The "midterm exam" results for new energy vehicles are out: Some rejoice, some lament

![]() 07/10 2024

07/10 2024

![]() 665

665

Introduction | Lead

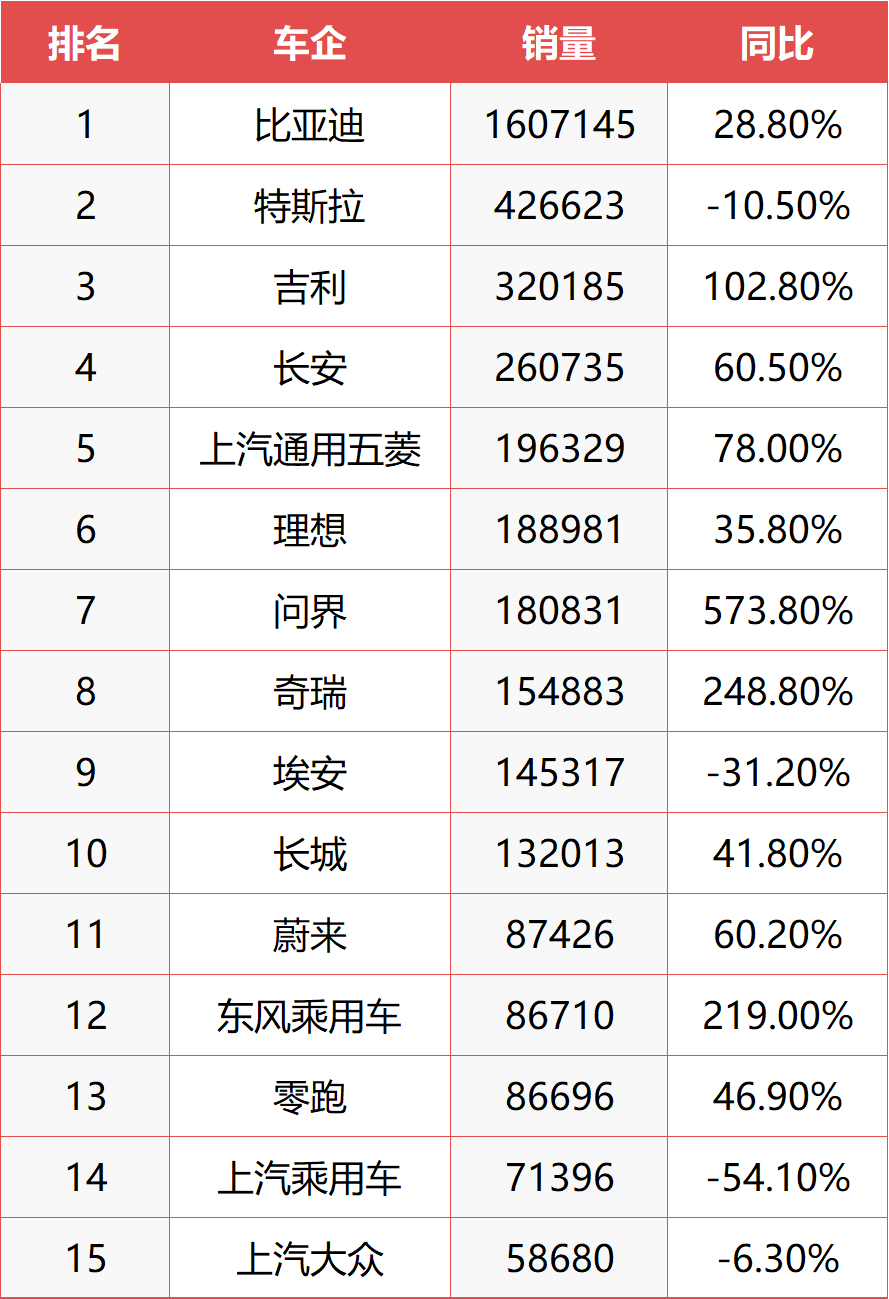

As half of 2024 has passed, domestic automakers have successively announced their sales figures for the first half of the year. Despite the deepening price war this year, with many automakers complaining, from the perspective of new energy vehicle wholesale numbers, the majority of mainstream domestic automakers are still growing rapidly. However, the situation for joint ventures and foreign automakers is not so rosy at present.

