BYD's prosperous year collides with Tesla's lean year

![]() 09/24 2024

09/24 2024

![]() 461

461

This article is based on public information and is intended for information exchange only and does not constitute any investment advice

In 2024, the landscape of the new energy vehicle (NEV) market exceeded most people's expectations. Let's start with the numbers. BYD: Second-quarter revenue of RMB 176.2 billion, up 26% YoY, with a net profit of RMB 9.1 billion, up 33% YoY. Overall gross margin was 19%, exceeding 22% when excluding BYD Electronics. The company sold 987,000 vehicles in the second quarter, up 40% YoY. Tesla: Second-quarter revenue of $25.5 billion, including $19.9 billion in automotive revenue, down 7% YoY, with a net profit of $1.81 billion, down 42% YoY. Overall gross margin was 18%, and automotive gross margin was 18.5%. Total deliveries in the second quarter were approximately 444,000 vehicles, down 5% YoY. Judging from the revenue and net profit figures in the second quarter, BYD and Tesla are surprisingly close. As they grow and decline, BYD and Tesla, two automakers that were once seen as operating in parallel universes, have now crossed paths.

01 BYD's Prosperous Year

1. Overcoming Bias Along the Way

BYD's achievements this year are truly admirable. Looking back, unlike other domestic new energy vehicle (NEV) startups that enjoyed significant media attention, BYD grew without much hype, facing mostly bias. It was seen as lacking substance, starting from a humble beginning. In 2003, BYD officially entered the automotive business with a license but struggled to survive amidst foreign, joint venture, and state-owned competitors. Fast forward 20 years, and BYD now holds the top position in domestic market capitalization. It was criticized for lacking a clear strategy, but in 2004, the company launched two pure electric passenger vehicles, at the same time as Tesla, making it a pioneer of domestic NEVs. In 2022, BYD made a bold decision to halt fuel vehicle production and transition fully to NEVs, while other automakers like Great Wall, Geely, Volkswagen, and BMW struggled with this transition. BYD was also criticized for lacking technology, despite having been in the NEV industry for 30 years without making significant mistakes in its technology roadmap. The company's Blade Battery, which was once popular, proved the strength of its core technology. Some even accused BYD of integrating vertically and squeezing its supply chain, but as one of the few profitable domestic NEV manufacturers with a gross margin of 22%, it proved the critics wrong. The list of biases goes on.

2. The End of the 'Intelligence Tax' Era

The last point of criticism levied against BYD was its brand power. In 2023, BYD's sales surpassed 3 million vehicles for the first time. With the launch of the DMI5.0 platform, the company is poised for significant improvements in fuel efficiency and driving range, leading the industry by at least a year. This platform is expected to propel BYD to sell 4 million vehicles this year, with the possibility of reaching 5 million by 2026. So, what does this have to do with brand power? The domestic automotive market is already saturated, so where will the next 2 million incremental sales come from? The answer lies in the seemingly invincible but vulnerable joint ventures. Currently, there are approximately 12 million annual sales of A- and B-segment sedans and SUVs in China, with joint ventures accounting for over half of that market share. In the first half of this year, even premium brands like BBA had to rely on discounts to maintain sales, and other joint ventures faced even greater difficulties. As domestic automakers like BYD, Xiaomi, and Lixiang gain ground on joint ventures in terms of both cost-effectiveness and reputation, the era of charging a 'intelligence tax' for a premium badge is coming to an end. It won't be long before we see a rapid decline in joint ventures, perhaps as early as next year.

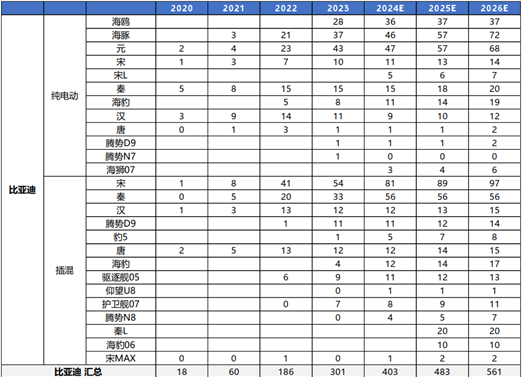

Figure: BYD's Vehicle Sales Forecast Source: China Passenger Car Association, Dongwu Securities

02 Tesla's Lean Year

Tesla's underwhelming performance this year is not entirely surprising. The core reason lies in a lack of new models. In the second quarter, 95% of Tesla's 444,000 deliveries were Model 3 and Model Y, and even the strongest product can suffer from aesthetic fatigue. Moreover, the benefits of capturing BBA's market share have peaked, leading to a decline in sales this year. Another benefit, the globalization of Tesla's supply chain, has also reached its limit with the full capacity utilization of its Chinese factories over the past three years. Furthermore, as competitors catch up with similar offerings at lower prices, Tesla's advantage diminishes. The highly anticipated Cybertruck, despite having over a million backorders, has faced manufacturing difficulties, leading to rumors that Tesla has stopped taking new orders. In 2024, Tesla's high valuation relies heavily on narratives, while Elon Musk relies on concepts like FSD in China, humanoid robots, autonomous driving, Robotaxi, and Dojo to support the company's valuation amidst the NASDAQ bull market.

