Pure electric, extended range, and plug-in hybrid - the battle for supremacy between NIO, Xpeng, Li Auto, and Xiaomi

![]() 09/23 2024

09/23 2024

![]() 672

672

Pure electric is the dream and distant horizon, while extended range is the immediate struggle, but survival is paramount.

@Original by Tech Insight

Among the new-energy vehicle startups in China, perhaps only a handful, led by NIO's Li Bin, remain committed to the pure electric route.

According to recent information obtained by 36Kr, Xpeng's extended-range vehicle project completed core component sourcing in the first half of this year, with the first extended-range model expected to enter mass production in the second half of 2025. As early as July this year, media reports claimed that Xpeng would launch a hybrid model, but the company quickly denied it, stating that the extended-range solution would only be adopted for flying cars.

Unlike Xpeng's sudden pivot, Xiaomi, which "loses 66,000 yuan on every car sold," began openly recruiting engineers for extended-range system design and development as early as August last year. According to sources, Xiaomi's extended-range model, codenamed "Kunlun," is likely to be its third model, set to launch in 2026 as part of a joint R&D project with Beijing Automotive Group before obtaining independent manufacturing qualifications.

Polestar, another brand that previously focused solely on pure electric vehicles, has also recently hinted at adopting a two-pronged approach. During Geely's 2024 interim results announcement, An Conghui, President of Geely Holding Group and CEO of Polestar, announced that the company would introduce a flagship large SUV in the third quarter of next year, available in both pure electric and plug-in hybrid versions.

Embracing fuel tanks is becoming a consensus among Chinese new energy vehicle manufacturers, despite their initial reluctance. Just four years ago, Stephan Wöllenstein, then CEO of Volkswagen Group China, expressed a radical view that extended-range electric vehicles were nonsense and the worst solution because fuel-powered electricity generation was unenvironmentally friendly. If we continue to burn fossil fuels to generate electricity, there's no point in making electric cars, he argued.

Yet environmental considerations cannot compete with the voting power of consumers. According to the China Passenger Car Association, pure electric vehicle wholesale sales in July fell 9% month-on-month to 505,000 units from 559,000 in June. Compared to the same period in 2023, pure electric vehicles' market share dropped from 68% to 53%, while plug-in hybrids and extended-range vehicles rose from 25% and 8% to 34% and 13%, respectively.

In the first battle between extended-range and pure electric vehicles, the outcome was clear. But what key factors will influence the second round as automakers flock to the extended-range race?

Part.1

A Leading Victory for a Lagging Technology

In November 2023, Li Xiang, whose idealized extended-range electric vehicles later surpassed those of NIO, Xpeng, and Li Auto, tweeted that Chinese autonomous brands still adhering to multi-speed PHEV systems would switch to extended-range technology within the next year or two.

While his prediction targeted plug-in hybrids, the allure of the extended-range route is undeniable, as evidenced by the shift of many pure electric vehicle manufacturers.

As of August 2024, sales of new energy vehicles in China reached 5.463 million units, up 38% year-on-year. Among the top ten brands in cumulative sales, only WENJIE and NIO ranked above the overall growth rate, with their best-selling models being extended-range products. The four brands adhering to the pure electric route, NIO, Volkswagen, Tesla, and GAC Aion, saw varying degrees of sales decline.

The extended-range route is not only a secret to boosting sales but also a lifesaver. Leapmotor and NIOZ, two emerging brands in the second tier, are typical examples of this revival.

Leapmotor delivered a total of 144,200 vehicles in 2023, 73.5% of which came from the C series, with 76.4% of those being the earlier-launched extended-range version of the Leapmotor C11. The latest financial report shows that Leapmotor achieved its first full-year positive gross margin. The relatively low cost and market preference for extended-range products have become two core competitive advantages.

Although Leapmotor is one of the new forces established at the same time as NIO, Xpeng, and Li Auto, it has long hovered on the brink of survival, marked by pay cuts, layoffs, and management changes. Previously, salespeople at downstream dealerships joked that customers' most common question upon entering the store was, "Will Leapmotor go bankrupt?"

The turning point came in March last year, when Leapmotor's extended-range models began delivery, leading to monthly sales increases. By the weekly sales rankings in August this year, Leapmotor surpassed WENJIE with 5,400 units sold, marking a brief victory.

