When will self-owned high-end sedans break the sales curse

![]() 09/24 2024

09/24 2024

![]() 514

514

Author | Yang Lu

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

In the past two months, several more self-owned brand sedans have been launched, including the Xiejie S9, Link&Co Z10, Jiyue 07, etc. Among them, some are aiming for the high-end market, while others are testing the pure electric waters.

However, a cruel fact remains: in the high-end sedan market, self-owned brands have struggled to gain traction.

“I've loved Audi since college and dreamed of buying one after graduation.” “I had already ordered an electric sedan, but I decided against it when I thought about the traffic jams during the New Year holiday. Plus, the price of the electric car plus the battery solution isn't cheap.” “For my first car, I still prefer BBA (Benz, BMW, Audi)...”

These are statements from three users on an Audi A6L owners' forum, all of whom share a common trait: they are in their early twenties. Apparently, not all young people prefer smart electric vehicles; many still aspire to own traditional luxury brands as their dream cars.

According to data from the China Passenger Car Association (CPCA), in August, the top three mid-to-large sedans in terms of sales were the BYD Han, Xiaomi SU7, and Audi A6L, with sales volumes of 15,000, 13,100, and 13,000 units, respectively. Monthly sales of other mid-to-large sedans were below 10,000 units.

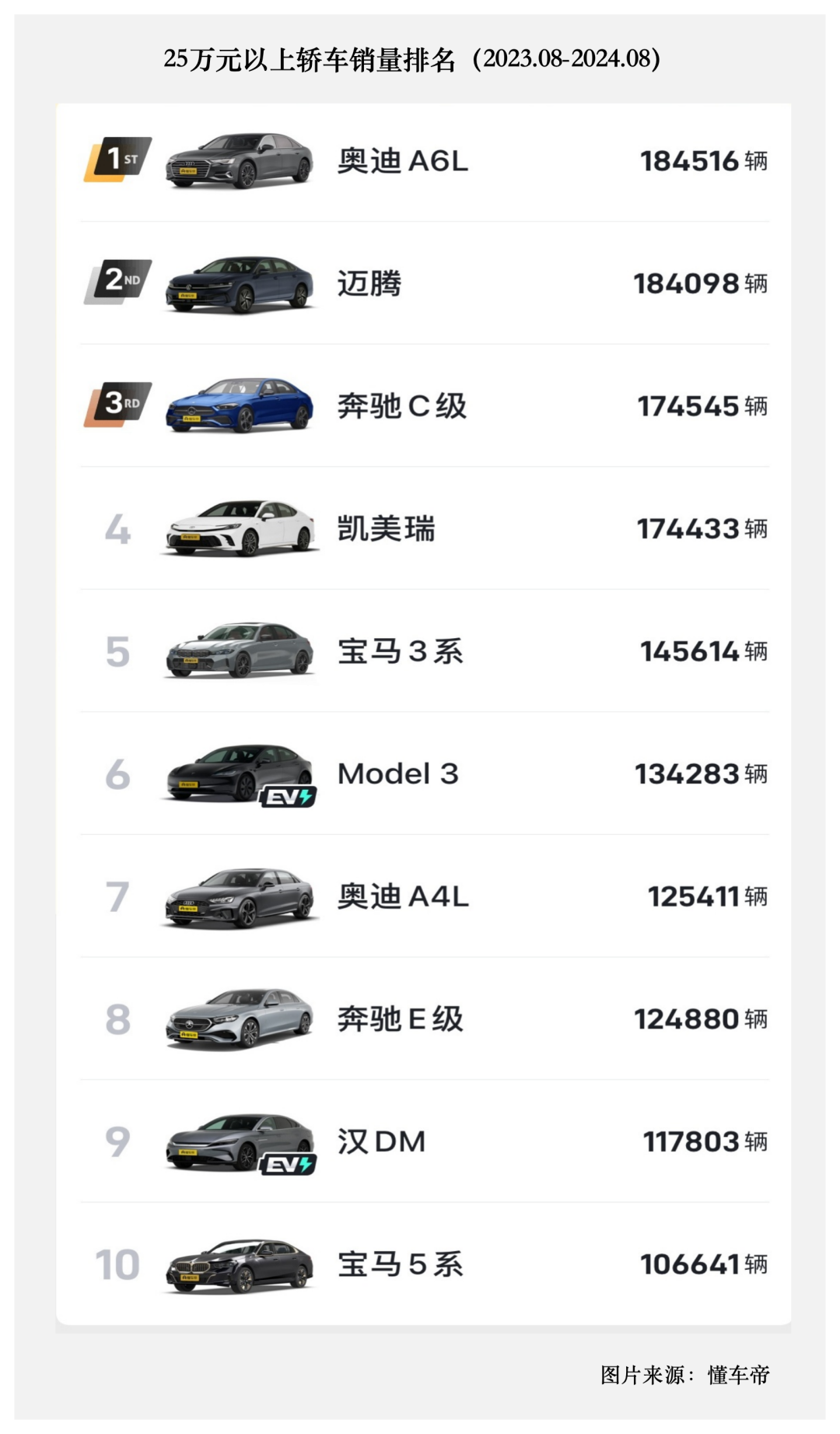

When limiting the scope to high-end sedans priced above 250,000 yuan, self-owned brands fare even worse in the rankings. According to Dongchedi data, in August, Xiaomi SU7 ranked fourth in sales of sedans priced above 250,000 yuan, with 13,111 units sold; Zeekr 001 ranked ninth with 8,481 units; and BYD Han ranked eleventh with 8,347 units. No other self-owned models exceeded 5,000 units in August sales.

Over the past year, the top three spots in sales of high-end sedans priced above 250,000 yuan have been dominated by Audi A6L, Magotan, and Mercedes-Benz C-Class. Among the top ten, only BYD Han, ranking ninth with 117,800 units sold, is a self-owned brand.

Clearly, while self-owned brands like BYD have been steadily eroding the market share of joint ventures in the 100,000-yuan sedan segment with their superior cost-effectiveness, the high-end sedan market continues to be dominated by joint ventures and foreign brands.

