Under group attacks, BYD's leading advantage is growing even larger

![]() 07/16 2024

07/16 2024

![]() 654

654

Introduction: Although many people have realized the strength of BYD, most people still do not fully understand just how powerful it really is.

Lishi | Author Lishi Business Review | Production

1

With BYD dominating the Chinese new energy vehicle market, it has become the target of numerous competitors in recent years. However, BYD's foundation has not been shaken by these competitors; instead, its competitive advantage continues to expand.

According to the latest sales data for the first half of 2024, BYD (including Denza, AWEX, FANGCHENGBAO, and exports) sold 1.607 million vehicles, leading the industry by a wide margin.

Readers familiar with China's automotive industry will understand that the first half of the year is not BYD's peak sales period. Its cutting-edge technology, Dmi5.0, was just released in May, and the first two models equipped with this technology, Qin L Dmi and Seal 06 Dmi, experienced their first full month of delivery in June. Despite being newly launched, BYD's new technology and products have already demonstrated significant power.

Recently, the author has seen some newly delivered Qin L and Seal 06 Dmi models on the streets. I had seen these two models in 4S stores before, but seeing them on the streets again was still impressive, considering their high quality despite starting prices of just 99,800 RMB. While other automakers may also produce models comparable to Qin L, their costs would be at least 20% higher than BYD's, giving BYD ample cost advantages and pricing power. These advantages are almost impossible for competitors to replicate, as they are the cumulative result of BYD's strategic, organizational, managerial, technological, scale, and integrated supply chain advantages.

The impact of Qin L and Seal 06 on the author is also reflected in specific sales figures. June sales data showed that Qin L and Seal 06 sold 20,100 and 14,000 units, respectively. With production capacity ramping up and delivery speeds improving, these two models are expected to continue setting new sales records in the coming months.

However, Qin L and Seal 06 are just the beginning of BYD's product push in 2024. In the second half of the year, it will continue to launch a wave of new products at an unprecedented pace. On one hand, BYD's main brand will complete the upgrade of existing products to Dmi5.0 and supplement its Dolphin, Seal, and Sea Lion product lines. On the other hand, Denza, FANGCHENGBAO, and AWEX, BYD's three high-end brands, will launch a series of flagship products.

For example, recently, BYD's main brand has exposed several upcoming SUV models, including Song L DMI, Song Pro DMI, Song Plus DMI, and Seal 05 DMI. These four new models are all focused on the compact and mid-size SUV segments, which have the largest market share. Based on the publicly available product information, these models have significant competitive advantages within their price ranges, poised to push BYD's sales to new heights.

The compact and mid-size car and SUV markets are the core sales segments for BYD's main brand. After stabilizing this base market, BYD will gradually expand into the large and medium-large product markets. For example, the mid-to-high-end models that have been highly anticipated, such as Han L, Tang L, and Tang MAX, are expected to be officially announced soon.

Currently, BYD has established an absolute leading position in the cost-effective market below 200,000 RMB with its main brand. It has also seized the initiative in the million-yuan luxury car market with its AWEX brand. However, due to previous strategic considerations, it has not systematically focused on the mid-to-high-end market between 200,000 and 500,000 RMB, giving opportunities to other brands such as Lixiang, Wenjie, NIO, Zeekr, Lynk & Co, and Tank.

But BYD will now fully focus on this price range. In addition to the price-competitive Han L and Tang L models under BYD's main brand mentioned earlier, flagship products such as the N9, Z9 from Denza and the BAO 8 from FANGCHENGBAO are also targeting this price range. Based on the publicly available information, these products have obvious advantages over their competitors in the same price segment. Unsurprisingly, the second half of this year will be a crucial juncture for BYD to catch up in the mid-to-high-end market. By then, BYD's advantage in China's new energy vehicle market will further expand.

2

Although many people have realized BYD's strength, most people still do not fully understand just how powerful it really is. Over the years of business research, the author has witnessed many excellent companies, but has never encountered one as impressive as BYD in China. Even Huawei's development experience in the operator and smartphone businesses pales in comparison to BYD's growth journey in the new energy vehicle field.

To deeply understand BYD's uniqueness, we need to go back to its inception. Founded in 1995, BYD has a 29-year history. This 29-year period can be roughly divided into four development stages.

The first stage was BYD's entrepreneurial focus on the battery field.

