Carmakers submit their "midterm exam" results, Geely "surges ahead" while Xpeng "lags behind"

![]() 07/10 2024

07/10 2024

![]() 407

407

Some are rejoicing, while others are concerned.

Half of 2024 has flown by, and in the domestic automotive market during the first half of the year, fierce "price wars" have risen one after another; carmakers have successively launched price reduction benefits, "trade-in" subsidies, and even offered various "fancy" perks.

Just stepping into July, multiple automotive brands have successively announced their monthly sales data for the first half of the year, submitting their "midterm exam" results; combining these results with the annual sales targets set by the automakers, it can be described as "some are rejoicing, while others are concerned".

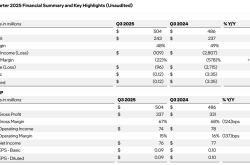

Image source: Qu Jie Shang Ye

Among them, BYD, Chery, Li Auto, AITO, and other automakers have all delivered positive news, with market performance achieving positive growth; at the same time, some automakers have not achieved 50% of their annual sales targets, and some have only achieved two to three tenths, far from their annual targets.

However, generally speaking, the annual sales of automobiles often follow a trend of "low in the first half and high in the second half". Although the performance in the second half is worth looking forward to, under the intense market competition, it is inevitable that "some will rejoice while others will be concerned".

01. Geely "soars", GAC Motor "struggles"

"The leader in new energy vehicles," BYD, continues to hold the top spot among domestic new energy automakers. Since the beginning of this year, BYD has launched the slogans of "electricity is cheaper than oil" and "price reductions without compromise," bringing the prices of plug-in hybrid models down to the RMB 80,000 level. The latest announcement shows that its cumulative passenger vehicle sales in the first half of the year reached 1.613 million units, an increase of 28.46% year-on-year; among them, 726,200 units were pure electric vehicles, and 881,000 units were plug-in hybrid models.

BYD Chairman Wang Chuanfu stated at the 2023 Annual Report Investor Communication Meeting in March this year that the sales target for 2024 is "to maintain growth of over 20% based on 2023," which means that BYD needs to complete a minimum of 3.624 million sales this year; combining the sales data from the first half of the year, the current "progress bar" for the annual target is approximately 44.5%, indicating a relatively steady pace.

Image source: Can Tou Tu Ku

Geely Auto (0175.HK) sold a cumulative total of 955,700 vehicles in the first half of the year, an increase of 41% year-on-year, setting a new high; among them, 320,200 units were new energy vehicles, an increase of 117% year-on-year.

Image source: Screenshot of Geely's announcement

It is worth mentioning that Geely Auto stated at the company's first-quarter earnings conference that based on sales performance so far this year, it has decided to increase its original annual sales target for 2024 by approximately 5%, from 1.9 million units to 2 million units, with the expected penetration rate of new energy products reaching over 40%.

Overall, Geely's overall state is very positive, and if it maintains a good state, it is highly likely to exceed its annual target this year.

Great Wall Motor lags slightly behind among the "top three private automakers." In June this year, Great Wall sold 98,100 units, a year-on-year decrease of 6.55%, becoming one of the few automakers with declining sales while many automakers set new monthly sales records. Cumulative sales from January to June reached 560,000 units, an increase of 7.79% year-on-year; based on Great Wall's annual target of 1.9 million units, the current completion rate is less than 30%.

This performance is not only far behind BYD, which broke through 1.6 million sales in half a year, but also lags significantly behind Geely, which sold nearly 1 million units in half a year; moreover, the growth rate is below double digits, and the gap with the above two companies is continuing to widen.

Image source: Can Tou Tu Ku

"Pioneer in going overseas," Chery Automobile, sold over 1.1 million units in the first half of the year, an increase of 48.4% year-on-year; for the first time, its half-year sales exceeded 1 million units, setting a new record high. Among them, new energy vehicle sales reached 180,900 units, an increase of 181.5% year-on-year.

In the fourth quarter of 2023, Yin Tongyue, Chairman of Chery Holding Group, publicly stated that Chery Automobile belongs to the category of "getting up early but arriving late" in the field of new energy. However, he remains confident in Chery entering the top tier in 2024 and set a new goal: "By mid-2024, we want to return to the top three in new energy, and by the end of this year, we want to become the second in the industry, catching up with Wang Chuanfu."