This phenomenon can be traced back to April 11, 1983, when the first CKD Santana sedan rolled off the production line at SAIC Volkswagen. Since then, joint venture sedans have formed a seemingly unbreakable bond with the Chinese market. For over 40 years, from official vehicles to private cars, joint venture brands have dominated the Chinese sedan market. Even today, despite some contraction in the low-end market, they remain the protagonists in the high-end segment.

Throughout this period, Chinese brands have consistently attempted to break into the high-end sedan market, but have repeatedly fallen short, lacking breakthrough models. In recent years, numerous new energy self-owned brands, both new forces and established players, have vigorously promoted high-end sedans, but most have failed to gain traction – with the notable exceptions of BYD Han and Xiaomi SU7, whose success is difficult to replicate.

Currently, joint venture sedans are lowering their price points, further compressing the market space for self-owned brands.

“Most Chinese brands started with SUVs, and among high-end sedans, only Xiaomi SU7 and BYD Han have performed well. This is a dilemma that plagues most self-owned brands,” said Lu Fang, CEO of Voyah Motors, in a recent interview with Bangning Studio.

Is it due to excessive pricing or inadequate marketing? Lu Fang believes neither is the case, arguing that the root cause lies in the insufficient consumer recognition of Chinese brand sedans.

So, how can self-owned brands break this curse and dethrone joint venture brands in the high-end sedan market?

Difficult to Sustain Momentum

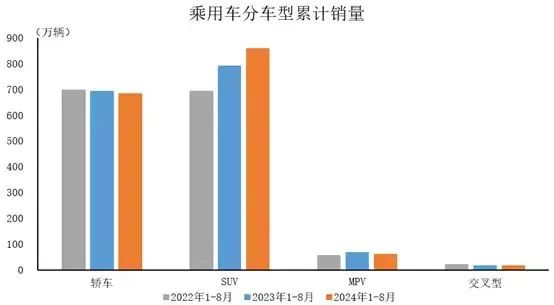

Over the past three years, overall sedan sales have remained relatively stable.

According to CPCA data, in 2024, sales of high-end models in the passenger car market increased, while the proportion of low- and mid-priced models declined. This trend was most evident in the SUV segment, and a similar shift was observed in the sedan market, particularly for B-segment sedans, indicating a growing demand for higher-quality and higher-performance sedans among consumers.

Of course, the best-selling and most prevalent segment remains compact sedans priced below 150,000 yuan, which represent the largest subsegment in the domestic sedan market due to their high demand and low prices.