During this stage, BYD, leveraging founder Wang Chuanfu's deep technical background in batteries, started with the most basic nickel-cadmium batteries and later entered nickel-metal hydride and lithium batteries, gradually becoming a core battery supplier for many well-known global mobile phone companies.

The second stage was entering the consumer electronics contract manufacturing industry centered on mobile phones.

Due to its cooperation with many top global mobile phone companies in the battery business, BYD gained access to high-quality customer resources and developed world-leading manufacturing capabilities through meeting the stringent demands of these companies.

As overseas consumer electronics giants increased their demand for contract manufacturing in China, BYD's resources and capabilities provided it with an opportunity to enter the mobile phone contract manufacturing industry. After entering this field, BYD relied on its excellent management capabilities to eventually become the second-largest mobile phone contract manufacturer globally, second only to Foxconn.

The third stage was entering the automotive industry.

Since mobile phones involve many precision components, their production is one of the most complex categories among all products. The capabilities accumulated in the mobile phone contract manufacturing field gave BYD the confidence and foundation to venture into other complex product fields.

In the 21st century, the automotive industry is recognized as one of the largest industrial opportunities. Drawing on its experience in mobile phone contract manufacturing, Wang Chuanfu believed that car manufacturing was not a difficult task for BYD. In 2003, it entered the automotive business by acquiring Xi'an Qinchuan Automobile Co., Ltd. Coupled with BYD's deep roots in battery technology, Wang Chuanfu invested heavily in the research and development of power batteries for new energy vehicles, setting pure electric vehicles as BYD's ultimate vision in the automotive field.

However, in 2003, China's pure electric vehicle market was far from mature, so BYD adopted a product strategy that combined traditional gasoline, pure electric, and hybrid power types. It first launched its first gasoline-powered car, Fuleer, in 2005; its first hybrid car, F3DM, in 2008; and its first pure electric car, e6, in 2010.

During this process, as electric vehicle sales were still small, BYD consistently used profits from batteries, mobile phone contract manufacturing, and gasoline-powered cars to support the research and development of electric vehicles, leading to continuous iterations and upgrades in BYD's electric vehicle technology and products, ultimately achieving a comprehensive lead in the new energy vehicle field.

The fourth stage was focusing on new energy vehicles.

Tesla's tremendous success in the new energy vehicle field attracted a large number of traditional automakers and new automotive forces, jointly accelerating the global automotive industry's transformation into the new energy vehicle era.

The improvement in the quality of new energy vehicles on the supply side has also led to a surge in demand from consumers, allowing BYD's technological and product advantages to be fully demonstrated. Since 2020, BYD's new energy vehicle sales have begun to rise rapidly.

Especially in the plug-in hybrid field, BYD, leveraging its scale advantages and strong integrated supply chain advantages, has been able to price its products at the same level as traditional gasoline-powered cars, prompting it to officially announce in 2022 that it would completely exit the gasoline-powered car segment and focus solely on new energy vehicles.

Due to its focus on new energy vehicles, BYD has demonstrated increasingly strong compound interest effects in technology and products, driving its market sales to soar. In 2022 and 2023, BYD sold 1.8634 million and 3.02 million vehicles, respectively, establishing itself as the absolute leader in China's and the world's new energy vehicle market.

Entering 2024, BYD continued to expand its advantages, leading to the product and sales success we mentioned earlier. The outstanding performance in the first half of the year and the certainty of the second half have also brought greater confidence in BYD from the capital market. For example, global investment bank JPMorgan believes that there is little doubt that BYD will achieve its full-year sales target of 3.6 million vehicles in 2024, raising its sales forecast for 2024 to 4 million vehicles and increasing BYD's A-share target price to 440 RMB. It also predicts that by 2026, BYD's global deliveries will reach 6 million vehicles, with approximately 1.5 million coming from overseas markets.

3

After a detailed review of BYD's four development stages mentioned above, the author believes that BYD offers four important insights for China's business community.

First, the origin of BYD's success in larger fields such as new energy vehicles and mobile phone contract manufacturing is first and foremost its industry leadership in the battery field. This suggests that other companies should focus on achieving excellence in their areas of expertise before exploring new opportunities.

Second, BYD's tremendous success today did not happen overnight but resulted from long-term exploration and multiple strategic iterations. This suggests that companies should actively seek change but avoid being overly ambitious in their strategies, striking a balance between strategic ambition and patience.

