Nezha Faces New Challenges on Its "Storming the Sea" Journey

![]() 07/10 2024

07/10 2024

![]() 676

676

Capital Issues Pose a Challenge

Recently, Hozon New Energy (hereinafter referred to as Nezha Auto or Nezha) submitted its prospectus, planning to list on the Hong Kong Stock Exchange. It is understood that the company's automotive brand, Nezha Auto, is a star player among China's new-energy vehicle startups, alongside NIO, XPeng, Lixiang, and Leapmotor.

However, as the sales champion among new-energy vehicle startups in 2022, Nezha Auto was surpassed by NIO, XPeng, Lixiang, and Leapmotor last year, slipping to fifth place in the rankings. After falling behind, Nezha Auto sought an alternative path and made inroads in the overseas market. But at the same time, challenges also arose. As the company further expands overseas by building factories, its capital requirements have increased significantly. Nezha Auto, which is not adept at cost control, has seen its capital chain become strained. Therefore, on its "storming the sea" journey, IPO financing has become a necessary path, and whether it can pass the test of the capital market has become crucial to its survival and development.

Sales Lagging Behind, Strategic "Missteps"

It is understood that when Nezha Auto was first established, it adopted the manufacturing concept of "equalizing technology" and focused on the new-energy vehicle market below RMB 200,000. Its first model, the N01, was a microcar priced at only RMB 66,800-99,600 after subsidies. Later, Nezha Auto launched the Nezha V and Nezha U, which were also affordable cars emphasizing cost-effectiveness. Together, they accounted for 98.48% of Nezha's annual sales in 2022.

In terms of performance, Nezha Auto delivered nearly 70,000 vehicles in 2021, a significant increase of 362% year-on-year. In 2022, sales further grew by 118% year-on-year to over 150,000 vehicles, making it the first new-energy vehicle startup to surpass 150,000 annual sales and capturing the sales crown among its peers.

However, the new-energy vehicle market is always full of uncertainties. In 2023, a price war swept through the industry, forcing automakers to cut prices in exchange for sales growth, with the starting prices of many new models approaching RMB 200,000. At the beginning of 2023, Tesla took the lead in reducing product prices, and a large number of automakers followed suit, compressing production and manufacturing costs to create room for price cuts. BYD significantly reduced overall vehicle costs by developing its own automotive parts and batteries, launching the Qin PLUS Glory Edition with a starting price of RMB 79,800 and capturing 23,590 orders within seven days of its launch.

Facing fierce competition, Nezha Auto delivered only 127,496 new vehicles in 2023, a year-on-year decline of 16%. Although its overseas sales performance was impressive, the total volume was still unimpressive, making it the only new-energy vehicle startup to experience a sales decline.

To change this dilemma, Nezha Auto also tried to enter the high-end market, launching models like the Nezha S and Nezha GT. Unfortunately, after a brief sales surge, these products eventually fell into obscurity. Zhang Yong even posted online, asking netizens how such great products could be sold to achieve monthly sales of 5,000 units.

Since the beginning of this year, Nezha Auto's sales have continued to decline. In the first quarter, Nezha Auto sold 24,434 vehicles across its entire model range, only completing 8% of its annual sales target of 300,000 vehicles.

Regarding the decline in sales, Nezha Auto explained in its prospectus that during this period, the company worked to rationalize and simplify its domestic production capacity and global supply structure to further advance its internationalization initiatives, temporarily affecting production. Based on the company's explanation, Nezha's lag is only a temporary "misstep".

Cash Flow is the Bigger Challenge

From a financial perspective, Nezha Auto's temporary strategic "missteps" are not the most critical issue; cost control is.

The prospectus shows that Nezha Auto's revenues for 2021-2023 were RMB 5.087 billion, RMB 13.05 billion, and RMB 13.555 billion, respectively; net losses were RMB 4.84 billion, RMB 6.666 billion, and RMB 6.867 billion, respectively, with a cumulative loss of RMB 18.373 billion over three years. Although the gross margin improved over the past three years, it remained negative at -34.4%, -22.5%, and -14.9%, respectively.

Losses are not uncommon in the new-energy vehicle industry. NIO and XPeng lost RMB 39.2 billion and RMB 24.4 billion, respectively, over the past three years, while Leapmotor lost a combined RMB 12.2 billion.

However, comparing cash flow, Nezha Auto's predicament is clear. According to the prospectus, as of the end of 2023, Nezha Auto had only RMB 2.84 billion in cash and cash equivalents on its balance sheet. During the same period, NIO, XPeng, Lixiang, and Leapmotor had cash reserves of RMB 103.67 billion, RMB 45.7 billion, RMB 57.3 billion, and RMB 19.4 billion, respectively, with Leapmotor having nearly seven times the cash reserves of Nezha Auto.

So, where did Nezha Auto spend all its money?

