Industry involution, strangling the upstream and downstream of the automotive industry

![]() 09/23 2024

09/23 2024

![]() 689

689

Editor's Note

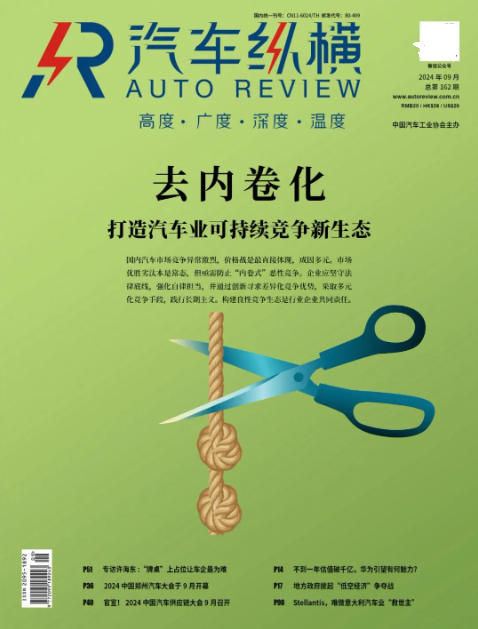

The domestic automotive market is fiercely competitive, with price wars being the most direct manifestation. The causes are multifaceted. While market survival of the fittest is normal, there is an urgent need to prevent vicious "involutionary" competition. Enterprises should adhere to legal boundaries, strengthen self-discipline, seek differentiated competitive advantages through innovation, adopt diversified competitive means, and practice long-termism. Building a healthy competitive ecosystem is a shared responsibility of industry enterprises.

Focusing on the impact of "involutionary" competition on the automotive industry, "Auto Review" has specially produced this "Cover Story" special report. This special report consists of five articles, with the fourth article being released today. Please stay tuned.

"Profit = Selling Price - Cost" is a seemingly simple arithmetic formula. However, behind this formula lies complex economic logic and severe market challenges.

In the first half of 2024, the word "involution" permeated the entire period. The relentless price war among automakers has plunged the entire automotive supply chain into the quagmire of "involution."

This is most evident in the end market: a plethora of new and existing models have emerged, offering "upgraded configurations at reduced prices" as their selling point. Automakers have either directly reduced prices for existing models or offered cash discounts, much to the delight of the "waiting game" enthusiasts. However, tensions have also arisen between these "waiting game" buyers and existing car owners who feel "betrayed" – with an average of less than six months between the launch of a new model that could be considered a generational upgrade, second-hand car prices have indirectly collapsed, causing widespread grievances among second-hand car dealers.

However, for the entire automotive supply chain, these may only be minor skirmishes. Behind the scenes, where consumers cannot see, lies another more brutal and silent battle that has already become a "bloodbath."

First Batch of "Victims"

A notable phenomenon under the price war is that when automakers reduce prices, the supply chain bears the brunt. Whenever the price of a new car is lowered, a "bloody storm" ensues among supply chain companies. Under this influence, the traditional supply chain system is being restructured, and the cost of automakers procuring automotive parts is falling at an unprecedented rate.

Industry insiders told "Auto Review" that automakers typically reduce costs for parts manufacturers at an annual frequency and by a margin of "3%-5%." However, starting in 2023, domestic OEMs have become increasingly assertive, integrating supply chains and tightening procurement budgets. According to related sources, some domestic brands have already shortened their cost reduction cycles to "every six months" or even "every three months," with annual reduction targets set at 20%.

This reflects both the intensity of the current price war and the dwindling profit margins left for parts manufacturers. It is reported that to achieve cost reduction, automakers have unanimously skipped agents when selecting suppliers and instead opted to sign direct supply or consignment agreements directly with parts suppliers.

Against this backdrop, many parts agents have seen a sharp decline in their business volume. Since the beginning of this year, many parts agents have been "optimized" by automakers due to "middlemen earning price differences," becoming the first batch of victims under the price "cleaver."

After eliminating the agent link, while indeed reducing costs for automakers, this operation actually transfers the pressure of cost reduction and financial risks entirely to suppliers. Without the buffer zone provided by agents, any product issues, such as quality problems or supply shortages, can lead to difficulties in withdrawing subsequent payments. Facing payment cycles ranging from three months to two or three years, many small and medium-sized suppliers cannot survive until the funds are received, and such cases are ubiquitous in China.