▲ Image source: China Association of Automobile Manufacturers (CAAM)

In this price range, self-owned brand sedans, led by BYD, have made significant inroads into the traditional joint venture stronghold, capturing a notable share of the market. Models like the BYD Seagull and BYD Qin are stealing market share from the likes of the Nissan Sylphy and Volkswagen Lavida.

This success can be attributed to the rapid development and pricing strategies of self-owned new energy vehicles. As the saying goes, there are no bad cars, only bad prices. Affordability is a key concern for compact sedan buyers.

But will these tactics work in the high-end sedan market?

Traditionally, the BMW 5 Series, Mercedes-Benz E-Class, and Audi A6L (colloquially known as the BBA trio) have been the top choices for high-end sedan buyers, consistently ranking among the top sellers in the market.

In the past decade, emerging new energy automakers, including both new forces and new entities incubated by traditional automakers, have mostly targeted the BBA segment in the sedan market. Despite their late entry, mostly with SUV offerings and relatively few sedan products to date, they have been actively pursuing this market.

Since 2020, these brands have successively launched high-end sedans, attempting to disrupt the BBA dominance with new powertrains and smart connectivity features. For example, the Zeekr 001 has achieved monthly sales of over 10,000 units multiple times since its 2021 launch, but its market performance has been uneven. In August this year, the 2025 model was introduced, just six months after the launch of the 2024 model, reflecting Zeekr's need to adapt quickly to changing market conditions despite the risks involved.

This is a typical experience for self-owned high-end sedans. Like the Zeekr 001, many self-owned high-end sedans enjoy initial popularity upon launch but struggle to sustain momentum as interest wanes, leading to declining sales. Automakers are forced to adjust configurations and prices and relaunch their models in an effort to regain momentum.

This suggests that the value proposition of emerging self-owned high-end sedan brands remains unstable in the minds of consumers.

Last year, the Huawei-Chery collaboration resulted in the launch of the Zhijie S7 sedan, but sales were disappointing. Huawei attributed this to factors such as insufficient production capacity. Six months later, in April this year, the Zhijie S7 was relaunched with upgraded configurations, but monthly sales remained in the low thousands.

Some attribute this failure to the strong product capabilities of the Zhijie S7 and Huawei's brand endorsement, but argue that the timing was off, and that Huawei's support for the model was not as robust as for other models in its portfolio.

Perhaps this is only a superficial view. Whether it's a relaunch or a facelift, the root cause of the Zhijie S7's failure lies in the fact that self-owned high-end sedans have yet to gain widespread recognition among Chinese consumers.

Taking August as an example, SAIC IM L6 sold just over 3,000 units; AVATR 12 from Changan sold 1,657 units; GAC Aion LX Plus sold just over 300 units, maintaining that level for several consecutive months; FAW Hongqi H9 also sold just over 300 units; Chery Star Ark ES did not disclose recent sales figures, but sold 109 units in June; sales figures for BAIC ARCFOX Alpha S were unavailable...

The exceptions are the BYD Han and Xiaomi SU7. Xiaomi's SU7 is particularly noteworthy, as its first model – a C-segment sedan – achieved monthly sales of over 10,000 units from the outset, becoming a phenomenon in the market. Behind this success lies the powerful marketing prowess of Xiaomi Group founder Lei Jun and the popular "Mi-Jetta" design that appeals to many young people – two aspects in which other self-owned brands cannot match.

Like NIO's ET7 and ET5, which have carved out a niche in the self-owned high-end sedan market, NIO's founder and CEO William Li has acknowledged that the high-end market above 300,000 yuan is challenging.

The reasons for this are threefold: first, overall consumer spending pressure is increasing; second, some high-end brands that were originally priced above 300,000 yuan have lowered their prices below this threshold; third, electric vehicles in the 200,000 yuan range are highly competitive, creating a gravitational pull around the 250,000 yuan price point, which has significantly impacted the market above 300,000 yuan.

Seizing the Window of Opportunity to Break Through

“We didn't do much research before buying our car. We were just browsing in the mall when we were greeted by a sales consultant from Jiyue,” said Ms. Zhang, a Jiyue 07 owner. “They were very enthusiastic and made us feel welcome. We ended up test-driving the car and decided to buy it on the spot.”

In modern car-buying decisions, the importance of service experience is growing.