At Leapmotor's C10 launch event in March, CEO Zhu Jiangming admitted that every detail of the C10 was inspired by the Li ONE. From "the next WM Motor" to "a viable alternative to the Li ONE," Leapmotor's remarkable transformation underscores the magic of the extended-range route.

Another automaker that views the extended-range route as a lifeline is NIOZ. After struggling to find its footing in the low-end market, NIOZ finally made it to the IPO threshold last year, thanks to the launch of the extended-range version of the NIOZ S. Of the public orders received after its launch, 62% of customers chose the extended-range version.

Having tasted success, NIOZ's latest model, the NIOZ L, no longer hides its homage to the Li ONE, though it struggles to compete with Leapmotor in the same segment.

From being dismissed and relegated to the bottom of the pecking order, the extended-range route has now become a popular choice among automakers, despite its lack of cutting-edge technological innovation. It perfectly addresses range anxiety, explaining why pure electric vehicles, despite constantly setting new benchmarks for driving range, still lag behind in sales.

Part.2

Range Anxiety in Pure Electric Vehicles

A small but vocal group of skeptics dismiss pure electric vehicles, arguing that the extended-range route is a no-brainer victory. Even Li Xiang, who first proved the strength of extended-range electric vehicles, stumbled with his pure electric offerings.

While Li Xiang acknowledges that pure electric is the ultimate goal for new energy vehicles, he believes that extended-range technology better aligns with his current understanding of product capabilities. After amassing a healthy cash flow, Li Auto launched the pure electric MEGA in March this year, only to see its success abruptly halted.

Criticism over its design and high price led to a mere 3,229 units sold in the first month, dropping to just 654 in July, even affecting sales of the flagship L series. In response to MEGA's struggles, Li Auto hastily introduced the relatively affordable L6 to offset the sales crisis, pushing back plans for the M series of pure electric vehicles to next year.

Choosing the extended-range route immediately lowers the entry barrier for new energy vehicle manufacturers. The extended-range system requires a smaller battery capacity, reducing dependence on upstream lithium mining and battery supplier fluctuations. The mature extended-range engine market has already driven prices below 10,000 yuan. Automakers also avoid the hefty investments in charging infrastructure required by Tesla and NIO, allowing them to focus resources on optimizing the product experience.

In reflecting on MEGA's failure, Li Xiang cited inadequate supercharger coverage as a major factor. The cost advantages of the extended-range route have enabled struggling brands like Leapmotor and NIOZ to easily transition. Sources reveal that Xpeng's extended-range vehicle will use an extended-range engine sourced from Dongan Engine, which also supplies Li Auto.

Consumers' preference for extended-range vehicles stems from complex factors, but range anxiety in pure electric vehicles remains a persistent concern. While mainstream gasoline-powered vehicles typically offer a driving range of around 500 km on a full tank, most new energy pure electric vehicles on the market today boast similar or even longer driving ranges in their standard configurations.

However, electric vehicle owners who have experienced their cars under daily use or extreme conditions like winter know all too well that manufacturers' advertised driving ranges are often inflated. This isn't merely marketing hyperbole; battery performance varies significantly under different operating conditions. New energy vehicles, with their emphasis on user experience, often come equipped with multiple screens, in-car refrigerators, and other power-hungry devices, rendering advertised driving ranges laughable.

Moreover, even with small fuel tanks, gasoline-powered vehicles rely on a nationwide network of over 110,000 gas stations, a crucial factor for car buyers considering extended-range or pure electric vehicles.

Yet, the temporary decline of the pure electric route does not signify a rewrite of the new energy vehicle narrative. Nor can the extended-range route rest easy with its current ascendancy; competition remains the dominant theme in the market.

Part.3

The Next Challenge for Extended Range

Alongside the rapid growth of extended-range vehicles, plug-in hybrids have also exploded in popularity, even outpacing extended-range vehicles in market share growth.