Choices Limited to "Making Less" and "Making Nothing"

Today, being able to successfully collect final payments is already a great relief for many small and medium-sized supply chain enterprises. Some automakers, in pursuit of extreme cost advantages, further shorten the cycle for introducing new parts suppliers and encourage competition between new and old suppliers to drive down prices, thereby further squeezing suppliers' profit margins. At this point, parts suppliers are often faced with only two choices: "making less" or "making nothing." The logic behind this is simple and brutal – "if you're unwilling to do it, someone else will be happy to take your place."

Choosing to "make less" might seem like a way for suppliers to "earn more by selling more," but more often than not, suppliers haven't even received their payments before the bidding process for the next batch of products begins.

After the first contract period with "friendship pricing" expires, some automakers will require suppliers to further reduce prices, and in some cases, even base their estimates on BOM costs. In such scenarios, quotes will only continue to decrease until they can no longer be lowered. Apart from a few Tier 1 suppliers with bargaining power, the rest of the small and medium-sized suppliers can only silently bear this burden. Some suppliers are even willing to take on orders at a loss to win so-called "big factory" contracts, facilitating future promotions. This vicious competition further complicates and subtly strains the relationship between automakers and suppliers.

According to reporter investigations, to ensure the stable operation of their capital chains, many supply chain enterprises have adopted precise strategies, prioritizing their supply systems and preferentially delivering products to partners with excellent credit and qualifications, even if this means moderately reducing transaction volumes and unit prices. Some parts manufacturers, feeling the pressure of the industry, have resolutely chosen to switch tracks, withdrawing from the fiercely competitive automotive manufacturing sector and exploring niche markets with smaller but more lucrative profit margins, such as focusing on the supply of mid-to-high-end aftermarket automotive accessories. Although the transformation is painful, at least it provides a sense of stability for now.

The "Price Cleaver" Aimed at Dealers

Compared to upstream suppliers, downstream dealers are in an even more difficult position. Relevant research data shows that dealer satisfaction with automakers has plummeted to 56.1% this year, a record low. Notably, this figure was 64.8% in the same period last year, a decrease of 8.7 percentage points – a significant drop and the largest in years, highlighting the survival pressures and growing dissatisfaction of dealers in the current market environment.

The reasons for this phenomenon include but are not limited to price wars leading to price inversions for new cars, overly ambitious sales targets set by automakers, insufficient market support, increased inventory pressures, and compressed dealer profit margins.

According to a survey by the All-China Federation of Industry and Commerce, the average price inversion ratio among the 27 automotive brands surveyed in 2023 was 23.05%; this figure rose to 26.26% in the first quarter of 2024. The survey also revealed extreme cases, with some high-end models experiencing price inversions of up to half a million to six hundred thousand yuan, meaning cars originally priced at one million yuan were sold by dealers for prices as low as four to five hundred thousand yuan, highlighting the immense challenges and pressures faced by current automotive dealers.

The reason for price inversions and selling cars at a loss lies in the enormous inventory pressures faced by automotive dealers. It is understood that a reasonable range for dealer inventory ratios is between 0.8 and 1.2. However, according to the latest data from the China Automobile Dealers Association, China's automotive dealer inventory ratio reached 1.5 in July this year, indicating that inventory levels have reached the warning line. Specifically, Jaguar Land Rover led with an inventory ratio of 2.55, while Beijing Hyundai followed closely with a ratio of 2.45, both of which performed poorly in the market.

Why Endure Such Hardships?

Meanwhile, polarization has emerged among dealers, with some thriving while others struggle. Autonomous brand dealers have seen revenue growth, but their profit margins are slim, customer payment cycles are long, and sales targets are high. Joint venture brand dealers face even greater difficulties, not only dealing with falling car prices but also experiencing sharp declines in sales and increasing inventory pressures.

Public data shows that in July this year, the market share of joint venture brands shrank to 25.6%, compared to several years ago when they dominated half of the new car market. In terms of sales targets, public data reveals that only 18.4% of dealers met their sales targets in the first half of this year, 34.8% achieved over 80% of their targets, and a staggering 13.5% failed to reach even 50% of their targets.

Due to the difficulty in achieving sales targets, many automotive dealers have fallen into profitability dilemmas in recent years, with many forced to withdraw from networks and close stores. After joining automaker networks, dealers need to invest their own funds to build 4S stores. Although OEMs provide subsidies for store construction, these subsidies are not paid in a lump sum but annually. Faced with construction costs that can easily exceed ten million yuan, early withdrawal from networks means that initial investments are lost.

Unable to sell cars and unable to afford to withdraw from networks, "soldiering on despite the odds" has become the norm for many dealers. Even large dealer groups with multiple chips to play are facing the dilemma of increased revenue without commensurate profits. The latest financial reports show that China's top dealer groups have all experienced significant declines in profits, with Zhongsheng Group's net profit falling by over 20% year-on-year last year, Yongda Group's net profit declining by over 60%, and Meidong Auto's net profit plummeting by over 70%.

