BMW's Price War Calling it Quits?

![]() 07/14 2024

07/14 2024

![]() 699

699

After a year and a half of fierce price wars, many automakers are on the verge of collapse.

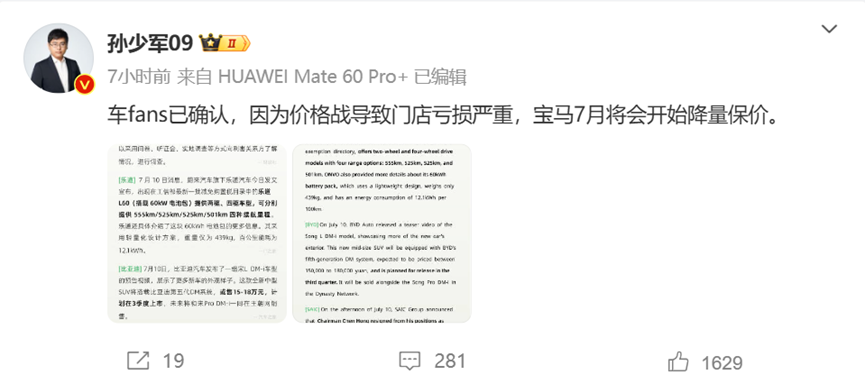

WM Motor, AITO, and HIPHI have successively gone bankrupt and delisted, while joint venture brands such as Mazda, Peugeot, Citroen, Hyundai, and Kia are teetering on the brink. Even BMW, a luxury brand highly popular in the Chinese market, is under unprecedented pressure. Recently, an auto blogger revealed, "Due to heavy losses in dealerships caused by the price war, BMW will start reducing output to maintain prices in July." "Reducing output to maintain prices" is a relatively new term in the automotive market over the past two years. After all, other automakers are busy cutting prices to increase sales, but BMW is doing the opposite. What is its intention?

This question can be inferred from BMW's actions in recent months. In May, tensions between Porsche China's dealers and the brand owner escalated, sparking heated discussions. Subsequently, BMW China suddenly sent a letter to all dealerships, deciding to offer significant subsidies and exemptions to BMW 4S stores in light of the market backdrop and the immense impact of domestic brands. These subsidies and exemptions cover various areas such as new car sales, customer support and services, BMW Finance, dealer development, and used car business. Clearly, to avoid repeating Porsche's mistakes and alleviate financial pressures on dealers caused by the price war, BMW has spared no expense. Notably, the BMW i3 35L model has become the focus of the market during this price war. Its official guidance price is 353,900 yuan, but driven by market competition and multiple preferential policies, the bare car price has plummeted to 189,500 yuan, a decrease of up to 46.4%.

However, even with significant price cuts in the Chinese market, BMW still cannot escape the fate of declining sales. According to BMW Group, in the first half of this year, BMW and MINI sold a total of 375,947 new cars in China, a year-on-year decrease of 4.2%. This is despite BMW's participation in the price war. Specifically, the top five BMW models in terms of sales in the first half of the year were the BMW 3 Series, BMW X3, BMW X1, BMW X5, and BMW 5 Series. Except for the BMW X5, the terminal prices of most of these models are within the range of 200,000 to 450,000 yuan, precisely facing competition from popular models such as the Lixiang L Series, WENJIE, NIO, and even Xiaomi's recently launched SU7. Compared with domestic new energy vehicles, BMW's electric cars do not have a significant competitive advantage, and the share of fuel vehicles in the overall automotive market continues to shrink. The current situation of many joint venture brands, including BMW, is not optimistic. Under such circumstances, continuing to adhere to the strategy of "trading price for volume" is not a long-term solution, either from BMW's profit margin or brand positioning. Therefore, BMW's decision to "reduce output to maintain prices" should be a decision made after weighing the pros and cons.

After BMW fired the first shot in the "anti-price war," it remains uncertain what changes it will bring to the market. This reminds us of the 2024 China Automotive Chongqing Forum held in early June, where executives from automakers such as GAC, SAIC, Geely, and major component companies like Bosch voiced concerns that price wars that breach the bottom line harm the entire market. However, executives representing automakers such as BYD, Chery, and Changan believe that price wars are the norm of market competition, and intense competition is a process of good money driving out bad. Although these two different views collided at the conference, the reality is that the automotive industry's internal competition has swept up every automaker, and most may not be able to make the tough decision to "reduce output to maintain prices" like BMW.

After all, as a luxury brand, BMW has its own audience, and the impact is still controllable. For most automakers, "reducing output to maintain prices" means taking on greater risks, potentially leading to ceding market share. Both "trading price for volume" and "reducing output to maintain prices" are choices automakers face in the current market situation, each with its advantages and disadvantages, depending on which aspect automakers value more. If they want to break the "either-or" situation, BYD is the best example. With self-developed components, reduced car costs, and pricing power in the market below 200,000 yuan, they are naturally no longer afraid of market competition. For luxury brands like BMW, accelerating the pace of electrification transformation may be the best way to break the deadlock.

(Images sourced from the internet, remove upon infringement)