Image source: Screenshot from Douyin video

According to Yin Tongyue's revelation at the beginning of the year, Chery aims to achieve a sales growth rate exceeding the industry growth rate by 10%-20% in 2024; based on this calculation, Chery's annual target completion rate has reached 47.6%-51.8%, but there is still a certain gap with BYD.

Sales of joint venture brands are facing unprecedented pressure. GAC Group experienced double-digit declines in both production and sales throughout the first half of the year, with both declines exceeding 25%. Production decreased by 28.19% year-on-year to 859,000 units, and sales decreased by 25.79% year-on-year to 863,000 units; among them, the two major joint venture brands, GAC Toyota and GAC Honda, experienced year-on-year declines of 25.80% and 28.28%, respectively.

GAC Group's new energy vehicle sales fell even more sharply, down by over 30% year-on-year; even GAC Aion, the main new energy brand that has seen sales rise steadily last year, experienced a cliff-like decline of 39.65% in sales in the first half of the year, and has seen sales decline for five consecutive months, currently achieving only about 25% of its annual target.

Image source: Can Tou Tu Ku

In the face of sluggish sales, capacity reduction and layoffs have become the norm in the industry; not long ago, GAC Honda announced layoffs affecting more than 2,000 people, while GAC Toyota had already started layoffs last year. However, GAC Aion will launch three new models intensively in the second half of the year, and it remains to be seen whether this can reverse the downtrend in the first half of the year.

02. Li Auto "stabilizes", Xpeng "lags behind"

Among the "new forces" brands, the former "NIO-Xpeng-Li Auto" trio has gradually diverged, with Li Auto and AITO vying for the title of new force sales champion, while other "new force" brands continue to find their place in niche markets.

NIO has accelerated the expansion of its "battery swap alliance" lineup and actively attracted external investment this year, finally welcoming sales growth. NIO delivered a cumulative total of 87,000 vehicles in the first half of the year, and with an annual sales target of 230,000 units, NIO's KPI progress bar has been completed by approximately 38%. With the entry of the second brand "LeDao," it remains to be seen whether this will help boost sales growth.

Xpeng delivered a cumulative total of 52,028 vehicles in the first half of the year, and with an annual sales target of 280,000 units, the target achievement rate is 18.57%, temporarily lagging behind. Among the various new force brands, Xpeng's half-year sales can be described as the "worst"; how to maintain its position is He Xiaopeng's top priority.

Recently, Xpeng's MONA, which targets the mid-to-low-end market, was launched and delivered, and it remains to be seen whether Xpeng, which has been building up momentum in the field of intelligence for a long time, can impress the market.

Image source: Can Tou Tu Ku

Li Auto sold a cumulative total of 188,981 vehicles in the first half of the year, ranking first among the "new forces." Looking solely at June sales, Li Auto delivered 47,774 new vehicles, an increase of 46.7% year-on-year; this is mainly due to the stable performance of Li Auto's L series, especially the L6, which is Li Auto's first large and medium-sized extended-range SUV priced below RMB 300,000, and became a bestseller after its launch.

Image source: Can Tou Tu Ku

However, the much-anticipated flagship MPV model, the Li Auto MEGA, was caught up in a public relations storm after its launch, and sales also suffered a setback. Considering market factors, Li Auto Chairman and CEO Li Xiang revised the annual sales target from 800,000 units set at the beginning of the year to 480,000 units in June; as of mid-year, approximately 39.4% of the target has been achieved, which is still on track.

Hongmeng Zhixing announced its cumulative sales for the first half of the year, delivering a total of 194,207 vehicles, making it the leader among the "new forces." Among them, the mainstay AITO contributed the vast majority of sales; in addition, with the multiple blessings of Huawei's brand, traffic, and channels, the sales of AITO M5, M7, and M9 models have soared.

Although AITO's total sales in the first half of the year were less than Li Auto's, the gap was not significant. On the weekly sales ranking of new force automotive brands in the first half of the year, AITO repeatedly surpassed Li Auto, and with the acceleration of AITO's production capacity and model expansion, its potential remains.

