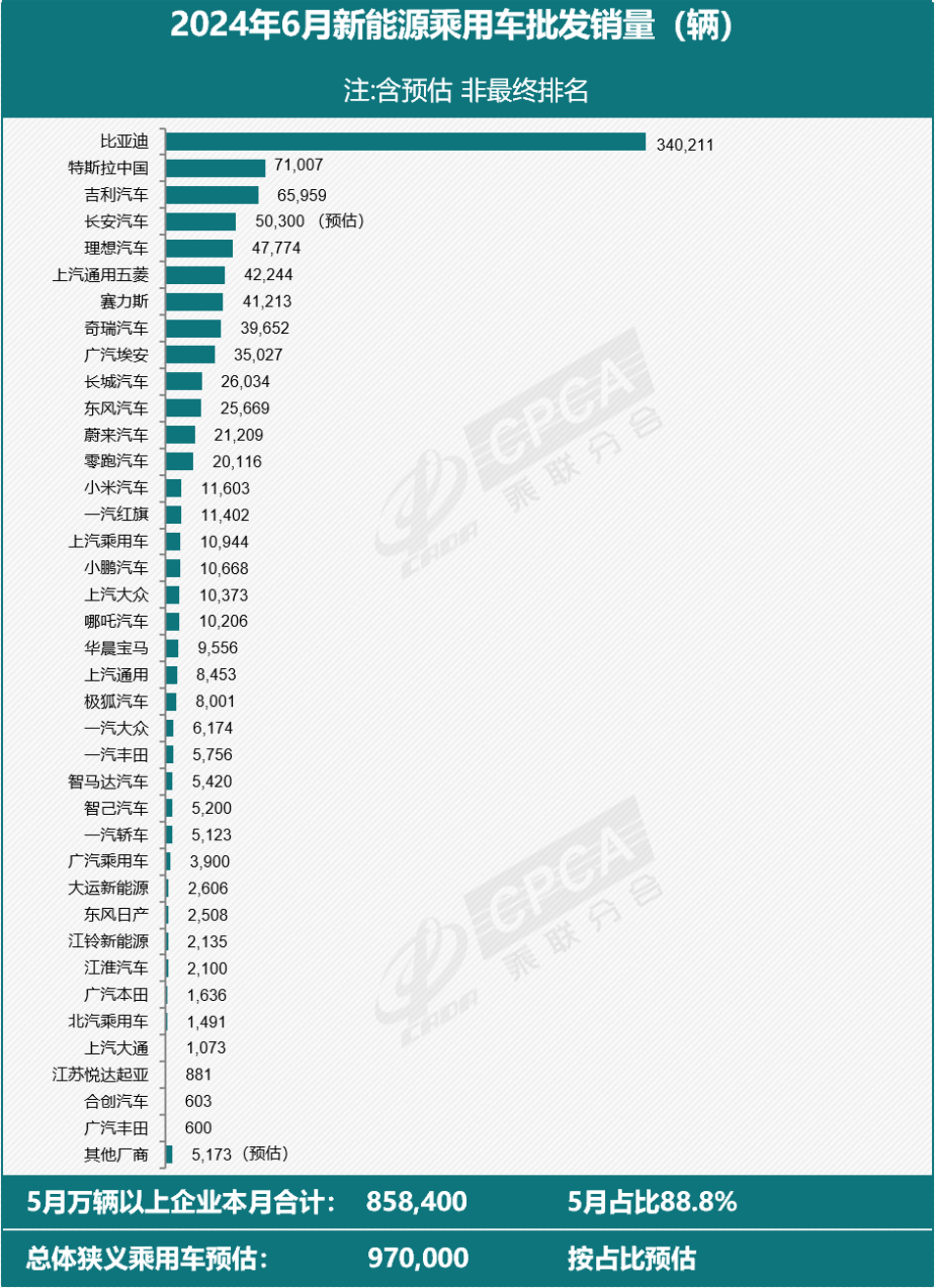

After all, combined with the relevant predictions of the China Passenger Car Association (CPCA), the wholesale sales of new energy passenger car manufacturers nationwide in June reached 970,000 units, representing a year-on-year increase of 28% and a month-on-month increase of 8%, laying a solid foundation.

Focusing further, with BYD's sales reaching a record high of 340,000 units in June, Tesla continuing to rebound to 71,000 units, Geely, Changan, Chery, GAC, and other companies making steady progress in the new energy sector, and many emerging automakers such as Li Auto, Hongmeng Zhixing, NIO, ZEEKR, and Leapmotor achieving good results.

From the macro level to micro-level automakers, it seems that all are confirming the arrival of the "turning point".

However, when it comes to data alone, some skeptics may still find it too thin to support such a judgment. Then, please continue to consider the next two phenomena.

In the first half of the year, there were not a few heavyweights making their debut in the gasoline car camp, such as the new generation BMW 5 Series, the new generation Volkswagen Tiguan, and the new generation哈弗H6...

Once upon a time, each of them, taken individually, was a force that made the Chinese auto market tremble. But now, even with great efforts, from marketing to pricing to the product itself, they have shown great changes and determination, but they can no longer reshape the glory of the past.