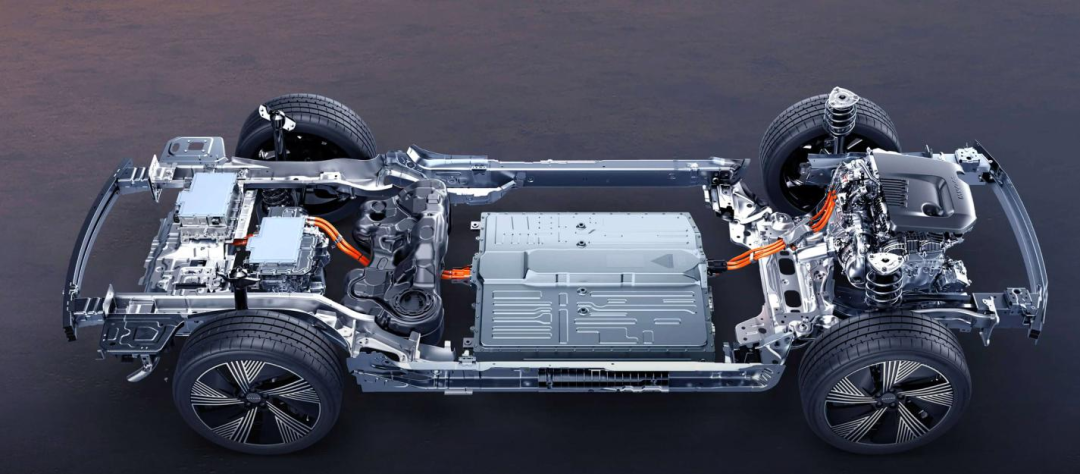

Extended-range technology is relatively straightforward, adding a fuel generator to the electric powertrain. The generator only kicks in when the battery is low, burning fuel to maintain electric drive. However, due to energy transmission losses, it can consume more fuel than a gasoline-powered car under certain conditions like highway driving.

The complete electric architecture compromises by incorporating a fuel generator, which can even reduce efficiency under certain conditions. This technical regression is precisely why industry insiders initially dismissed the extended-range route.

Plug-in hybrids, on the other hand, build upon traditional gasoline engines by integrating an electric motor. The gasoline engine can directly power the vehicle or charge the electric motor through a generator. The electric motor can also independently power the vehicle when fully charged or work in tandem with the gasoline engine.

While automakers offering plug-in hybrids vary in their technical approaches, this transition from gasoline to electric power aligns more closely with positive technological iteration. However, the system-level development threshold poses a formidable challenge for new energy vehicle startups. Simply put, adding an extended-range version to an electric vehicle is straightforward, but converting it to a plug-in hybrid is much more complex.

Ultimately, the battle between technological factions will be judged by user needs. Mainstream plug-in hybrid models generally fall into two categories: large-battery and small-battery options. Sales data shows that small-battery plug-in hybrids, represented by BYD's Dynasty series, dominate the 100,000-150,000 yuan price range. Large-battery plug-in hybrids are more prevalent in the mid-to-high-end market above 200,000 yuan, while extended-range vehicles aim for the premium segment above 300,000 yuan.

Research into actual post-purchase usage reveals that owners of low-priced hybrid models tend to use their plug-in or extended-range vehicles like traditional gasoline cars, valuing their green license plates and cost-effectiveness. Owners of high-priced hybrid models, however, exhibit diverse needs. Those opting for plug-in hybrids prefer them for long-distance or off-road driving, relying on the mechanical performance of the gasoline engine. In contrast, extended-range vehicle owners seek a fully electric driving experience, with the gasoline generator serving as a backup for emergencies.

As extended-range and plug-in hybrid technologies compete, pure electric advocates won't sit idly by. NIO, the leader in battery swap technology within the pure electric segment, has invested heavily in swap stations, precluding a pivot or transition.

Li Bin, speaking after the launch of the budget-friendly Letao brand, said, "If I had to go back to 2015 or 2016 and decide whether to seize the opportunities of the next decade, I probably wouldn't have chosen the extended-range route. We're not opportunists. Plug-in hybrids and extended-range vehicles address 5% or 1% of extreme usage scenarios and range anxiety."

The next rival for the extended-range route could be plug-in hybrids, battery swap technology, or a revitalized pure electric segment through technological innovation. But the most likely contender is the extended-range route itself. As automakers abandon their prejudices and embrace the extended-range segment for survival, the automotive market enters a phase where competition supersedes pride. The low barrier to entry and high demand inevitably lead to a price war, and only those who survive this battle will be eligible to write the future of pure electric vehicles.