03 Parallel Universes Collide

Over the past five years, one player dominated the price range above RMB 300,000, while another thrived below that threshold, yet they never crossed paths. Even in 2024, Tesla and BYD remained in separate worlds. However, after a lean year for Tesla and a prosperous one for BYD, the gap between them has narrowed. If previously it was a one-sided battle between NEV makers and traditional automakers, the internal competition within the NEV sector will intensify starting in 2025.

1. BYD's Three Major Growth Points Collide with Tesla

As BYD solidifies its position, where are its future growth points? The answer lies in premiumization, intelligentization, and internationalization. Like the mobile phone market, the automotive market offers thin margins in the low-to-mid-price range, with BYD earning less than RMB 10,000 per vehicle, relying on scale advantages and vertical integration. Premium vehicles, while fewer in number, offer significantly higher profits, with annual sales of nearly 5 million vehicles priced above RMB 300,000 in China, dominated by BBA, joint ventures, and Tesla. Among NEV makers, NIO and Huawei-backed brands have paved the way, and BYD is catching up with its Denza, Look up , and Fangchengbao brands, stepping up marketing efforts. If BYD can stabilize sales of these premium models at 150,000 units this year, it will be well-positioned for future growth.

In the past, BYD's Achilles' heel was its lack of intelligence. However, as it pursues premiumization, intelligence becomes essential. Since 2021, BYD has invested in autonomous driving chips through Horizon Robotics and established a joint venture with Momenta to develop its own intelligent driving algorithms, demonstrating its commitment to underlying technologies. Its intelligent driving platforms are segmented into three versions:

Based on the Horizon Journey 5 chip, mass-produced in models like the Han priced around RMB 200,000;

Based on NVIDIA's Orin-X chip with dual LiDAR, mass-produced in the Denza N7 priced around RMB 300,000;

Based on dual NVIDIA Orin-X chips with triple LiDAR, featured in the 1.1 million RMB Look up model.

The final piece of the puzzle is internationalization. BYD is serious about going global, evidenced by its second-quarter sales of 106,000 vehicles overseas, accounting for 11% of total sales. Among major automakers, BYD is the only one that has not yet achieved globalization, but its aggressive expansion in Hungary, Thailand, Brazil, Uzbekistan, and Indonesia, with factories spanning multiple continents, reveals its ambition to conquer the world market. With a planned capacity of 1 million vehicles, BYD is poised to compete head-to-head with Tesla as it pursues premiumization, intelligentization, and internationalization.

2. Tesla's New Growth Points Will Also Encounter BYD

Facing growth bottlenecks, Tesla is increasingly turning to the low-end market. This aligns with Elon Musk's product roadmap of reducing prices for technological inclusivity. Additionally, more information about Tesla's upcoming models is emerging. Rumors suggest that Tesla plans to launch a more affordable electric vehicle in the first half of 2025, possibly called the Model 2 or Model Q, priced at around RMB 160,000 to 180,000, directly overlapping with BYD's price range. With a potential annual production capacity of nearly 3 million units and Foxconn as a potential manufacturing partner, this model could significantly boost Tesla's sales. Including the current sales of Model 3 and Model Y (over 1 million units annually), future Cybertruck sales (tens of thousands of units), and the projected 3 million units of the new model, Tesla's annual sales could reach 5 million units, mirroring BYD's target. From 2025 onwards, these two automakers, once seen as operating in separate worlds, will be compared head-to-head in terms of product quality, price range, sales volume, and supply chain. In 2011, when asked about BYD, Musk dismissed it, but in 2023, he acknowledged BYD's growing competitiveness. Next year, one of the most frequently asked questions in Tesla's earnings calls is likely to be how it plans to compete with BYD.

3. Recognizing the Strength of Domestic Autonomous Brands is a Necessary Correction of Bias

Sales figures don't lie. Despite operating in parallel universes and never seeing each other as direct competitors, BYD and Tesla will inevitably compete fiercely starting next year. On the other hand, domestic automakers have repeatedly shattered perceptions by outperforming both traditional automakers and joint ventures. Now, they have set their sights on Tesla, the global leader, earning their respect. However, the strength of domestic NEV brands is still severely underestimated due to widespread bias. This bias is bound to be corrected as domestic automakers compete with Tesla in 2025. Two potential challenges arise: first, Tesla will address its model lineup issues and accelerate autonomous driving developments next year, leaving domestic automakers with a narrow window of opportunity. It remains to be seen whether the gap will widen again. Second, intense competition among domestic automakers threatens their progress. BYD's success and Xiaomi's entry into the automotive market with a 15% gross margin highlight supply chain management as a core competency. As the industry becomes more competitive, domestic automakers may turn against each other. While none intend to compete directly with Tesla, the rise of domestic NEV brands and their global expansion will inevitably lead to competition with Tesla in the existing market. This competition will be the biggest and most intriguing variable in the NEV industry in 2025.