Struggling for 182 Days

![]() 07/10 2024

07/10 2024

![]() 435

435

Introduction

Born amidst adversity and forged through hardships, China's automotive industry faces the "bitterness" of evolution as a threshold and persists in the "struggle" for rise as a path, forging ahead and climbing to new heights.

Editor-in-Charge | Li Sijia

Editor | He Zengrong

Paul Cézanne was once evaluated by Pablo Picasso as saying, "He didn't truly paint apples; he painted the weight of space above those circles."

Yet, the weight of time surpasses even that of space, transcending the bounds of language, words, and images.

"Which keyword would you use to summarize the first half of 2024?" This question sparked heated debate at the topic selection meeting, only to leave the gathered talents in silence.

Suddenly realizing that words like "turning point," "transformation," "magical," "lying flat," and "involution" had all been used in previous years, they now failed to adequately express the complex emotions of the entire automotive industry—a mix of heavy pain and joy of advancement.

Ultimately, we chose the plain words "struggling" to document the glory, dreams, sweat, and tears of China's auto people over the past six months—born amidst adversity and forged through hardships, China's automotive industry faces the "bitterness" of evolution as a threshold and persists in the "struggle" for rise as a path, forging ahead and climbing to new heights.

As the overall marginal benefits of the industry decline, "bitterness" is inevitable—anguish, pain, suffering.

There is the bitterness of price cuts.

Since Tesla led the way in reducing the prices of new energy vehicles last year, and Citroen C6 kicked off the follow-up price cuts in traditional fuel vehicles, the trend of "involution" has swept through the entire automotive market. This year, we've even seen "BMW for 180,000 yuan and Camry for 120,000 yuan."

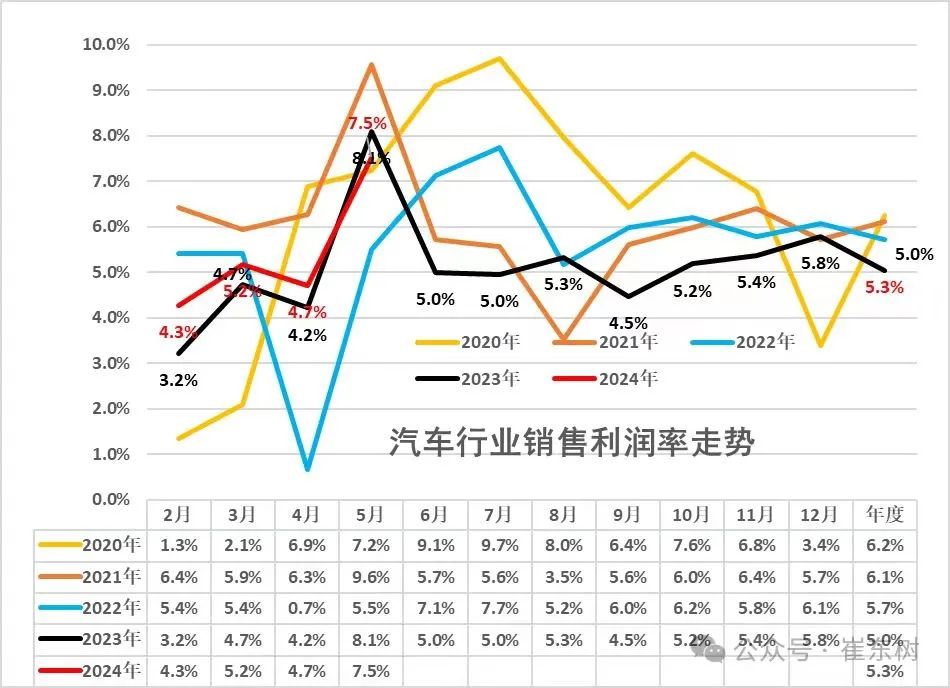

While lower prices benefit consumers, the automotive industry itself bears heavy pressure, with brand premiums eroding and dealer channels suffering huge losses. The profit margin of the entire automotive industry hit a low of 5.0% in 2023 and stood at only 5.3% in the first five months of this year, lower than the 6.3% level of downstream industries.

There is the bitterness of trade blockades.

As Chinese cars gradually gain recognition from global consumers, there are inevitably jealous forces attempting to intervene and obstruct through non-market means. Hence, the United States investigates "security vulnerabilities" in Chinese electric vehicles, and the European Union imposes temporary tariffs on Chinese cars, even causing dissatisfaction among European automakers...

If we look back at the 67-year history of China's automobile exports, it has never been smooth sailing. Since 1957, when Jordanian merchants ordered three Jiefang trucks, the ups and downs of automobile exports have never ceased.

There is the bitterness of path confusion.

With the iteration of technology and marketing models, even industry experts and corporate executives often find it difficult to "understand" or "see clearly" the path forward.

"China's large models and chip technology are inferior to those of the United States. How can China's automotive intelligence surpass that of the United States?" This is a viewpoint held in the investment community. However, the differences between general AI and specialized AI, and between SOC, IGBT, and MCU in chips, which are suitable for smart cars and where China already stands at the forefront, cannot be summed up in a single sentence.