Produced by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | He Zi

2796 words in total

4 minutes to read

In July 2024, many domestic automakers unveiled their mid-year performance reports. If we narrow the scope to the field of new energy vehicles, the performance of most mainstream domestic automakers with independent brands has been impressive. They have not only continued to expand their advantages in the electric vehicle sector but are also constantly seizing market share from joint venture brands with their newly released plug-in hybrid models. Moreover, this momentum is unlikely to reverse before competitive plug-in hybrid models from joint venture automakers are launched.

BYD's Leading Edge Remains Unshaken

BYD's frontrunner status is unlikely to change in the short term, especially with the launch of the Qin L priced at 99,800 yuan and the Haiyang Net Seal 06 in the first half of this year, which will join forces with the Honor Edition models launched last year to accelerate the erosion of the domestic fuel vehicle market. In the second half of the year, BYD will release its second-generation Blade Battery. As a powerful tool for BYD to compete in the global electric vehicle market, the Blade Battery provides the optimal solution for BYD. Even with CATL's launch of the Shenxing Super Charging Battery and Geely's Shendun Short Blade Battery, BYD's advantage remains very apparent.

△ Qin L becomes a powerful tool for BYD to further harvest joint venture fuel vehicles

Meanwhile, Geely, Changan, and Chery have also performed well.

For Geely, it has established a new energy brand matrix represented by Zeekr, Geometry, and Lynk & Co EMP. However, there is still a significant gap between Geely and BYD in terms of new energy vehicle sales. To surpass BYD, Geely must work harder on cost-effectiveness. Recently, Geely launched the Shendun Short Blade Battery. In terms of safety and energy density, the Shendun Short Blade Battery surpasses BYD's first-generation Blade Battery. Geely's plug-in hybrid models, which are also benchmarked against the Qin L, achieve a driving range of over 2,000 kilometers while keeping fuel consumption below 2L. However, to surpass BYD, Geely needs to further focus on cost reduction. After all, the Galaxy series is still more expensive than BYD's models. Therefore, it is more feasible for Geely to win the tough battle against Tesla in the second half of the year. To surpass BYD, essentially, it is necessary to overtake BYD in the battery field. Geely needs to accumulate not only technology and craftsmanship but also how to reduce costs to the extreme.

△ The key to the success of Geely's Shendun Short Blade Battery is still cost

Similar to Geely's situation, both Changan and Chery have built their complete new energy vehicle matrices. Changan has introduced Huawei technology to develop its own branded models, while Chery has directly introduced the Hongmeng Intelligent Driving Mode, allowing Huawei to fully operate the Zhijie brand. In particular, Chery has launched a large number of new energy vehicle models since the second half of 2023, and its new energy vehicle wholesale sales in the first half of this year increased by 248.8% year-on-year, making it the second fastest-growing automaker in terms of sales after Wenjie. However, Chery still lags far behind BYD and has a significant gap with Tesla and Geely.

△ Chery focuses on both independent research and development and comprehensive cooperation with Huawei

SAIC and GAC Urgently Need to Catch Up

On this list, Tesla, Aion, SAIC Motor Passenger Vehicles, and SAIC Volkswagen are the only four automakers with declining sales of new energy vehicles.

Tesla's declining sales are mainly related to the lack of new model launches. For domestic consumers, the new car effect is still very evident. Although Tesla has a relatively high brand appeal, for models that have not been refreshed for many years, even with the aura of Elon Musk, domestic consumers may experience aesthetic fatigue. To address this issue, Musk has laid off employees internally while focusing on Full Self-Driving (FSD). If no revolutionary breakthroughs can be made in the field of artificial intelligence, L4 intelligent driving may never arrive. For Tesla or Musk, compared to launching brand-new models, he seems to have placed all his bets on the implementation of FSD.

△ Musk bets on FSD to turn Tesla around

Aion's biggest problem is that its brand premiumization has not achieved the expected results. Aion's past success lies in its models meeting the needs of the mobility market, but globally, no automaker has achieved long-term success by operating in the B-end market. For Aion, no matter how difficult it may be, it must win the battle for Hao Platinum's turnaround. Currently, the combination of volume-driven Hao Platinum HT and Hao Platinum GT is difficult to meet market demand, and Hao Platinum also needs to boost sales through new models.