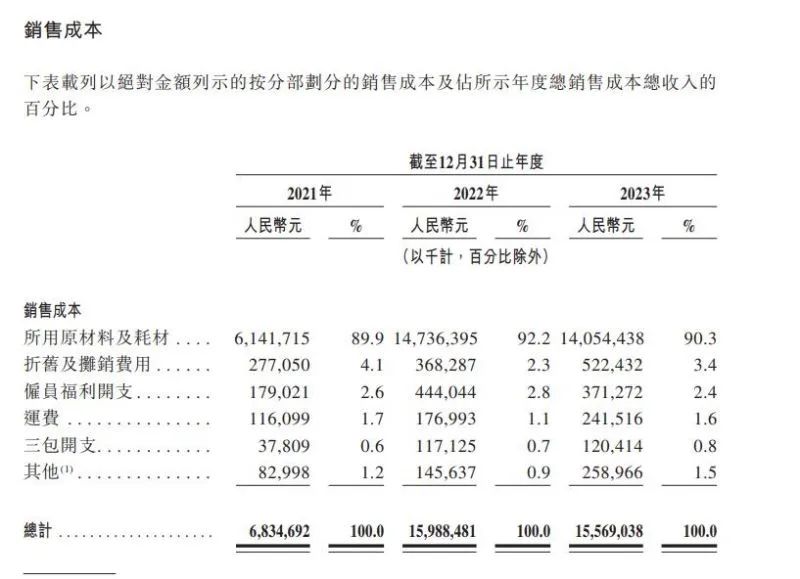

In 2023's operating costs, Shengma Finance noted that just "raw materials and supplies" amounted to RMB 14.054 billion, exceeding that year's revenue of RMB 13.555 billion.

In addition, Nezha Auto's heavy losses were also caused by rapidly growing selling expenses. In 2023, Nezha Auto's selling expenses surged from RMB 1.042 billion to RMB 1.923 billion, with "advertising and promotion expenses" alone increasing from RMB 333 million to RMB 917 million.

Its selling expense growth rate last year reached 84.5%, exceeding Leapmotor, which had a similar scale, by over 20 percentage points. Leapmotor's growth rate was 61.2%, while NIO, XPeng, and Lixiang's selling expense growth rates were 22%, -1.9%, and 72.42%, respectively, during the same period.

In 2023, Nezha Auto's selling expense ratio was 14.19%, lower than NIO and XPeng but higher than Lixiang and Leapmotor. However, the excessive marketing expenses did not seem to have given Nezha Auto the desired brand influence. At the beginning of this year, the founder of Nezha Auto tweeted candidly that 2023 was not a good year, mainly due to issues with new product launches, product strategies, and marketing communications. He also stated that in 2024, he would concurrently serve as the company's marketing general manager. It is evident that this year, Nezha Auto will need to carefully manage its marketing expenses.

Looking at cash flow, automaking is also a business of cash flow management. The high value of individual vehicles means that selling 1,000 vehicles priced at RMB 100,000 each generates RMB 100 million in revenue. However, if sales do not pick up, cash will be tied up in factories, equipment, and inventory. Automakers need sufficient liquidity to sustain operations. Data shows that Nezha Auto's liquidity is not abundant. Over the past three years, the company's operating cash flow has been negative, at RMB -2.991 billion, RMB -5.408 billion, and RMB -4.354 billion, respectively.

Going Overseas is a Path, but Capital Issues Remain a Challenge

While domestic market performance has been sluggish, Nezha Auto's overseas expansion strategy has achieved some success.

The prospectus shows that Nezha Auto's overseas revenue has increased significantly. In 2022 and 2023, overseas revenue was RMB 241 million and RMB 1.62 billion, respectively, with the revenue share rising from 1.8% to 12%. From January to May 2024, Nezha Auto exported 16,458 vehicles, ranking first among new-energy vehicle startups in terms of exports.

In terms of layout, Southeast Asia is Nezha Auto's key market. According to a report by China Insights Consultancy, based on insurance take-up in 2023, Nezha Auto ranks among the top three brands of new-energy passenger vehicles in Southeast Asia. In March and May of this year, Nezha Auto's factories in Thailand and Indonesia began production, respectively, while construction of the factory in Malaysia began in January of this year.

However, it is not yet time for Nezha Auto to relax. First, although Nezha Auto has achieved some success in Southeast Asia, the passenger vehicle market in the region is still dominated by Japanese automakers. According to a report by China Insights Consultancy, in 2023, total passenger vehicle sales in Southeast Asia reached 3.2531 million units, with Japanese automakers accounting for 2.0751 million units and a market share of 63.8%.

While Chinese automakers accounted for 70.1% of total new-energy passenger vehicle sales in Southeast Asia in the same year, the total volume was only 87,000 units, and the scale cannot be compared to Japanese automakers in the short term. However, this also provides Nezha Auto with greater development potential in the future.

Secondly, capital issues remain a significant challenge.

Nezha Auto also clearly stated in its prospectus that the proceeds from this IPO will first be used to strengthen its overseas layout, further invest in the Southeast Asian market, and rapidly expand into potential markets such as Latin America, the Middle East, and Africa, enhancing its global operational capabilities by establishing subsidiaries, further localizing overseas supply chains, and setting up more overseas stores to expand its sales and service networks.

As of the end of 2023, Nezha Auto had cash and cash equivalents of RMB 2.84 billion on its balance sheet; as of the end of April this year, the company still had borrowings of RMB 5.75 billion. Based on its loss rate over the past few years, this amount of money will not be sufficient to sustain Nezha Auto for long.

In 2024, Zhang Yong has set a global sales target of 300,000 vehicles for Nezha Auto, with 200,000 units targeted for the domestic market and 100,000 units for overseas markets. It is evident that to achieve its set targets, Nezha Auto urgently needs substantial funding support both domestically and internationally.

Although Nezha Auto has supplemented its cash through various means this year, such as announcing agreements with multiple institutions in April to obtain investments of no less than RMB 5 billion, and Zhang Yong revealing in an interview in March that Nezha Auto had actually raised RMB 1.6 billion led by an industrial capital investor, going public remains an important financing channel for the company. Whether it succeeds or fails may directly determine whether Nezha Auto can take its "storming the sea" journey even further.