As the dealer model is asset-heavy, once dealers encounter problems, it can lead to the so-called "grey rhino" effect, triggering a series of practical issues such as inventory vehicle and after-sales parts disposal, OEM rebates, customer rights and interests, and employee layoffs. Since last year, to further achieve "cost reduction and efficiency enhancement," some automakers have reduced rebates for dealers, leading to even more severe losses and escalating conflicts between dealers and OEMs. Earlier this year, there was even a collective rebellion by Porsche dealers against their OEM.

At present, to ensure survival, many dealers have chosen to cooperate with overseas traders, opting to sell cars at low prices to alleviate inventory pressures. Some dealers have even switched to becoming used car dealers, albeit facing similar difficulties but at least no longer beholden to others.

When Will Involution End?

Automakers, suppliers, and dealers share common interests and should stand together through thick and thin. However, judging from the current state of parts suppliers and dealers, the involution in the automotive industry seems to have no end in sight. In the current industry landscape, everyone is like a clay Buddha crossing a river – struggling to preserve their own profits, let alone consider others.

Yet, as the ancients said, "When the nest is overturned, how can the eggs remain unbroken?" From the reporter's perspective, while consumers can indeed buy cars at lower prices under involution, the disorderly competition of "cutting five cities today, ten tomorrow" through squeezing suppliers is unacceptable. If this continues, the entire automotive supply chain may collapse, leading to the phenomenon of "bad money driving out good," affecting the healthy and stable development of the industry.

"We should compete in terms of technological innovation, product quality improvement, quality assurance, service provision, and brand building. We must not adopt short-sighted behaviors such as price wars and other forms of 'involutionary' vicious competition that hinder long-term sustainable development," appealed Shi Jianhua, Deputy Secretary-General of the China Electric Vehicle Hundred Person Forum.

"Under the influence of price wars, upstream automakers will inevitably demand low-cost supplies from downstream suppliers. In response, suppliers may seek survival through layoffs and salary reductions, use low-end materials and rough craftsmanship to reduce costs, or forgo technological innovation and breakthroughs to avoid excessive R&D investment. This bottomless price war harms the future of China's automotive industry," said Lu Fang, CEO of VOYAH Auto.

At the 2024 China Automotive Forum held recently, Xin Guobin, Vice Minister of Industry and Information Technology, also shared his insights on the current phenomenon of disorderly competition. He noted that domestic automotive consumer demand is not robust, market competition is fiercely intense, and disorderly competition has emerged, leading to declining profits or even losses for many enterprises and increasing defaults among enterprises. These phenomena have impacted and disrupted the stability of the industrial and supply chains.

Regarding the future transformation and upgrading of the domestic automotive industry, he put forward three suggestions: first, adhere to innovation-driven development, give full play to the role of enterprises as the mainstay, and continue to intensify technological and managerial innovation to contribute more original innovative technologies to the global automotive industry transformation, so that the benefits of scientific and technological innovation can reach more people around the world; second, uphold sustainable development, with enterprises aspiring to become century-old enterprises, maintaining a sense of awe, adhering to integrity and innovation, proceeding steadily and far-sightedly, resolutely resisting unfair competition, and safeguarding a clean and healthy market environment; third, uphold open cooperation, as the division of labor and cooperation within the industrial chain is an inevitable choice to improve quality, reduce costs, and increase efficiency in the automotive industry. It is necessary to respect the basic laws of industrial development, strengthen exchanges and cooperation with enterprises from various countries with an open and inclusive mindset, learn from each other's strengths, and achieve win-win development.

"Involution" is a form of competition and the essence of a market economy. Profit is not merely the difference between selling price and cost but requires comprehensive consideration by enterprises. Today, the elimination race in the automotive industry has already begun. As we revisit industry "involution," it may be more appropriate to view it as a voyage across the ocean, where gale-force winds and high waves are inevitable. Automakers, supply chain enterprises, and dealers are all sailors on the same ship – only by pulling together can they sail out of the gloom and into broader horizons.

Note: This article was first published in the "Cover Story" section of the September 2024 issue of "Auto Review." Please stay tuned.

Related Reports:Cover Story (Part I): Involution Approaching the Critical Point, It's Time to "Stop"Cover Story (Part II): Exclusive Interview with Xu Haidong: "Occupying a Seat at the Table" is the Most Difficult Challenge for AutomakersCover Story (Part III): To Break "Involution," Joint Venture Brands Successively Withdraw from "Price Wars"

Images: From the Internet

Article: Auto Review

Typesetting: Auto Review