△ Aion Hao Platinum needs to inject a shot in the arm for itself

As for SAIC's independent brands, the problems they need to solve are similar to those of GAC. Its high-end electric vehicle brand IM Motor has continuously lowered its pricing to boost sales, which not only leaves no room for the Flyme brand but also puts SAIC in a situation where it has no high-end electric vehicle brand. For SAIC, in addition to the embarrassing situation of having no flagship products in the domestic market, the high punitive tariffs imposed by Europe on SAIC will make it difficult for the MG brand to establish itself in the European market. Without the support of this 200,000-unit market, the development of SAIC's independent brands will be even more challenging.

△ The retail price of the L6 entry-level model has entered the 200,000 yuan range

Joint Venture Automakers Still Lurking and Awaiting Change

Since SGMW primarily uses its own local technology, SAIC Volkswagen has become the only joint venture automaker to rank among the top 15 in domestic new energy vehicle wholesale sales in the first half of this year. The significant price reduction of the ID.3 played a crucial role in boosting SAIC Volkswagen's new energy vehicle sales, but price cuts cannot continue indefinitely. Although SAIC Volkswagen is still the largest joint venture automaker in terms of new energy vehicle sales, a year-on-year decline of 6.3% means that SAIC Volkswagen also needs strong support; otherwise, even if it can continue to lead joint venture automakers, it will be increasingly outpaced by domestic independent brands.

△ The sales-boosting effect of Volkswagen ID.3's price reduction is not as significant as before

In the traditional fuel vehicle sector, joint venture automakers' market share is being constantly eroded by domestic independent brands' plug-in hybrid models. According to data disclosed by SAIC Motor, as the two pillars of SAIC's domestic sales that once dominated the market: SAIC Volkswagen's cumulative sales in the first half of the year were 512,088 units, with a year-on-year increase of only 1.75%; SAIC GM's sales during the same period were 225,579 units, with a year-on-year decline of up to 49.98%. With such disappointing performance from SAIC Volkswagen and SAIC GM, it is even more unnecessary to mention other domestic joint venture automakers. Honda China's half-year sales were 415,900 units, a year-on-year decrease of 21.5%. With the successive launches of models like BYD Qin L and Geely Galaxy E5, joint venture brands are facing their most difficult moment in the domestic market since entering China. If they cannot defend their fuel vehicle market, joint venture automakers will find it difficult to compete with independent brands in the new energy vehicle market in the short term.

△ SAIC GM's sales declined by nearly 50% in the first half of the year

For joint venture and foreign automakers, the solace they can take is that their global performance remains stable. Although Chinese automakers are actively expanding overseas, it will still be difficult to shake the sales of those multinational automaker giants in overseas markets in the short term. The multinational automaker groups are betting that, on the one hand, most domestic new-force automakers are selling cars at a loss, and this model is unsustainable. Once financing problems arise in the later stages, whether it is NIO, XPeng, Nezha, or some traditional automakers, they will struggle to survive. On the other hand, major multinational automaker groups are also actively promoting their smart electric vehicle/plug-in hybrid vehicle projects. Through independent research and development and technology引进, multinational automaker groups also plan to quickly close the product competitiveness gap with independent brands through the iterative development of one or two generations of models.

Commentary

As long as the situation of overcapacity in China's domestic automobile industry does not ease, the price war will continue to burn. Currently, the reason domestic independent brand new energy vehicles can maintain significant growth is that the market share of joint venture fuel vehicles is declining rapidly. However, when the market share of joint venture fuel vehicles declines to a certain extent, not only will it become more difficult for the share to decline further, but joint venture automakers will also launch their new-generation electric vehicle/plug-in hybrid models to compete with independent brand new energy vehicles again. In the future, the price war in the domestic automobile market will intensify, and it is hoped that the domestic automobile industry will experience survival of the fittest, creating a Matthew effect, allowing China to truly produce a few multinational giants like Toyota and Volkswagen, and avoiding the situation where bad money drives out good money, leaving automakers that make good cars losing out to those that cut corners.

(This article is originally written by "Heyan Yueche" and may not be reproduced without authorization.)