Image source: Can Tou Tu Ku

According to "Qu Jie Shang Ye," as an "up-and-coming star," Xiaomi Automobile aims to deliver over 100,000 vehicles in 2024, with a sprint goal of 120,000 vehicles. Xiaomi Automobile delivered a cumulative total of 25,688 vehicles in the first half of the year, with an annual target completion rate of approximately 26%; Xiaomi Automobile also announced that it delivered over 10,000 vehicles in June but did not disclose the specific number, and stated that deliveries in July will also exceed 10,000 units.

With the entry and expansion of "new new forces" such as Xiaomi and Huawei, the landscape of the domestic automotive market in the first half of 2024 has been deeply "reshaped," also representing that the "elimination round" in the domestic automotive industry has entered a white-hot stage.

Image source: Can Tou Tu Ku

On the global pure electric vehicle sales ranking, Tesla currently ranks first, ahead of BYD's pure electric series with sales of 726,200 units.

In the first half of this year, Tesla's global deliveries declined by 6.6% year-on-year to 837,700 units. Tesla's global sales in the first two quarters of this year were 386,800 units and 444,000 units, respectively, marking the first time that Tesla has experienced year-on-year declines in sales for two consecutive quarters.

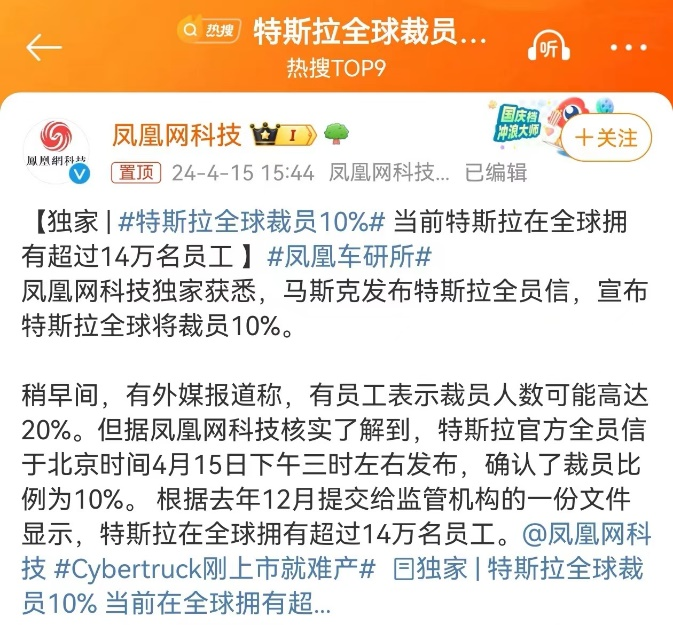

It is worth mentioning that in April this year, Tesla CEO Elon Musk stated in an internal email to employees that the company would lay off more than 10% of its global workforce to cut costs and improve productivity; this means that at least 14,000 employees will leave, making it the largest known layoff in the automotive industry, causing an uproar in public opinion.

Image source: Screenshot from Weibo

Professionals have analyzed that Tesla's layoffs are mainly to address problems caused by declining sales and intensifying price wars in the electric vehicle industry.

Following Tesla's first "official price reduction" of the new year in January, in April, Tesla announced a price reduction of RMB 14,000 for all Model 3/Y/S/X series in mainland China; by July, Tesla released a new loan policy, offering up to 5 years of interest-free and low-interest loans for the Model 3/Y.

Last year, Tesla barely achieved its annual sales target of 1.8 million units, and the situation this year may be even more difficult. Cost reduction and efficiency enhancement, coupled with trading volume for price, provided effective support for Tesla's sales in the second quarter; however, how long can this approach last?

03. How to break through in the second half?

According to preliminary statistics from the Passenger Car Market Information Joint Meeting of the China Automobile Dealers Association (hereinafter referred to as the "CADA Joint Meeting"), cumulative retail sales of passenger vehicles from January to June reached 9.828 million units, an increase of 3% year-on-year; among them, retail sales of new energy passenger vehicles reached 4.119 million units, an increase of 33% year-on-year.

As competition in the Chinese car market gradually enters an elimination phase, the Matthew effect is particularly evident. As Changan Automobile Chairman Zhu Huarong stated, the domestic car market is currently entering an elimination phase and is consolidating around strong brands. "Next year, this momentum will further accelerate, and the 'strong get stronger, and the weak get weaker' phenomenon will become more pronounced," Zhu remarked.

