Mid-term exam for emerging forces: XPeng Motors must strive

![]() 07/17 2024

07/17 2024

![]() 694

694

Author | Lu Shiming

Editor | Dafeng

The changes in the new energy vehicle market are always unpredictable.

Over the past few years, the development of many new energy vehicle companies has been erratic, especially some emerging forces. A few months ago, they were questioned about possible bankruptcy, and a few months later, they soared to new heights. Examples include Li Auto and NIO.

From a certain perspective, this trend of "ups and downs" is not necessarily a bad thing for automakers. At least, it can highly exercise their market resilience and accumulate more competitive experience. The truly horrible scenario is when there are no significant rises, only continuous declines, which can easily make enterprises feel powerless or be silently eliminated amidst constant self-doubt.

Compared to the "good days" of Li Auto and NIO, as one of the three emerging swordsmen, XPeng Motors' operating conditions have deteriorated since the beginning of last year.

At present, XPeng Motors' core management team is still undergoing changes, and sales are not optimistic, gradually widening the gap with other emerging brands. Under pressure on sales, XPeng Motors further lowered prices, hoping that MONA would open up the mid-to-low-end market. However, the extent to which the newly launched MONA can boost XPeng Motors' sales remains uncertain.

For XPeng, this year will be a significant test.

Declining Sales

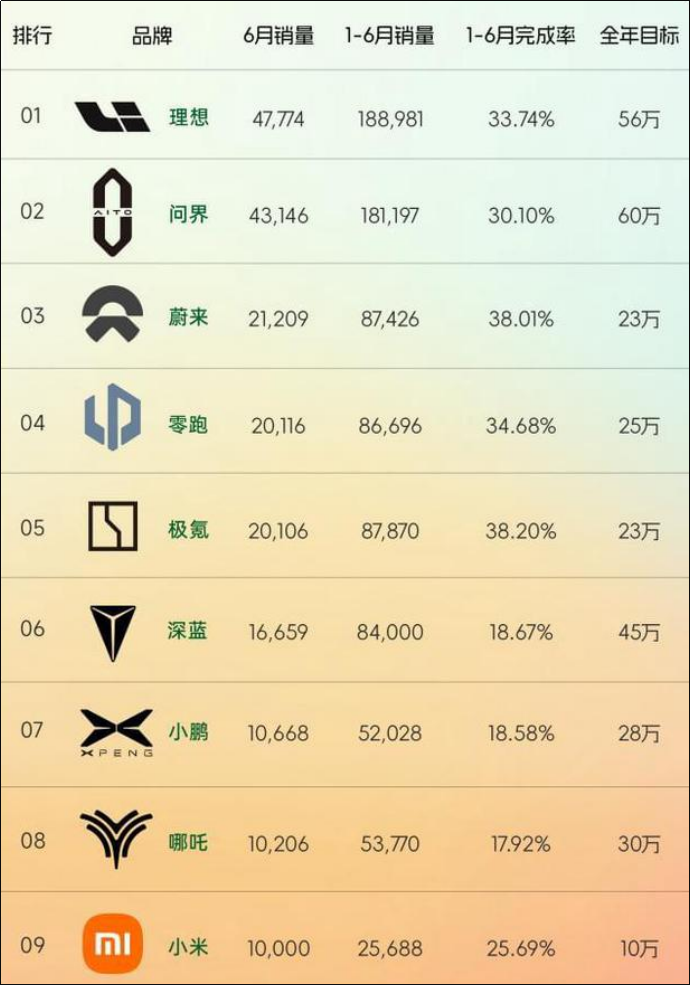

With the disclosure of June sales figures, the mid-year performance reports of emerging automakers have also been unveiled.

Among them, XPeng Motors is undoubtedly the most disappointed, with a cumulative sales decline of 40%, and June sales even halved, clearly falling behind.

Specifically, XPeng Motors delivered 10,668 new vehicles in June this year, a year-on-year increase of 24%. In the first six months of this year, XPeng Motors delivered a total of 52,028 vehicles, compared to 41,435 vehicles in the same period last year, representing a year-on-year increase of 26%. Even so, XPeng has only completed 18.58% of its year-end target of 280,000 vehicles, far from expectations.

In comparison, Li Auto, which ranks first, delivered 188,981 vehicles in the first half of the year, achieving 33.7% of its annual target of 560,000 to 640,000 vehicles. In June, it sold 47,774 vehicles, an increase of 36.4% month-on-month. As for NIO, although its performance in the first few months was unsatisfactory, the situation improved significantly in the second quarter, with 21,209 vehicles delivered in June, exceeding 20,000 vehicles again.

In fact, automakers such as Wenjie, ZEEKR, and Leapmotor significantly outsold XPeng in the first half of the year. Even NIO Auto, which also faced development obstacles, slightly surpassed XPeng in sales during the same period.

It can be said that XPeng is currently facing enormous pressure, even to the point of being on the brink of survival. Facing these challenges, XPeng Motors had to make the decision to sell its core technology.

In July 2023, Volkswagen invested $700 million in XPeng Motors. Both parties reached a technical cooperation framework agreement, with XPeng Motors outputting technology to Volkswagen, which in turn bet on the Chinese new energy vehicle market through XPeng Motors.

By February this year, XPeng Motors announced its cooperation with Volkswagen to develop B-segment vehicles, with XPeng primarily taking on the role of technology output. Crucially, XPeng Motors plans to sell its iconic XNGP intelligent driving technology. It is worth noting that this technology was once XPeng's core competitiveness, and it is difficult to believe that XPeng would make such a decision without financial and market pressures.

Fortunately, XPeng sold its core technology at a good price.