Should marketing efforts push company executives to become personal IPs? What are the pros and cons of the "fan circle" economy in marketing? Should all bets be placed on "end-to-end" autonomous driving? Can solid-state batteries be relied upon for power batteries? Which paths are truly suitable for promotion, and which are tied to individual interests? The answers are never simple.

Yet, in response to "bitterness," there is the unyielding "struggle" of tens of millions of Chinese auto people—fighting, outsmarting, battling.

There is the struggle to sail overseas.

Even in the face of policy and industrial risks in foreign markets, perseverant Chinese automakers continue to conquer overseas fortresses. Blocked in the Americas, they shift their focus to Europe, where NIO ES7 and BYD Tang can fetch prices comparable to BMW X5. When the European situation is unfavorable, they delve deeper into ASEAN, their largest trading partner.

Auto Society visited Thailand in late June to conduct research and obtained a large amount of first-hand and even exclusive information and data, understanding that China's solid footing and diligent cultivation in Southeast Asia are far from comparable to the low-price strategy of motorcycles in the past.

There is the struggle to return to rationality.

"I won't buy an electric car if there's a fuel car available" and "Electric cars are the future, and internal combustion engines will surely be phased out" are twin extreme viewpoints. The former completely ignores the inevitable trend of electrification aligning with the upgrade of automotive products towards "environmental protection, intelligence, and safety," while the latter overlooks the shortcomings of pure electric and hydrogen energy vehicles in low-temperature environments and scenarios lacking charging infrastructure.

Plug-in hybrids and extended-range electric vehicles find a stable equilibrium between "electrification" and "internal combustion engines," and consumers vote with their feet.

In the first half of 2024, when overall passenger vehicle retail sales increased by only 2.9% year-on-year to 9.933 million units, new energy vehicles stood out with sales of 4.111 million units and a growth rate of 33.1%, achieving a penetration rate of 41.4%. Among them, plug-in hybrids (including extended-range models) surged by 69.5% year-on-year, while pure electric vehicles increased by 15.8%. The sales of plug-in hybrids at 1.687 million units were not far behind those of pure electric vehicles at 2.425 million units.

There is the struggle to break through the fog.

Since the path is confusing, we must find the best balance point through continuous self-correction and improvement.

Solid-state batteries have low lithium-ion activity and lack liquid to fill internal cracks? Then semi-solid-state batteries are a compromise solution, with SAIC Qingtao and Weilan New Energy both bringing mass-produced semi-solid-state batteries to market.

If end-to-end large model autonomous driving encounters incorrect rules that are difficult to manually correct? Companies, including Tesla, will use "teacher models" to drive "student models" to continuously self-correct, with "human intervention" serving as a "backstop" for "end-to-end" systems.

Will fan circle culture and extreme public opinion lead to marketing backlash? It is evident that companies that inflate numbers and buy trending topics have already been restricted. "Backlash" itself is a mechanism for "restoring order," and ultimately, the industry will return to the right track.

China's automotive industry has never feared "bitterness" or "struggle." After all, any transformation and switch inevitably entail "the pain of reform," and the foundation for prosperity often lies on the bedrock of depression or even war.

Just as after World War I, the capitalist world flourished from 1924 to 1929, but the depression from 1929 to 1933 inevitably led to World War II; after World War II, the West flourished again with the establishment of the European Community and the support of the U.S. Marshall Plan, until the global economic crisis struck again in 1974-1975...

Since China's domestic auto sales peaked in 2017, the entire industry bid farewell to the "golden era" of "earning money effortlessly." From then on, through to 2024, no one denies that the industry is rife with pain, and the next golden era in the cycle comes at the cost of this pain, as a threshold and a ticket. You can sigh, cry, and curl up, but it's best not to succumb to despondency, lying flat, or despair.

The giant hand of the cycle law tells us that the new pair of keywords is "beginning and end."

In fact, "beginning and end" are the two endpoints of change. And farewell is the prelude to rebirth. When one journey comes to a close, the start of the next wonderful journey is not far off. "Change is the essence of law." Wei Xi's words echo beautifully with Kang Youwei's "heavenly principle."

China has bid farewell to the years of high economic growth but also to the backward situation where manufacturing technology lagged far behind the West, moving towards the simultaneous rise of domestic manufacturing and the economy. As we look back at the comparison between the plans of 2015 and the achievements of 2023, China has made significant progress in many fields.

The automotive industry has bid farewell to the first golden era of extensive growth a decade ago but also to the shackles of relying entirely on foreign technology for positive advancements, leveraging the opportunity of the new four modernizations to "change lanes and overtake."

If Shi Tao's words in "Painting Discourse" that "everything that has a rule must have a variation, and everything that has a method must have a transformation" merely remind us that "beginning" and "end" must alternate frequently, then American writer Karl Deutsch directly tells us that after these two endpoints repeatedly intertwine, "the greatest force in today's world is the force of change."

The first half of 2024 spans 182 days. In these 182 days, we shed sweat and tears amidst hardship but also fought with determination to illuminate the path ahead.

Whether it's the automotive industry that has existed for a century or the national civilization that has spanned thousands of years, it is precisely through such "struggling" that we pass down from generation to generation, thriving unceasingly, with our feet eventually leading us to the pinnacle in the distance.