From the overall market landscape, traditional brands are experiencing a stark contrast of fortunes. BYD leads the pack, vying with Tesla, while other brands either maintain a steady course or face the crisis of falling behind. Emerging brands are becoming increasingly formidable, with the former "NIO, Xpeng, and Li Auto" structure being disrupted by the rapid rise of cross-industry ventures like Hongmeng Zhixing and Xiaomi in car manufacturing.

Simultaneously, the entry of new players into the car manufacturing space is intensifying the sense of urgency within the industry. On the R&D front, some product development cycles have been shortened to just over a year, more than twice as fast as the development processes of previous foreign car enterprises. In the sales domain, collecting customer information and adding them on WeChat has become KPI metrics, with companies going to great lengths to obtain leads and close deals.

With slow domestic demand growth and escalating industry competition, automakers are fiercely engaging in price wars to gain a competitive edge. Whether it's new energy vehicles or internal combustion engine cars, luxury brands or value-for-money brands, all are directly participating in the price reduction trend, causing significant distress for dealers.

Xing Haitao, Secretary-General of the National Federation of Industry and Commerce Automobile Dealers Chamber, noted that, in the most extreme cases, cars worth millions of yuan are being sold by dealers for as low as four to five hundred thousand yuan. Many dealers lament, "Breaking even is already considered making money."

The cost of price wars is a decline in profits. In 2023, among the 19 A-share and H-share listed vehicle companies, nearly half experienced revenue growth without profit increases. Among new forces, only Li Auto (2015.HK) was profitable, while all others incurred losses. Among joint venture car companies, SAIC Motor (600104.SH) saw net profits for its Volkswagen, General Motors, and GM Wuling brands decline by 58% year-on-year.

As electrification and intelligence sweep through the automotive industry, the traditional technological advantage built on "engine + transmission" is becoming less significant. Finding differentiated competitive points, accurately capturing consumer demands and preferences, and returning to a dedicated pursuit of product technology is what will build a true moat.

As once-prestigious luxury car series "fall from their pedestals," the BMW i3 has seen a "halving" in price, dropping below 200,000 yuan. The Audi A4L's bare car price has entered the "100,000 yuan range," and the entry-level Mercedes-Benz EQA has fallen below the 200,000 yuan mark. The joke "If you don't work hard, you'll have to drive a BBA (BMW, Benz, Audi)" is gradually becoming a reality.

However, some voices within the auto industry are already speaking out against the excessive internal competition.

In June this year, Zeng Qinghong, Chairman of GAC Group, stated at the China Auto Chongqing Forum that excessive internal competition can negatively impact corporate profitability and social contributions. He emphasized that the auto industry should have a comprehensive perspective and focus on long-term strategy rather than engaging in cutthroat competition.

Li Yunfei, General Manager of the BYD Brand and PR Department, previously compared the competition in the car market to playing cards. "If someone plays a card, you can follow if you can, pass if you can't. Don't get upset or flip the table because there's always the next round."

Li Ruifeng, CGO (Chief Growth Officer) of Great Wall Motor Co., Ltd., stated that Chinese auto brands are an integrated whole, a symbol. "Competing is not a problem, but it should be healthy, positive, and within limits. These limits mean providing long-term value to car owners."

Historically, the auto industry has indeed gone through cycles of "a hundred flowers blooming" to "oligopoly dominance." Thus, there is a consensus within the industry to view the dual nature of internal competition.

Another consensus is that in the short term, it is difficult to see an end to the current relentless internal competition.

Lin Shi, Secretary-General of the China-Europe Association of Intelligent and Connected Vehicles, believes it is hard to predict how long the internal competition will last. Without technological breakthroughs or innovative, high-quality products, it is almost impossible for car companies to balance profitability, as homogeneous products can't fetch high prices, and the costs of overloading features are high.

Feng Shiming, Director of Shanghai Minghua Consulting, suggested that the duration of this competition varies by company. Companies with booming sales may maintain high-intensity internal competition for a long time, while those with sluggish sales and engaging in competition for the sake of it may soon face bankruptcy and restructuring, thus naturally ending the competition.

However, it is certain that this "internal competition drama" will continue in the second half of the year. In this increasingly fierce competition, we also hope to see more innovation and breakthroughs, as well as a more mature and rational competitive environment.