Previously, Jiyue Motors focused on its technological image as a “car robot,” with brand power being a weakness. It is now expanding its store network and strengthening store management. “We've been thinking about how to efficiently utilize our physical stores. As a startup, we need to execute 10 times faster than others to achieve 10 times the efficiency,” said Xia Yiping, CEO of Jiyue Motors. He has previously stated that even if customers don't buy a car when they visit the store, they should still learn about the Jiyue brand.

Lin Jie, Senior Vice President of Geely Automobile Group and General Manager of Lynk & Co Sales Co., Ltd., believes that the direct sales model has certain advantages when a brand is just entering the market. Automakers choose to promote their brands in shopping malls and supermarkets, not only because of the high communication efficiency but also because consistent service helps establish a strong brand image.

However, when it comes to the Lynk & Co brand, the approach is slightly different. Lynk & Co has established direct sales companies in 20 cities across China, serving as user centers that integrate branding and sales. This model fully aligns with the direct sales system of new forces while retaining the original dealer network. Both service and pricing are benchmarked against the user center, which acts as a bridge between dealers and automakers, allowing traditional self-owned brands to navigate the balance between change and consistency.

This approach has yielded some results, as evidenced by the case of a Lynk & Co Z10 owner in Anhui Province. One day in September, he went to a mall for lunch and stumbled upon a Lynk & Co store on his way out. Inside, a red Lynk & Co Z10 caught his eye. Impressed by its exterior design and interior styling, and with the enthusiastic assistance of the sales consultant, he quickly discussed the purchase with his family over lunch and placed an order after a test drive.

High-end sedan brands are emphasizing direct sales. In this regard, Tesla and Xiaomi Motors have set successful examples. Tesla established direct sales stores, revolutionizing the automotive sales channel, while Xiaomi Motors has disrupted the marketing model with its fan culture and the personal brand of Lei Jun. Both have proven the feasibility of this approach with their sales figures. As a result, self-owned high-end sedan brands are eager to follow suit, focusing on creating new channels and marketing strategies.

Apart from Xiaomi Motors, the brand that has consistently generated buzz among consumers is Huawei. This year, Huawei and Beijing Automotive Group jointly launched the luxury sedan Xiangjie S9. Integrating the best resources of both parties, Huawei launched an extensive advertising campaign and invited celebrities like Huang Xiaoming and Yang Mi to take delivery of the car, making them owners of the Xiangjie S9.

As an executive flagship sedan, the Xiangjie S9 further narrows its target audience. After its launch event on August 26, Yu Chengdong, Executive Director of Huawei, Chairman of the Terminal BG, Chairman of the Intelligent Automotive Solutions BU, and Director of the Intelligent Terminal and Intelligent Automotive Components IRB, announced that pre-orders for the Xiangjie S9 had exceeded 8,000 units.

The latest sales figures are not yet available, but based on market buzz, consumer enthusiasm for the car does not appear to be high.

Lu Fang told Bangning Studio that Voyah Motors is analyzing the sales performance of its executive flagship sedan, Zhui Guang, but stressed that “it's definitely not due to a lack of product quality.”

Despite the challenges faced by self-owned high-end sedans, the situation is improving.

On the one hand, self-owned brands are growing in confidence. “Everyone who has driven the Zhui Guang believes it surpasses the Mercedes-Benz E-Class, Audi A6, and BMW 5 Series. Not long ago, several foreign directors from other companies visited Voyah Motors for research and were blown away by the Zhui Guang, saying it overturned their perceptions of domestic cars,” said Lu Fang.

On the other hand, foreign brands are also acknowledging the progress made by self-owned brands. Ford Motor Company CEO Jim Farley recently told the media that he has visited China multiple times since 2023 and admitted, “I didn't realize we were already behind until I came to China.” During this year's Beijing Auto Show, many foreign engineers showed keen interest in domestic models, even using flashlights and tape measures to inspect them on the exhibition stands.

In the new automotive era, the transformation towards new energy and intelligence has created unprecedented opportunities for self-owned brands to leapfrog the competition. In the high-end sedan segment, while joint venture brands still dominate, self-owned brands are innovating in technology, marketing, and channels, striving to catch up. The long-cherished dream of rewriting the landscape of the high-end sedan market in the Chinese automotive industry may soon become a reality.