Instead, the attention of end consumers has been attracted by the overwhelming number of new energy vehicles. And the introduction of new gasoline cars has gradually become a non-issue, becoming the second argument for the arrival of the "turning point".

As for the third, it is even more profound and serves as the subtitle of this section: When the diehards start to be broken.

In June, a childhood friend in Chengdu suddenly threw me a choice question: "Which should I choose between the NIO ES6 and the Li Auto L6?"

To be honest, in my memory, since graduating from university, he has always been a loyal fan of gasoline cars and prefers German "pocket rockets." But whether it's surrendering to reality or embracing the big trend, the result is clearly there.

Also in June, a close relative, who had just retired from a state-owned enterprise in Lanzhou with a budget of 150,000 yuan, approached me with a car purchase request.

Taking into account his preference for gasoline cars, especially joint venture gasoline cars, the habitual answer would be Toyota Camry and Honda CR-V. But I didn't expect that soon he gave feedback: "What about the BYD Qin L or Geely Yinhe L7?"

And the above two cases are just a few examples of diehards starting to be broken one by one by "green license plates" in the first half of the year. The "mindset war" ignited by new energy vehicles is far more terrifying than imagined. Of course, it is also the best argument for the arrival of the "turning point".

From being the target of criticism to being favored by the people, it often only takes a moment.

Resources are starting to concentrate at the top

At the beginning of this section, let's revisit a previous viewpoint of Li Bin.

"The automotive industry has never been a winner-takes-all scenario, and competition is fierce. In 2025, the automotive industry will enter the finals, but the finals will far from be over. From a global perspective, by 2035, Chinese brands will occupy 5 spots among the top 10 enterprises in the world, and we will strive to become one of them."

Behind these words, one can sense his absolute confidence in China's new energy vehicles, as well as his vision and future prospects for his own company.

However, the slightly controversial point focuses on the first sentence.

This was indeed the case in the era of gasoline cars, due to the existence of technical barriers among various companies, the diversity of user needs, and a sufficiently wide price range, the automotive industry would not be a winner-takes-all scenario.

But in the era of new energy vehicles, when technical barriers are broken, demand becomes increasingly homogeneous, and the price range is compressed, resources are rapidly concentrating on top-tier members.

Continuing with the example of just-passed June, the estimated wholesale sales of new energy passenger car manufacturers nationwide were 970,000 units, with BYD alone reaching 340,000 units, accounting for over 35% of the share.

And apart from BYD's dominance, the extended-range segment is almost a battle between Li Auto and Hongmeng Zhixing, coupled with Leapmotor attacking fiercely in the under-200,000 yuan range. In the mid-to-high-end pure electric segment, Tesla, NIO, and ZEEKR undoubtedly occupy the largest leading edge.

Looking at the list released by the CPCA, the "fault line" phenomenon is already very prominent.

The dividends contained in new energy vehicles are becoming increasingly larger, but the number of OEMs that can truly benefit from them, fill their bellies, and earn a fortune is actually quite small. Correspondingly, many weaker brands have been helplessly playing the role of "runners-up".

And what's even worse is that as the cognition of potential consumers becomes increasingly mature and solidified, there are only a few star products that can catch the eye in each price range. Correspondingly, many new players cannot even make it onto their shortlist.

Based on this background, personally, I increasingly believe that after switching to the electric racetrack, the Chinese auto market will only be a winner-takes-all scenario.

By 2025, the overall competition landscape will be settled. Who are the true top-tier members, who are the middle-tier forces that are not quite as good as the top but better than the bottom, and who will be completely submerged by the fierce tide, the answer will be revealed at that time.

In this process, if you must ask which group has been most affected?

Not surprisingly, "joint venture brands" will undoubtedly receive the majority of votes. Because, in China, they had a first-mover advantage in the era of gasoline cars, firmly grasping everything; but in the era of new energy vehicles, they are turning slowly and rapidly losing everything.

And this year, there is a subtle saying: "Among joint venture brands, the French brands that are most at risk in this wave of gunfire are those that are not suited to the local market, followed by Korean and American brands that adhere to the cost-effective route. Next, Japanese brands that focus on economic and low consumption will encounter big trouble. German brands, due to the presence of BBA and Volkswagen, have the thickest "blood bar", but they are still far from their former glory."

Referring to the situation of joint venture brands in the first half of 2024, especially in the just-passed June, the above judgment is undoubtedly gradually being verified, with shrinking orders, plummeting sales, collapsing prices, and weak voices.

And this, perhaps, is yet another proof of the arrival of the "turning point".

As for the future of joint venture brands in China, in my judgment, their overall share should shrink to around 30% or even lower.

On the contrary, at the automaker level, apart from Volkswagen, Toyota, and BBA, which can continue to compete with domestic brands based on their relatively solid foundations, other OEMs will encounter "big trouble" to varying degrees, ranging from continuous contraction to complete withdrawal.

As I write this, the article is nearing its conclusion. Finally, I want to mention again that from the perspective of an observer, I do not wish to create any so-called opposition, but I still increasingly feel that Li Bin's statement in 2021, which was severely criticized, will one day become an undisputed fact.

Referencing the pace of the first half of 2024, this turning point will come much earlier than expected. And after June, it's indeed harder for gasoline cars...