XPeng's first-quarter financial report showed that due to "technology swaps," its automotive services and other revenues reached 1 billion yuan, an increase of 93.1% year-on-year and 22.1% month-on-month. It is understood that this revenue comes from the technical cooperation with Volkswagen, and the profit margin of this segment is as high as 53.9%.

The effect of technology output on reducing losses was immediate, with XPeng Motors' net loss in the first quarter of this year being 1.37 billion yuan, a year-on-year narrowing of 41.5%.

It is not difficult to see that platform and software technology service revenue is becoming an important source of income for XPeng Motors.

Continuous Turnover of Senior Management

The increasing market pressure faced by XPeng is closely related to its frequent personnel transfers.

Earlier this month, XPeng Vice President Jiao Qingchun suddenly resigned. Jiao Qingchun served as the head of XPeng Motors' H platform, and the newly launched MPV model XPeng X9 at the beginning of this year was produced on the H platform under Jiao Qingchun's responsibility, which is currently the only mass-produced model on that platform.

XPeng X9 Source: XPeng Motors official website

Looking at the sales trend in the first half of this year, the monthly sales peak of XPeng X9 occurred in March at 3,946 vehicles, followed by a continuous decline below 2,000 vehicles, currently maintained at around 1,600 vehicles. Compared to other XPeng models, XPeng X9's sales are decent, but there is still a significant gap compared to other brands' MPV models.

Many insiders believe that the mediocre performance of XPeng X9 may be the trigger for Jiao Qingchun's resignation. However, it doesn't matter what the exact reason for Jiao Qingchun's resignation is. What's important is that since the internal organizational restructuring began, XPeng Motors has undergone more than a year of strategic adjustments and recovery.

As early as the end of 2022, XPeng had already started organizational restructuring, during which there were several personnel changes. The biggest change during this period was the addition of Wang Fengying, the former second-in-command of Great Wall Motors, last year.

After entering 2024, XPeng Motors continued its reforms under the leadership of Wang Fengying, and the intensity did not decrease but increased.

In January this year, after initiating a new round of organizational restructuring, XPeng touched upon marketing, human resources, intelligent data, production and manufacturing, and product planning. At the same time, it launched several cost reduction and efficiency enhancement initiatives, involving budget cuts and investigations into corruption issues. As a result, personnel changes at XPeng Motors have been unusually frequent this year.

Image: Wang Fengying (left) and He Xiaopeng (right)

Earlier this year, Zhang Li, former general manager of Great Wall, joined XPeng and began overseeing production and manufacturing; Jiang Ziyang, a former senior consultant at RIES (where Wang Fengying once worked), also joined XPeng to oversee product planning.

In March, XPeng Motors' two founders, Xia Heng and He Tao, were also reported to be gradually stepping down from management positions; in May, Gu Yuanqin replaced Wang Tong as head of XPeng Motors' sales; in June, renowned designer Juanma Lopez officially joined XPeng Motors as Vice President of Design.

Although executive turnover is a common way of organizational change that can have an important driving effect on enterprises, it can also negatively impact their stability.

At present, XPeng's frequent personnel transfers have had side effects, but with the executive landscape gradually stabilizing, it is uncertain whether XPeng can usher in a new period of rapid growth.

Sub-brand Struggles to Carry the Burden

Facing its current predicament, XPeng Motors chose to "sink" and try to boost sales by launching a sub-brand.

At this year's Beijing Auto Show, XPeng Motors Chairman He Xiaopeng announced the launch of the MONA brand, which is positioned as a global popularizer of AI-driven vehicles with the meaning of "Made Of New AI." The new brand's models will be differentiated from XPeng Motors' existing brand products, primarily focusing on the 150,000 yuan price range.

Zinc Finance understands that MONA is actually a new project established by XPeng Motors after acquiring Didi's auto manufacturing-related teams and assets in August last year. Its predecessor was Didi's auto manufacturing project "Da Vinci."

Earlier this month, XPeng Motors' first model in the "MONA" series, M03, made its debut.

It is worth noting that previous information disclosed by XPeng Motors indicated that MONA's product price range was set at 150,000 yuan, but the latest news shows that M03 targets the market below 200,000 yuan, further widening the product pricing range.

MONA M03 Source: XPeng Motors official website

In He Xiaopeng's view, MONA will achieve very good sales in the second half of this year, but judging from the current market situation, his expectations may turn into disappointment.

First, in the 150,000 yuan segment, whether it's BYD's Qin L, Song PLUS, Yuan PLUS, and Dolphin, or Geely's Galaxy series, Aion's S and Y, the high-sales models in this price range have more advantages in terms of space, range, charging speed, and other "hard indicators." Intelligence is not the primary consideration for consumers when purchasing vehicles.

Second, unlike NIO, XPeng is inherently a mid-to-low-end brand and is not suitable for lowering its profile further. The mid-to-low-end market is inherently the territory of traditional OEMs, and only traditional OEMs can provide consumers with a sense of security. Emerging forces entering this segment can make consumers worry about "who knows when they will go bankrupt."

More importantly, the M03 model is not only targeted at consumers but will also be sold to ride-hailing companies, i.e., ride-hailing operators.

According to relevant information, as early as August last year, XPeng Motors and Didi reached an annual sales bet agreement with a minimum of 100,000 and a maximum of 180,000 vehicles over two years. This means that after the official launch and delivery of M03, a significant number of vehicles are likely to flow into the ride-hailing market.

It is undeniable that this will greatly alleviate and help XPeng Motors' sales pressure and cash flow. However, targeting the ride-hailing market with M03 will undoubtedly have a certain impact on its brand image.

Considering specific sales figures, financial reports, personnel changes, and strategic approaches, XPeng's current situation is extremely dire. With fierce competition in the new energy vehicle industry, XPeng Motors must quickly fight several successful turnarounds to survive in this convoluted race.