Third, in the development of all its businesses, BYD has keenly grasped the two most critical factors determining a company's long-term development: quality and cost. It has implemented short-term and long-term strategies centered on these two key factors. The short-term strategy involves leveraging China's labor cost advantages to build a semi-automated model combining "human labor + fixtures." The long-term and fundamental strategy is to achieve "quality and cost" leadership through breakthroughs in core technologies.

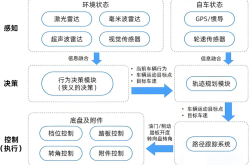

For example, BYD currently has 10 major technology teams with over 100,000 engineers. Among them, the Electrification Team, led by Lian Yubo, has 25,000 engineers and is BYD's largest R&D team. The Semiconductor Team, led by Chen Gang, has 5,000 engineers. The Intelligence Team, led by Yang Dongsheng, has 15,000 engineers. The Rail Transit Team, led by Ren Lin, has 2,000 engineers. The Automotive Integration Team, led by Luo Zhongliang, has 10,000 engineers. The New Materials and Basic Sciences Team, led by Gong Qing, has 3,000 engineers. The Powertrain Team, led by Yao Wei, has 7,000 engineers. The Electronics R&D Team, led by Jiang Xiangrong, has 11,000 engineers. The Battery Team, led by Liu Siyuan, has 10,000 engineers. The Commercial Vehicle Team, led by Peng Wang, has 3,000 engineers.

These technology teams have ultimately led to BYD's all-round leadership in core technologies. Leading technologies, on the one hand, bring BYD absolute cost advantages and pricing power, and on the other hand, bring product differentiation and brand premiumization.

BYD's technological practices offer important insights for most Chinese companies: do not seek quick wins through differentiation based on non-critical factors such as appearance and flashy features. Instead, focus on the truly critical factors that determine a company's long-term success. Recognize that breakthroughs in these critical factors must rely on technology in the long run. The earlier companies invest in technology, the sooner they will see results. In contrast, some new automotive forces in the current industry focus more on appearance and flashy features, lacking accumulation in the core factors of quality, cost, and technology.

Lastly, it comes back to the origin of "talent." Even if a company's strategies are correct, they will be ineffective without a group of loyal and capable talents to implement them. In the past, public opinion has focused too much on BYD's technological breakthroughs and business achievements, greatly neglecting its excellent practices in "talent development." In fact, BYD is an enterprise that attaches great importance to talent development.

For example, in BYD's early days, it had a well-known "car disassembling culture." This refers to BYD's practice of recruiting students from prestigious universities and investing tens of millions of yuan annually to purchase various branded cars for these new graduates to disassemble and study hands-on. Only first-tier brand products were purchased, as Wang Chuanfu believed that studying second-tier brands was meaningless. This "car disassembling culture" quickly cultivated a large number of outstanding engineers who became the talent foundation for BYD's future technological transformation.

The aforementioned "car disassembling culture" is just a glimpse of BYD's talent development efforts. Its talent strategy can be summarized by two keywords: "human sea strategy" and "human heart strategy." The "human sea strategy" involves overstaffing talent in advance to increase talent density. The "human heart strategy" involves creating a "family culture" that provides talents with a work and living environment that fully unleashes their potential, both spiritually and materially, to discourage them from leaving.

At the current stage, BYD is even more unconventional in its talent recruitment. For example, the leaders in charge of BYD's five passenger vehicle sales systems, including Dynasty Network, Ocean Network, Denza, FANGCHENGBAO, and AWEX, are all internally cultivated and previously unknown in the industry.

Notably, among the leaders in charge of the three high-end brands of AWEX, FANGCHENGBAO, and Denza, both Hu Xiaoqing, the leader of AWEX, and Xiong Tianbo, the leader of FANGCHENGBAO, are women, while Zhao Changjiang, the leader of Denza, is a young man born in 1986. This demonstrates BYD's boldness in talent recruitment.

4

In addition to the above core insights, BYD has excellent practices in various specific functional areas such as R&D, products, supply chain, branding, marketing, and channels, which are also worth learning by other companies. However, to some extent, these practices are the result of the aforementioned core ideas.

Currently, more and more companies are studying and learning from BYD. The author suggests that companies hoping to learn from BYD's successful experience should not mistake the "fruits" for the "causes" of its success. Instead, they should find the deeper evolutionary logic and roots of success behind these superficial "fruits" to more accurately learn the core essence of BYD.